San Diego California Guaranty without Pledged Collateral is a legal term that refers to a financial agreement made by a guarantor to assume responsibility for a debt or obligation without requiring any collateral. This type of guaranty is commonly used in various commercial transactions and contracts. In San Diego, California, there are two types of Guaranty without Pledged Collateral that are often encountered: 1. Unsecured Guaranty: This type of guaranty is a promise made by a guarantor to repay a debt or perform an obligation if the primary debtor fails to do so. Unlike a secured guaranty, there is no specific property or asset offered as collateral to secure the debt. Instead, the guarantor's creditworthiness and financial standing are relied upon. San Diego businesses frequently opt for unsecured guaranties to obtain financing or secure contracts. 2. Corporate Guaranty: When a company guarantees repayment or performance of an obligation without any collateral, it is referred to as a corporate guaranty. In this case, the guarantor is typically a corporation or limited liability company (LLC) rather than an individual. This type of guaranty is commonly used in commercial leases, loans, and contracts in San Diego, California. San Diego California Guaranty without Pledged Collateral is a significant tool in the realm of business and finance. It provides an extra layer of protection for lenders and creditors, assuring them of repayment in the event of default. While the absence of pledged collateral may pose a higher risk for creditors, it also allows borrowers and businesses to secure financing without having to put up valuable assets as collateral. Overall, San Diego California Guaranty without Pledged Collateral is a legal mechanism that enables businesses and individuals to establish financial agreements and transactions without the need for collateral. It offers flexibility and convenience, promoting economic growth and facilitating business activities in the thriving city of San Diego, California.

San Diego California Guaranty without Pledged Collateral

Description

How to fill out San Diego California Guaranty Without Pledged Collateral?

Preparing legal documentation can be burdensome. Besides, if you decide to ask a lawyer to draft a commercial contract, papers for proprietorship transfer, pre-marital agreement, divorce paperwork, or the San Diego Guaranty without Pledged Collateral, it may cost you a lot of money. So what is the best way to save time and money and create legitimate documents in total compliance with your state and local laws and regulations? US Legal Forms is a perfect solution, whether you're looking for templates for your individual or business needs.

US Legal Forms is largest online library of state-specific legal documents, providing users with the up-to-date and professionally checked templates for any scenario collected all in one place. Therefore, if you need the recent version of the San Diego Guaranty without Pledged Collateral, you can easily locate it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample using the Download button. If you haven't subscribed yet, here's how you can get the San Diego Guaranty without Pledged Collateral:

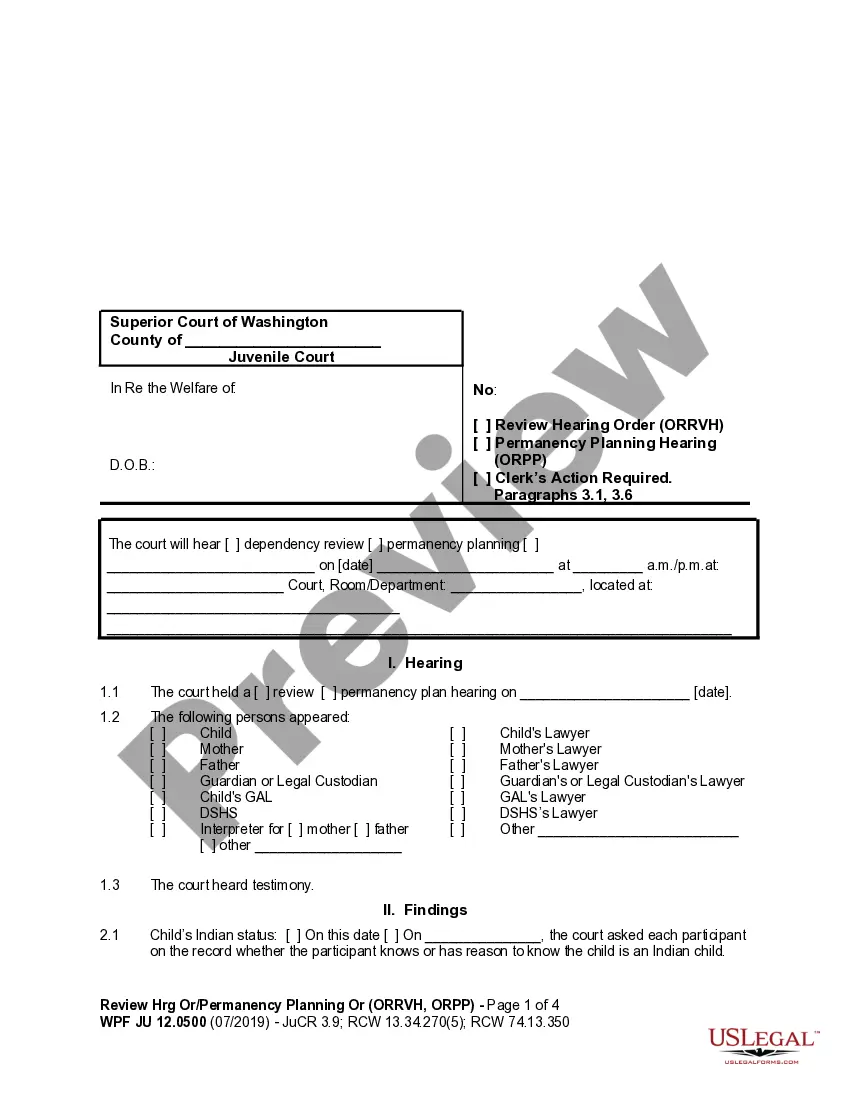

- Look through the page and verify there is a sample for your region.

- Examine the form description and use the Preview option, if available, to make sure it's the template you need.

- Don't worry if the form doesn't satisfy your requirements - search for the correct one in the header.

- Click Buy Now when you find the needed sample and pick the best suitable subscription.

- Log in or sign up for an account to pay for your subscription.

- Make a payment with a credit card or through PayPal.

- Opt for the file format for your San Diego Guaranty without Pledged Collateral and save it.

When done, you can print it out and complete it on paper or import the template to an online editor for a faster and more convenient fill-out. US Legal Forms enables you to use all the paperwork ever acquired many times - you can find your templates in the My Forms tab in your profile. Try it out now!