Santa Clara California Guaranty without Pledged Collateral is a legal arrangement that provides a guarantee to a lender in Santa Clara, California, without requiring any collateral or assets to be pledged as security. This type of guaranty offers an additional layer of assurance to lenders who are providing financing or credit facilities to individuals or businesses in the Santa Clara area. One type of Santa Clara California Guaranty without Pledged Collateral is the Personal Guaranty. In this type of agreement, an individual (the guarantor) agrees to be personally responsible for the repayment of a debt or loan if the borrower defaults. The lender can pursue legal action against the guarantor's personal assets without the need for collateral. Another type is the Corporate Guaranty, which involves a business entity serving as the guarantor for a loan or debt. In this scenario, the corporation assumes the responsibility for repayment should the borrower default. The lender can take legal action against the corporation and its assets in case of non-payment. Furthermore, Santa Clara California Guaranty without Pledged Collateral can also encompass Commercial Guaranties. These guaranties are commonly used in commercial real estate transactions, where the guarantor, usually a business entity, provides a guarantee for the repayment of a loan or lease agreement. The guarantor's assets are not directly used as collateral but can be pursued in the event of non-payment. This type of guaranty allows lenders in Santa Clara, California, to extend credit facilities without requiring traditional collateral. It provides a level of comfort to lenders by offering an alternate means of recovering their funds in case of a default. However, it places a significant responsibility on the guarantor who assumes the risk of being held personally or corporately liable for the outstanding debt. In summary, Santa Clara California Guaranty without Pledged Collateral is a legal arrangement that provides lenders with a level of security without requiring collateral. It includes different types such as Personal Guaranties, Corporate Guaranties, and Commercial Guaranties, each catering to different borrowers and loan types. These guaranties offer lenders peace of mind while placing the burden of repayment on the guarantors.

Santa Clara California Guaranty without Pledged Collateral

Description

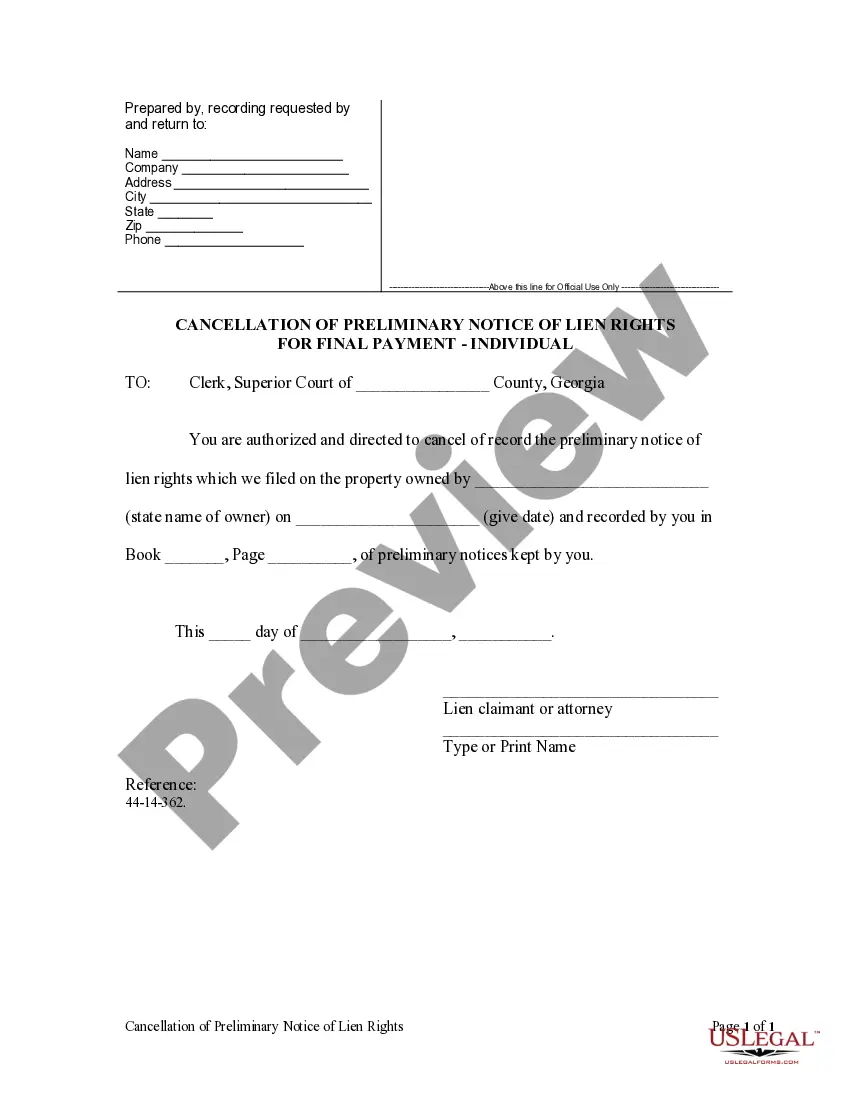

How to fill out Santa Clara California Guaranty Without Pledged Collateral?

Do you need to quickly create a legally-binding Santa Clara Guaranty without Pledged Collateral or maybe any other form to handle your own or business affairs? You can go with two options: contact a professional to draft a legal paper for you or create it entirely on your own. Luckily, there's a third solution - US Legal Forms. It will help you get neatly written legal documents without paying sky-high fees for legal services.

US Legal Forms offers a rich collection of more than 85,000 state-specific form templates, including Santa Clara Guaranty without Pledged Collateral and form packages. We offer documents for a myriad of life circumstances: from divorce papers to real estate documents. We've been out there for over 25 years and gained a rock-solid reputation among our customers. Here's how you can become one of them and obtain the needed template without extra hassles.

- To start with, carefully verify if the Santa Clara Guaranty without Pledged Collateral is adapted to your state's or county's laws.

- If the form comes with a desciption, make sure to verify what it's suitable for.

- Start the search again if the document isn’t what you were looking for by utilizing the search box in the header.

- Choose the subscription that is best suited for your needs and proceed to the payment.

- Select the file format you would like to get your form in and download it.

- Print it out, fill it out, and sign on the dotted line.

If you've already registered an account, you can simply log in to it, locate the Santa Clara Guaranty without Pledged Collateral template, and download it. To re-download the form, simply head to the My Forms tab.

It's easy to buy and download legal forms if you use our catalog. Additionally, the documents we provide are updated by industry experts, which gives you greater confidence when dealing with legal matters. Try US Legal Forms now and see for yourself!