Clark Nevada Guaranty with Pledged Collateral is a legal agreement that provides a guarantee for a loan or debt obligation, where the guarantor pledges collateral to secure the repayment of the loan. This type of guaranty is commonly used in commercial lending scenarios, where a borrower may not have sufficient assets or creditworthiness to obtain a loan on their own. The essence of Clark Nevada Guaranty with Pledged Collateral lies in the commitment of the guarantor to make full or partial payment of the outstanding debt if the borrower defaults on their repayment obligations. To provide additional security for the lender, the guarantor pledges collateral, typically in the form of real estate, equipment, inventory, or other valuable assets that can be liquidated to recover the debt. One key advantage of Clark Nevada Guaranty with Pledged Collateral is that it reduces the lender's risk by providing an additional source of repayment. In case of default, the lender can seize and sell the pledged collateral to recoup the outstanding loan amount. This aspect makes it an attractive option for lenders when dealing with borrowers who have limited credit history or are deemed higher risk. It is important to note that there may be different variations or types of Clark Nevada Guaranty with Pledged Collateral, depending on the specific terms and conditions agreed upon by the lender and the guarantor. Some common variations include: 1. Full Pledged Collateral Guaranty: In this type, the guarantor pledges assets that fully cover the loan amount. If the borrower defaults, the lender can seize and sell the collateral to satisfy the entire debt. 2. Limited Pledged Collateral Guaranty: Here, the guarantor pledges assets that cover only a portion of the loan amount. In case of default, the lender can recover the outstanding debt up to the value of the pledged collateral, leaving the remaining balance as unsecured. 3. Cross-Collateralization Guaranty: This type involves the guarantor pledging collateral that secures multiple loans or obligations. If the borrower defaults on any of these obligations, the lender can seize and sell the pooled collateral to satisfy the outstanding debts. When entering into a Clark Nevada Guaranty with Pledged Collateral, both the lender and the guarantor should carefully review and negotiate the terms of the agreement. The agreement should clearly outline the responsibilities and obligations of each party, including the specifics of the pledged collateral, default triggers, repayment procedures, and any potential release or substitution clauses. Furthermore, it is recommended to seek legal counsel to ensure the agreement complies with all relevant laws and regulations. In conclusion, Clark Nevada Guaranty with Pledged Collateral is an effective tool that enhances the security of lenders when providing loans to borrowers with limited creditworthiness. By pledging valuable assets as collateral, the guarantor provides an additional source of repayment in case the borrower defaults. Various types of Clark Nevada Guaranty with Pledged Collateral exist, each with its own specific terms and conditions to suit the needs of the parties involved.

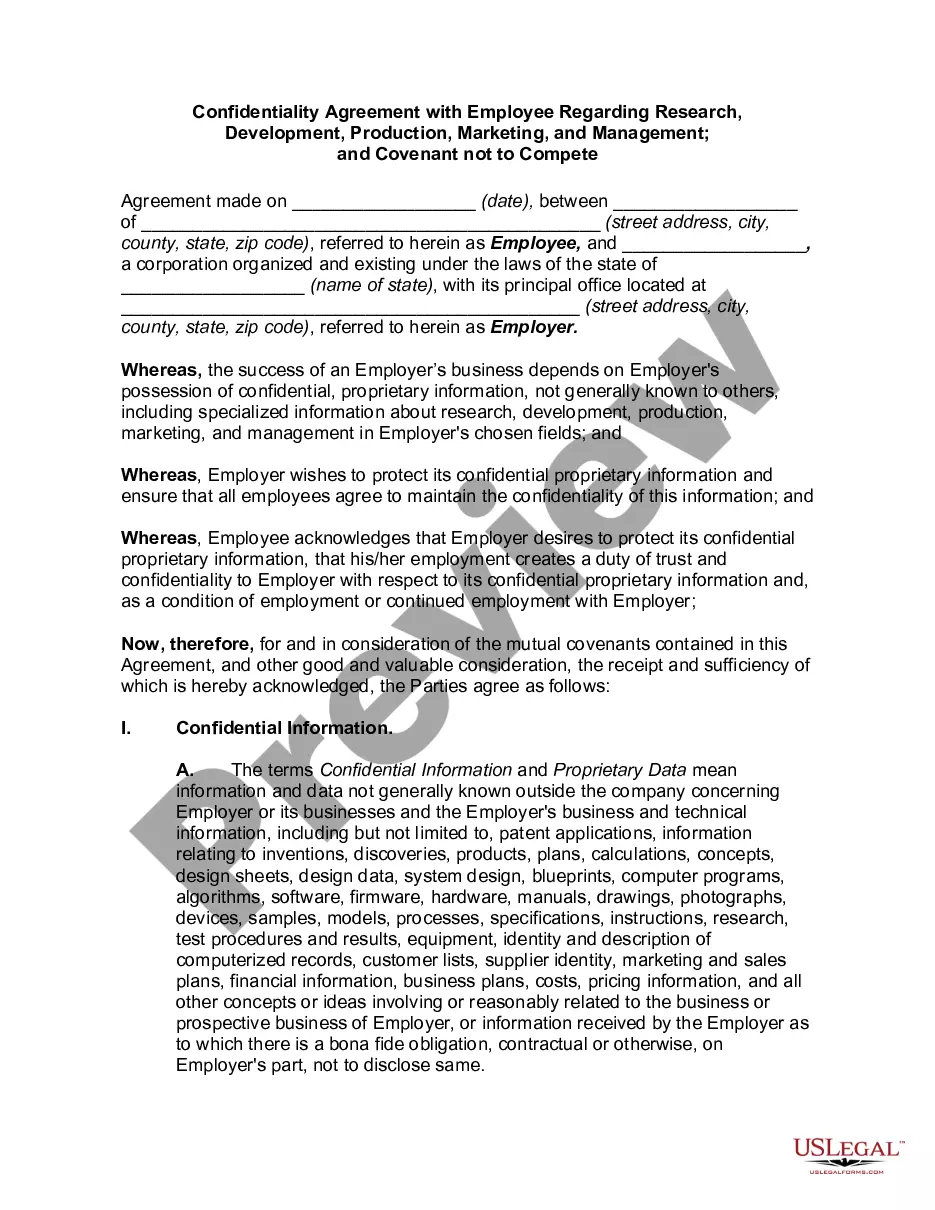

Clark Nevada Guaranty with Pledged Collateral

Description

How to fill out Clark Nevada Guaranty With Pledged Collateral?

Creating legal forms is a necessity in today's world. However, you don't always need to look for professional help to draft some of them from the ground up, including Clark Guaranty with Pledged Collateral, with a platform like US Legal Forms.

US Legal Forms has over 85,000 templates to pick from in different categories varying from living wills to real estate papers to divorce papers. All forms are arranged according to their valid state, making the searching process less challenging. You can also find information materials and tutorials on the website to make any tasks associated with document execution straightforward.

Here's how to purchase and download Clark Guaranty with Pledged Collateral.

- Take a look at the document's preview and description (if provided) to get a basic information on what you’ll get after getting the document.

- Ensure that the template of your choice is adapted to your state/county/area since state laws can affect the validity of some documents.

- Examine the related forms or start the search over to locate the right document.

- Hit Buy now and create your account. If you already have an existing one, select to log in.

- Choose the option, then a suitable payment method, and purchase Clark Guaranty with Pledged Collateral.

- Choose to save the form template in any offered format.

- Go to the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can locate the appropriate Clark Guaranty with Pledged Collateral, log in to your account, and download it. Of course, our website can’t take the place of a legal professional entirely. If you have to cope with an exceptionally complicated situation, we advise getting an attorney to check your form before executing and submitting it.

With more than 25 years on the market, US Legal Forms became a go-to provider for many different legal forms for millions of customers. Become one of them today and get your state-specific documents with ease!