Cook Illinois Guaranty with Pledged Collateral is a type of financial agreement that provides a guarantee for loans or obligations made by Cook County, Illinois, with collateral pledged to secure the repayment. This arrangement serves as a form of security for lenders or investors who extend credit to the county, mitigating the risk of default. The Cook Illinois Guaranty with Pledged Collateral is a legal instrument used to provide assurance to creditors that they will be repaid in the event of default. The collateral pledged can include various assets owned by the county, such as real estate, infrastructure, or other tangible properties. The specific collateral depends on the terms of the agreement. This type of guarantee is primarily used by Cook County when seeking to secure financing for capital projects, infrastructure development, public works, or other initiatives that require substantial funding. By offering collateral, the county offers reassurance to lenders or investors, increasing the likelihood of obtaining the necessary funds at favorable interest rates. Different types of Cook Illinois Guaranty with Pledged Collateral may include: 1. Real Estate-backed Guaranty: In this arrangement, Cook County pledges its real estate assets as collateral to secure the loan or obligation. These assets may include government buildings, administrative offices, or land owned by the county. 2. Infrastructure-backed Guaranty: Cook County may pledge its infrastructure projects, such as transportation networks, water management systems, or utility facilities, as collateral. This ensures lenders or investors have a tangible asset to fall back on in case of default. 3. Revenue-backed Guaranty: Cook County may also offer a pledge on future revenue streams or tax collections to guarantee the repayment of loans or obligations. This type of guaranty relies on the county's ability to generate sufficient revenue to meet its financial obligations. 4. Equipment or Asset-backed Guaranty: In certain cases, Cook County may pledge specific equipment or valuable assets it owns as collateral. This could include vehicles, machinery, technology, or other valuable items owned by the county. Overall, Cook Illinois Guaranty with Pledged Collateral is a financial tool used by Cook County, Illinois, to secure funding for critical projects or initiatives. By offering collateral, the county ensures lenders or investors have a form of security in place, reducing the risk associated with lending to the public entity.

Cook Illinois Guaranty with Pledged Collateral

Description

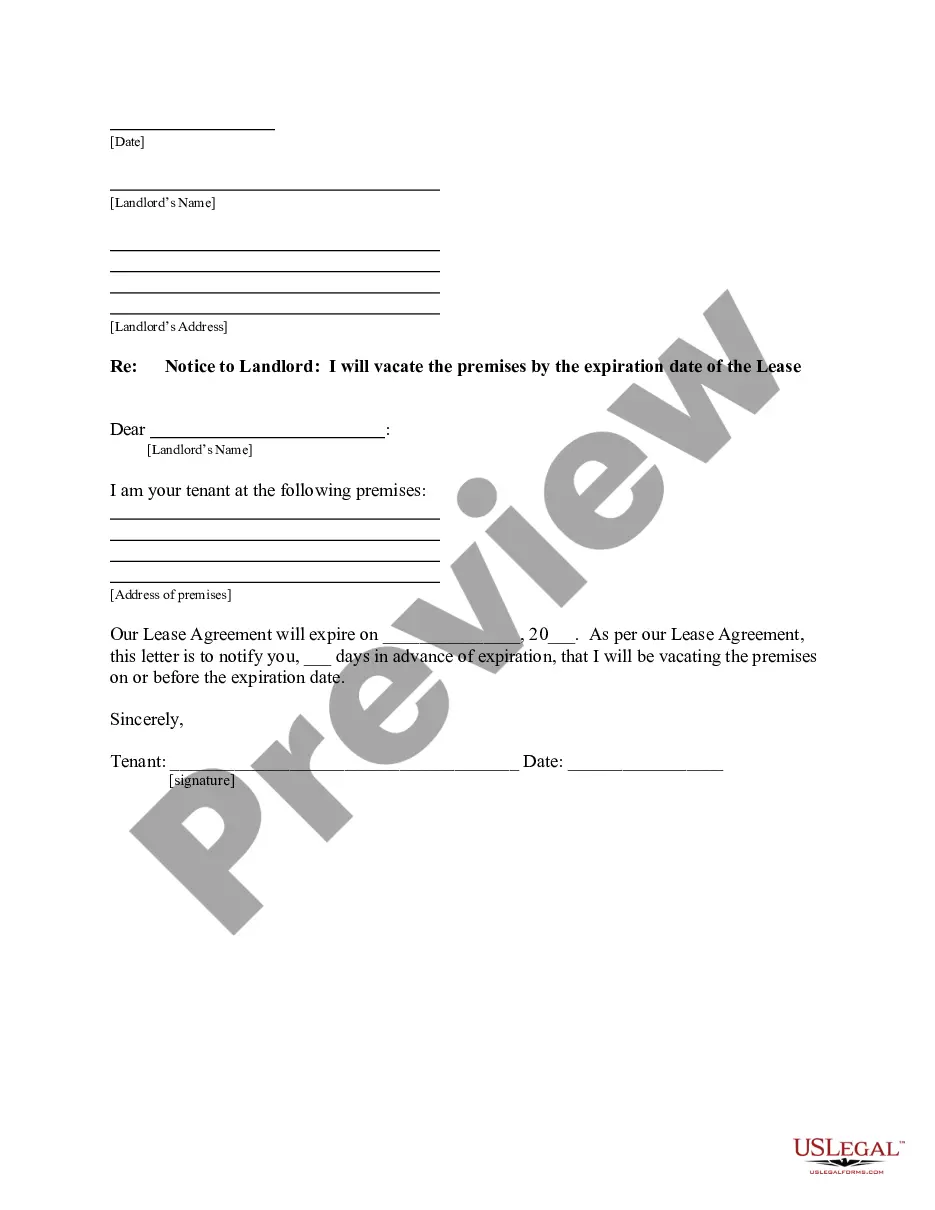

How to fill out Guaranty With Pledged Collateral?

Laws and statutes in every domain vary across the nation.

If you're not a lawyer, it's simple to become confused by different standards when it comes to creating legal documents.

To prevent expensive legal aid when drafting the Cook Guarantee with Pledged Collateral, you require a validated template valid for your jurisdiction.

That's the simplest and most economical method to obtain current templates for any legal purposes. Discover them all in just a few clicks and maintain your paperwork organized with the US Legal Forms!

- Explore the page content to confirm you've located the appropriate sample.

- Make use of the Preview option or read the form description if it exists.

- Look for an alternative document if there are discrepancies with any of your requirements.

- Press the Buy Now button to secure the document once you identify the correct one.

- Select one of the subscription plans and Log In or set up an account.

- Choose how you would like to pay for your subscription (using a credit card or PayPal).

- Pick the format you wish to save the document in and hit Download.

- Complete and sign the document by hand after printing it or execute everything electronically.

Form popularity

FAQ

A formal pledge is a legally binding commitment where an individual or organization promises to fulfill specific obligations, often backed by collateral. This formal arrangement provides reassurance to lenders and investors, knowing there is a structured framework in place. In the realm of the Cook Illinois Guaranty with Pledged Collateral, a formal pledge enhances trust, making transactions smoother and more reliable.

Assets pledged as collateral can include various items like real estate, vehicles, stocks, or equipment. These assets serve as a safeguard for the lender, ensuring their funds are protected. When you participate in the Cook Illinois Guaranty with Pledged Collateral, you can choose the type of assets that align best with your financial strategy while securing your investment effectively.

Enforcing a guaranty requires clear documentation and understanding of the stipulations in the Cook Illinois Guaranty with Pledged Collateral. When a borrower fails to meet obligations, the lender must present proof of the default and communicate with the guarantor about their repayment responsibilities. If needed, lawsuits can be filed to recover losses. Strategically utilizing resources like uslegalforms may facilitate smoother enforcement.

To enforce a guaranty, a lender must first verify the terms outlined in the Cook Illinois Guaranty with Pledged Collateral. The lender should gather evidence of default and communicate directly with the guarantor to seek resolution. If informal attempts fail, legal action may be necessary, requiring court intervention. Using a reliable service like uslegalforms can help structure the enforcement process efficiently.

Enforcing a personal guarantee typically involves the lender initiating legal action if the primary borrower defaults. This process requires the lender to present documentation proving the existence of the Cook Illinois Guaranty with Pledged Collateral. Legal options may include pursuing the guarantor's assets or obtaining a judgment in court. Additionally, engaging a reliable platform like uslegalforms can simplify documentation and aid in legal processes.

Therefore, 'Guarantee', 'Pledge' and 'Mortgage' share a similar definition that is to make an agreement or a contract for reliability and as a guarantee for debt payment.

An agreement typically used to create a security interest in equity interests (including capital stock, LLC interests, and partnership interests) and promissory notes.

Mortgage A mortgage is close to pledging which is to hand over property as a guarantee of the debt payment. The property which is guaranteed for a mortgage must be Real estate only, such as land, condominium, etc.

Pledged Issuer means any Subsidiary of any Loan Party in its capacity as the issuer (as defined in the definition of Equity Interest) of any Subsidiary Equity Interest in which any Loan Party has any right, title or interest and which is subject to a Lien in favor of Agent for the benefit of the Secured Parties

Is that pledge is a solemn promise to do something while guaranty is (legal) an undertaking to answer for the payment of some debt, or the performance of some contract or duty, of another, in case of the failure of such other to pay or perform; a warranty; a security.