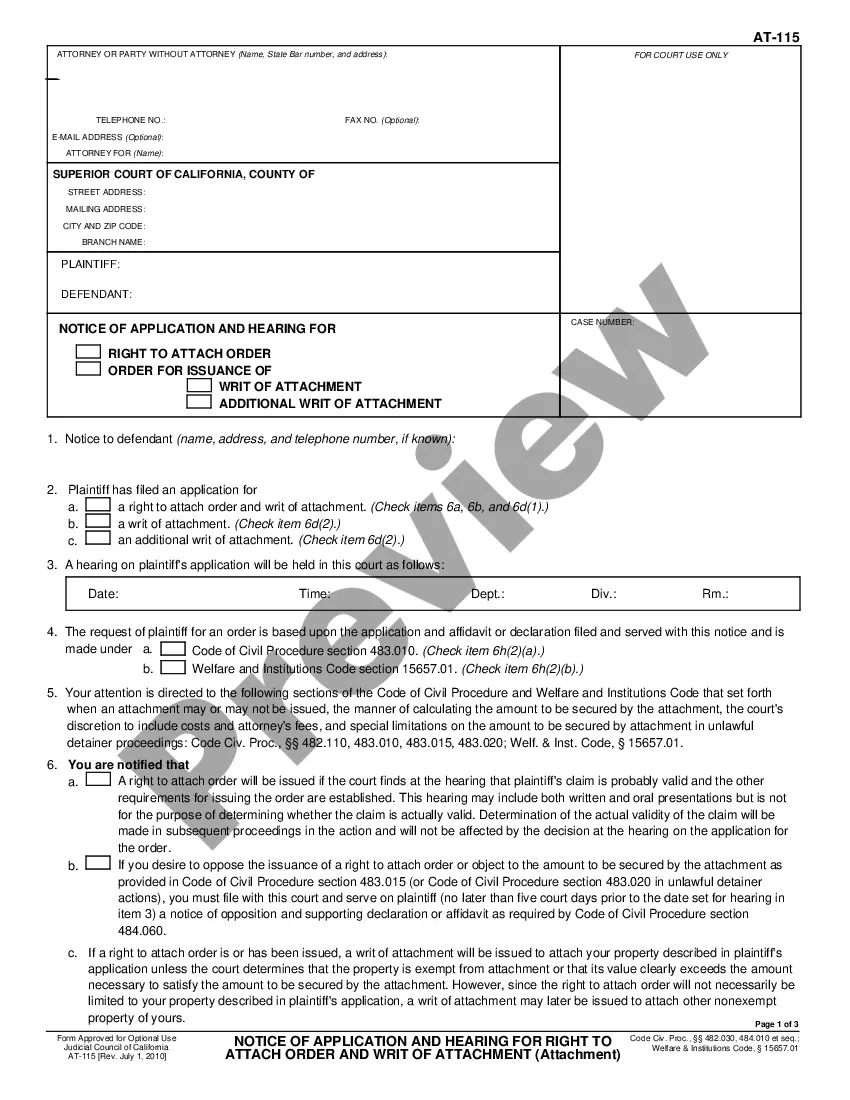

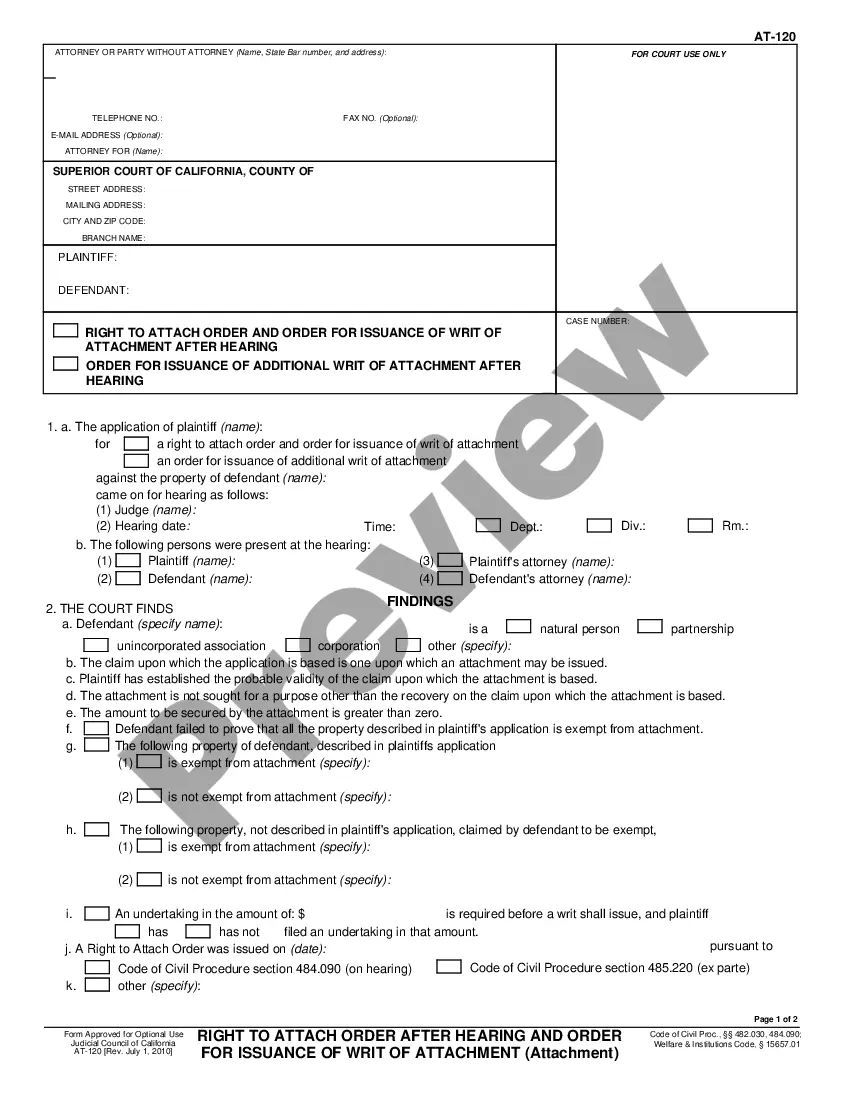

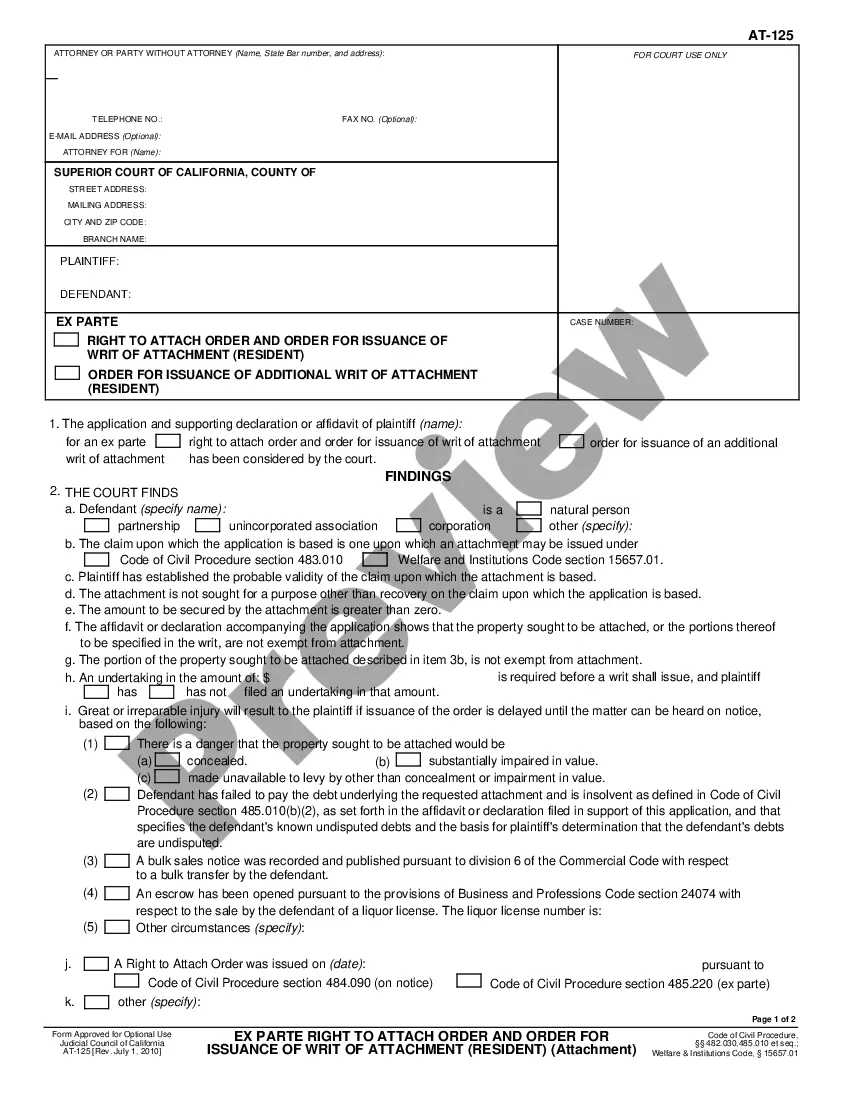

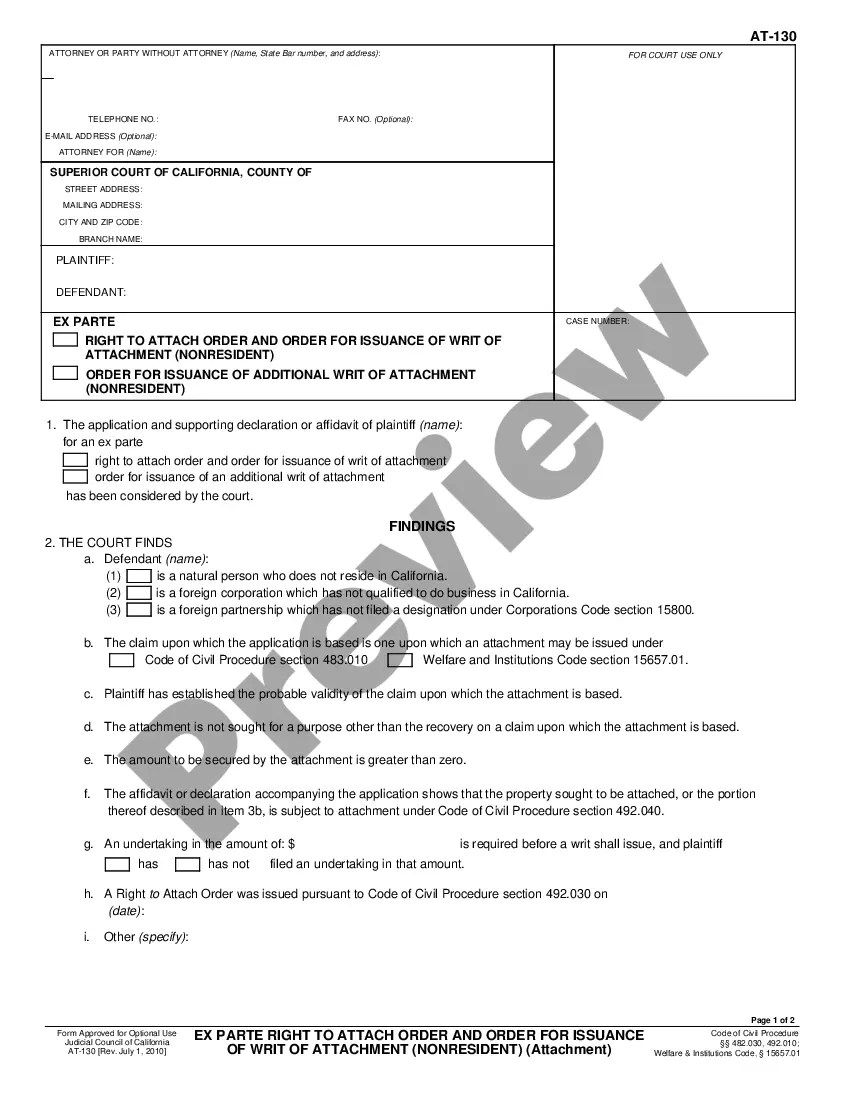

Kings New York Guaranty with Pledged Collateral is a financial service offered by Kings New York Bank that enables individuals and businesses to obtain loans backed by collateral. This type of guarantee provides security to lenders and allows borrowers to access a higher loan amount than what they would typically qualify for. With Kings New York Guaranty with Pledged Collateral, borrowers pledge assets such as real estate, vehicles, stocks, or other high-value items as collateral to secure the loan. The lender holds the collateral until the loan is fully repaid, reducing the risk for the lender and potentially allowing for more favorable loan terms. There are various types of Kings New York Guaranty with Pledged Collateral, each suited to different borrowing needs: 1. Real Estate Collateral: This type of guarantee allows borrowers to use residential or commercial properties as collateral. The value of the property determines the loan amount, and borrowers can benefit from competitive interest rates and extended repayment periods. 2. Vehicle Collateral: Kings New York Guaranty with Pledged Collateral extends to vehicles such as cars, motorcycles, or boats. Lenders evaluate the vehicle's market value to determine the loan amount and loan terms, ensuring borrowers can access funds while maintaining their vehicle's ownership. 3. Stock Collateral: With this type of guarantee, borrowers can pledge their stocks, bonds, or other securities as collateral. The loan amount is typically based on a percentage of the stock's value, allowing borrowers to access capital without selling their investments. 4. High-Value Item Collateral: Kings New York Guaranty with Pledged Collateral also covers high-value assets like artwork, collectibles, or jewelry. These items are appraised, and the loan amount is determined based on their estimated worth, giving borrowers the flexibility to leverage their valuable possessions temporarily. By offering Kings New York Guaranty with Pledged Collateral, Kings New York Bank ensures access to financing options even for borrowers with limited credit history or lower income levels. This secured loan solution provides peace of mind to lenders while empowering borrowers to harness the value of their assets to achieve their financial goals.

Kings New York Guaranty with Pledged Collateral

Description

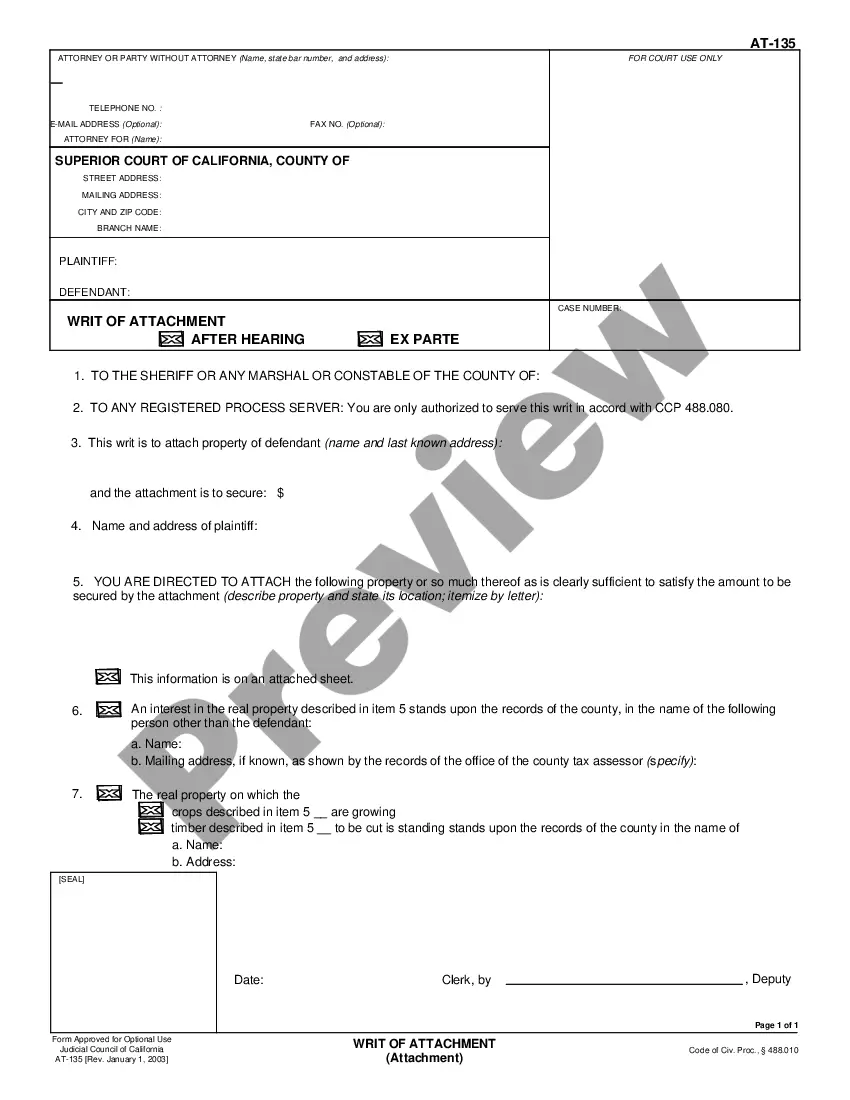

How to fill out Kings New York Guaranty With Pledged Collateral?

If you need to find a reliable legal document supplier to find the Kings Guaranty with Pledged Collateral, look no further than US Legal Forms. Whether you need to launch your LLC business or take care of your asset distribution, we got you covered. You don't need to be knowledgeable about in law to locate and download the needed template.

- You can search from over 85,000 forms arranged by state/county and case.

- The intuitive interface, variety of learning resources, and dedicated support make it simple to locate and complete various papers.

- US Legal Forms is a reliable service providing legal forms to millions of customers since 1997.

Simply select to look for or browse Kings Guaranty with Pledged Collateral, either by a keyword or by the state/county the form is intended for. After locating needed template, you can log in and download it or save it in the My Forms tab.

Don't have an account? It's effortless to start! Simply locate the Kings Guaranty with Pledged Collateral template and take a look at the form's preview and short introductory information (if available). If you're confident about the template’s legalese, go ahead and hit Buy now. Create an account and select a subscription option. The template will be immediately available for download as soon as the payment is completed. Now you can complete the form.

Handling your legal matters doesn’t have to be expensive or time-consuming. US Legal Forms is here to demonstrate it. Our extensive variety of legal forms makes these tasks less expensive and more affordable. Create your first business, arrange your advance care planning, draft a real estate agreement, or complete the Kings Guaranty with Pledged Collateral - all from the convenience of your home.

Join US Legal Forms now!