Mecklenburg North Carolina Guaranty with Pledged Collateral is a legal agreement that provides a guarantee of payment and performance on a loan or obligation, with the addition of pledged collateral as a form of security. This type of guaranty is commonly used in financial transactions to mitigate risk and ensure that the lender or creditor is protected. In Mecklenburg County, North Carolina, there are several types of Guaranty with Pledged Collateral that are commonly encountered: 1. Real Estate Collateral Guaranty: This type of guaranty involves using real estate assets as collateral, such as residential or commercial properties. The value of the pledged collateral helps reduce the risk to the lender, as they have a tangible asset to liquidate in the event of default. 2. Business Assets Collateral Guaranty: In certain cases, a guaranty may involve business assets being pledged as collateral. These assets can include inventory, equipment, accounts receivable, or any other valuable business asset. By offering these assets as collateral, the guarantor provides an added layer of security. 3. Securities Collateral Guaranty: This type of guaranty involves the pledge of financial securities, such as stocks, bonds, or other investment instruments, as collateral. The value of these securities offers the lender a secondary source of repayment in case of default. 4. Cash Collateral Guaranty: Sometimes, a guarantor may pledge cash as collateral to secure the guaranty. This type of collateral provides immediate liquidity to the lender and reduces the risk associated with the loan. The Mecklenburg North Carolina Guaranty with Pledged Collateral is a legally binding agreement that outlines the rights and responsibilities of both parties involved. It defines the terms of the guaranty, including the obligations of the guarantor, the conditions of default, the event of foreclosure or liquidation of the collateral, and any relevant fees or charges. It is crucial for all parties involved to thoroughly review and understand the terms and implications of this agreement before entering into it. In summary, Mecklenburg North Carolina Guaranty with Pledged Collateral serves as a valuable risk mitigation tool in financial transactions, ensuring that lenders have a tangible form of security to protect their interests. Whether utilizing real estate, business assets, securities, or cash as collateral, these guaranties provide peace of mind and assurance for both lenders and borrowers.

Mecklenburg North Carolina Guaranty with Pledged Collateral

Description

How to fill out Mecklenburg North Carolina Guaranty With Pledged Collateral?

How much time does it typically take you to draw up a legal document? Because every state has its laws and regulations for every life sphere, locating a Mecklenburg Guaranty with Pledged Collateral meeting all regional requirements can be stressful, and ordering it from a professional attorney is often costly. Numerous web services offer the most common state-specific templates for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most extensive web collection of templates, grouped by states and areas of use. Apart from the Mecklenburg Guaranty with Pledged Collateral, here you can find any specific document to run your business or individual affairs, complying with your county requirements. Experts check all samples for their validity, so you can be certain to prepare your documentation correctly.

Using the service is fairly easy. If you already have an account on the platform and your subscription is valid, you only need to log in, select the needed sample, and download it. You can retain the file in your profile at any moment later on. Otherwise, if you are new to the website, there will be a few more actions to complete before you get your Mecklenburg Guaranty with Pledged Collateral:

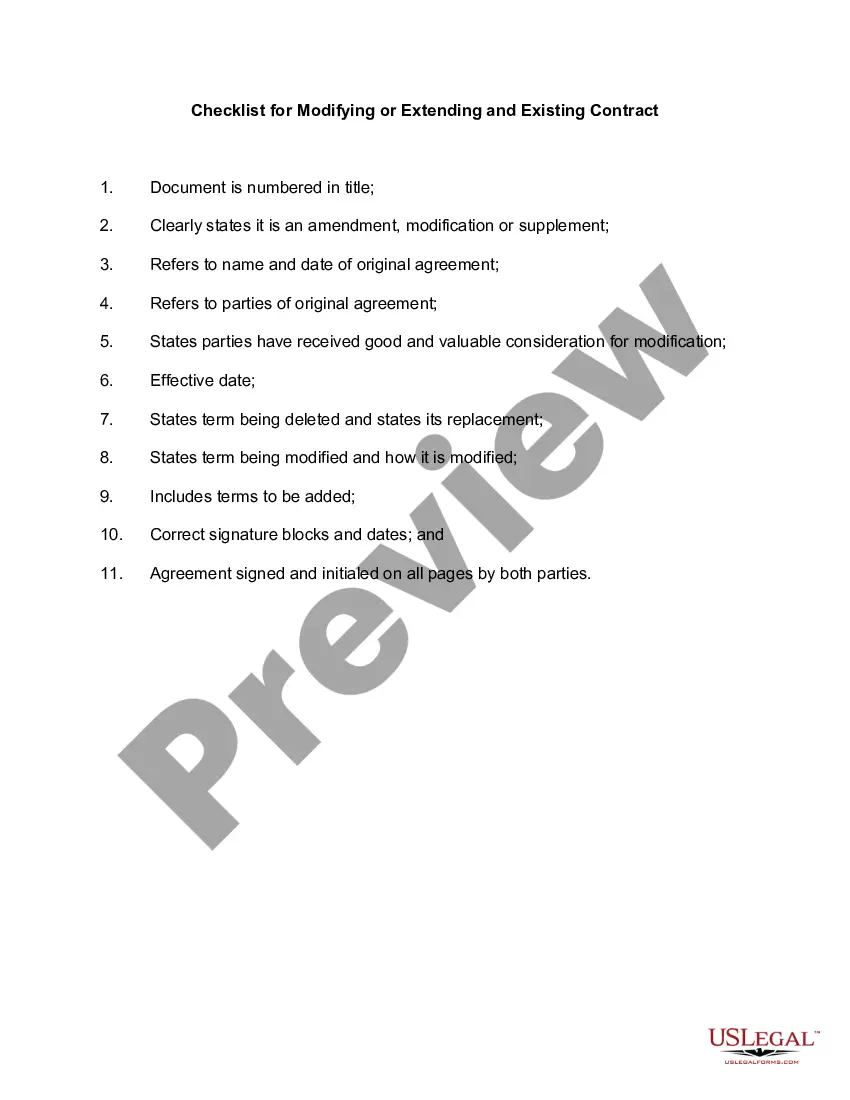

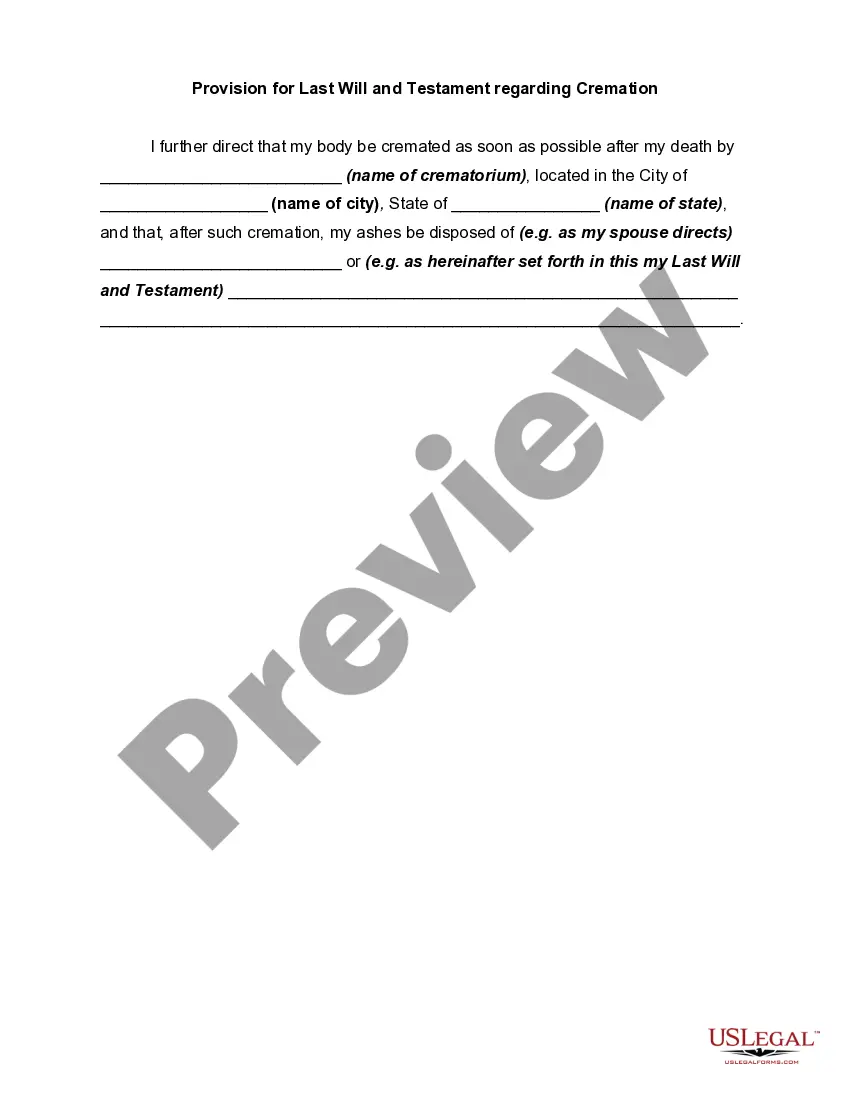

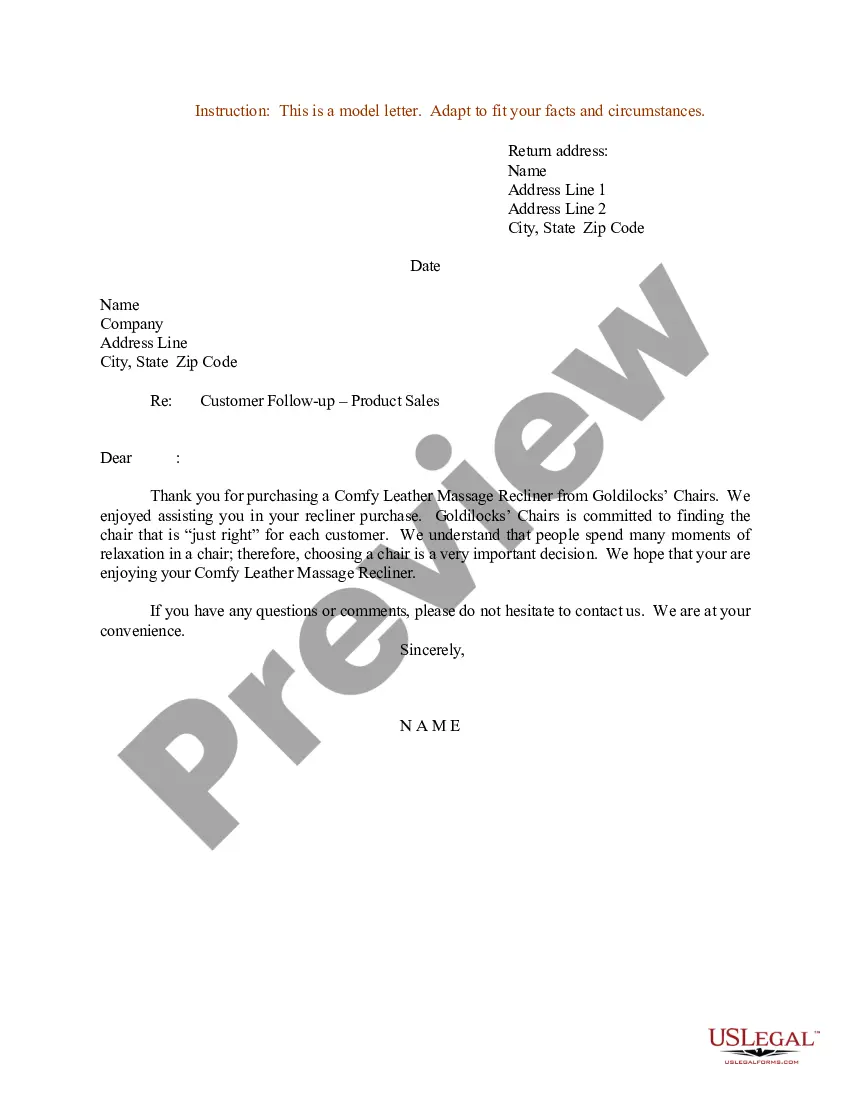

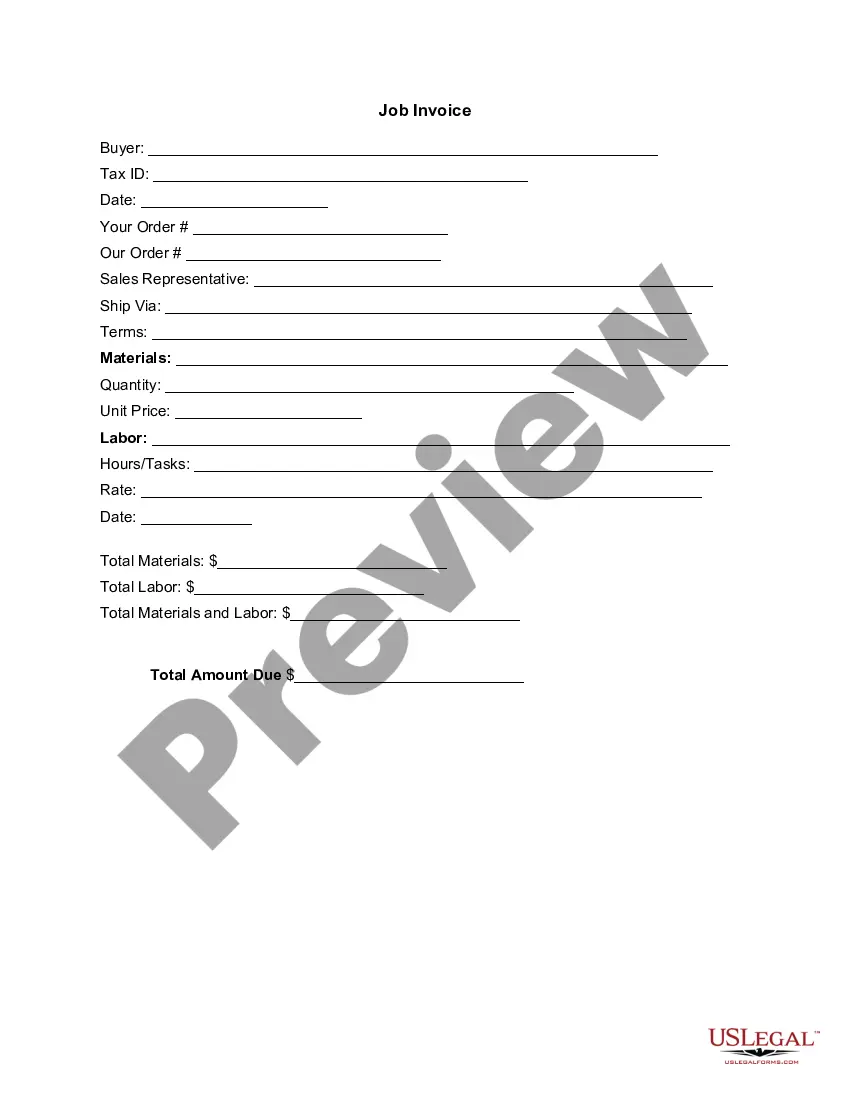

- Check the content of the page you’re on.

- Read the description of the sample or Preview it (if available).

- Search for another document utilizing the corresponding option in the header.

- Click Buy Now when you’re certain in the selected file.

- Choose the subscription plan that suits you most.

- Create an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Switch the file format if necessary.

- Click Download to save the Mecklenburg Guaranty with Pledged Collateral.

- Print the doc or use any preferred online editor to complete it electronically.

No matter how many times you need to use the purchased document, you can find all the samples you’ve ever downloaded in your profile by opening the My Forms tab. Give it a try!