San Diego California Guaranty with Pledged Collateral is a legal agreement commonly used in the state of California to secure a loan or debt obligation. It involves a third party, called the guarantor, who agrees to be held financially responsible for the debt in case the borrower defaults. The San Diego California Guaranty with Pledged Collateral process typically requires the borrower to provide collateral, which can be in the form of real estate, personal assets, or financial instruments. The guarantor then pledges this collateral, making it available to the lender in case of default. The purpose of the San Diego California Guaranty with Pledged Collateral is twofold. Firstly, it provides an extra layer of security for the lender, ensuring they have an additional source of repayment in case the borrower cannot fulfill their obligations. Secondly, it allows borrowers with less-than-perfect credit or insufficient assets to secure a loan, as the guarantor's collateral provides the necessary reassurance to the lender. There are several types of San Diego California Guaranty with Pledged Collateral, depending on the nature of the loan or debt being secured. These may include: 1. Real Estate Pledge: In this type of guaranty, the borrower pledges a property they own as collateral. This could be residential, commercial, or vacant land. 2. Securities Pledge: Here, the borrower pledges financial instruments such as stocks, bonds, or mutual funds as collateral. These securities can be held in a brokerage account or other approved depository. 3. Personal Asset Pledge: This type involves the borrower pledging personal assets such as vehicles, jewelry, or valuable collectibles to secure the loan. 4. Business Asset Pledge: In certain cases, a San Diego California Guaranty with Pledged Collateral may involve the borrower pledging specific business assets, such as equipment, inventory, or accounts receivable. It is essential for both the borrower and guarantor to fully understand the implications and risks associated with a San Diego California Guaranty with Pledged Collateral. The agreement typically outlines the obligations and responsibilities of all parties involved, as well as the procedures for handling default situations and potential liquidation of the pledged collateral. Overall, a San Diego California Guaranty with Pledged Collateral offers added security for lenders and increased access to financing for borrowers, while also requiring careful consideration and evaluation of the collateral being pledged.

San Diego California Guaranty with Pledged Collateral

Description

How to fill out San Diego California Guaranty With Pledged Collateral?

Whether you intend to open your company, enter into an agreement, apply for your ID update, or resolve family-related legal concerns, you must prepare specific paperwork meeting your local laws and regulations. Finding the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 expertly drafted and verified legal templates for any individual or business case. All files are grouped by state and area of use, so picking a copy like San Diego Guaranty with Pledged Collateral is fast and straightforward.

The US Legal Forms library users only need to log in to their account and click the Download button next to the required template. If you are new to the service, it will take you a few more steps to get the San Diego Guaranty with Pledged Collateral. Follow the instructions below:

- Make sure the sample meets your individual needs and state law regulations.

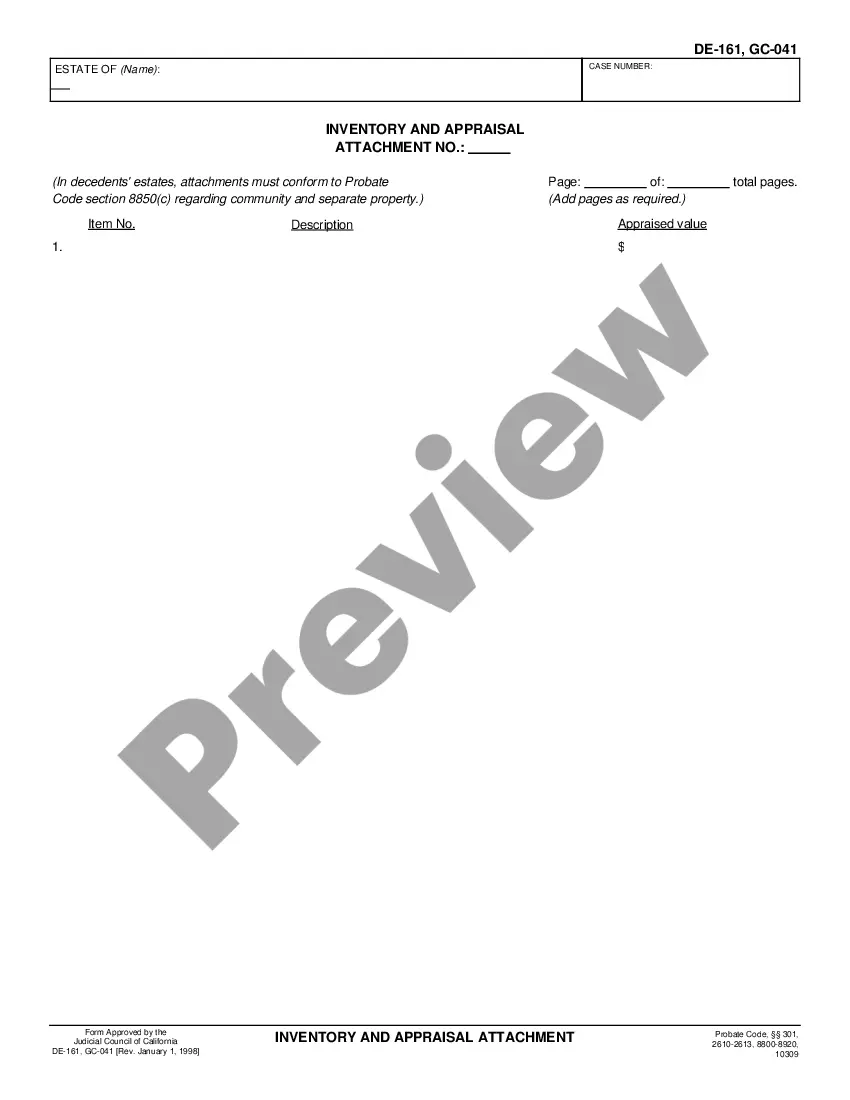

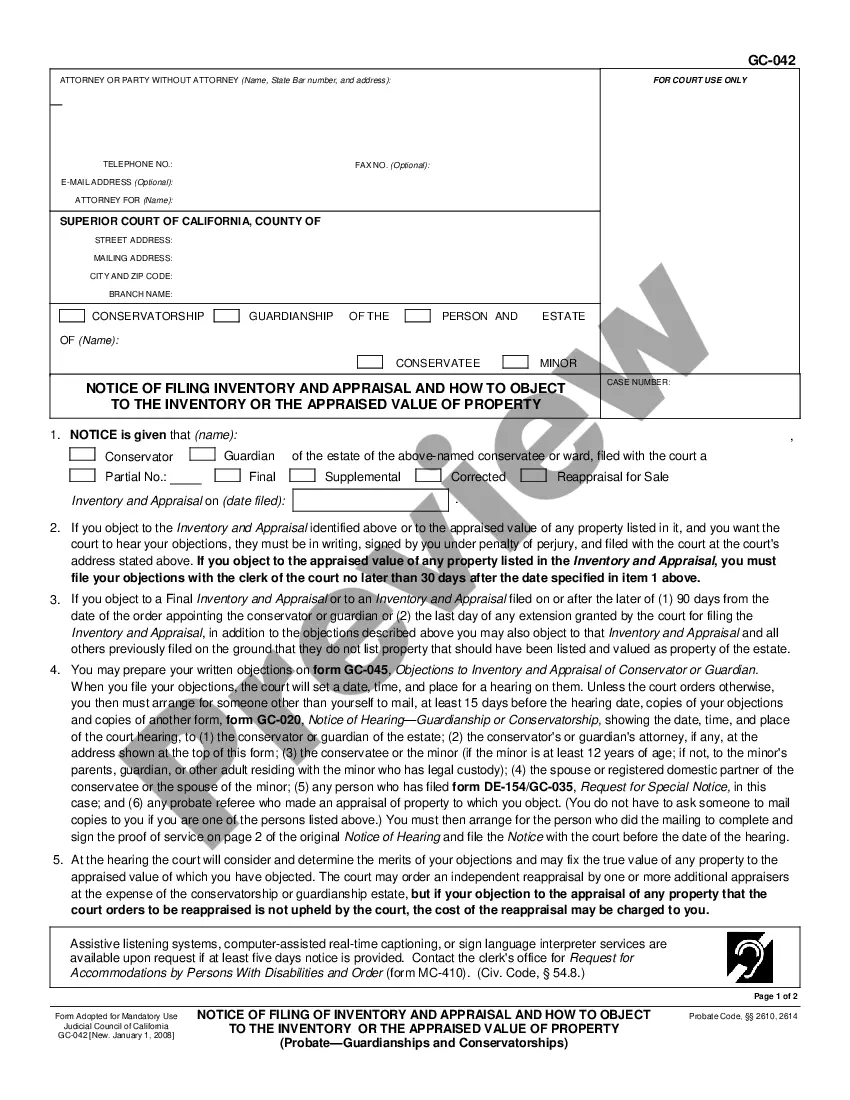

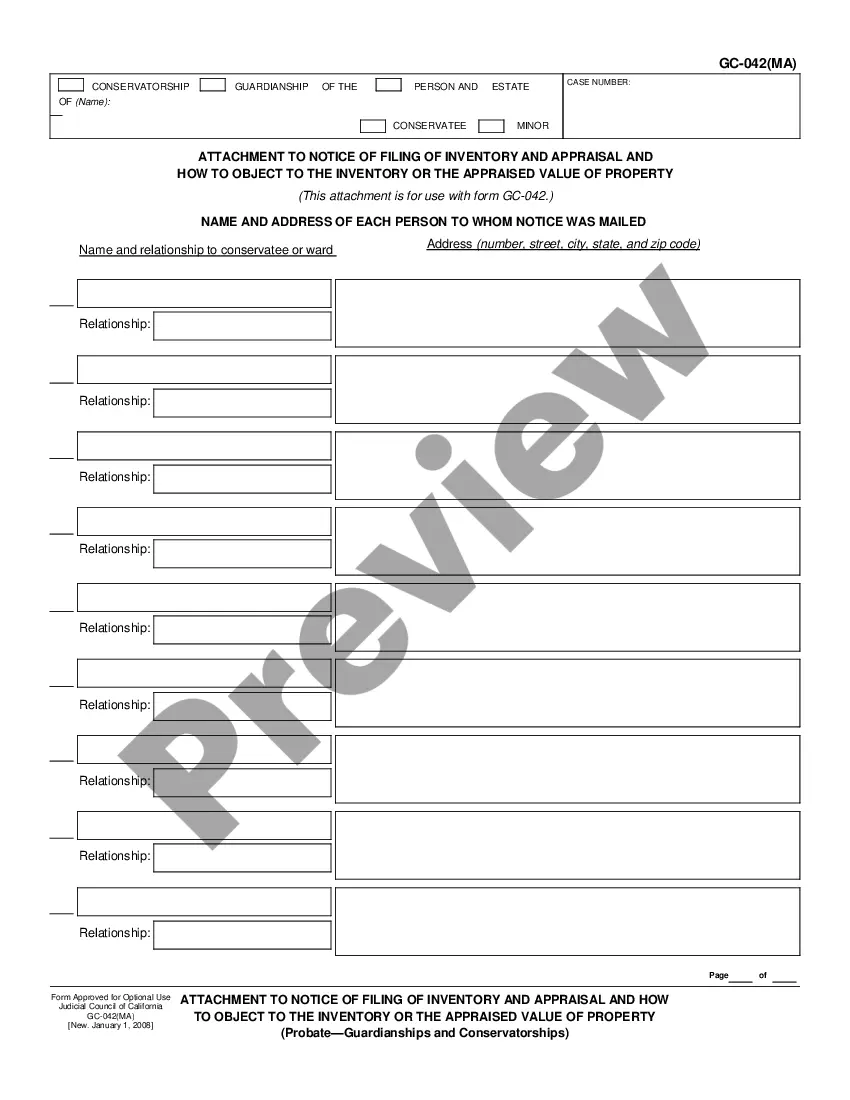

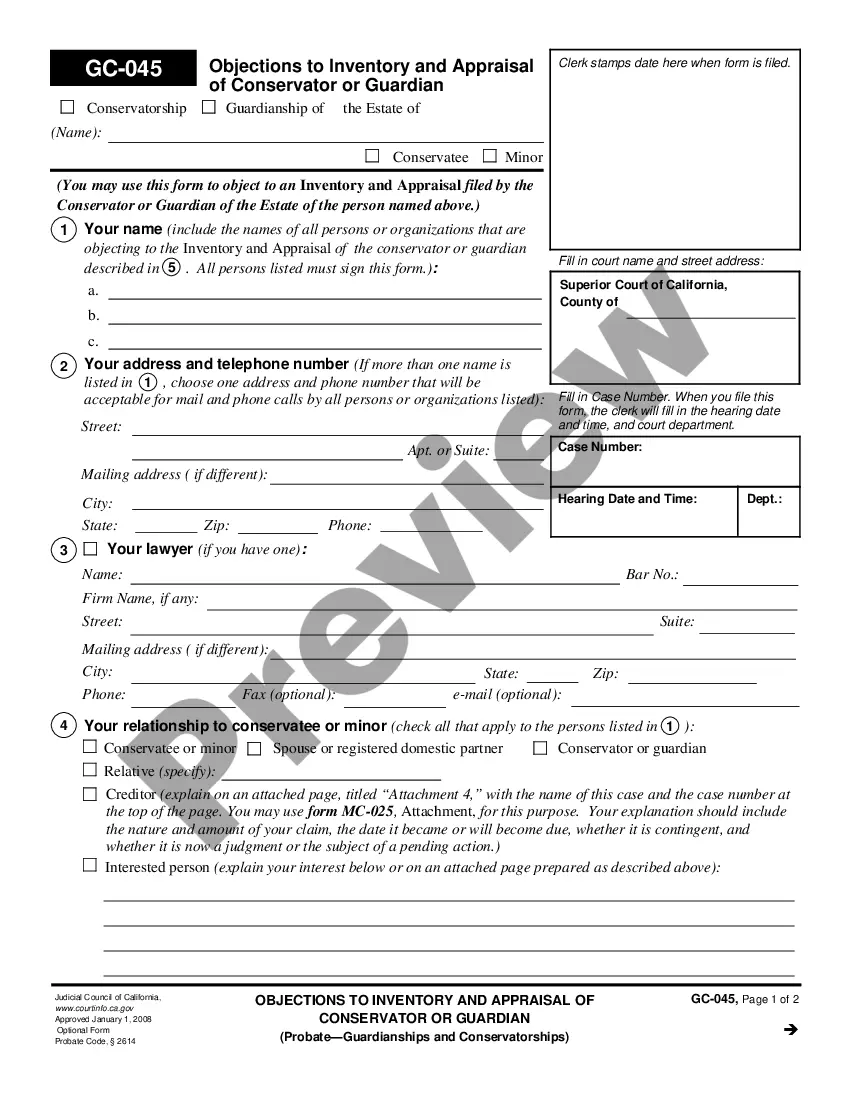

- Read the form description and check the Preview if there’s one on the page.

- Utilize the search tab providing your state above to find another template.

- Click Buy Now to get the sample when you find the proper one.

- Opt for the subscription plan that suits you most to proceed.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the San Diego Guaranty with Pledged Collateral in the file format you require.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Documents provided by our library are reusable. Having an active subscription, you are able to access all of your previously purchased paperwork at any moment in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date official documentation. Join the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form collection!