Wayne Michigan Guaranty with Pledged Collateral is a legal contract that provides certain assurances and protections to lenders in case of default by a borrower. This type of guaranty allows the lender to have an additional layer of security by requiring the borrower to pledge specific assets, known as collateral, to secure the loan. In Wayne Michigan, there are primarily two types of Guaranty with Pledged Collateral: 1. Real Estate Collateral: One type of collateral commonly used in Wayne Michigan Guaranty agreements is real estate. This can include residential or commercial properties, vacant land, or even industrial buildings. By pledging such assets, borrowers provide additional security to lenders, assuring them that if the borrower fails to repay the loan, the lender can seize and sell the pledged property to recover the outstanding debt. 2. Personal Property Collateral: Personal property, such as vehicles, equipment, inventory, or valuable assets like jewelry or artwork, can also be pledged as collateral under Wayne Michigan Guaranty agreements. This type of collateral allows lenders to have a right to possess and sell these assets in the event of a default, thereby recouping their losses. It is important to note that the specific terms and conditions of each Wayne Michigan Guaranty with Pledged Collateral may vary depending on the lender, borrower, and the nature of the loan. These agreements are tailored to meet the unique needs of the parties involved and are typically drafted by legal professionals to ensure compliance with local regulations and laws. By requiring pledged collateral, lenders can reduce their risk and have a sense of security that they have recourse in case the borrower fails to fulfill their financial obligations. However, borrowers should carefully consider the terms and implications of such guaranty agreements before entering into them, as the collateral pledged may be at risk of being seized by the lender in case of default. In summary, Wayne Michigan Guaranty with Pledged Collateral provides lenders enhanced protection by requiring borrowers to pledge specific assets as collateral. This extra layer of security offers lenders reassurance and allows them to recover outstanding debt through the sale of pledged real estate or personal property. It is crucial for both lenders and borrowers to consult legal professionals to ensure compliance with relevant laws and to understand the terms and conditions of these agreements thoroughly.

Wayne Michigan Guaranty with Pledged Collateral

Description

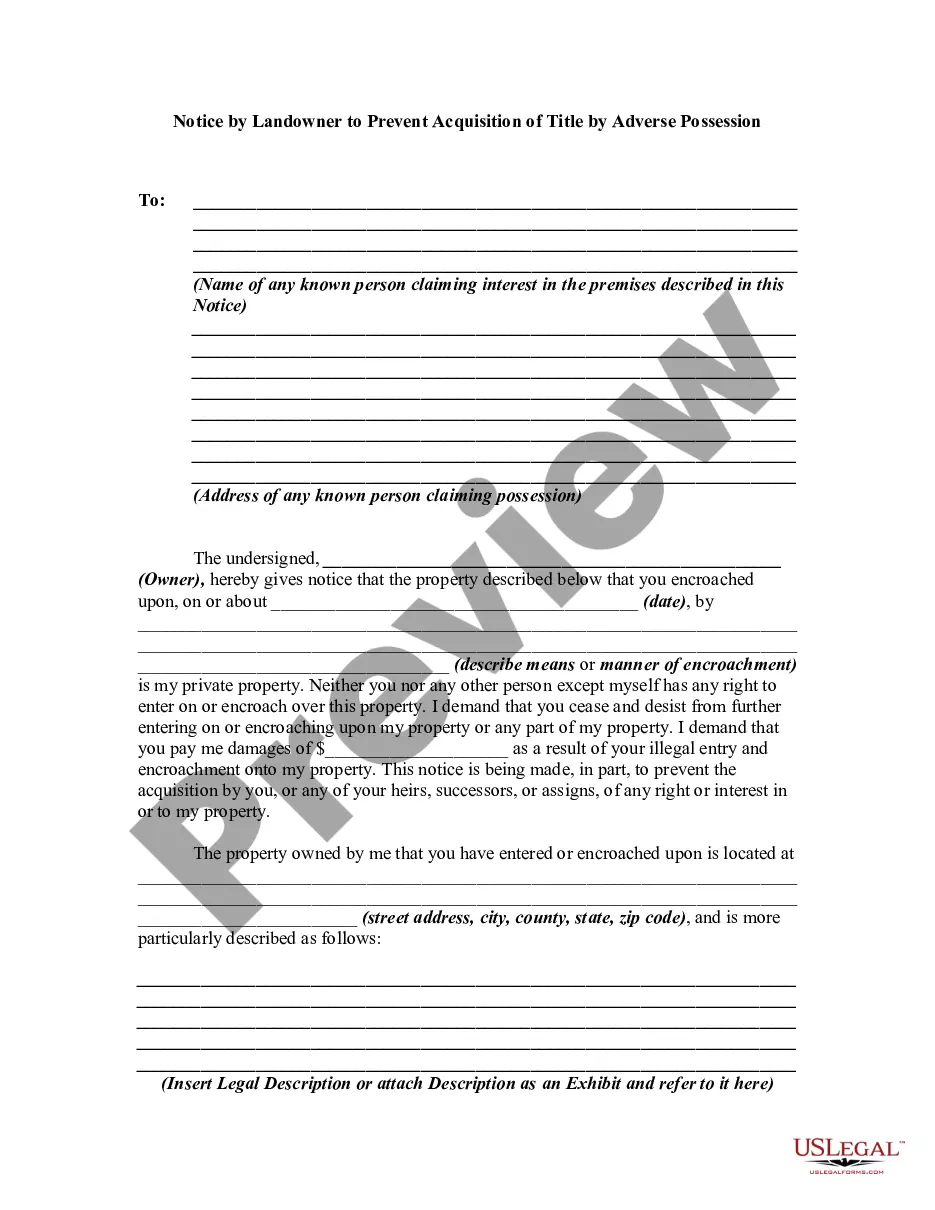

How to fill out Wayne Michigan Guaranty With Pledged Collateral?

If you need to get a trustworthy legal document provider to get the Wayne Guaranty with Pledged Collateral, consider US Legal Forms. Whether you need to start your LLC business or take care of your asset distribution, we got you covered. You don't need to be knowledgeable about in law to find and download the appropriate form.

- You can select from over 85,000 forms arranged by state/county and situation.

- The self-explanatory interface, variety of supporting resources, and dedicated support team make it simple to find and complete various papers.

- US Legal Forms is a reliable service providing legal forms to millions of customers since 1997.

Simply type to look for or browse Wayne Guaranty with Pledged Collateral, either by a keyword or by the state/county the document is intended for. After locating needed form, you can log in and download it or retain it in the My Forms tab.

Don't have an account? It's easy to get started! Simply locate the Wayne Guaranty with Pledged Collateral template and take a look at the form's preview and description (if available). If you're comfortable with the template’s legalese, go ahead and hit Buy now. Create an account and choose a subscription plan. The template will be immediately available for download as soon as the payment is processed. Now you can complete the form.

Taking care of your law-related affairs doesn’t have to be expensive or time-consuming. US Legal Forms is here to demonstrate it. Our rich collection of legal forms makes this experience less costly and more affordable. Set up your first business, arrange your advance care planning, create a real estate agreement, or complete the Wayne Guaranty with Pledged Collateral - all from the comfort of your home.

Join US Legal Forms now!