Allegheny Pennsylvania Charitable Trust with Creation Contingent upon Qualification for Tax Exempt Status is an organization that operates in Allegheny County, Pennsylvania, with the primary purpose of serving the community through charitable activities. As the name suggests, this trust is formed under Pennsylvania state law and is contingent upon meeting the requirements for tax-exempt status. The Allegheny Pennsylvania Charitable Trust with Creation Contingent upon Qualification for Tax Exempt Status adheres to strict guidelines and regulations to ensure its eligibility for tax exemption. This status grants the trust certain advantages, such as exemption from federal and state income taxes, allowing it to maximize its resources in fulfilling its charitable objectives. There can be various types of charitable trusts falling under the umbrella of the Allegheny Pennsylvania Charitable Trust with Creation Contingent upon Qualification for Tax Exempt Status, such as: 1. Educational Charitable Trusts: These focus on promoting education by funding scholarships, supporting educational institutions, or improving educational facilities. 2. Health and Medical Charitable Trusts: These trusts aim to enhance public health and fund medical research, healthcare services, hospitals, or similar initiatives to benefit the community's health and well-being. 3. Arts and Culture Charitable Trusts: These trusts contribute to the development and promotion of arts, culture, and heritage through funding artistic initiatives, cultural events, museums, or preserving historical landmarks. 4. Social Welfare Charitable Trusts: These trusts address social issues and work towards eradicating poverty, providing assistance to underprivileged communities, supporting social services, or improving living conditions for disadvantaged individuals. 5. Environmental Charitable Trusts: These trusts focus on environmental conservation, promoting sustainable practices, protecting natural resources, and raising awareness about environmental issues through funding environmental initiatives, conservation programs, or supporting related organizations. 6. Animal Welfare Charitable Trusts: These trusts work towards the welfare, protection, and care of animals. They can support animal shelters, rescue organizations, veterinary services, or fund initiatives related to animal rights and advocacy. Each type of Allegheny Pennsylvania Charitable Trust with Creation Contingent upon Qualification for Tax Exempt Status plays a vital role in improving and enriching the lives of individuals and communities within Allegheny County, Pennsylvania. By operating legally and meeting the requirements for tax-exempt status, these trusts can effectively mobilize resources and make a significant impact on the causes they support.

Allegheny Pennsylvania Charitable Trust with Creation Contingent upon Qualification for Tax Exempt Status

Description

How to fill out Allegheny Pennsylvania Charitable Trust With Creation Contingent Upon Qualification For Tax Exempt Status?

Preparing paperwork for the business or personal needs is always a big responsibility. When drawing up a contract, a public service request, or a power of attorney, it's essential to take into account all federal and state regulations of the specific area. Nevertheless, small counties and even cities also have legislative procedures that you need to consider. All these details make it tense and time-consuming to generate Allegheny Charitable Trust with Creation Contingent upon Qualification for Tax Exempt Status without expert assistance.

It's easy to avoid spending money on lawyers drafting your paperwork and create a legally valid Allegheny Charitable Trust with Creation Contingent upon Qualification for Tax Exempt Status by yourself, using the US Legal Forms online library. It is the biggest online collection of state-specific legal documents that are professionally cheched, so you can be certain of their validity when picking a sample for your county. Previously subscribed users only need to log in to their accounts to save the necessary document.

In case you still don't have a subscription, follow the step-by-step instruction below to get the Allegheny Charitable Trust with Creation Contingent upon Qualification for Tax Exempt Status:

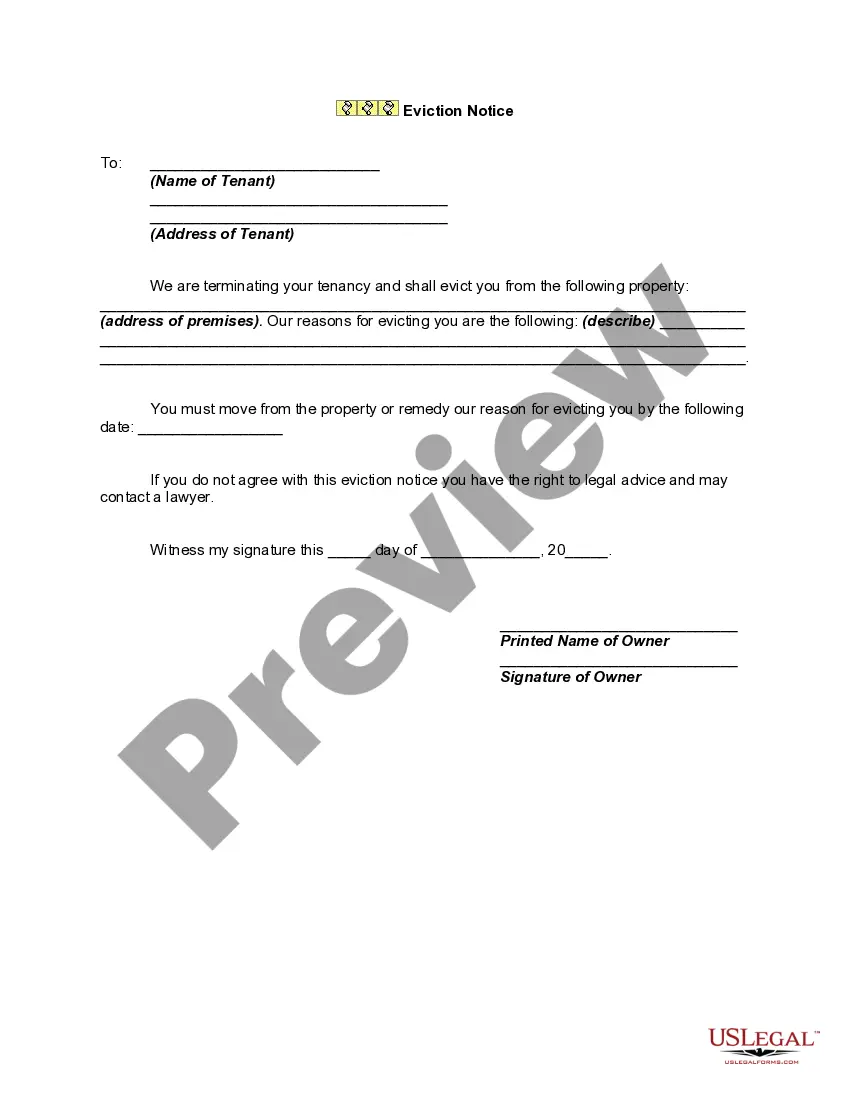

- Examine the page you've opened and check if it has the sample you need.

- To accomplish this, use the form description and preview if these options are presented.

- To locate the one that fits your needs, utilize the search tab in the page header.

- Recheck that the template complies with juridical criteria and click Buy Now.

- Pick the subscription plan, then log in or create an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the selected document in the preferred format, print it, or fill it out electronically.

The great thing about the US Legal Forms library is that all the paperwork you've ever obtained never gets lost - you can get it in your profile within the My Forms tab at any time. Join the platform and easily get verified legal templates for any use case with just a couple of clicks!