Cuyahoga Ohio Charitable Trust with Creation Contingent upon Qualification for Tax Exempt Status is a legal entity established in Cuyahoga County, Ohio, with the purpose of supporting and promoting charitable activities within the local community. This specific type of charitable trust is created with certain conditions, one being that it must qualify for tax-exempt status. Cuyahoga Ohio Charitable Trust serves as a vehicle for individuals, families, or organizations to make philanthropic contributions and create a lasting impact in the community. By establishing a charitable trust, individuals can establish a legacy of giving and ensure their charitable intentions are carried out even after their lifetime. Qualifying for tax-exempt status is an essential aspect of this type of charitable trust. By obtaining tax-exempt status, the Cuyahoga Ohio Charitable Trust becomes eligible for various tax benefits, including exemption from federal income tax, which allows more funds to be directed towards charitable causes and programs. Different types of Cuyahoga Ohio Charitable Trusts with creation contingent upon qualification for tax-exempt status can include: 1. Educational Charitable Trust: This type of trust aims to support education-related activities within Cuyahoga County. It can provide scholarships, grants, or funding for educational institutions, programs, or initiatives that promote academic excellence and access to education. 2. Health and Wellness Charitable Trust: This trust focuses on improving the health and wellbeing of individuals in Cuyahoga County. It may support healthcare facilities, medical research, community health programs, or initiatives that address specific health issues prevalent in the region. 3. Environmental Charitable Trust: Such a trust is designed to protect and preserve the environment in Cuyahoga County. It may fund initiatives related to conservation, sustainability, environmental education programs, or projects promoting the restoration of natural habitats. 4. Community Development Charitable Trust: This trust aims to enhance the overall quality of life in Cuyahoga County through community development initiatives. It can support affordable housing programs, economic development projects, community outreach programs, or initiatives that strive to create a positive social impact. 5. Arts and Culture Charitable Trust: This type of trust focuses on nurturing the arts and cultural landscape of Cuyahoga County. It may support local museums, art galleries, theaters, music programs, or festivals that contribute to the enrichment of the community's artistic and cultural experiences. Establishing a Cuyahoga Ohio Charitable Trust with Creation Contingent upon Qualification for Tax Exempt Status enables donors to support causes close to their hearts while enjoying potential tax benefits. It is essential to work with legal and financial advisors who specialize in charitable giving and trust administration to ensure compliance with all legal requirements and maximize the trust's impact.

Cuyahoga Ohio Charitable Trust with Creation Contingent upon Qualification for Tax Exempt Status

Description

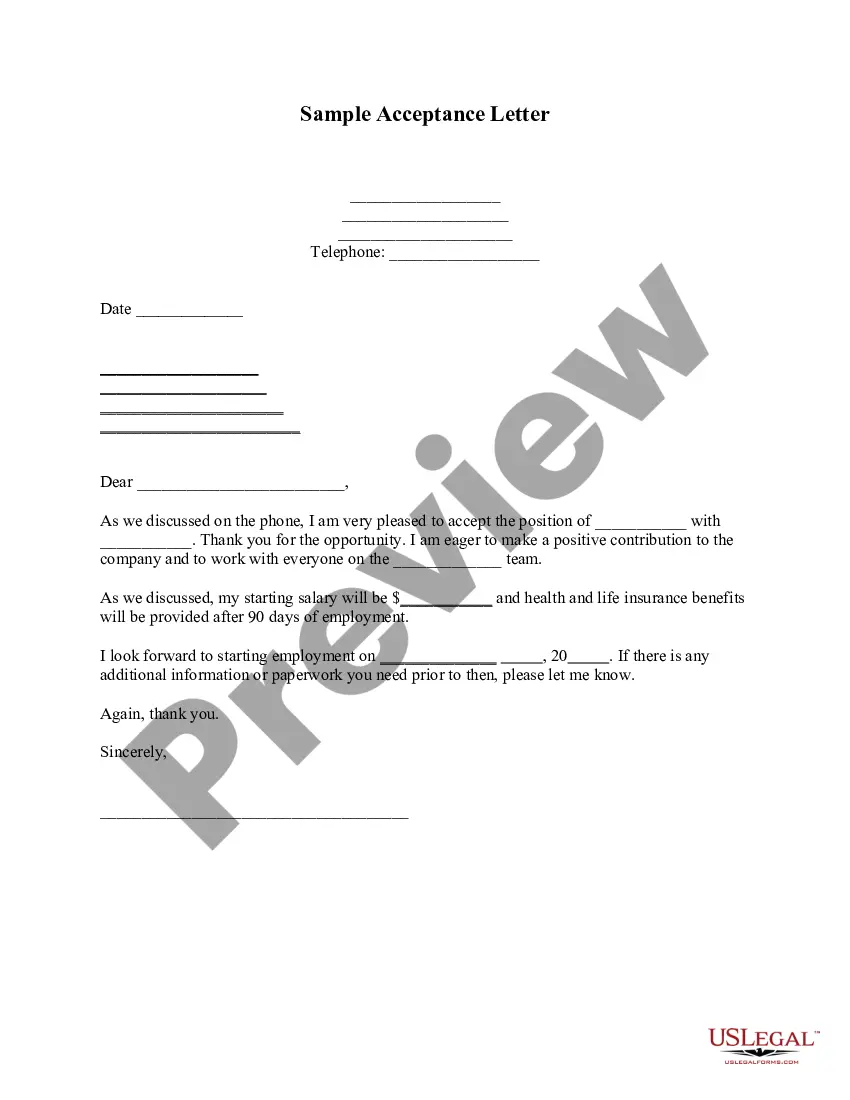

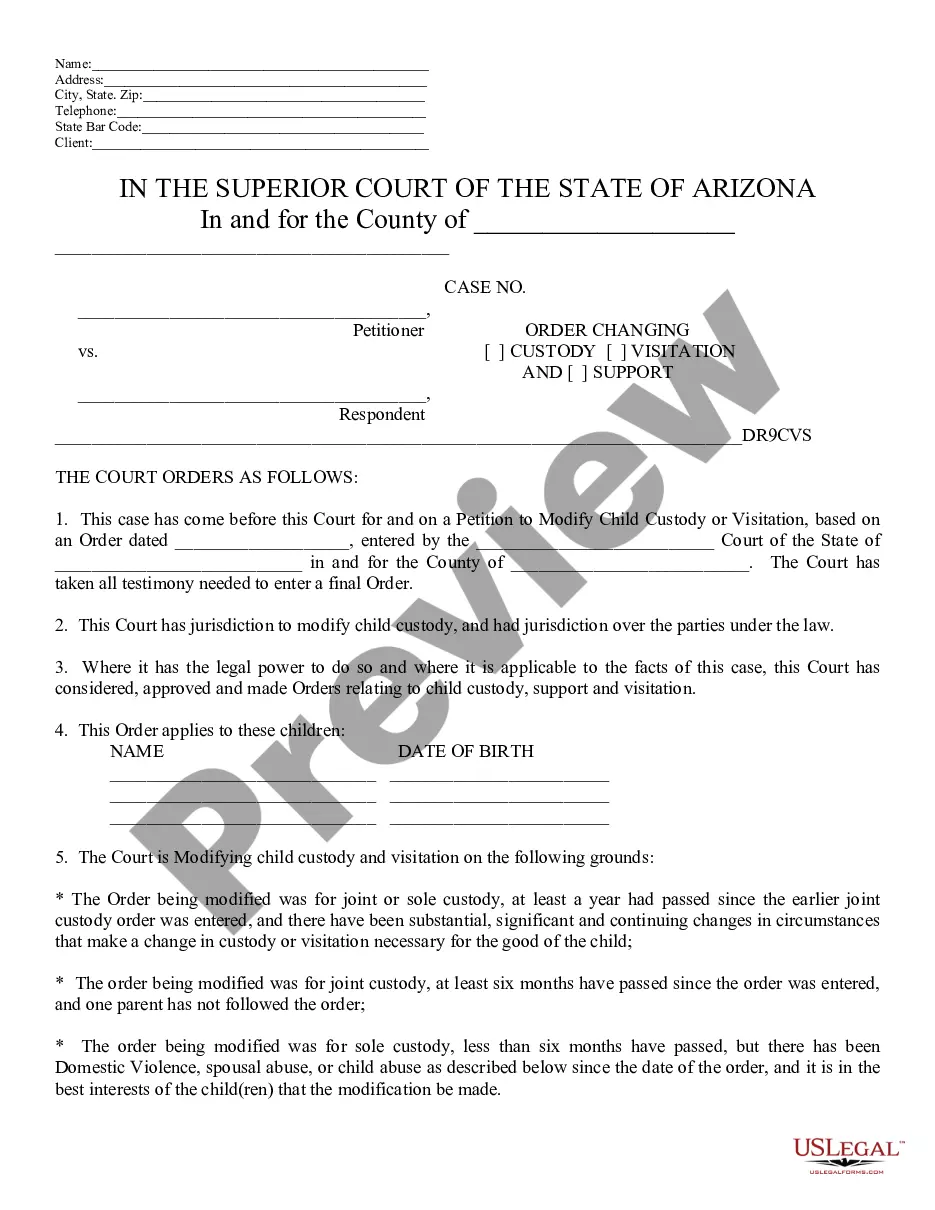

How to fill out Cuyahoga Ohio Charitable Trust With Creation Contingent Upon Qualification For Tax Exempt Status?

If you need to get a trustworthy legal paperwork supplier to find the Cuyahoga Charitable Trust with Creation Contingent upon Qualification for Tax Exempt Status, consider US Legal Forms. Whether you need to start your LLC business or take care of your asset distribution, we got you covered. You don't need to be knowledgeable about in law to locate and download the needed form.

- You can search from more than 85,000 forms arranged by state/county and situation.

- The self-explanatory interface, variety of supporting materials, and dedicated support make it easy to locate and complete different papers.

- US Legal Forms is a trusted service providing legal forms to millions of customers since 1997.

You can simply select to search or browse Cuyahoga Charitable Trust with Creation Contingent upon Qualification for Tax Exempt Status, either by a keyword or by the state/county the form is intended for. After locating needed form, you can log in and download it or retain it in the My Forms tab.

Don't have an account? It's effortless to start! Simply find the Cuyahoga Charitable Trust with Creation Contingent upon Qualification for Tax Exempt Status template and check the form's preview and short introductory information (if available). If you're comfortable with the template’s terminology, go ahead and hit Buy now. Register an account and choose a subscription option. The template will be instantly available for download as soon as the payment is processed. Now you can complete the form.

Handling your law-related affairs doesn’t have to be pricey or time-consuming. US Legal Forms is here to prove it. Our extensive variety of legal forms makes these tasks less pricey and more reasonably priced. Create your first company, organize your advance care planning, draft a real estate agreement, or complete the Cuyahoga Charitable Trust with Creation Contingent upon Qualification for Tax Exempt Status - all from the comfort of your sofa.

Sign up for US Legal Forms now!