Mecklenburg North Carolina Charitable Trust with Creation Contingent upon Qualification for Tax Exempt Status is a type of trust established in Mecklenburg County, North Carolina, with the intention of supporting charitable causes while also seeking tax-exempt status. This trust structure ensures that the trust's assets are allocated for philanthropic purposes and that it meets the necessary requirements to be eligible for tax benefits. The creation of a Mecklenburg North Carolina Charitable Trust with Creation Contingent upon Qualification for Tax Exempt Status involves several key steps. Firstly, an individual or entity, known as the granter, initiates the creation of the trust by transferring assets into the trust. These assets could include cash, real estate, securities, or any other valuable property. The granter then establishes the purpose of the trust, which should be exclusively charitable. To be eligible for tax-exempt status, the trust must be established and operated in accordance with the rules and regulations set forth by the Internal Revenue Service (IRS). This includes meeting the criteria outlined in section 501(c)(3) of the Internal Revenue Code. The qualification process involves submitting an application to the IRS and receiving an official determination letter stating that the trust qualifies for tax-exempt status. Once the Mecklenburg North Carolina Charitable Trust is successfully established and recognized as tax-exempt, it can enjoy several benefits. Firstly, it becomes eligible for various tax advantages, including exemption from federal income tax, as well as potential exemptions from state and local taxes. Additionally, it may attract potential donors who can deduct their contributions to the trust on their tax returns, further incentivizing philanthropic giving. Different types of charitable trusts that can be created in Mecklenburg, North Carolina, with contingent qualification for tax-exempt status could include: 1. Charitable Remainder Trust: This type of trust allows the donor to receive income from the trust during their lifetime, after which the remaining assets are distributed to charitable organizations. 2. Charitable Lead Trust: In this trust, the income generated from the trust's assets is directed to charitable organizations for a specified period, after which the remaining assets are returned to the donor or their designated beneficiaries. 3. Pooled Income Fund: This is a type of trust where multiple donors pool their assets together, and the income generated is distributed to various charitable organizations. Each donor's income share is determined by their contribution to the fund. 4. Charitable Gift Annuity: With this trust, the donor transfers assets to the trust in exchange for a guaranteed income stream for life, and upon their passing, the remaining assets are directed to charitable causes. These are just a few examples of the various types of charitable trusts that can be established in Mecklenburg County, North Carolina, with contingent qualification for tax-exempt status. Each provides a unique structure for individuals or entities to support philanthropy while enjoying potential tax advantages. It is crucial to consult with legal and financial professionals to determine the most suitable trust structure based on individual circumstances and philanthropic goals.

Mecklenburg North Carolina Charitable Trust with Creation Contingent upon Qualification for Tax Exempt Status

Description

How to fill out Mecklenburg North Carolina Charitable Trust With Creation Contingent Upon Qualification For Tax Exempt Status?

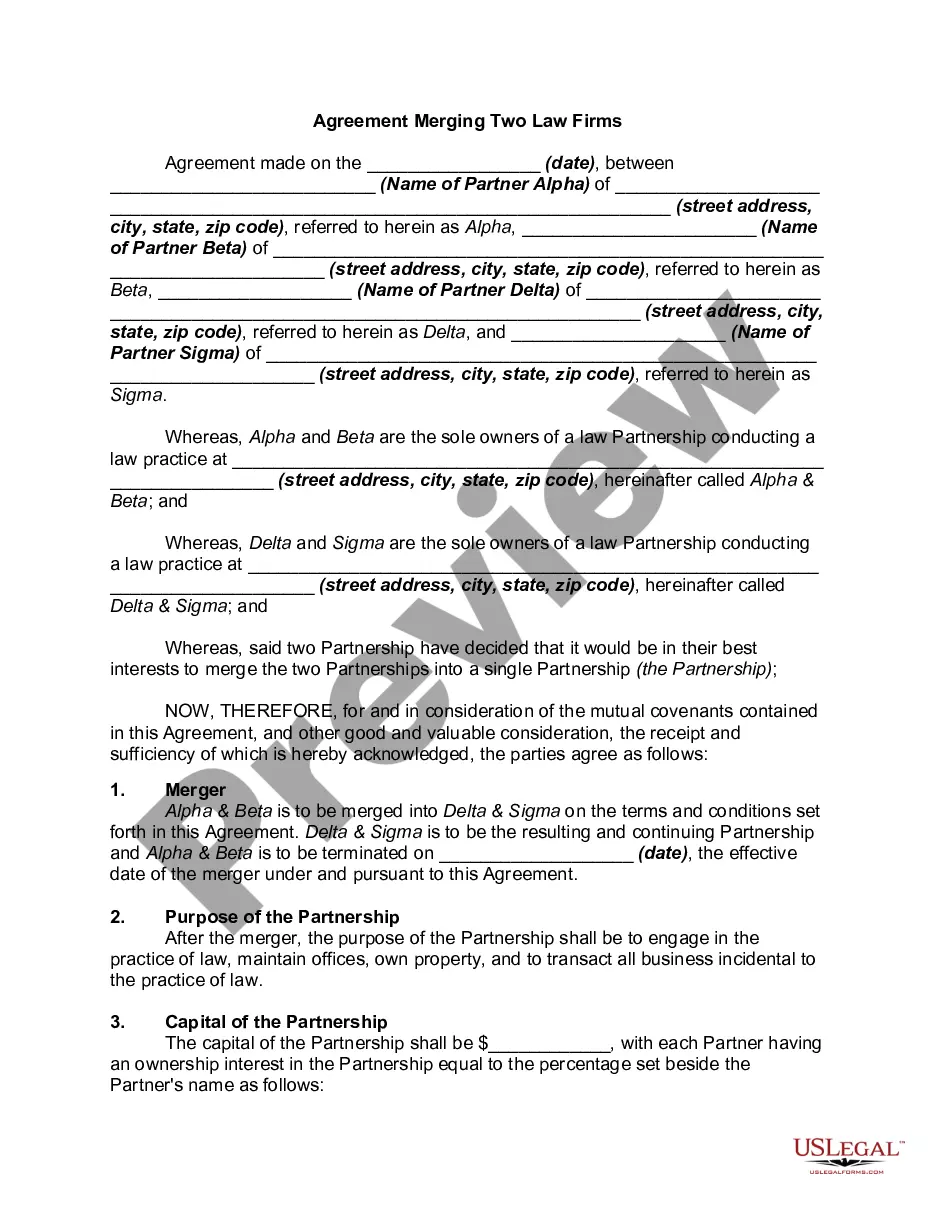

Dealing with legal forms is a necessity in today's world. However, you don't always need to seek professional help to draft some of them from the ground up, including Mecklenburg Charitable Trust with Creation Contingent upon Qualification for Tax Exempt Status, with a platform like US Legal Forms.

US Legal Forms has over 85,000 templates to pick from in different types ranging from living wills to real estate paperwork to divorce documents. All forms are arranged according to their valid state, making the searching process less challenging. You can also find information materials and tutorials on the website to make any tasks associated with paperwork execution straightforward.

Here's how you can find and download Mecklenburg Charitable Trust with Creation Contingent upon Qualification for Tax Exempt Status.

- Take a look at the document's preview and description (if available) to get a general idea of what you’ll get after downloading the document.

- Ensure that the document of your choice is specific to your state/county/area since state laws can impact the validity of some documents.

- Examine the similar forms or start the search over to locate the right document.

- Click Buy now and create your account. If you already have an existing one, select to log in.

- Choose the option, then a suitable payment method, and purchase Mecklenburg Charitable Trust with Creation Contingent upon Qualification for Tax Exempt Status.

- Choose to save the form template in any offered file format.

- Go to the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can locate the appropriate Mecklenburg Charitable Trust with Creation Contingent upon Qualification for Tax Exempt Status, log in to your account, and download it. Of course, our platform can’t replace a lawyer entirely. If you need to deal with an exceptionally challenging situation, we advise getting a lawyer to examine your form before signing and submitting it.

With over 25 years on the market, US Legal Forms became a go-to platform for many different legal forms for millions of users. Join them today and purchase your state-specific paperwork effortlessly!