Oakland Michigan Charitable Trust with Creation Contingent upon Qualification for Tax Exempt Status refers to a specific kind of charitable trust established in Oakland County, Michigan that is eligible for tax exemption, subject to meeting specific qualifications. These trusts are designed to support various charitable causes and organizations, providing financial assistance and resources to make a positive impact on the community. The creation of an Oakland Michigan Charitable Trust with Creation Contingent upon Qualification for Tax Exempt Status involves carefully adhering to legal and regulatory requirements to ensure tax-exempt status is granted. This includes adherence to the Internal Revenue Service (IRS) guidelines and provisions outlined by the state of Michigan. By establishing a charitable trust, individuals or organizations can contribute assets or funds to support specific charitable causes or organizations of their choice. The assets are held and managed by a trustee, who is responsible for distributing the funds according to the donor's wishes and within the limits set by applicable laws and regulations. In Oakland, Michigan, there may be various types of charitable trusts created with a qualification for tax-exempt status. Some common examples include: 1. Oakland Michigan Charitable Trust for Education: This type of trust is designed to support educational institutions, scholarships, or programs within the community. It aims to promote education and help students pursue their academic goals. 2. Oakland Michigan Charitable Trust for Health and Wellness: This trust focuses on supporting healthcare facilities, research programs, or initiatives that enhance community health and wellness. Funding might be directed towards medical equipment, healthcare services, or public health campaigns. 3. Oakland Michigan Charitable Trust for the Arts: This trust is established to promote and support artistic endeavors, such as funding for local museums, art galleries, theater groups, or musical organizations. It aims to enrich the cultural landscape of the community and foster artistic expression. 4. Oakland Michigan Charitable Trust for Environmental Conservation: This type of trust focuses on conservation efforts, preservation of natural resources, and protection of the environment. It may support initiatives related to wildlife preservation, environmental research, or sustainable practices in the community. 5. Oakland Michigan Charitable Trust for Social Services: This trust is dedicated to assisting individuals or organizations that provide social services to vulnerable populations. It may support programs addressing poverty alleviation, homelessness, domestic violence, or other related causes. Creating an Oakland Michigan Charitable Trust with Creation Contingent upon Qualification for Tax Exempt Status offers individuals and organizations an opportunity to support causes they care about while potentially benefiting from tax advantages. It is essential to consult legal and financial professionals to ensure compliance with all applicable laws and regulations.

Oakland Michigan Charitable Trust with Creation Contingent upon Qualification for Tax Exempt Status

Description

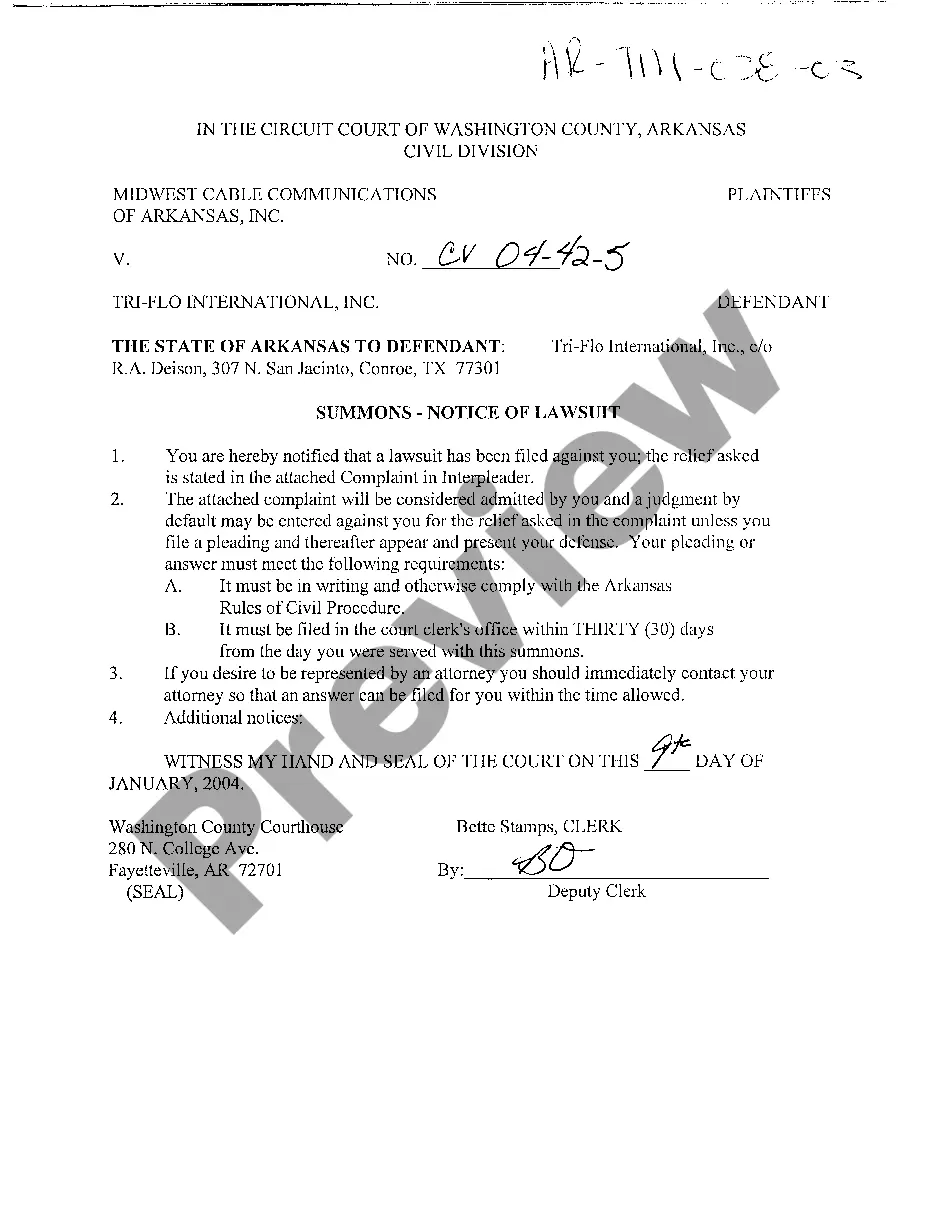

How to fill out Oakland Michigan Charitable Trust With Creation Contingent Upon Qualification For Tax Exempt Status?

Do you need to quickly draft a legally-binding Oakland Charitable Trust with Creation Contingent upon Qualification for Tax Exempt Status or probably any other form to take control of your personal or business affairs? You can go with two options: contact a legal advisor to write a valid document for you or draft it entirely on your own. Luckily, there's a third option - US Legal Forms. It will help you get professionally written legal paperwork without having to pay sky-high fees for legal services.

US Legal Forms offers a rich catalog of more than 85,000 state-specific form templates, including Oakland Charitable Trust with Creation Contingent upon Qualification for Tax Exempt Status and form packages. We provide templates for an array of life circumstances: from divorce paperwork to real estate document templates. We've been on the market for more than 25 years and gained a rock-solid reputation among our clients. Here's how you can become one of them and obtain the needed template without extra hassles.

- First and foremost, carefully verify if the Oakland Charitable Trust with Creation Contingent upon Qualification for Tax Exempt Status is adapted to your state's or county's laws.

- In case the document comes with a desciption, make sure to verify what it's intended for.

- Start the searching process again if the form isn’t what you were looking for by utilizing the search box in the header.

- Select the subscription that best fits your needs and proceed to the payment.

- Select the format you would like to get your document in and download it.

- Print it out, fill it out, and sign on the dotted line.

If you've already registered an account, you can easily log in to it, locate the Oakland Charitable Trust with Creation Contingent upon Qualification for Tax Exempt Status template, and download it. To re-download the form, just go to the My Forms tab.

It's stressless to find and download legal forms if you use our catalog. In addition, the templates we provide are updated by industry experts, which gives you greater confidence when writing legal matters. Try US Legal Forms now and see for yourself!

Form popularity

FAQ

Exemption Requirements - 501(c)(3) Organizations To be tax-exempt under section 501(c)(3) of the Internal Revenue Code, an organization must be organized and operated exclusively for exempt purposes set forth in section 501(c)(3), and none of its earnings may inure to any private shareholder or individual.

These include social welfare organizations, civic leagues, social clubs, labor organizations and business leagues.

Organizations organized and operated exclusively for religious, charitable, scientific, testing for public safety, literary, educational, or other specified purposes and that meet certain other requirements are tax exempt under Internal Revenue Code Section 501(c)(3).

One of the requirements for a non-profit organization is that it must serve the public. The IRS requires that the organization must be structured and operated solely for exempt purposes such as science, religion, charitable, literary, research, public safety testing, children's safety, and animal cruelty prevention.

The most common way to show tax status is to give the donor a copy of your organization's IRS determination letter, which you received when you received 501(c)(3) tax-exempt entity. This letter shows the type tax-exempt and whether it is a private foundation or a public charity.

A qualified charitable organization is recognized as tax-exempt in the pursuit of philanthropic, nonprofit, or civic activities. Section 501(c)(3) is the specific portion of the U.S. Internal Revenue Code (IRC) and a specific tax category for nonprofit organizations.

In order to be exempt, trust is required to apply at-least 85% of its income to charitable or religious purpose in India. As per the definition provided under tax provisions, charitable purpose includes the following: Relief of the poor.

A charitable remainder trust is a split interest giving vehicle that allows you to make contributions to the trust and be eligible for a partial tax deduction, based on the CRT's assets that will pass to charitable beneficiaries.

To qualify as a nonprofit, your business must serve the public good in some way. Nonprofits do not distribute profit to anything other than furthering the advancement of the organization.

Convert Appreciated Assets into Income with a Charitable Remainder Trust ("CRT") Convert Appreciated Assets into a Lifetime or Retirement Income Stream.Couple a CRT with a Donor-Advised Fund (DAF).Reduce Your Taxes with a Charitable Income Tax Deduction.Defer Capital Gains Tax.Reduce or Eliminate Estate Taxes.