San Diego California Charitable Trust with Creation Contingent upon Qualification for Tax Exempt Status: A San Diego California Charitable Trust with Creation Contingent upon Qualification for Tax Exempt Status refers to a legal entity established for charitable purposes in the city of San Diego, California. This type of trust seeks to achieve tax-exempt status from the Internal Revenue Service (IRS) to provide certain benefits and advantages to its members and donors. The primary objective of a San Diego California Charitable Trust with Creation Contingent upon Qualification for Tax Exempt Status is to engage in philanthropic activities and support causes that contribute positively to the community. By qualifying for tax-exempt status, the trust can provide donors with tax deductions for their charitable contributions, thereby incentivizing philanthropic giving. There are several types of San Diego California Charitable Trusts with Creation Contingent upon Qualification for Tax Exempt Status, including: 1. Public Charitable Trust: This type of trust operates exclusively for charitable, educational, religious, or scientific purposes meant to benefit the public or a specific group of individuals. Public Charitable Trusts often engage in community development, health initiatives, educational programs, poverty alleviation, and more. 2. Private Charitable Trust: These trusts are established for the benefit of a specific individual or family, with the primary purpose of distributing funds to charitable causes. Although they serve philanthropic goals, their focus may be more limited in scope and impact. Private Charitable Trusts often support causes aligned with the interests and passions of the trust's creator or beneficiaries. 3. Operating Foundations: Operating foundations are charitable trusts that actively engage in conducting their own charitable activities. They use their funds to directly support projects and initiatives rather than distributing grants to other charities or organizations. These foundations play an active role in the implementation and execution of programs aimed at achieving their philanthropic goals. To qualify for tax-exempt status, these charitable trusts must meet specific requirements set forth by the IRS. These stipulations typically include demonstrating that the trust's activities are exclusively charitable, that it operates for the benefit of the public, and that it does not engage in activities that serve private interests or individuals. Overall, a San Diego California Charitable Trust with Creation Contingent upon Qualification for Tax Exempt Status represents a legal structure aimed at supporting charitable endeavors while enjoying certain tax benefits. By adhering to IRS guidelines and fulfilling the necessary criteria, these trusts can make a significant positive impact within the San Diego community and beyond.

San Diego California Charitable Trust with Creation Contingent upon Qualification for Tax Exempt Status

Description

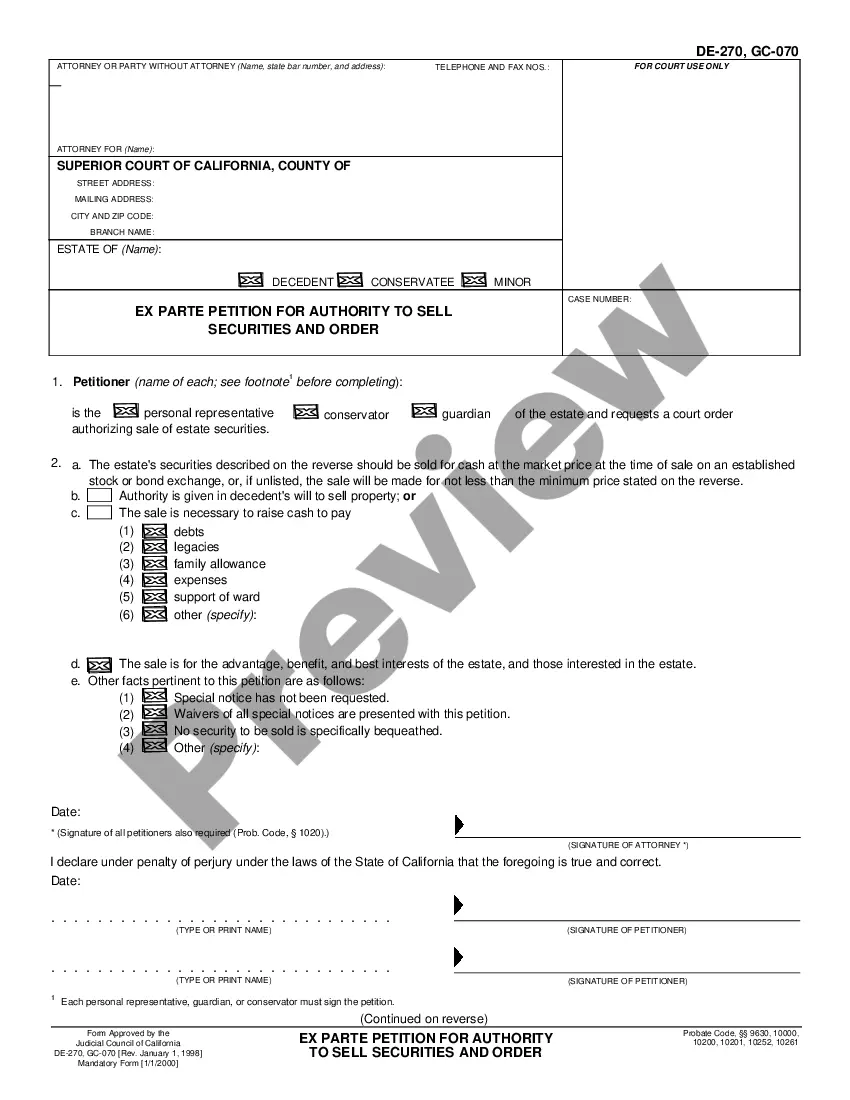

How to fill out San Diego California Charitable Trust With Creation Contingent Upon Qualification For Tax Exempt Status?

Drafting paperwork for the business or personal demands is always a huge responsibility. When drawing up an agreement, a public service request, or a power of attorney, it's crucial to consider all federal and state regulations of the specific region. Nevertheless, small counties and even cities also have legislative procedures that you need to consider. All these details make it burdensome and time-consuming to create San Diego Charitable Trust with Creation Contingent upon Qualification for Tax Exempt Status without professional help.

It's easy to avoid wasting money on lawyers drafting your paperwork and create a legally valid San Diego Charitable Trust with Creation Contingent upon Qualification for Tax Exempt Status by yourself, using the US Legal Forms web library. It is the biggest online catalog of state-specific legal templates that are professionally verified, so you can be certain of their validity when picking a sample for your county. Previously subscribed users only need to log in to their accounts to save the needed form.

If you still don't have a subscription, follow the step-by-step guideline below to obtain the San Diego Charitable Trust with Creation Contingent upon Qualification for Tax Exempt Status:

- Examine the page you've opened and verify if it has the sample you need.

- To achieve this, use the form description and preview if these options are available.

- To locate the one that meets your requirements, utilize the search tab in the page header.

- Double-check that the sample complies with juridical criteria and click Buy Now.

- Select the subscription plan, then sign in or register for an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the chosen document in the preferred format, print it, or fill it out electronically.

The exceptional thing about the US Legal Forms library is that all the paperwork you've ever obtained never gets lost - you can access it in your profile within the My Forms tab at any time. Join the platform and quickly get verified legal forms for any situation with just a few clicks!