San Jose California Charitable Trust with Creation Contingent upon Qualification for Tax Exempt Status refers to a specific type of charitable trust established in San Jose, California, USA. This trust is created with the condition that it will only be formed once it has obtained tax-exempt status from the relevant authorities. This designation allows the trust to receive certain tax benefits, including exemption from federal income tax. San Jose, located in the heart of Silicon Valley, is a thriving and diverse city known for its technological innovations, vibrant culture, and commitment to social causes. The San Jose California Charitable Trust with Creation Contingent upon Qualification for Tax Exempt Status plays a significant role in supporting various philanthropic endeavors within the community. By establishing this trust, individuals or organizations can ensure that their charitable contributions have a lasting impact. Donors can contribute funds, assets, or property to the trust, which is then managed and disbursed according to the trust's established guidelines and charitable purposes. The tax-exempt status of this trust allows it to utilize its resources to promote social welfare, support educational initiatives, provide relief for disadvantaged individuals or groups, or address community-specific issues. The trust can engage in diverse endeavors such as funding scholarships, offering grants to non-profit organizations, supporting public services, or advancing medical research, among others. Types of San Jose California Charitable Trusts with Creation Contingent upon Qualification for Tax Exempt Status may include: 1. Education-focused Trusts: These trusts concentrate on supporting educational institutions, scholarships, vocational training programs, or other educational initiatives aimed at improving access to quality education and promoting lifelong learning. 2. Healthcare and Medical Research Trusts: This type of charitable trust focuses on advancing medical research, improving healthcare facilities, supporting community clinics, or funding programs that provide medical assistance to underserved populations. 3. Arts and Culture Trusts: These trusts aim to preserve and promote art, culture, and creative expressions within the San Jose community. They often fund arts organizations, museums, cultural events, or initiatives that enhance community engagement and cultural diversity. 4. Environment and Conservation Trusts: These trusts prioritize causes related to environmental protection, wildlife conservation, sustainable development, or initiatives addressing climate change. They support projects that promote ecological awareness, restore natural resources, or preserve biodiversity. 5. Social Welfare Trusts: This type of trust focuses on providing relief and assistance to disadvantaged individuals or communities facing poverty, homelessness, domestic violence, or other societal challenges. They may support organizations that offer essential services, such as food banks, shelters, counseling programs, or job training. San Jose California Charitable Trusts with Creation Contingent upon Qualification for Tax Exempt Status offer an avenue for individuals and organizations to make a meaningful difference in the community while also enjoying the tax benefits that come with supporting charitable causes.

San Jose California Charitable Trust with Creation Contingent upon Qualification for Tax Exempt Status

Description

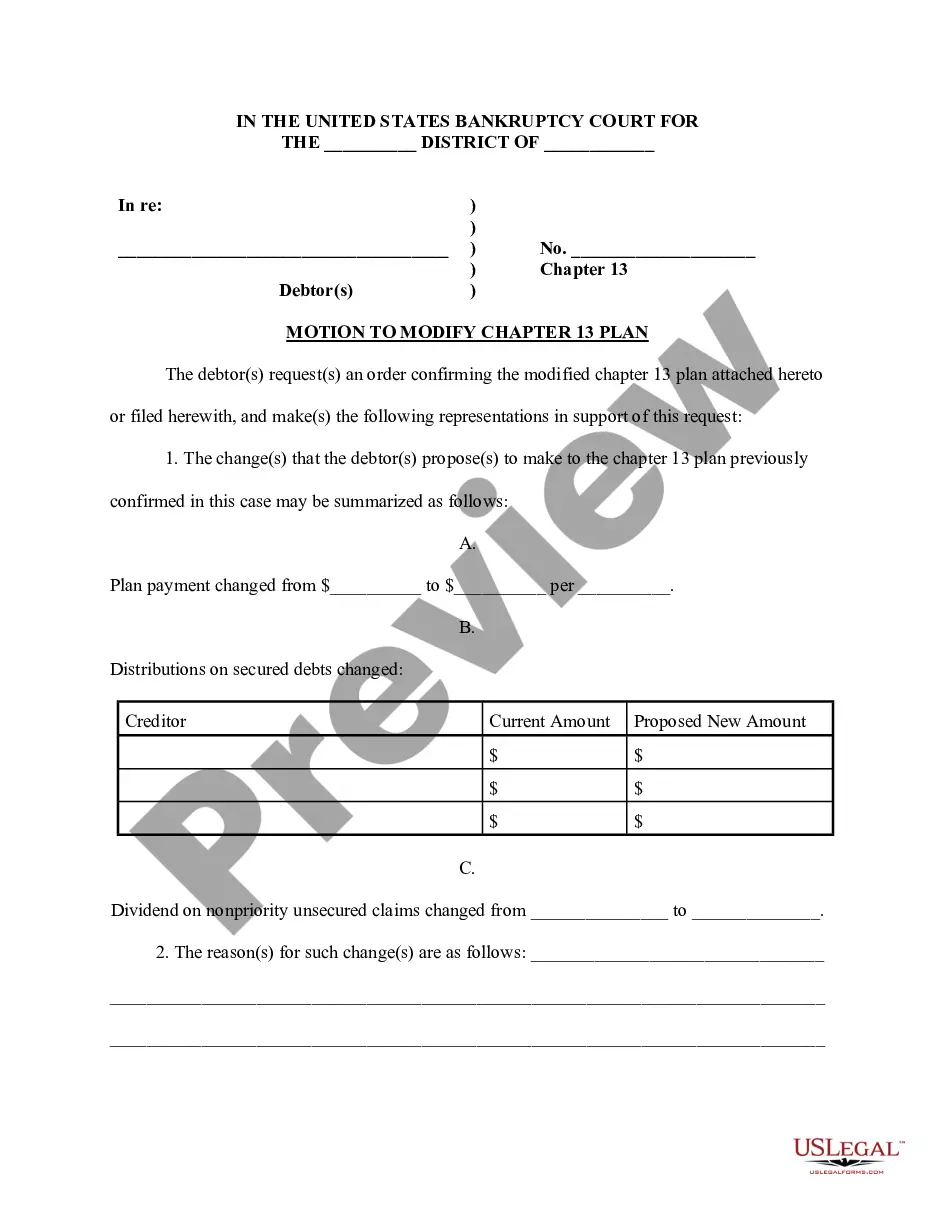

How to fill out San Jose California Charitable Trust With Creation Contingent Upon Qualification For Tax Exempt Status?

Are you looking to quickly draft a legally-binding San Jose Charitable Trust with Creation Contingent upon Qualification for Tax Exempt Status or maybe any other form to handle your own or corporate affairs? You can go with two options: hire a professional to draft a legal paper for you or draft it entirely on your own. Thankfully, there's another option - US Legal Forms. It will help you receive professionally written legal papers without paying unreasonable prices for legal services.

US Legal Forms provides a huge catalog of over 85,000 state-compliant form templates, including San Jose Charitable Trust with Creation Contingent upon Qualification for Tax Exempt Status and form packages. We provide templates for an array of use cases: from divorce papers to real estate documents. We've been out there for more than 25 years and got a spotless reputation among our customers. Here's how you can become one of them and obtain the needed document without extra troubles.

- To start with, carefully verify if the San Jose Charitable Trust with Creation Contingent upon Qualification for Tax Exempt Status is tailored to your state's or county's regulations.

- If the form comes with a desciption, make sure to check what it's intended for.

- Start the search again if the template isn’t what you were looking for by using the search box in the header.

- Choose the plan that best fits your needs and proceed to the payment.

- Select the file format you would like to get your form in and download it.

- Print it out, fill it out, and sign on the dotted line.

If you've already set up an account, you can easily log in to it, locate the San Jose Charitable Trust with Creation Contingent upon Qualification for Tax Exempt Status template, and download it. To re-download the form, simply go to the My Forms tab.

It's easy to buy and download legal forms if you use our services. Additionally, the paperwork we offer are reviewed by industry experts, which gives you greater confidence when writing legal matters. Try US Legal Forms now and see for yourself!