Cook Illinois Certificate of Amendment to Certificate of Trust of (Name of Trust or) is a legal document that modifies the terms and conditions of an existing trust in Cook County, Illinois. Any changes made to the trust are officially recognized through this certificate, ensuring the trust or's intentions are accurately reflected. The Cook Illinois Certificate of Amendment to Certificate of Trust of (Name of Trust or) allows individuals or entities to make necessary alterations to their trust while adhering to the specific regulations set forth by Cook County and Illinois state law. This certificate is typically prepared and filed with the Cook County Clerk's Office to ensure its legality and enforceability in the jurisdiction. Key elements that may be modified in the Cook Illinois Certificate of Amendment to Certificate of Trust include: 1. Trust or's Information: The certificate includes the full legal name, address, and contact details of the trust or. Any changes to this information, such as a change in address or contact information, can be included in the amendment. 2. Trustee Information: The certificate may specify the appointed trustee(s) responsible for managing and overseeing the trust. If there is a change in trustee(s), the amendment should reflect the updated information, including their names, addresses, and contact details. 3. Beneficiary Details: Any modifications regarding the beneficiaries' names, addresses, or addition/removal of beneficiaries can be included in the certificate. It ensures that the trust or's beneficiaries are accurately represented and accounted for in the trust. 4. Terms and Conditions: The Cook Illinois Certificate of Amendment can be used to modify the terms and conditions of the original trust, such as altering or expanding the scope of the trust, changing the distribution of assets, or adding specific clauses that better reflect the trust or's current intentions. 5. Powers and Authorities: This certificate can also involve changes to the powers and authorities granted to the trustee(s) to manage and administer the trust. It may include modifications to investment strategies, granting broader decision-making abilities, or limiting certain powers as required. It's important to note that there may be different types of Cook Illinois Certificate of Amendment to Certificate of Trust, depending on the specific changes being made to the trust. These can include amendments related to minor changes in beneficiary information, substantial modifications to the trust's purpose, or amendments that correct errors made in the original trust documentation. Filing a Cook Illinois Certificate of Amendment to Certificate of Trust provides legal protection to both the trust or and the trustee(s) and ensures compliance with the governing laws of Cook County. It is recommended to work with a knowledgeable attorney or legal professional specializing in trust and estate planning to ensure the amendment accurately reflects the desired changes while adhering to all legal requirements.

Cook Illinois Certificate of Amendment to Certificate of Trust of (Name of Trustor)

Description

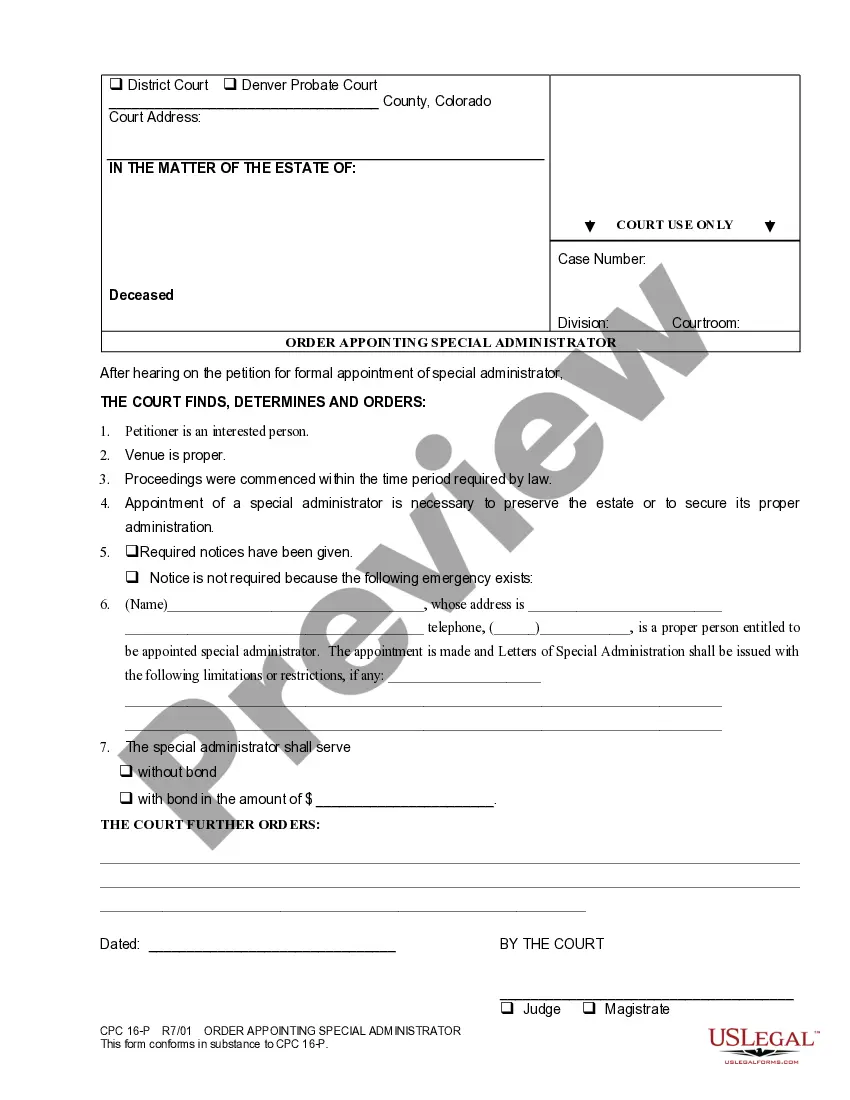

How to fill out Cook Illinois Certificate Of Amendment To Certificate Of Trust Of (Name Of Trustor)?

Preparing legal paperwork can be burdensome. In addition, if you decide to ask a lawyer to write a commercial contract, papers for ownership transfer, pre-marital agreement, divorce paperwork, or the Cook Certificate of Amendment to Certificate of Trust of (Name of Trustor), it may cost you a lot of money. So what is the best way to save time and money and create legitimate documents in total compliance with your state and local regulations? US Legal Forms is a perfect solution, whether you're looking for templates for your individual or business needs.

US Legal Forms is the most extensive online library of state-specific legal documents, providing users with the up-to-date and professionally checked forms for any scenario gathered all in one place. Therefore, if you need the current version of the Cook Certificate of Amendment to Certificate of Trust of (Name of Trustor), you can easily find it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample with the Download button. If you haven't subscribed yet, here's how you can get the Cook Certificate of Amendment to Certificate of Trust of (Name of Trustor):

- Glance through the page and verify there is a sample for your region.

- Check the form description and use the Preview option, if available, to make sure it's the template you need.

- Don't worry if the form doesn't satisfy your requirements - look for the right one in the header.

- Click Buy Now when you find the needed sample and select the best suitable subscription.

- Log in or sign up for an account to purchase your subscription.

- Make a transaction with a credit card or via PayPal.

- Opt for the file format for your Cook Certificate of Amendment to Certificate of Trust of (Name of Trustor) and save it.

When done, you can print it out and complete it on paper or upload the template to an online editor for a faster and more convenient fill-out. US Legal Forms enables you to use all the documents ever purchased multiple times - you can find your templates in the My Forms tab in your profile. Give it a try now!

Form popularity

FAQ

An amended birth certificate is a certificate that was officially edited and changed from its original form.

(California Probate Code §15401-15402). The only way to amend an irrevocable living trust is to have the consent of each and every beneficiary to the trust. Once they all agree upon the amendment(s) to the trust, they can compel modification of the trust with a petition to the court.

Fill out the form with the name of your trust. If this is the first change you've made to the trust, state that. If you have made other changes to the trust, you will need to list them by date. Indicate if this amendment overrides those previous changes or if you want them to remain in effect.

(a) A trust may be modified or terminated by the written consent of the settlor and all beneficiaries without court approval of the modification or termination.

Codicil. A codicil is a formal document making a change to one or multiple parts of a Last Will and Testament. Restatement of Living Trust. If your Living Trust has been lost or destroyed, we can Restate your original Trust.

(California Probate Code §15401-15402). The only way to amend an irrevocable living trust is to have the consent of each and every beneficiary to the trust. Once they all agree upon the amendment(s) to the trust, they can compel modification of the trust with a petition to the court.

Revoking or amending a revocable living trust can be done with or without an attorney. You can amend a living trust without having to go to court. There are a few ways to do this. You can do it yourself, using living trust forms you find online, you can use an online service, or you can use an attorney.

The simplest way to make a change to a living trust is with a trust amendment form. A living trust amendment allows you to make changes to an existing trust while keeping the original document active. If you have a joint trust with your spouse, you both must agree to any changes to the trust.

One of the most attractive features of a revocable living trust is its flexibility: You can change its terms, or end it altogether, at any time. If you created a shared trust with your spouse, either of you can revoke it.