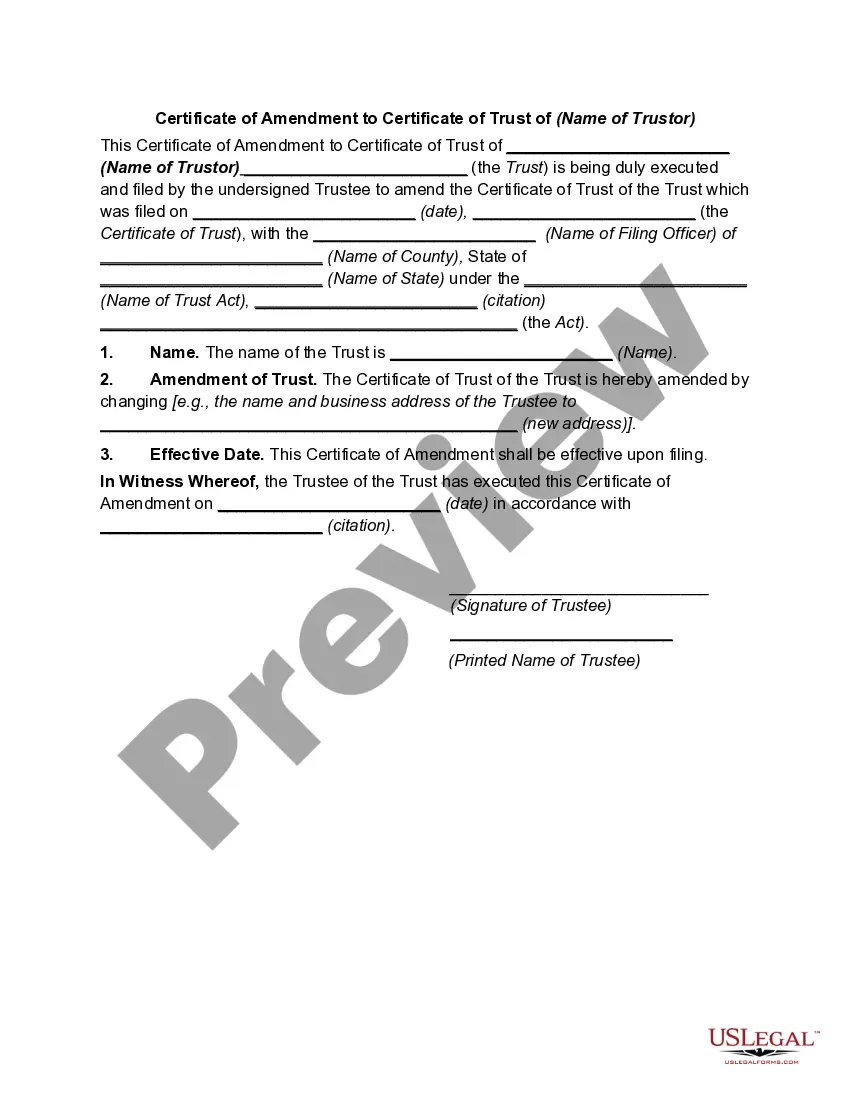

Harris Texas Certificate of Amendment to Certificate of Trust of (Name of Trustor)

Description

How to fill out Certificate Of Amendment To Certificate Of Trust Of (Name Of Trustor)?

How long does it typically take you to draft a legal document.

Considering that each state has its own laws and regulations for different life situations, locating a Harris Certificate of Amendment to Certificate of Trust of (Name of Trustor) that satisfies all local requirements can be overwhelming, and procuring it from a qualified attorney is frequently costly.

Many online platforms provide the most sought-after state-specific templates for download, but utilizing the US Legal Forms library is the most advantageous.

- US Legal Forms is the largest online collection of templates, organized by states and areas of use.

- In addition to the Harris Certificate of Amendment to Certificate of Trust of (Name of Trustor), you can obtain any specific form to manage your business or personal matters, adhering to your local requirements.

- Experts verify all samples for their relevance, ensuring you can prepare your documents accurately.

- Utilizing the service is quite simple.

- If you already possess an account on the platform and your subscription is active, you just need to Log In, choose the required sample, and download it.

- You can access the file in your profile anytime in the future.

- Conversely, if you are a newcomer to the platform, there will be a few additional steps to take before you acquire your Harris Certificate of Amendment to Certificate of Trust of (Name of Trustor).

- Review the information on the page you’re on.

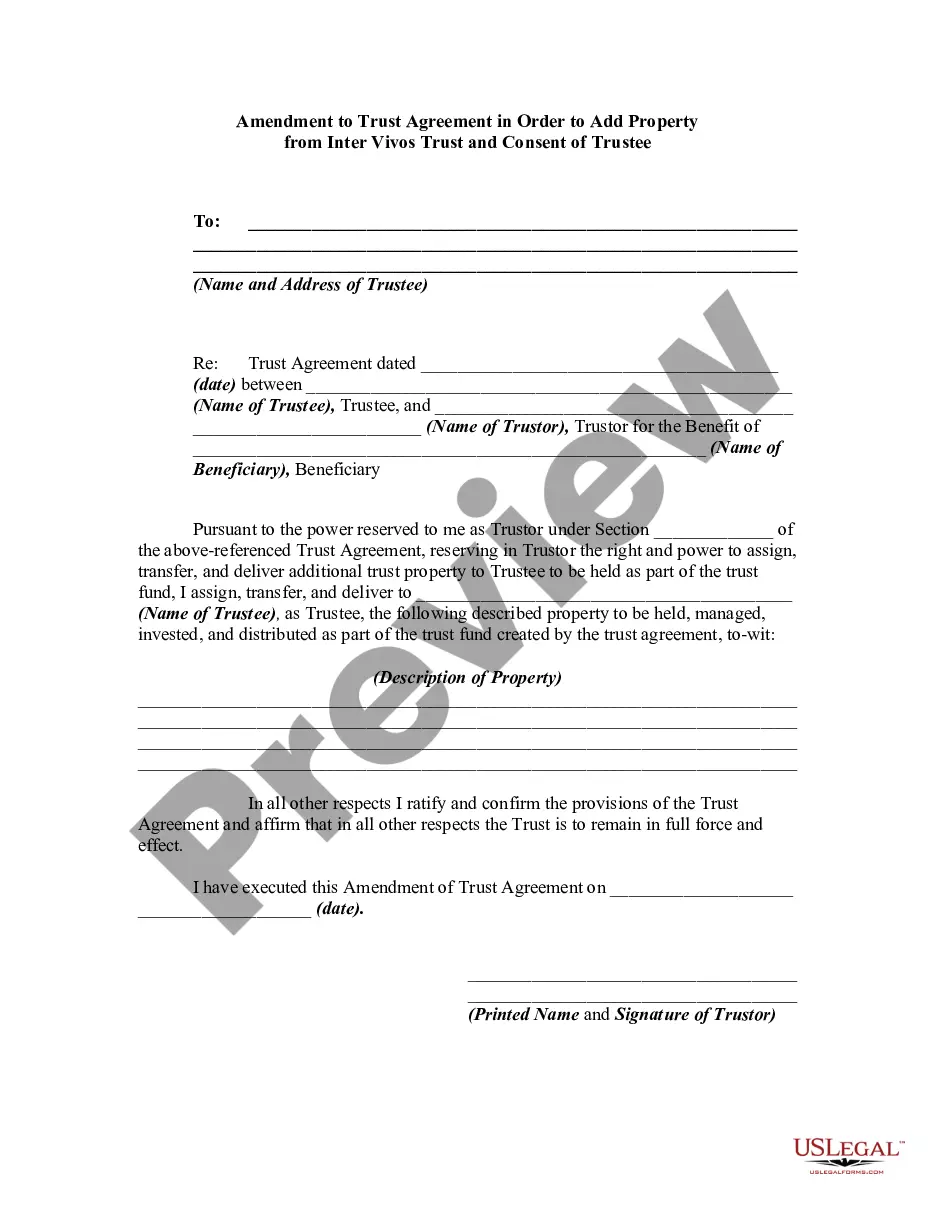

- Examine the description of the template or Preview it (if accessible).

- Search for another form using the corresponding option in the header.

- Click Buy Now when you’re confident in the selected file.

- Select the subscription plan that fits you best.

- Create an account on the platform or Log In to proceed to payment options.

- Pay using PayPal or your credit card.

- Alter the file format if needed.

- Click Download to save the Harris Certificate of Amendment to Certificate of Trust of (Name of Trustor).

- Print the template or utilize any preferred online editor to complete it electronically.

- Regardless of how many times you need to utilize the obtained template, you can find all the samples you’ve ever saved in your profile by accessing the My documents tab.

- Give it a shot!

Form popularity

FAQ

Adding a member to your LLC in Texas involves a straightforward process. You will need to draft an amendment to your LLC's operating agreement, which could take the form of a Harris Texas Certificate of Amendment to Certificate of Trust of (Name of Trustor). After updating the agreement, make sure to notify the Texas Secretary of State by filing any necessary documents to officially register the new member. This ensures that all legal and operational records reflect the current membership structure.

Fill out the form with the name of your trust. If this is the first change you've made to the trust, state that. If you have made other changes to the trust, you will need to list them by date. Indicate if this amendment overrides those previous changes or if you want them to remain in effect.

How To Notarize A Document In California Step 1: Personal appearance is required.Step 2: Check over the document before notarizing.Step 3: Carefully identify the signer.Step 4: Complete your journal entry.Step 5: Fill in the notarial certificate.

(California Probate Code §15401-15402). The only way to amend an irrevocable living trust is to have the consent of each and every beneficiary to the trust. Once they all agree upon the amendment(s) to the trust, they can compel modification of the trust with a petition to the court.

Without having to go to court, you can amend a living trust. The process can be accomplished in a few different ways. You can do it yourself, using living trust forms you find online, you can use an online service, or you can use an attorney.

When you want to change your revocable trust through an amendment, you will need to make it official before it can be used. To make the document legally binding, you will need to have it notarized.

The only way to amend an irrevocable living trust is to have the consent of each and every beneficiary to the trust. Once they all agree upon the amendment(s) to the trust, they can compel modification of the trust with a petition to the court.

Revoking or amending a revocable living trust can be done with or without an attorney. You can amend a living trust without having to go to court. There are a few ways to do this. You can do it yourself, using living trust forms you find online, you can use an online service, or you can use an attorney.

A Trust amendment is a legal document changing one or more aspects of a revocable living Trust -- without revoking the entire structure. The goal of a living trust amendment is to help you make changes to beneficiaries, trustees, provisions, or modify any conditions to the Trust.

If there is no amendment clause in the Trust Deed, any amendment has to be done with the permission of a Civil Court. Once the Civil Court has allowed permission for amendment, it is not open on the part of the Income Tax Officer or any other person to challenge such amendment.