Kings New York Annuity as Consideration for Transfer of Securities is a financial product designed to help individuals manage and grow their wealth through a secure, long-term investment strategy. This annuity, offered by Kings New York Finance, functions as an alternative consideration for the transfer of securities, providing individuals with a reliable income stream for their future needs. The Kings New York Annuity offers several key features that make it an attractive option for investors. First and foremost, it provides a guaranteed income that is not subject to market fluctuations, allowing individuals to mitigate risk and plan their financial future with confidence. The annuity typically pays out a fixed amount at regular intervals, ensuring a stable income throughout the predetermined payout period. One distinct advantage of Kings New York Annuity is its tax-deferred growth potential. The growth on the invested funds within the annuity is not taxed until the annuity holder starts receiving payments, which can provide significant advantages in terms of accumulating wealth over time. This tax-deferred growth allows the principal investment to compound, potentially resulting in a larger sum to be received in the future. Another variant of Kings New York Annuity is the Fixed Annuity, which guarantees a predetermined interest rate for a specified period. This type of annuity is appealing to risk-averse individuals as it offers predictable returns without exposure to market volatility. The fixed annuity is an ideal option for those seeking a steady and secure income in retirement. Contrasting, Kings New York also offers the Variable Annuity as part of their product lineup. This type of annuity provides individuals with the opportunity to invest in a selection of underlying investment options, typically including stocks, bonds, and mutual funds. The variable annuity's returns are tied to the performance of these investment options, offering the potential for higher gains but also subject to the risk of market downturns. In summary, the Kings New York Annuity as Consideration for Transfer of Securities is a reliable financial product that aims to provide individuals with a stable income for their future needs. It offers guaranteed income, tax-deferred growth potential, and flexibility in terms of investment options. The Fixed Annuity and Variable Annuity are two variations of this annuity, catering to different risk tolerances and investment preferences. With Kings New York Annuity, investors can secure their financial future and enjoy the benefits of long-term wealth accumulation.

Kings New York Annuity as Consideration for Transfer of Securities

Description

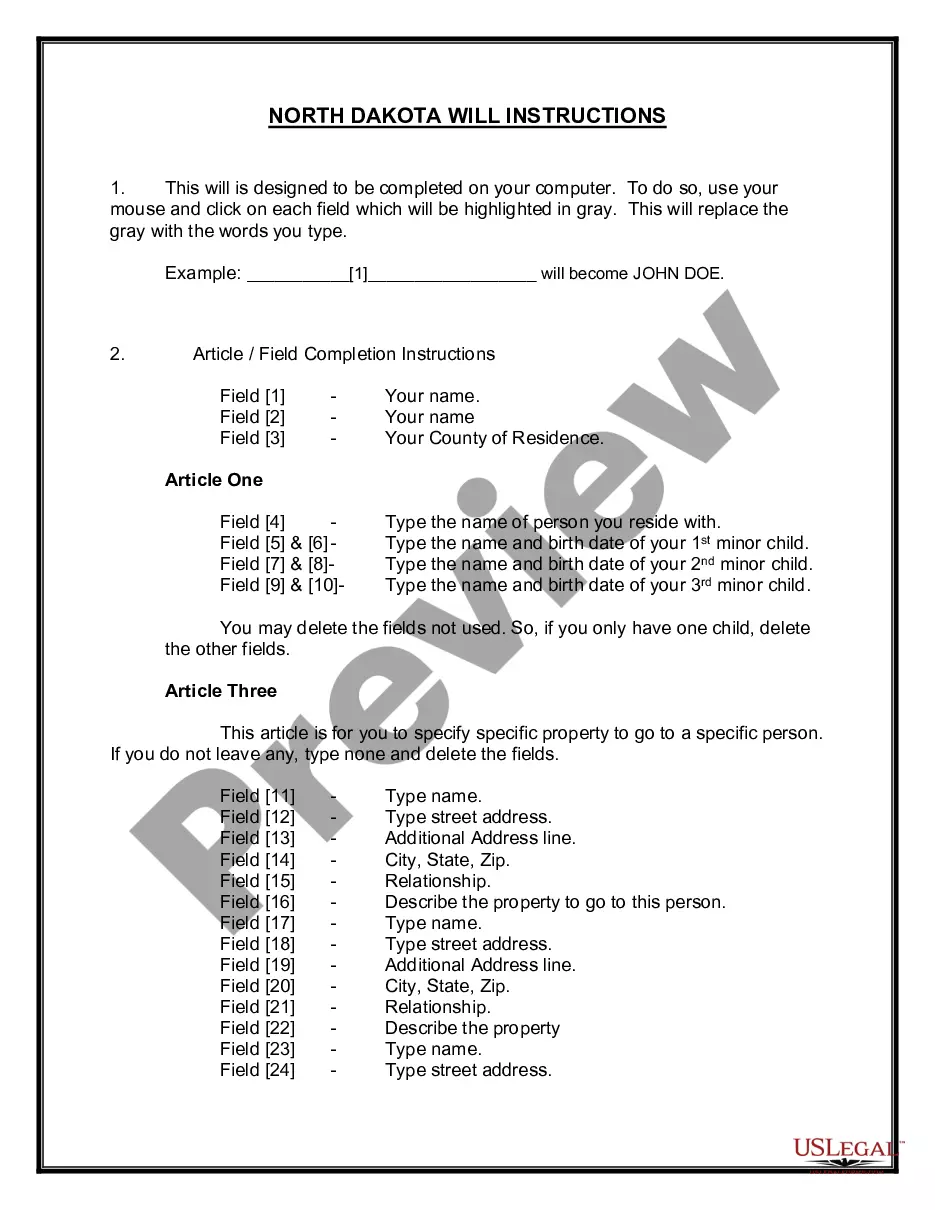

How to fill out Kings New York Annuity As Consideration For Transfer Of Securities?

Creating paperwork, like Kings Annuity as Consideration for Transfer of Securities, to take care of your legal matters is a challenging and time-consumming task. A lot of situations require an attorney’s involvement, which also makes this task expensive. However, you can get your legal affairs into your own hands and deal with them yourself. US Legal Forms is here to the rescue. Our website features over 85,000 legal forms intended for a variety of scenarios and life circumstances. We make sure each form is in adherence with the regulations of each state, so you don’t have to be concerned about potential legal pitfalls compliance-wise.

If you're already aware of our website and have a subscription with US, you know how easy it is to get the Kings Annuity as Consideration for Transfer of Securities form. Go ahead and log in to your account, download the form, and customize it to your requirements. Have you lost your form? No worries. You can get it in the My Forms folder in your account - on desktop or mobile.

The onboarding process of new customers is fairly straightforward! Here’s what you need to do before downloading Kings Annuity as Consideration for Transfer of Securities:

- Ensure that your template is specific to your state/county since the regulations for creating legal documents may differ from one state another.

- Find out more about the form by previewing it or reading a quick description. If the Kings Annuity as Consideration for Transfer of Securities isn’t something you were looking for, then take advantage of the search bar in the header to find another one.

- Log in or create an account to start utilizing our website and download the document.

- Everything looks good on your end? Hit the Buy now button and select the subscription plan.

- Select the payment gateway and type in your payment information.

- Your form is good to go. You can try and download it.

It’s an easy task to locate and purchase the appropriate document with US Legal Forms. Thousands of businesses and individuals are already taking advantage of our extensive library. Subscribe to it now if you want to check what other benefits you can get with US Legal Forms!