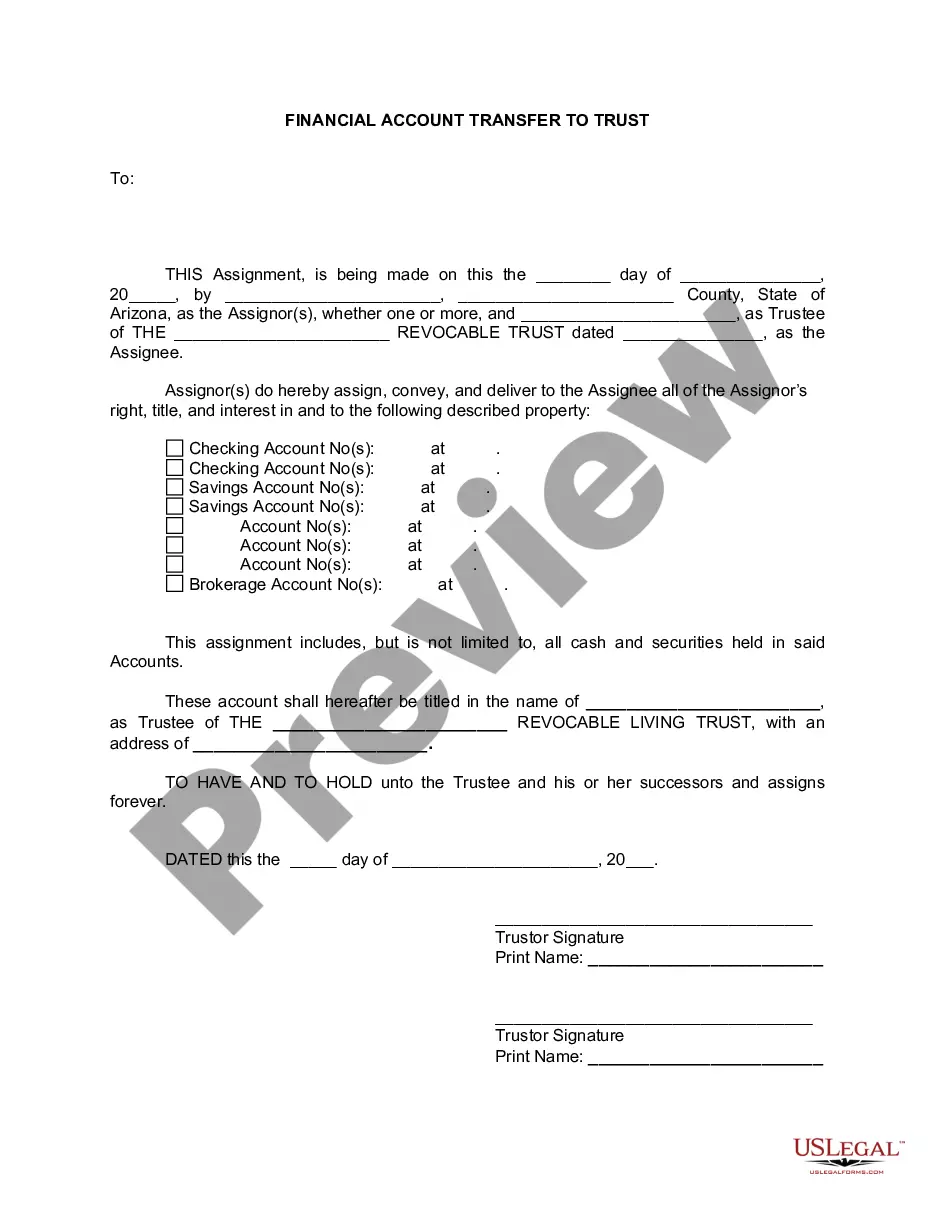

Nassau New York Private Trust Company is a premier financial institution based in Nassau County, New York. It specializes in providing comprehensive trust and wealth management services tailored to the unique needs of affluent individuals, families, and organizations. With a stellar reputation spanning several decades, Nassau New York Private Trust Company is known for its commitment to delivering exceptional personalized service, ensuring the preservation, growth, and transfer of wealth for its clients. As a Private Trust Company, Nassau New York offers a wide range of financial solutions, including fiduciary and estate planning, investment management, trust administration, and charitable giving strategies. Their team of experienced professionals works closely with clients to develop customized strategies that align with their financial goals, risk tolerance, and values. The company's unwavering dedication to client satisfaction sets it apart in the industry. Nassau New York Private Trust Company offers several specialized services to cater to the diverse needs of its clients. These include: 1. Personal Trust Services: The company offers comprehensive personal trust services, ensuring the smooth administration of trusts established to provide for beneficiaries' financial well-being. From managing investments to distributing assets based on trust provisions, Nassau New York administers trusts with utmost professionalism and discretion. 2. Estate Planning: The company assists clients in creating effective estate plans that maximize tax efficiencies and help preserve wealth for future generations. Their estate planning experts provide guidance on wills, trusts, estate tax considerations, and facilitate the seamless transfer of assets. 3. Investment Management: Nassau New York's investment management services help clients grow their wealth while managing risk. Using a disciplined approach, the company develops investment strategies tailored to clients' individual objectives, time horizons, and risk profiles. 4. Philanthropic Planning: Recognizing the importance of charitable giving, Nassau New York Private Trust Company offers specialized services for philanthropic planning. Their expert advisors help clients establish and administer charitable foundations, donor-advised funds, and other charitable vehicles, ensuring that their philanthropic goals are met effectively. Clients of Nassau New York Private Trust Company benefit from their longstanding heritage, deep knowledge of local markets, and access to a vast network of experienced professionals. The company holds itself to the highest fiduciary standards, putting clients' interests first in every decision made. In conclusion, Nassau New York Private Trust Company is a reputable and distinguished financial institution that provides a wide range of trust and wealth management services. Their commitment to personalized service, expertise in fiduciary matters, and a strong emphasis on client satisfaction make them a trusted partner for individuals and families seeking tailored financial solutions.

Nassau New York Private Trust Company

Description

How to fill out Nassau New York Private Trust Company?

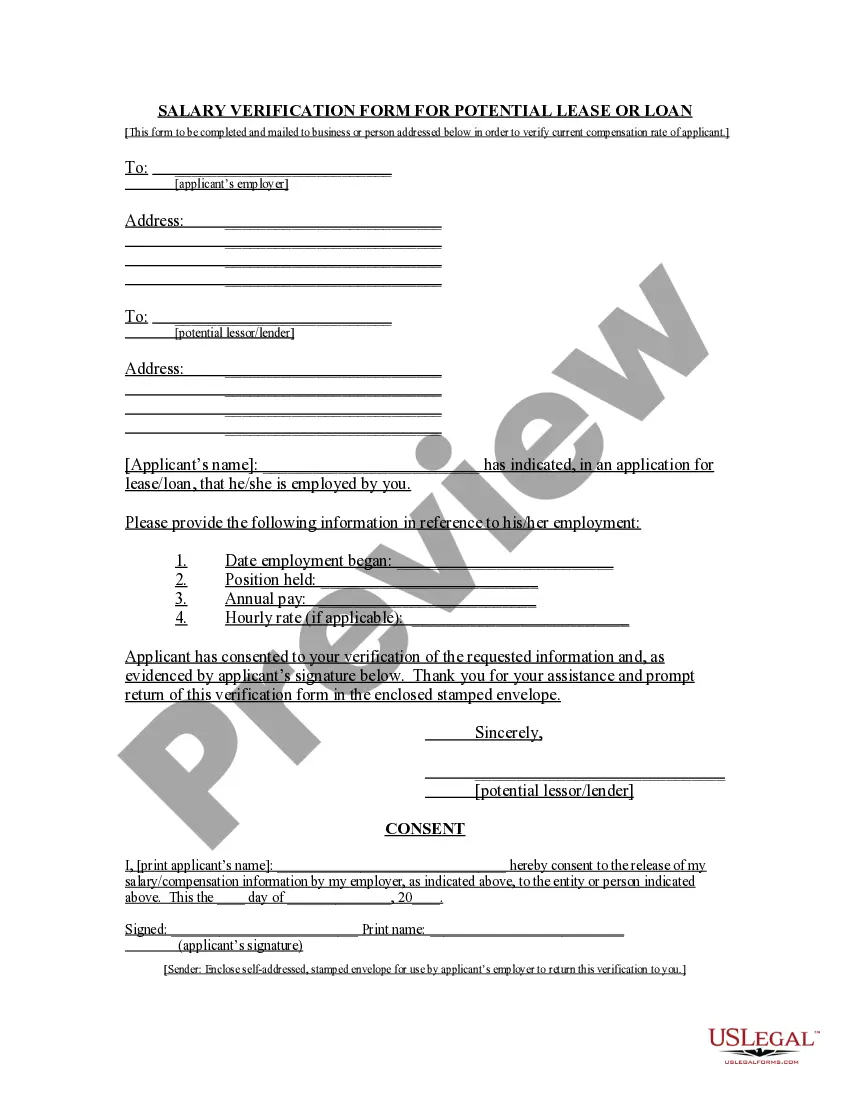

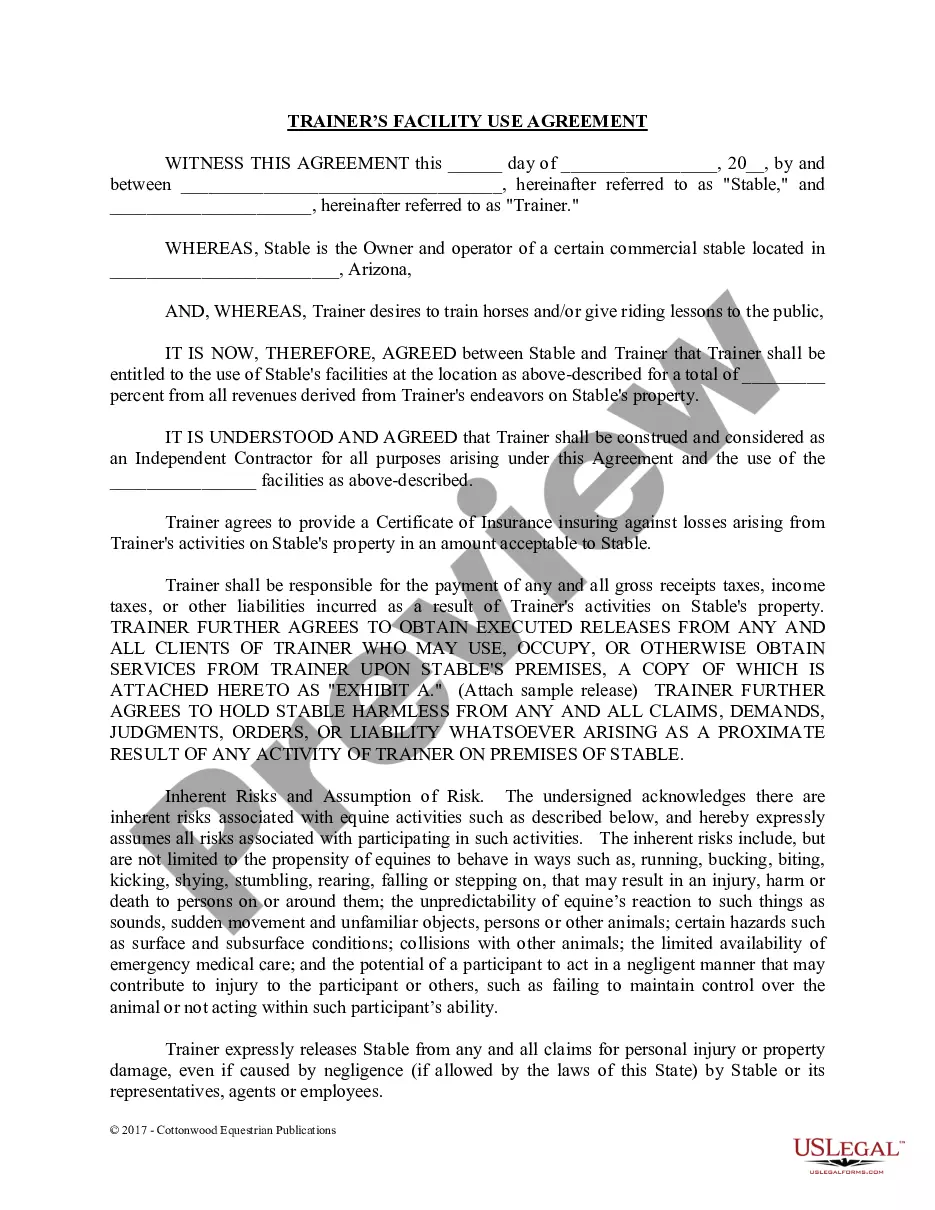

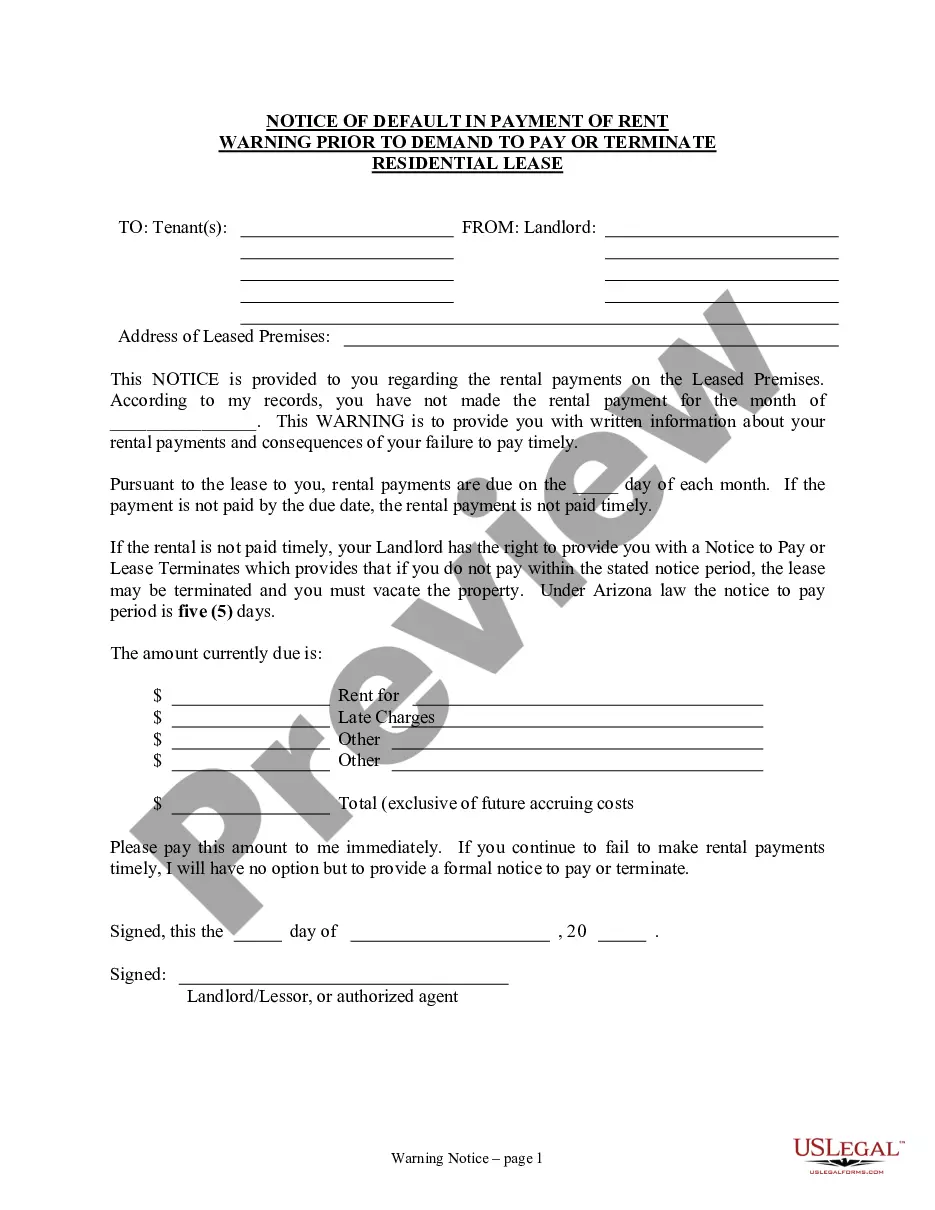

Whether you intend to open your business, enter into a deal, apply for your ID update, or resolve family-related legal issues, you must prepare certain paperwork corresponding to your local laws and regulations. Locating the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 expertly drafted and verified legal documents for any personal or business case. All files are collected by state and area of use, so opting for a copy like Nassau Private Trust Company is fast and easy.

The US Legal Forms website users only need to log in to their account and click the Download button next to the required template. If you are new to the service, it will take you several more steps to get the Nassau Private Trust Company. Adhere to the instructions below:

- Make certain the sample fulfills your personal needs and state law regulations.

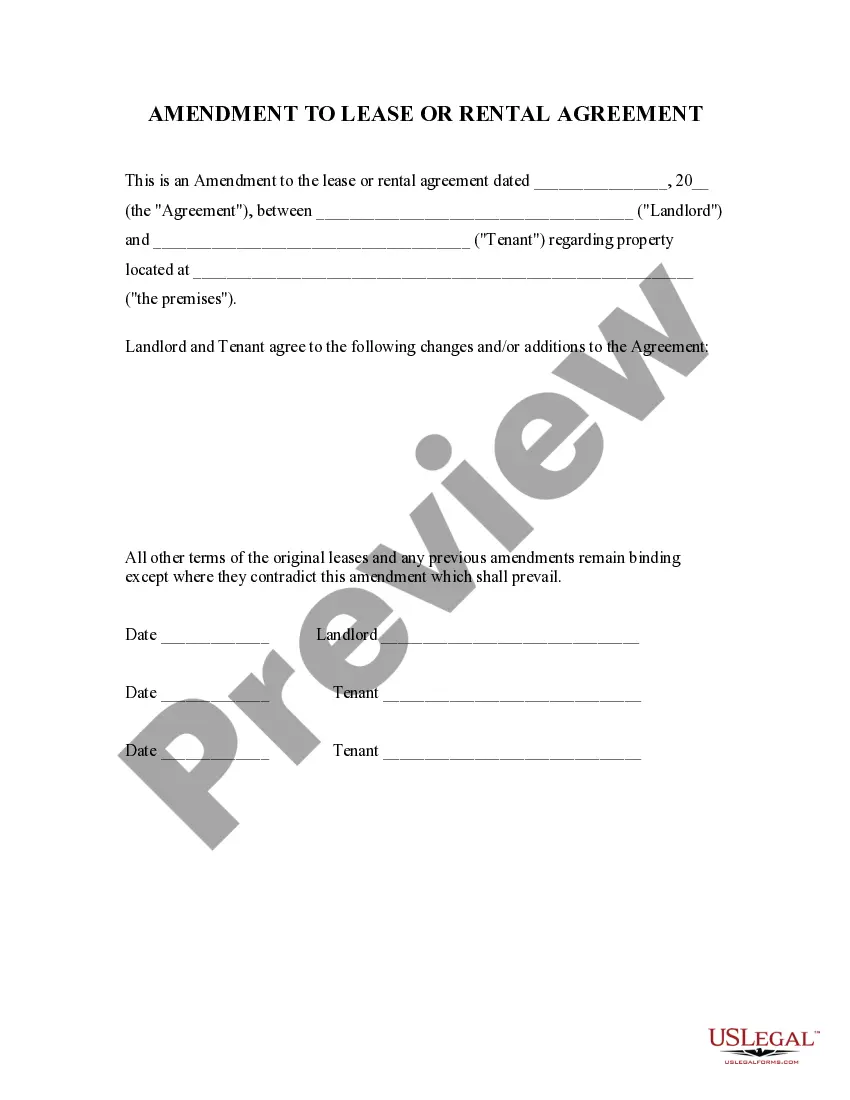

- Look through the form description and check the Preview if there’s one on the page.

- Make use of the search tab providing your state above to locate another template.

- Click Buy Now to obtain the sample when you find the correct one.

- Choose the subscription plan that suits you most to continue.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the Nassau Private Trust Company in the file format you require.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Documents provided by our website are reusable. Having an active subscription, you can access all of your previously purchased paperwork at any moment in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date official documents. Join the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form library!