The Allegheny Pennsylvania Agreement for Sale of all Assets of a Corporation with Allocation of Purchase Price to Tangible and Intangible Business Assets is a legally binding document that outlines the terms and conditions for the sale of all assets of a corporation, including both tangible and intangible business assets. This agreement is commonly used in Pennsylvania, specifically in the Allegheny region, to ensure a smooth transfer of assets and to determine the value and allocation of the purchase price. This agreement is crucial when a corporation decides to sell its entire business operations, including physical property, equipment, inventory, intellectual property, customer lists, trademarks, patents, goodwill, and other intangible assets. It not only protects the interests of both the buyer and the seller but also provides clarity on the distribution of the purchase price among the different types of assets involved in the transaction. The specifics of the Allegheny Pennsylvania Agreement for Sale of all Assets of a Corporation with Allocation of Purchase Price to Tangible and Intangible Business Assets may vary depending on the nature of the business being sold and the preferences of the parties involved. However, the following are some common types or classifications of assets that might be included and allocated in this agreement: 1. Tangible Assets: This category includes physical assets such as real estate properties, buildings, machinery, equipment, vehicles, furniture, fixtures, inventory, and any other physical items that hold value and contribute to the overall business operations. 2. Intangible Business Assets: These are non-physical assets that contribute to the value of a business and may include various elements such as trademarks, copyrights, patents, trade secrets, proprietary technologies, customer lists, contracts, licenses, permits, brand recognition, software, databases, and goodwill. The allocation of the purchase price to these different types of assets is essential to determine tax implications, depreciation schedules, and financial statements. The parties involved in the agreement must carefully negotiate and agree upon the allocation percentages for each asset category. It is common for a professional appraiser or an expert to be involved in assessing the fair market value of the assets and assisting in the allocation process. The Allegheny Pennsylvania Agreement for Sale of all Assets of a Corporation with Allocation of Purchase Price to Tangible and Intangible Business Assets aims to provide a comprehensive framework for a transparent and successful transaction. It protects the rights and interests of both the buyer and the seller and ensures a smooth transfer of ownership with clearly defined terms regarding the allocation of the purchase price to the tangible and intangible assets of the business.

Allegheny Pennsylvania Agreement for Sale of all Assets of a Corporation with Allocation of Purchase Price to Tangible and Intangible Business Assets

Description

How to fill out Allegheny Pennsylvania Agreement For Sale Of All Assets Of A Corporation With Allocation Of Purchase Price To Tangible And Intangible Business Assets?

Preparing papers for the business or personal demands is always a big responsibility. When drawing up an agreement, a public service request, or a power of attorney, it's crucial to consider all federal and state regulations of the specific region. Nevertheless, small counties and even cities also have legislative procedures that you need to consider. All these aspects make it stressful and time-consuming to generate Allegheny Agreement for Sale of all Assets of a Corporation with Allocation of Purchase Price to Tangible and Intangible Business Assets without expert help.

It's easy to avoid spending money on lawyers drafting your paperwork and create a legally valid Allegheny Agreement for Sale of all Assets of a Corporation with Allocation of Purchase Price to Tangible and Intangible Business Assets on your own, using the US Legal Forms online library. It is the biggest online catalog of state-specific legal documents that are professionally verified, so you can be certain of their validity when choosing a sample for your county. Previously subscribed users only need to log in to their accounts to save the needed form.

If you still don't have a subscription, follow the step-by-step instruction below to obtain the Allegheny Agreement for Sale of all Assets of a Corporation with Allocation of Purchase Price to Tangible and Intangible Business Assets:

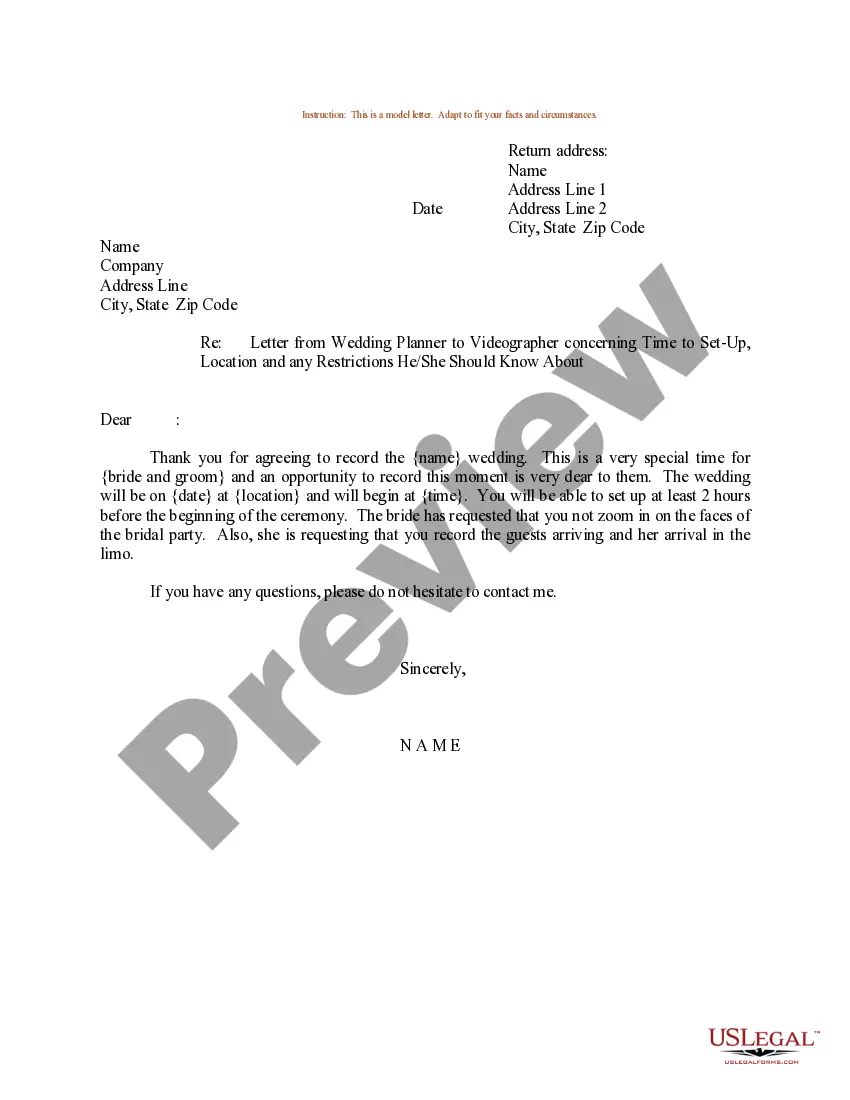

- Look through the page you've opened and verify if it has the sample you require.

- To achieve this, use the form description and preview if these options are presented.

- To find the one that suits your requirements, utilize the search tab in the page header.

- Double-check that the sample complies with juridical criteria and click Buy Now.

- Opt for the subscription plan, then log in or create an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the selected file in the preferred format, print it, or complete it electronically.

The great thing about the US Legal Forms library is that all the paperwork you've ever obtained never gets lost - you can get it in your profile within the My Forms tab at any time. Join the platform and quickly obtain verified legal forms for any situation with just a couple of clicks!