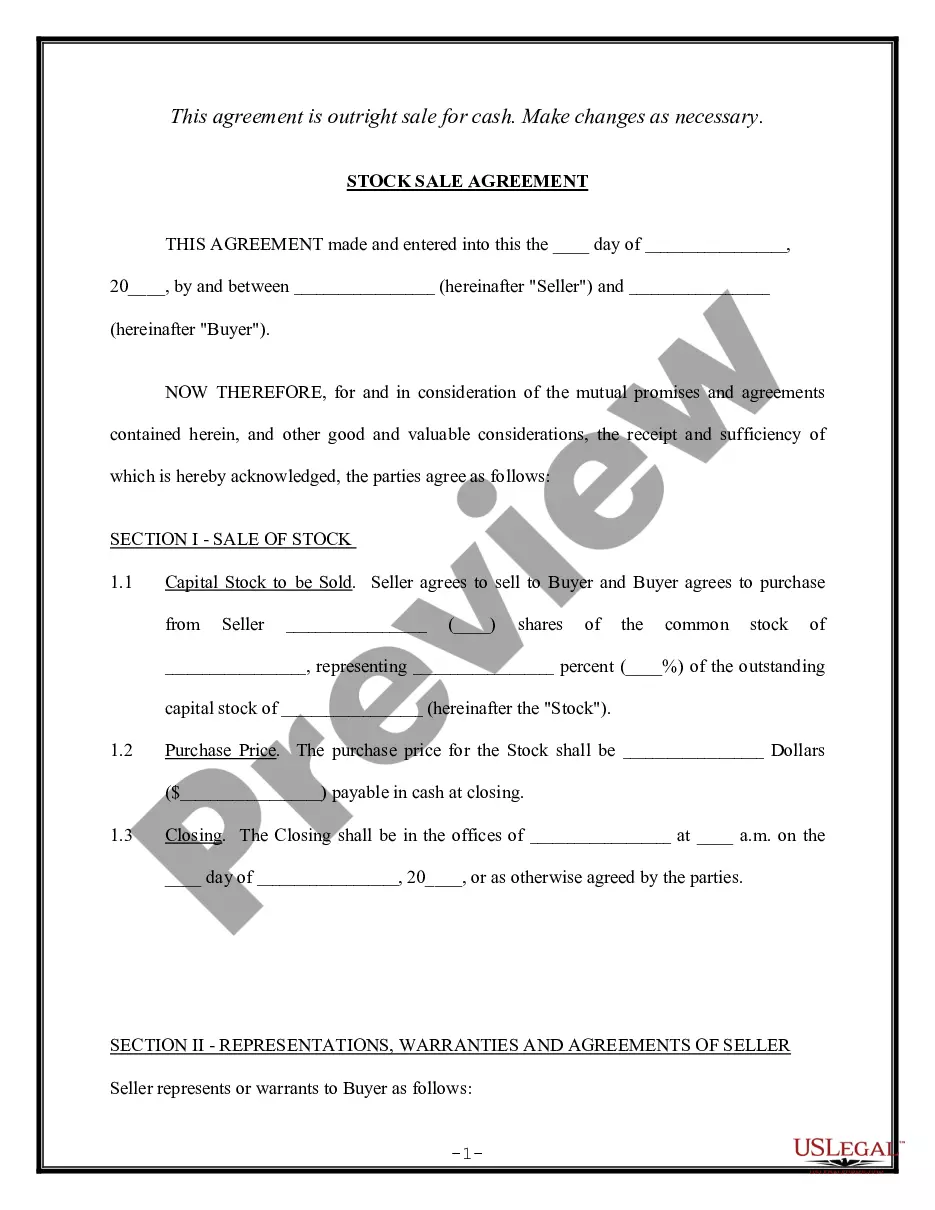

The Chicago Illinois Agreement for Sale of all Assets of a Corporation with Allocation of Purchase Price to Tangible and Intangible Business Assets is a legally binding document designed to facilitate the transfer of a company's assets from the seller to the buyer. This type of agreement outlines the terms and conditions of the sale, including the allocation of the purchase price between tangible and intangible assets. Chicago Illinois is known for its thriving business environment, and such agreements play a crucial role in facilitating mergers, acquisitions, or business transfers in the city. Here is a breakdown of the key components typically included in a Chicago Illinois Agreement for Sale of all Assets of a Corporation with Allocation of Purchase Price to Tangible and Intangible Business Assets: 1. Parties: This section identifies the buyer and the seller involved in the transaction, including their legal names, addresses, and contact details. 2. Definitions: The agreement provides clear definitions of key terms used throughout, ensuring a mutual understanding between the parties involved. 3. Recitals: This section outlines the purpose and background of the agreement, including the reasons for the asset sale and the desired outcomes. 4. Purchase Price Allocation: The agreement specifies how the total purchase price will be divided between tangible assets (such as property, equipment, inventory, etc.) and intangible assets (such as intellectual property rights, patents, goodwill, etc.). This allocation is essential for tax and accounting purposes. 5. Assets to be Transferred: A comprehensive list of the assets being sold is included, with detailed descriptions, quantities, and any conditions or warranties associated with each item. 6. Assumed Liabilities: This section defines the liabilities that the buyer agrees to assume as part of the sale, such as outstanding debts, contracts, legal obligations, or environmental responsibilities. 7. Closing Procedure: The agreement outlines the steps and conditions for completing the asset transfer, including any required approvals, consents, or notifications. 8. Representations and Warranties: Both parties make various statements regarding the accuracy of information provided, compliance with laws, absence of undisclosed liabilities, and ownership of assets. These representations and warranties serve to protect the buyer's interests. 9. Indemnifications: This section states the obligations of each party to indemnify the other against any losses, damages, or liabilities arising from breaches of the agreement's terms or misrepresentations. 10. Governing Law and Jurisdiction: The agreement specifies that it will be governed by the laws of the state of Illinois and designates the exclusive jurisdiction for resolving disputes. It's important to note that while there may not be different "types" of Chicago Illinois Agreement for Sale of all Assets of a Corporation with Allocation of Purchase Price to Tangible and Intangible Business Assets, variations in content, language, and specific clauses may exist based on the unique needs of each transaction or the parties involved. However, the fundamental elements mentioned above generally form the core of such agreements.

Chicago Illinois Agreement for Sale of all Assets of a Corporation with Allocation of Purchase Price to Tangible and Intangible Business Assets

Description

How to fill out Chicago Illinois Agreement For Sale Of All Assets Of A Corporation With Allocation Of Purchase Price To Tangible And Intangible Business Assets?

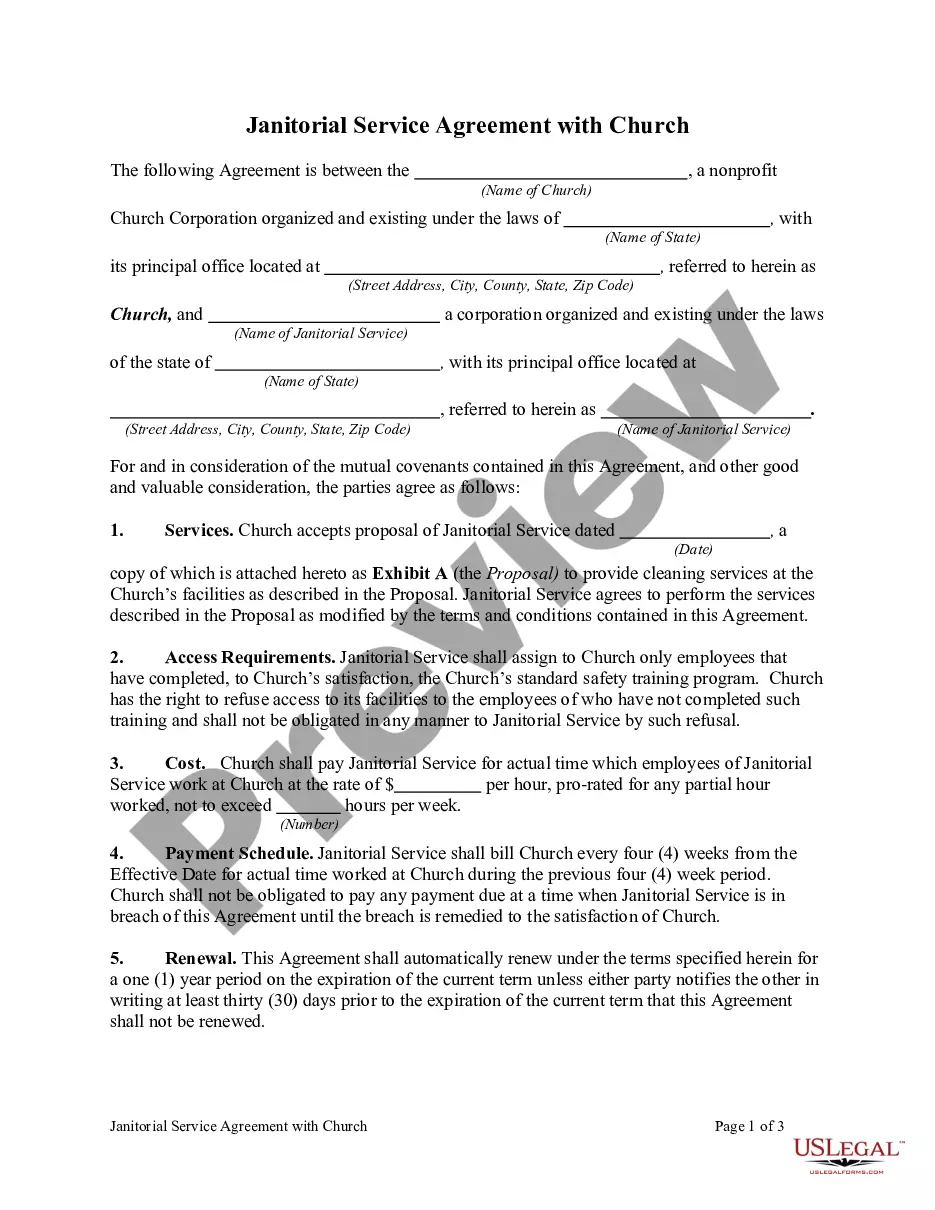

If you need to find a trustworthy legal document provider to find the Chicago Agreement for Sale of all Assets of a Corporation with Allocation of Purchase Price to Tangible and Intangible Business Assets, look no further than US Legal Forms. Whether you need to start your LLC business or take care of your asset distribution, we got you covered. You don't need to be knowledgeable about in law to locate and download the appropriate form.

- You can search from more than 85,000 forms arranged by state/county and situation.

- The intuitive interface, number of supporting resources, and dedicated support make it easy to find and execute various documents.

- US Legal Forms is a trusted service offering legal forms to millions of users since 1997.

Simply type to search or browse Chicago Agreement for Sale of all Assets of a Corporation with Allocation of Purchase Price to Tangible and Intangible Business Assets, either by a keyword or by the state/county the document is created for. After finding the needed form, you can log in and download it or retain it in the My Forms tab.

Don't have an account? It's effortless to get started! Simply find the Chicago Agreement for Sale of all Assets of a Corporation with Allocation of Purchase Price to Tangible and Intangible Business Assets template and check the form's preview and description (if available). If you're comfortable with the template’s terminology, go ahead and hit Buy now. Create an account and select a subscription option. The template will be instantly available for download once the payment is completed. Now you can execute the form.

Handling your legal matters doesn’t have to be expensive or time-consuming. US Legal Forms is here to prove it. Our extensive collection of legal forms makes these tasks less expensive and more reasonably priced. Set up your first business, arrange your advance care planning, create a real estate agreement, or execute the Chicago Agreement for Sale of all Assets of a Corporation with Allocation of Purchase Price to Tangible and Intangible Business Assets - all from the comfort of your home.

Join US Legal Forms now!

Form popularity

FAQ

In a non-stock sale, the usual principle is that the purchase price of the company's assets should be allocated based on fair market value. The buyer and the seller will negotiate the allocation of purchase price for these assets so that neither party is disadvantaged by the sale.

Allocated Sales means a portion of the Gross Receipts. Where the Product includes hardware and software, the Allocated Sales will be for all software that utilizes the Technology calculated by using the list price of the software and hardware to determine a software allocation ratio.

An important consideration in a transaction structured as an asset sale is the purchase price allocation because it determines the sellers' tax liability and the buyers' tax basis in the acquired assets.

Typically, it is a three-step process: Determining the purchase price (total consideration paid) Identifying the correct assets acquired and liabilities assumed. Calculating the fair market value of those assets and liabilities.

A purchase price allocation is an exercise performed as part of a buyer's acquisition accounting. As the name suggests, it is the process of allocating the purchase price paid for an acquired company to the acquired company's tangible and intangible assets.

Purchase price allocation (PPA) is an application of goodwill accounting whereby one company (the acquirer), when purchasing a second company (the target), allocates the purchase price into various assets and liabilities acquired from the transaction.

In a non-stock sale, the usual principle is that the purchase price of the company's assets should be allocated based on fair market value. The buyer and the seller will negotiate the allocation of purchase price for these assets so that neither party is disadvantaged by the sale.

The steps to performing purchase price allocation (PPA) are the following: Assign the Fair Value of Identifiable Tangible and Intangible Assets Purchased. Allocate the Remaining Difference Between the Purchase Price and the Collective Fair Values of the Acquired Assets and Liabilities into Goodwill.

Before the closing can take place, you and the buyer must agree on how the purchase price is allocated. This is known as the allocation of purchase price. Both the seller and the buyer are required by law to file Form 8594 with the IRS.