The Fulton Georgia Agreement for Sale of all Assets of a Corporation with Allocation of Purchase Price to Tangible and Intangible Business Assets is a legally binding document that outlines the sale and transfer of all assets of a corporation located in Fulton, Georgia. This agreement is crucial in mergers and acquisitions, as it ensures a smooth transition of ownership while clearly allocating the purchase price to both tangible and intangible business assets. Tangible business assets include physical items such as buildings, property, vehicles, equipment, inventory, and any other material possessions owned by the corporation. Allocation of the purchase price to these assets is essential to determine their fair market value and appropriately account for tax purposes. Intangible business assets are non-physical assets that hold value for the corporation, such as intellectual property, patents, trademarks, copyrights, trade secrets, customer lists, contracts, and goodwill. The allocation of the purchase price to these intangible assets often requires specialized knowledge and evaluation by experts to determine their fair value. Different types of the Fulton Georgia Agreement for Sale of all Assets of a Corporation with Allocation of Purchase Price to Tangible and Intangible Business Assets may include specific variations based on the unique nature of the corporation and the assets involved. These variations may include: 1. Asset-specific agreements: Sometimes, a corporation may have a significant portion of its value tied to specific intangible assets, such as a software product or a proprietary technology. In such cases, an agreement may be tailored to address the unique transfer and valuation of these specific assets. 2. Sector-specific agreements: Different industries have their norms and regulations regarding asset transfers. For instance, the sale of assets in the healthcare sector may involve considerations such as patient records, licenses, or compliance requirements. Agreements in such sectors may require additional provisions to accommodate these unique elements. 3. Partial asset sales: In some cases, a corporation may choose to sell only a portion of its assets instead of a complete sale. This scenario may call for a modified agreement that clearly outlines the specific assets being transferred and the allocated purchase price for those assets. 4. Asset purchase with liabilities and debts: Sometimes, a buyer may assume certain liabilities or debts of the selling corporation as part of the purchase agreement. In such cases, the agreement would include provisions addressing the allocation of the purchase price and handling the assumption of these obligations. In summary, the Fulton Georgia Agreement for Sale of all Assets of a Corporation with Allocation of Purchase Price to Tangible and Intangible Business Assets is a crucial legal document that facilitates the transfer of ownership in a corporation. It ensures a transparent and fair allocation of the purchase price to tangible and intangible business assets, while accommodating any specific variations, sector-specific considerations, and partial asset sales that may arise during the negotiation and execution process.

Fulton Georgia Agreement for Sale of all Assets of a Corporation with Allocation of Purchase Price to Tangible and Intangible Business Assets

Description

How to fill out Fulton Georgia Agreement For Sale Of All Assets Of A Corporation With Allocation Of Purchase Price To Tangible And Intangible Business Assets?

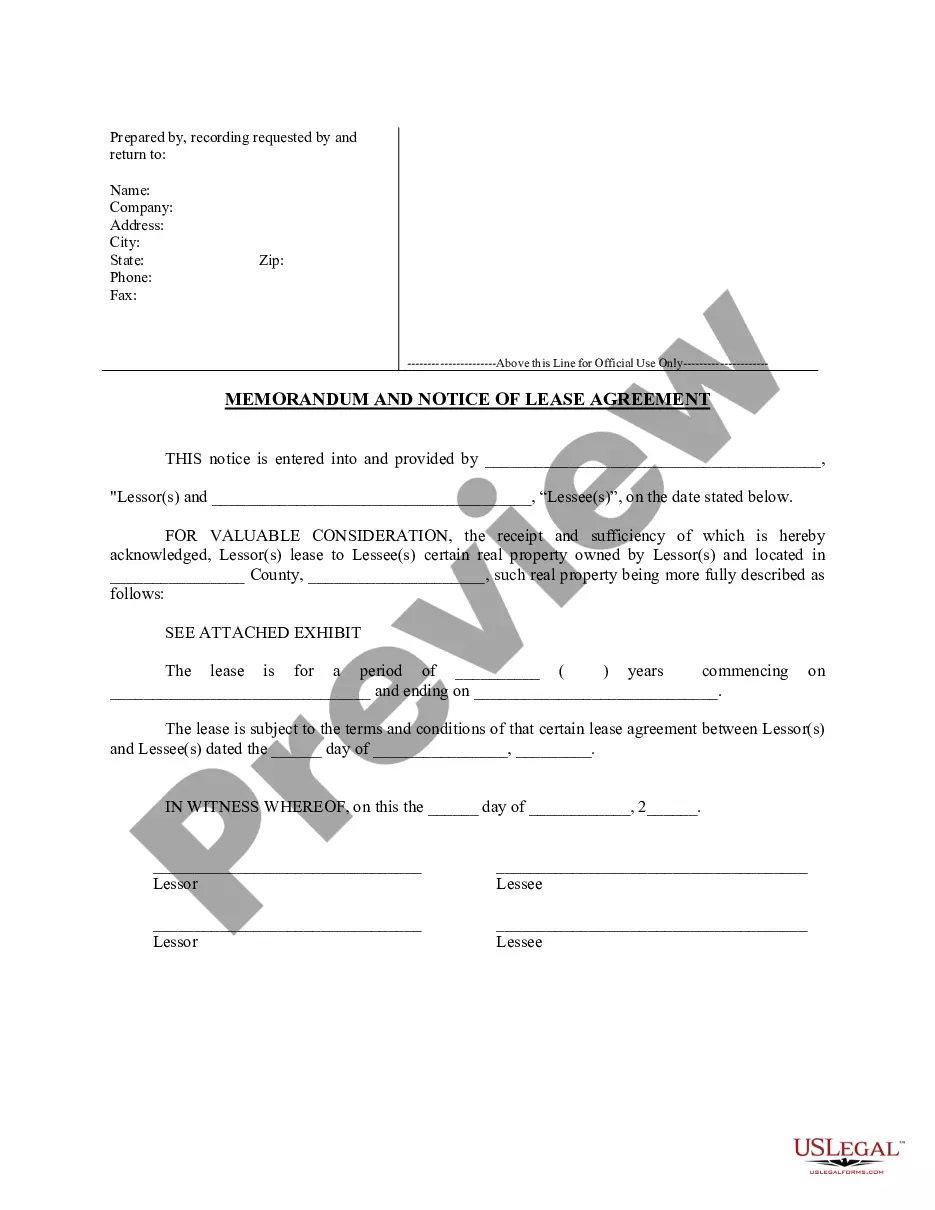

Whether you intend to open your company, enter into a deal, apply for your ID renewal, or resolve family-related legal concerns, you must prepare certain paperwork corresponding to your local laws and regulations. Locating the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 professionally drafted and checked legal documents for any individual or business case. All files are collected by state and area of use, so picking a copy like Fulton Agreement for Sale of all Assets of a Corporation with Allocation of Purchase Price to Tangible and Intangible Business Assets is fast and easy.

The US Legal Forms website users only need to log in to their account and click the Download button next to the required form. If you are new to the service, it will take you several more steps to obtain the Fulton Agreement for Sale of all Assets of a Corporation with Allocation of Purchase Price to Tangible and Intangible Business Assets. Adhere to the guide below:

- Make certain the sample fulfills your individual needs and state law regulations.

- Look through the form description and check the Preview if available on the page.

- Make use of the search tab specifying your state above to find another template.

- Click Buy Now to get the file when you find the correct one.

- Select the subscription plan that suits you most to proceed.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the Fulton Agreement for Sale of all Assets of a Corporation with Allocation of Purchase Price to Tangible and Intangible Business Assets in the file format you require.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Documents provided by our website are multi-usable. Having an active subscription, you can access all of your earlier purchased paperwork at any time in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date formal documentation. Join the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form collection!