The Maricopa Arizona Agreement for Sale of all Assets of a Corporation with Allocation of Purchase Price to Tangible and Intangible Business Assets is a legally binding document that outlines the sale and transfer of a corporation's assets within the Maricopa Arizona jurisdiction. This agreement is crucial when a corporation decides to sell its entire business to another party, and it includes the identification and allocation of the purchase price to both tangible and intangible assets. Keywords: Maricopa Arizona, agreement, sale of assets, corporation, purchase price, tangible assets, intangible assets, allocation, business assets. There are a few different types of Maricopa Arizona Agreement for Sale of all Assets of a Corporation with Allocation of Purchase Price to Tangible and Intangible Business Assets, differentiated by the nature and specifics of the corporation's assets. Some of these types include: 1. Tangible Assets-Only Agreement for Sale of all Assets: This type of agreement focuses solely on the sale and transfer of tangible assets, such as real estate, machinery, inventory, vehicles, and other physical possessions of the corporation. It outlines the allocation of the purchase price to these tangible assets in detail. 2. Intangible Assets-Only Agreement for Sale of all Assets: Such an agreement primarily deals with the sale and transfer of intangible assets, such as patents, copyrights, trademarks, intellectual property, customer lists, and goodwill. It specifies how the purchase price will be allocated to these intangible assets during the transaction. 3. Comprehensive Agreement for Sale of all Assets: This type of agreement encompasses both tangible and intangible assets. It provides a comprehensive overview of all assets being sold by the corporation, including tangible possessions, intellectual property, and other intangible assets. The agreement outlines the division and allocation of the purchase price to ensure transparency and mutually agreeable terms. Regardless of the specific type, a Maricopa Arizona Agreement for Sale of all Assets of a Corporation with Allocation of Purchase Price to Tangible and Intangible Business Assets is a critical legal document that protects all involved parties during the sale and transfer of business assets. It ensures that all assets are accurately identified, valued, and fairly divided, providing a solid foundation for a successful transaction.

Maricopa Arizona Agreement for Sale of all Assets of a Corporation with Allocation of Purchase Price to Tangible and Intangible Business Assets

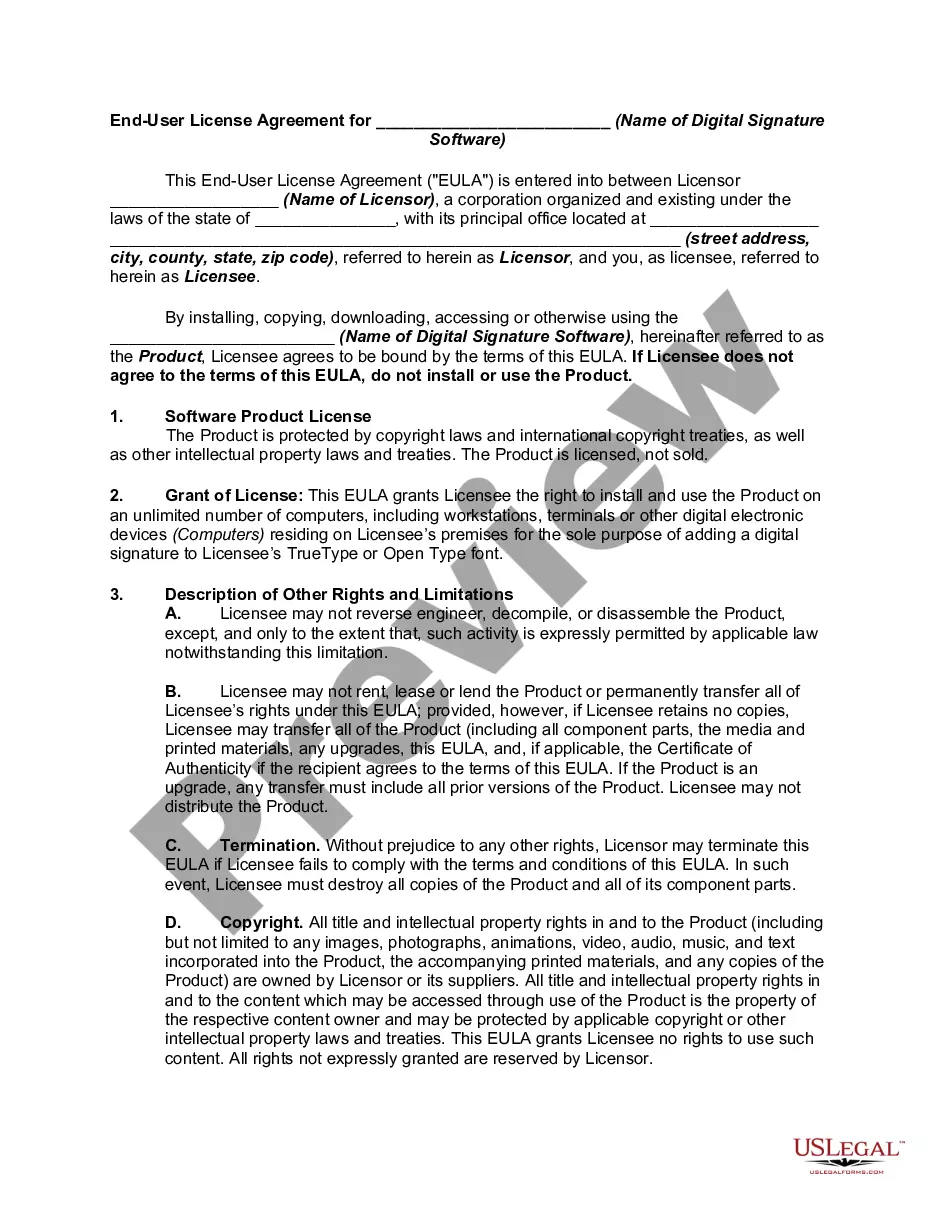

Description

How to fill out Maricopa Arizona Agreement For Sale Of All Assets Of A Corporation With Allocation Of Purchase Price To Tangible And Intangible Business Assets?

How much time does it typically take you to create a legal document? Given that every state has its laws and regulations for every life sphere, finding a Maricopa Agreement for Sale of all Assets of a Corporation with Allocation of Purchase Price to Tangible and Intangible Business Assets suiting all regional requirements can be tiring, and ordering it from a professional lawyer is often pricey. Numerous online services offer the most common state-specific templates for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most comprehensive online catalog of templates, collected by states and areas of use. Aside from the Maricopa Agreement for Sale of all Assets of a Corporation with Allocation of Purchase Price to Tangible and Intangible Business Assets, here you can find any specific document to run your business or personal deeds, complying with your regional requirements. Experts check all samples for their actuality, so you can be certain to prepare your paperwork correctly.

Using the service is remarkably simple. If you already have an account on the platform and your subscription is valid, you only need to log in, pick the needed sample, and download it. You can retain the document in your profile at any moment later on. Otherwise, if you are new to the website, there will be a few more actions to complete before you get your Maricopa Agreement for Sale of all Assets of a Corporation with Allocation of Purchase Price to Tangible and Intangible Business Assets:

- Check the content of the page you’re on.

- Read the description of the template or Preview it (if available).

- Search for another document using the corresponding option in the header.

- Click Buy Now when you’re certain in the chosen document.

- Decide on the subscription plan that suits you most.

- Sign up for an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Switch the file format if needed.

- Click Download to save the Maricopa Agreement for Sale of all Assets of a Corporation with Allocation of Purchase Price to Tangible and Intangible Business Assets.

- Print the doc or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the purchased template, you can find all the files you’ve ever saved in your profile by opening the My Forms tab. Try it out!