The Phoenix Arizona Agreement for Sale of all Assets of a Corporation with Allocation of Purchase Price to Tangible and Intangible Business Assets is a legal document that outlines the terms and conditions of the sale of a corporation's assets in Phoenix, Arizona. This agreement ensures the proper allocation of the purchase price to both tangible and intangible assets, providing a clear understanding of the value and distribution of assets involved in the transaction. The agreement typically covers various aspects such as the identification of assets, including but not limited to real estate, physical inventory, equipment, intellectual property, customer lists, contracts, and goodwill. It provides a detailed description of each asset type, its condition, and any warranties or guarantees associated with it. Keywords: 1. Phoenix Arizona 2. Agreement for Sale of all Assets 3. Corporation 4. Allocation of Purchase Price 5. Tangible Business Assets 6. Intangible Business Assets Different types or variations of the Phoenix Arizona Agreement for Sale of all Assets of a Corporation with Allocation of Purchase Price to Tangible and Intangible Business Assets may include: 1. Standard Phoenix Arizona Agreement for Sale of all Assets of a Corporation with Allocation of Purchase Price to Tangible and Intangible Business Assets: This is the general agreement template used for sales of assets, covering all necessary elements for a typical transaction. 2. Customized Phoenix Arizona Agreement for Sale of all Assets of a Corporation with Allocation of Purchase Price to Tangible and Intangible Business Assets: This variant includes specific terms or clauses tailored to meet the unique requirements of the involved parties or to address specific circumstances of the sale. 3. Phoenix Arizona Agreement for Sale of only Tangible Business Assets with Allocation of Purchase Price: In some cases, the sale may solely involve tangible assets, excluding intangible assets like intellectual property or goodwill. This agreement variant focuses solely on the tangible assets' transfer and allocation of the purchase price. 4. Phoenix Arizona Agreement for Sale of only Intangible Business Assets with Allocation of Purchase Price: Similarly, when the sale primarily consists of intangible assets, such as intellectual property rights or customer contracts, this specialized agreement outlines the transfer and price allocation of those assets exclusively. 5. Phoenix Arizona Agreement for Sale of Specific Tangible and Intangible Business Assets: If the sale includes only specific assets, this variation narrows down the agreement's scope to deal with those particular tangible and intangible assets, allowing for a more focused and concise agreement.

Phoenix Arizona Agreement for Sale of all Assets of a Corporation with Allocation of Purchase Price to Tangible and Intangible Business Assets

Description

How to fill out Phoenix Arizona Agreement For Sale Of All Assets Of A Corporation With Allocation Of Purchase Price To Tangible And Intangible Business Assets?

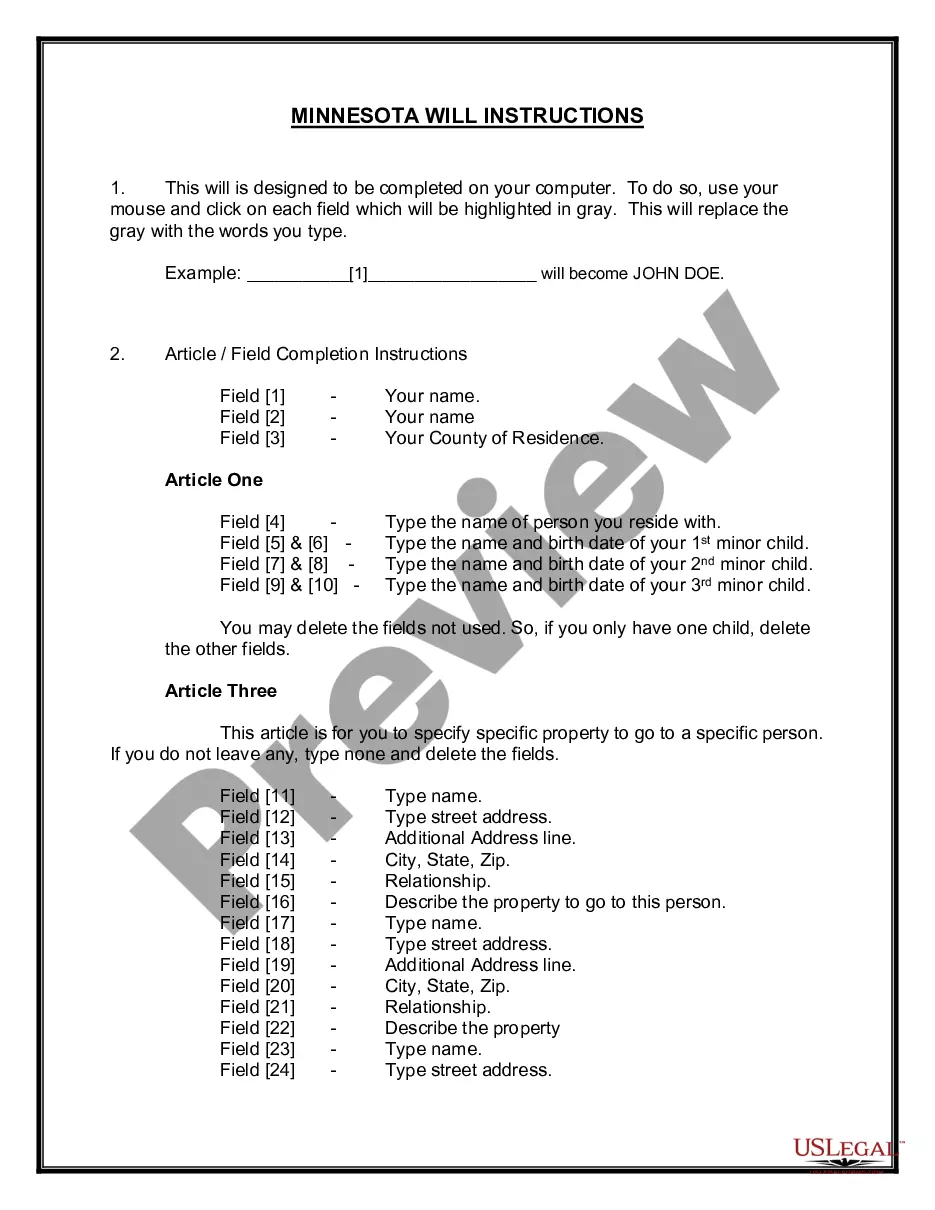

Dealing with legal forms is a necessity in today's world. However, you don't always need to seek qualified assistance to draft some of them from the ground up, including Phoenix Agreement for Sale of all Assets of a Corporation with Allocation of Purchase Price to Tangible and Intangible Business Assets, with a platform like US Legal Forms.

US Legal Forms has more than 85,000 templates to pick from in different types ranging from living wills to real estate papers to divorce papers. All forms are organized according to their valid state, making the searching experience less challenging. You can also find information resources and tutorials on the website to make any activities associated with paperwork execution straightforward.

Here's how you can purchase and download Phoenix Agreement for Sale of all Assets of a Corporation with Allocation of Purchase Price to Tangible and Intangible Business Assets.

- Go over the document's preview and description (if available) to get a general idea of what you’ll get after downloading the form.

- Ensure that the template of your choosing is adapted to your state/county/area since state regulations can impact the legality of some records.

- Check the similar forms or start the search over to find the appropriate document.

- Click Buy now and create your account. If you already have an existing one, choose to log in.

- Choose the pricing {plan, then a needed payment gateway, and buy Phoenix Agreement for Sale of all Assets of a Corporation with Allocation of Purchase Price to Tangible and Intangible Business Assets.

- Select to save the form template in any available format.

- Go to the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can find the appropriate Phoenix Agreement for Sale of all Assets of a Corporation with Allocation of Purchase Price to Tangible and Intangible Business Assets, log in to your account, and download it. Needless to say, our website can’t replace a lawyer entirely. If you need to cope with an extremely complicated case, we advise using the services of a lawyer to examine your document before executing and submitting it.

With over 25 years on the market, US Legal Forms proved to be a go-to platform for many different legal forms for millions of customers. Join them today and get your state-compliant documents effortlessly!