Riverside California is a city situated in the Inland Empire region of Southern California. Known for its scenic beauty and vibrant community, Riverside is home to various industries and businesses that contribute to its economy and growth. In the realm of corporate transactions, a common legal framework used is the Agreement for Sale of all Assets of a Corporation with Allocation of Purchase Price to Tangible and Intangible Business Assets. This agreement outlines the specific terms, conditions, and allocation of the purchase price in a sale transaction involving a corporation's assets. The Agreement for Sale of all Assets of a Corporation with Allocation of Purchase Price is a comprehensive document that covers various aspects of the transaction. It typically includes information about the parties involved, the specific assets being sold, and the allocation of the purchase price between tangible assets (such as real estate, equipment, inventory) and intangible assets (such as intellectual property, customer lists, goodwill). This type of agreement ensures that all parties have a clear understanding of the assets being transferred, the value attributed to each asset category, and their respective rights and obligations. Moreover, it helps protect the buyer and the seller from any potential disputes or future claims by establishing a legally binding agreement. Within the broader scope of Riverside California, agreements for the sale of all assets of a corporation with allocation of purchase price may vary depending on the unique circumstances of the transaction. These variations could include agreements specific to particular industries, such as technology, manufacturing, retail, or service-based businesses. Additionally, the agreement may differ if the transaction involves a merger or acquisition, or if it is a standalone asset sale. In conclusion, Riverside California is a dynamic city home to diverse businesses and industries. The Agreement for Sale of all Assets of a Corporation with Allocation of Purchase Price to Tangible and Intangible Business Assets outlines the terms and conditions for such asset sales, ensuring clarity and protection for all parties involved in these transactions.

Riverside California Agreement for Sale of all Assets of a Corporation with Allocation of Purchase Price to Tangible and Intangible Business Assets

Description

How to fill out Riverside California Agreement For Sale Of All Assets Of A Corporation With Allocation Of Purchase Price To Tangible And Intangible Business Assets?

Preparing paperwork for the business or personal demands is always a huge responsibility. When creating an agreement, a public service request, or a power of attorney, it's important to consider all federal and state laws of the specific region. Nevertheless, small counties and even cities also have legislative provisions that you need to consider. All these details make it burdensome and time-consuming to draft Riverside Agreement for Sale of all Assets of a Corporation with Allocation of Purchase Price to Tangible and Intangible Business Assets without professional help.

It's easy to avoid spending money on lawyers drafting your paperwork and create a legally valid Riverside Agreement for Sale of all Assets of a Corporation with Allocation of Purchase Price to Tangible and Intangible Business Assets by yourself, using the US Legal Forms web library. It is the largest online collection of state-specific legal templates that are professionally cheched, so you can be sure of their validity when picking a sample for your county. Earlier subscribed users only need to log in to their accounts to save the necessary document.

If you still don't have a subscription, adhere to the step-by-step guideline below to obtain the Riverside Agreement for Sale of all Assets of a Corporation with Allocation of Purchase Price to Tangible and Intangible Business Assets:

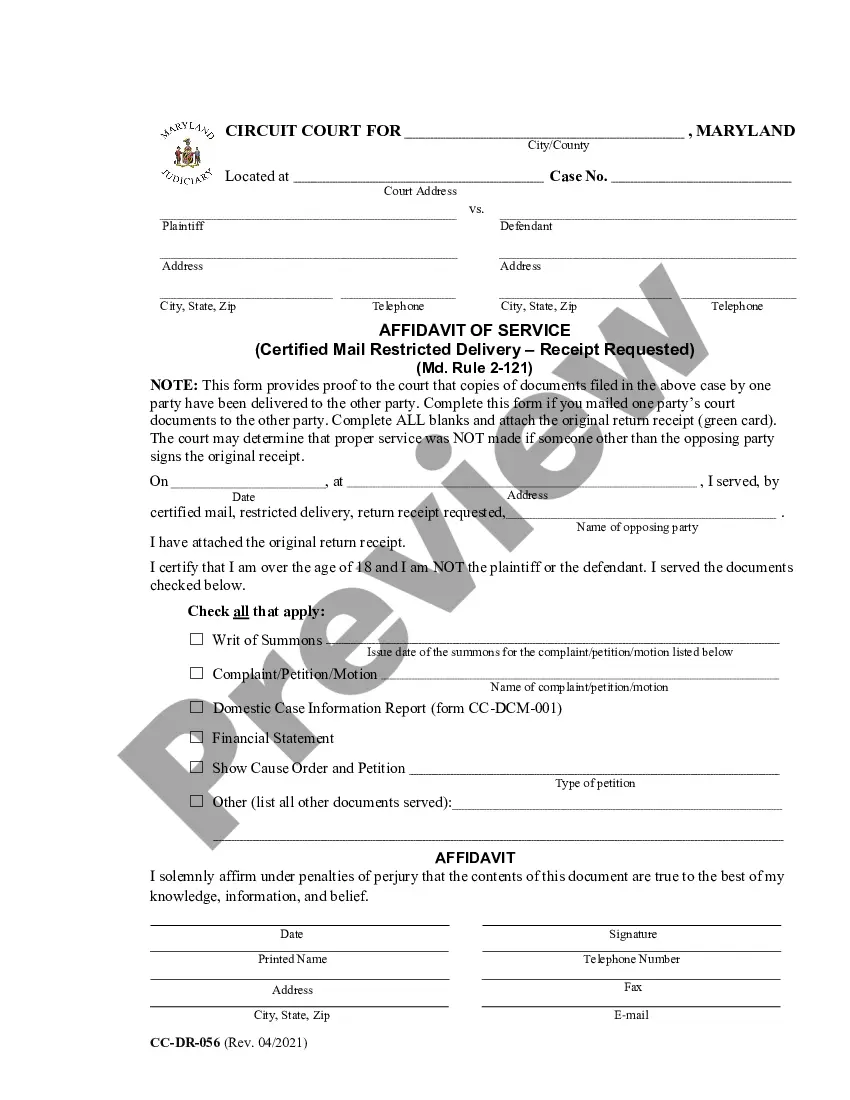

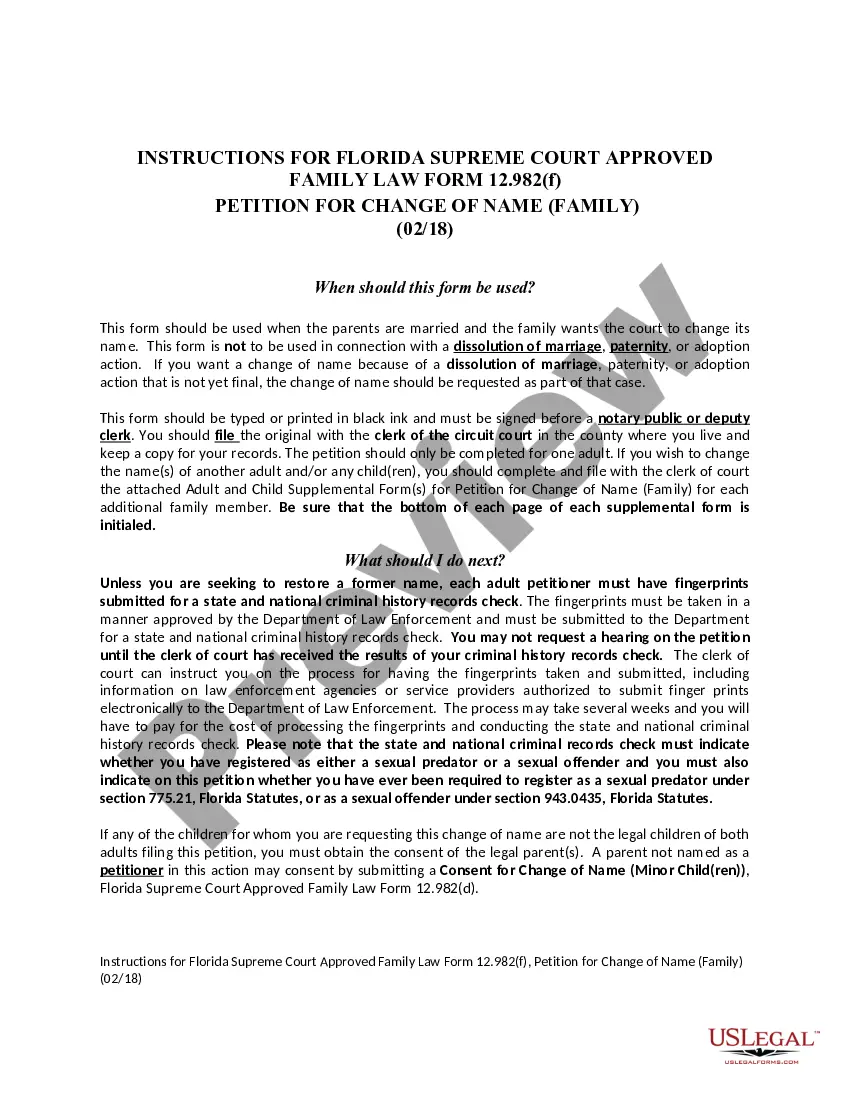

- Look through the page you've opened and verify if it has the sample you require.

- To accomplish this, use the form description and preview if these options are available.

- To locate the one that satisfies your requirements, use the search tab in the page header.

- Double-check that the template complies with juridical criteria and click Buy Now.

- Choose the subscription plan, then sign in or create an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the chosen document in the preferred format, print it, or complete it electronically.

The exceptional thing about the US Legal Forms library is that all the paperwork you've ever purchased never gets lost - you can access it in your profile within the My Forms tab at any time. Join the platform and easily get verified legal templates for any scenario with just a few clicks!