The San Bernardino California Agreement for Sale of all Assets of a Corporation with Allocation of Purchase Price to Tangible and Intangible Business Assets is a legal document that outlines the terms and conditions involved in the sale of all assets of a corporation located within the San Bernardino, California area. This agreement specifically allocates the purchase price between tangible assets and intangible business assets. Keywords: San Bernardino California, agreement, sale of assets, corporation, allocation, purchase price, tangible assets, intangible assets, business assets. There may be different types or variations of the San Bernardino California Agreement for Sale of all Assets of a Corporation with Allocation of Purchase Price to Tangible and Intangible Business Assets, depending on the specific circumstances and requirements of the parties involved. Some potential variations may include: 1. San Bernardino California Agreement for the Sale of Tangible Assets of a Corporation with Allocation of Purchase Price: This type of agreement focuses solely on the sale of tangible assets, such as real estate, inventory, equipment, and other physical property. The allocation of the purchase price is determined based on the fair market value of these tangible assets. 2. San Bernardino California Agreement for the Sale of Intangible Business Assets of a Corporation with Allocation of Purchase Price: In contrast to the previous type, this agreement specifically addresses the sale of intangible assets, including intellectual property rights, patents, trademarks, copyrights, customer lists, brand names, and goodwill. The allocation of the purchase price is determined based on the appraisal value or other agreed-upon valuation methods for these intangible assets. 3. San Bernardino California Agreement for the Sale of Specific Business Divisions with Allocation of Purchase Price: This type of agreement is applicable when a corporation intends to sell only specific divisions or segments of its business. The allocation of the purchase price is determined based on the value assigned to the respective tangible and intangible assets associated with those specific divisions. 4. San Bernardino California Agreement for the Sale of Business as a Going Concern: This particular agreement is suitable when a corporation is sold as a complete entity with all its tangible and intangible business assets, including ongoing operations, contracts, customer relationships, trademarks, and more. The allocation of the purchase price is determined based on the fair market value of all the assets, both tangible and intangible, as well as the value assigned to the business as a going concern. Please note that the exact terminology and specific types of agreements may vary, and consulting with a legal professional is advisable to ensure compliance with local laws and regulations.

San Bernardino California Agreement for Sale of all Assets of a Corporation with Allocation of Purchase Price to Tangible and Intangible Business Assets

Description

How to fill out San Bernardino California Agreement For Sale Of All Assets Of A Corporation With Allocation Of Purchase Price To Tangible And Intangible Business Assets?

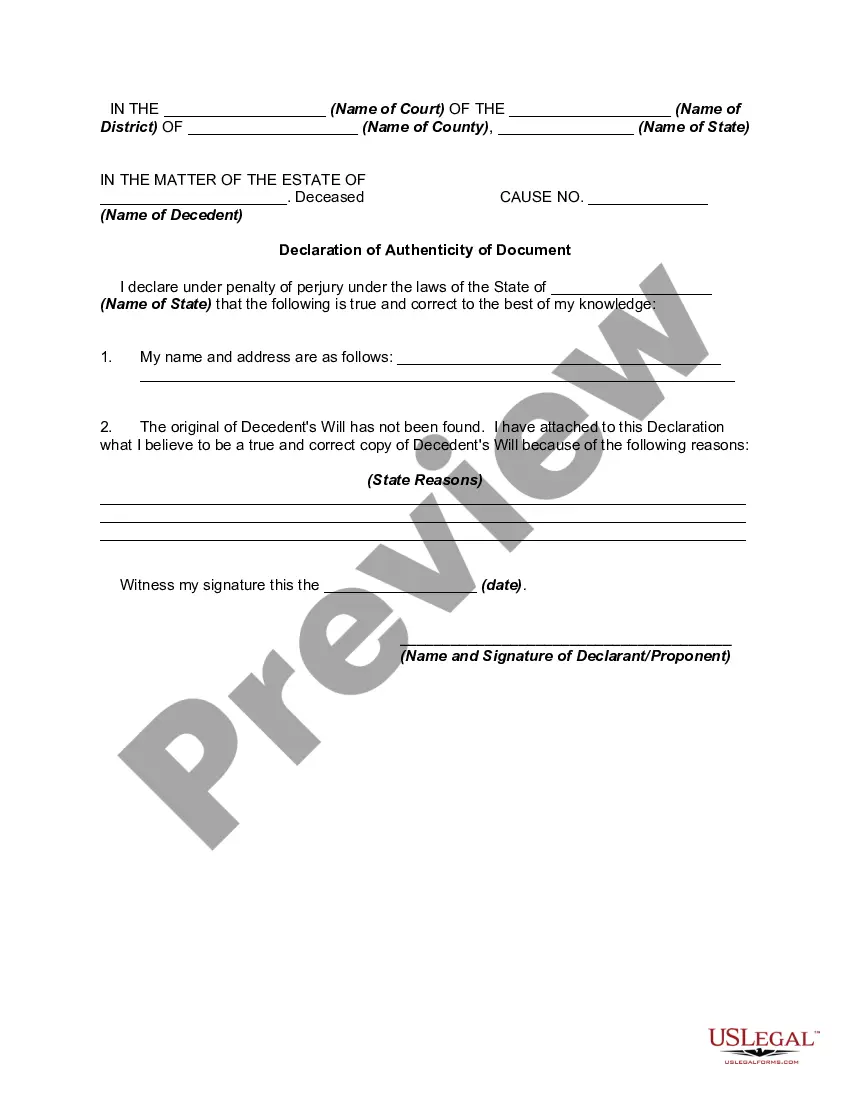

If you need to find a reliable legal paperwork provider to get the San Bernardino Agreement for Sale of all Assets of a Corporation with Allocation of Purchase Price to Tangible and Intangible Business Assets, consider US Legal Forms. No matter if you need to start your LLC business or manage your belongings distribution, we got you covered. You don't need to be well-versed in in law to locate and download the needed template.

- You can select from over 85,000 forms categorized by state/county and situation.

- The self-explanatory interface, variety of learning materials, and dedicated support team make it simple to find and complete various documents.

- US Legal Forms is a reliable service providing legal forms to millions of customers since 1997.

You can simply select to search or browse San Bernardino Agreement for Sale of all Assets of a Corporation with Allocation of Purchase Price to Tangible and Intangible Business Assets, either by a keyword or by the state/county the document is intended for. After finding the necessary template, you can log in and download it or retain it in the My Forms tab.

Don't have an account? It's effortless to start! Simply find the San Bernardino Agreement for Sale of all Assets of a Corporation with Allocation of Purchase Price to Tangible and Intangible Business Assets template and check the form's preview and description (if available). If you're comfortable with the template’s language, go ahead and click Buy now. Create an account and choose a subscription plan. The template will be instantly ready for download once the payment is processed. Now you can complete the form.

Handling your legal matters doesn’t have to be pricey or time-consuming. US Legal Forms is here to demonstrate it. Our comprehensive variety of legal forms makes this experience less costly and more reasonably priced. Create your first business, arrange your advance care planning, create a real estate agreement, or complete the San Bernardino Agreement for Sale of all Assets of a Corporation with Allocation of Purchase Price to Tangible and Intangible Business Assets - all from the comfort of your sofa.

Join US Legal Forms now!