King Washington Substituted Agreement is a legal agreement that involves the substitution of the original debtor with a new debtor. This agreement is typically used in the context of financial transactions, such as loans or mortgages, where the original borrower seeks to transfer their obligations to another party. The King Washington Substituted Agreement is designed to formally replace the rights and responsibilities of the original debtor with those of the new debtor. This ensures that the new debtor is now fully responsible for repaying the debt and meeting all associated obligations. There are several types of King Washington Substituted Agreements, each catering to specific circumstances and requirements: 1. Loan Substituted Agreement: This type of Agreement is commonly used when a borrower wishes to transfer their outstanding loan obligations to a new borrower. It involves the negotiation and execution of a new contract between the lender, the original borrower, and the new borrower, outlining the terms and conditions of the substituted loan. 2. Mortgage Substituted Agreement: In the case of a mortgage, this Agreement allows for the substitution of the original mortgagor with a new one. This can occur due to various reasons, such as a change in ownership of the property or the need for a new borrower to obtain better loan terms. The substituted agreement details how the new mortgagor will assume all obligations related to the mortgage. 3. Guarantor Substituted Agreement: This Agreement plays a crucial role when a guarantor wants to transfer their guarantor responsibilities to a different individual. It involves the consent of all parties involved, including the original guarantor, new guarantor, and the creditor. The substituted agreement releases the original guarantor from their obligations and substitutes them with the new guarantor. The King Washington Substituted Agreement serves as an essential legal document that safeguards the rights and obligations of all parties involved in a financial arrangement. It ensures a smooth transfer of responsibility from the original debtor to the new debtor, providing clarity and certainty in the transaction.

King Washington Substituted Agreement

Description

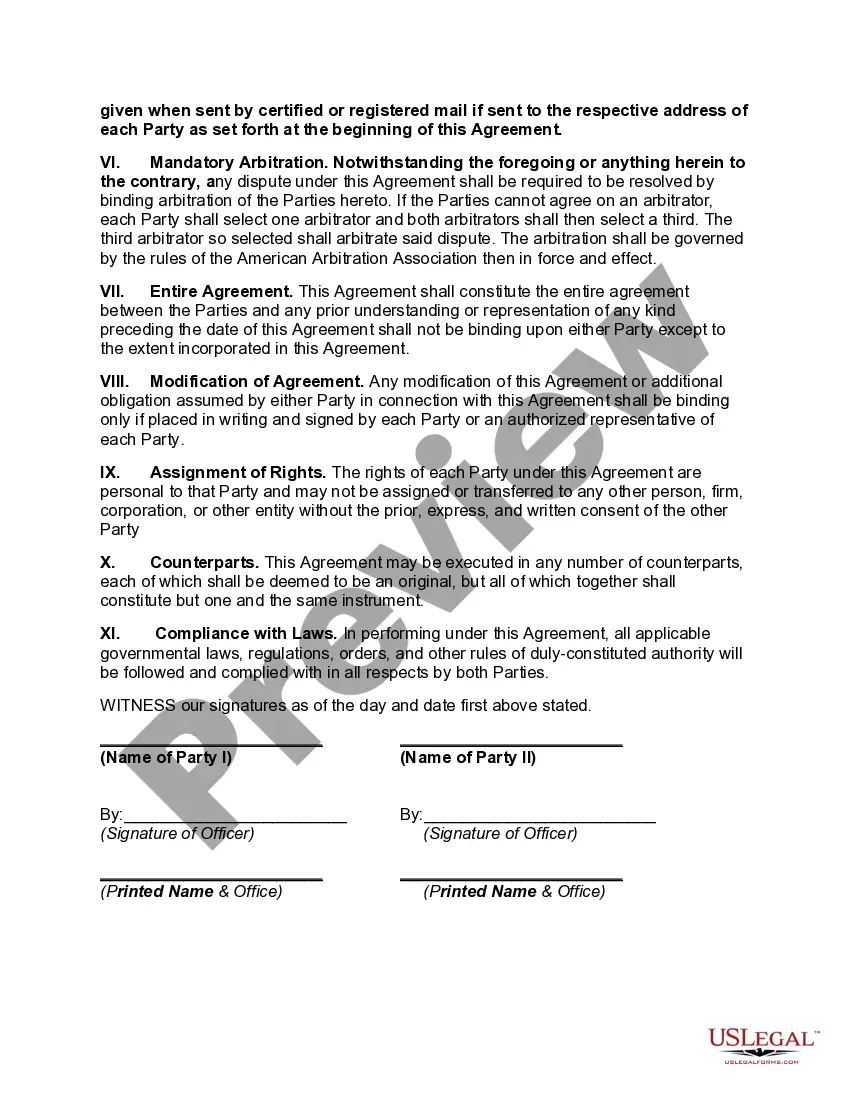

How to fill out King Washington Substituted Agreement?

Creating legal forms is a necessity in today's world. However, you don't always need to seek professional help to create some of them from scratch, including King Substituted Agreement, with a platform like US Legal Forms.

US Legal Forms has over 85,000 forms to choose from in various categories ranging from living wills to real estate paperwork to divorce documents. All forms are arranged based on their valid state, making the searching experience less challenging. You can also find information resources and tutorials on the website to make any tasks related to document completion straightforward.

Here's how to locate and download King Substituted Agreement.

- Take a look at the document's preview and description (if available) to get a basic idea of what you’ll get after getting the form.

- Ensure that the template of your choice is adapted to your state/county/area since state regulations can affect the validity of some records.

- Examine the related document templates or start the search over to locate the correct file.

- Hit Buy now and register your account. If you already have an existing one, select to log in.

- Pick the pricing {plan, then a needed payment method, and buy King Substituted Agreement.

- Choose to save the form template in any offered format.

- Visit the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can locate the appropriate King Substituted Agreement, log in to your account, and download it. Of course, our platform can’t replace a lawyer entirely. If you need to cope with an exceptionally complicated case, we recommend using the services of an attorney to check your document before signing and submitting it.

With over 25 years on the market, US Legal Forms became a go-to provider for many different legal forms for millions of users. Join them today and get your state-specific documents with ease!