A Chicago Illinois Assignment of Security Agreement and Note with Recourse is a legal document that outlines the transfer of rights and obligations from one party to another regarding a security agreement and accompanying promissory note. This type of agreement is commonly used in business transactions, especially when financing is involved. It allows the lender to assign or transfer their interest in the security agreement and note to another party, while also retaining the right to recover any outstanding balances in case of default by the borrower. In Chicago, Illinois, there are various types of Assignment of Security Agreement and Note with Recourse documents that can be utilized depending on the specific circumstances of the transaction. Some common types include: 1. Commercial Loan Assignment of Security Agreement and Note with Recourse: This type of assignment typically involves commercial loans, where a lender assigns their rights to another party in exchange for immediate payment or as part of a loan portfolio transaction. The recourse option ensures that the original lender can seek payment from the assignee if the borrower defaults on the loan. 2. Real Estate Assignment of Security Agreement and Note with Recourse: In real estate transactions, lenders may assign their rights to the property's security agreement and note to another party, usually when selling mortgage portfolios or transferring loans. This type of assignment allows the original lender to maintain recourse options if the borrower fails to fulfill their obligations. 3. Equipment Financing Assignment of Security Agreement and Note with Recourse: When financing the purchase of equipment, lenders can assign their interests in the security agreement and note to a third party. This can occur in cases where the lender needs immediate liquidity or wants to transfer the risk associated with the loan. The recourse provision enables the original lender to recover any outstanding payments from the assignee in case of default by the borrower. 4. Vendor Financing Assignment of Security Agreement and Note with Recourse: This type of assignment is commonly used when a vendor provides financing to a buyer directly. The vendor assigns their rights under the security agreement and note to a financing institution or third party, allowing them to receive instant payment for the financed purchase. The recourse clause ensures that the original vendor still has the ability to seek payment from the assignee if the buyer fails to make the required payments. Overall, Chicago Illinois Assignment of Security Agreement and Note with Recourse documents serve as important legal instruments that facilitate the transfer of rights and obligations between parties involved in various types of financing transactions. These agreements provide a framework for the lenders to assign their interests, while also preserving their recourse options if the borrower defaults. It is crucial for all parties involved to carefully review and understand the terms and conditions outlined in the agreement to ensure compliance with Chicago's legal requirements and to protect their interests in the transaction.

Chicago Illinois Assignment of Security Agreement and Note with Recourse

Description

How to fill out Chicago Illinois Assignment Of Security Agreement And Note With Recourse?

Creating legal forms is a must in today's world. Nevertheless, you don't always need to look for qualified assistance to draft some of them from the ground up, including Chicago Assignment of Security Agreement and Note with Recourse, with a platform like US Legal Forms.

US Legal Forms has more than 85,000 templates to select from in different categories varying from living wills to real estate papers to divorce documents. All forms are arranged according to their valid state, making the searching experience less challenging. You can also find detailed materials and tutorials on the website to make any activities associated with document completion straightforward.

Here's how to purchase and download Chicago Assignment of Security Agreement and Note with Recourse.

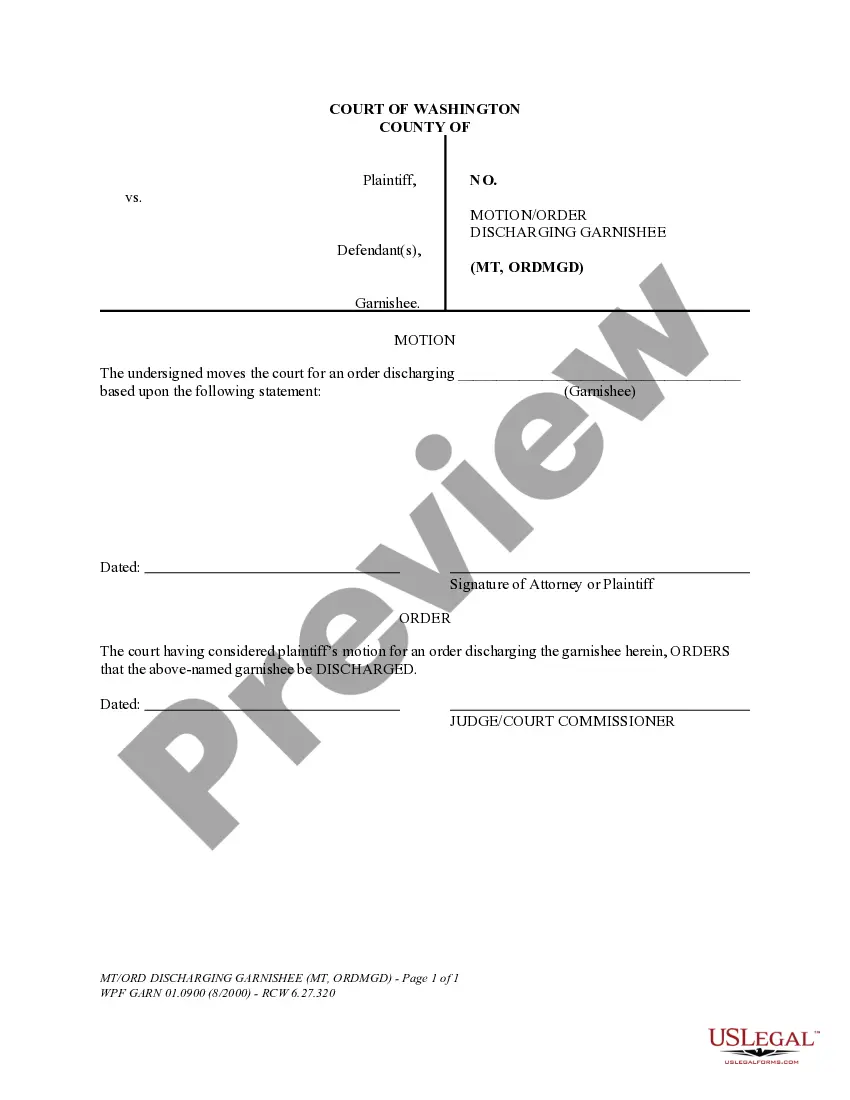

- Go over the document's preview and description (if available) to get a basic information on what you’ll get after downloading the form.

- Ensure that the template of your choice is specific to your state/county/area since state regulations can impact the legality of some records.

- Check the related forms or start the search over to find the appropriate file.

- Click Buy now and register your account. If you already have an existing one, select to log in.

- Choose the option, then a suitable payment gateway, and purchase Chicago Assignment of Security Agreement and Note with Recourse.

- Choose to save the form template in any offered file format.

- Visit the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can find the needed Chicago Assignment of Security Agreement and Note with Recourse, log in to your account, and download it. Of course, our website can’t replace a lawyer completely. If you have to deal with an extremely difficult situation, we recommend getting an attorney to check your form before signing and filing it.

With over 25 years on the market, US Legal Forms became a go-to platform for various legal forms for millions of customers. Become one of them today and get your state-compliant paperwork with ease!