Mecklenburg County, located in the state of North Carolina, has various types of Assignment of Security Agreement and Note with Recourse. In this article, we will explore the details and importance of this legal document, highlighting its various types and key information. An Assignment of Security Agreement and Note with Recourse is a contractual agreement where a lender transfers their rights and interests in a security agreement and promissory note to another party. This legal tool is commonly used in financing arrangements, such as loans or mortgages, to provide additional security to the lender. Key Terms and Clauses: 1. Security Agreement: The document outlines the collateral securing the loan or mortgage. It provides details about the pledged assets, such as real estate, vehicles, equipment, or other valuable property that the borrower puts up as security for the debt. The Assignment of Security Agreement transfers the lender's interest in this agreement. 2. Promissory Note: This document establishes the borrower's promise to repay the loan, including the terms and conditions of repayment, interest rate, payment schedule, and penalties for defaulting. The Assignment of Note transfers the lender's rights and interests in the promissory note. 3. With Recourse: This clause places liability on the original lender even after the assignment. If the borrower defaults, the assignee (new lender or investor) can seek compensation from the original lender. This provision provides an added layer of security for the assignee. Types of Assignment of Security Agreement and Note with Recourse in Mecklenburg North Carolina: 1. Real Estate Assignment: This type of assignment pertains specifically to loans or mortgages secured by real estate. The Assignment of Security Agreement transfers the rights and interests in the security agreement and the Assignment of Note transfers the rights and interests in the promissory note. 2. Vehicle Assignment: This type of assignment involves loans or financing secured by vehicles, such as cars, motorcycles, or recreational vehicles. The collateral securing the loan consists of the vehicle(s) and its related equipment. 3. Equipment Assignment: In financing arrangements involving business loans or leases, equipment assignment is common. It transfers the lender's rights and interests in the equipment, machinery, or other business assets serving as collateral. Importance of Mecklenburg North Carolina Assignment of Security Agreement and Note with Recourse: 1. Enhanced Security: With the Assignment of Security Agreement and Note with Recourse, lenders gain an additional layer of security. In the event of default, they can pursue compensation from the original lender. 2. Risk Mitigation: Assigning the rights and interests in the security agreement and note protects lenders against potential losses. It reduces the lender's exposure to risk and safeguards their financial interests. 3. Smooth Transactions: Assignments allow lenders to transfer loans or mortgages more efficiently. They can sell the loans in the secondary market or assign them to another lender or investor, thereby ensuring liquidity and potentially increased profitability. In Mecklenburg County, North Carolina, Assignment of Security Agreement and Note with Recourse plays a vital role in securing loans, mortgages, and financing arrangements. The different types, including real estate, vehicle, and equipment assignments, allow lenders to establish a more robust security framework and mitigate potential risks. By understanding and implementing these legal tools, lenders can pursue opportunities while safeguarding their financial interests effectively.

Mecklenburg North Carolina Assignment of Security Agreement and Note with Recourse

Description

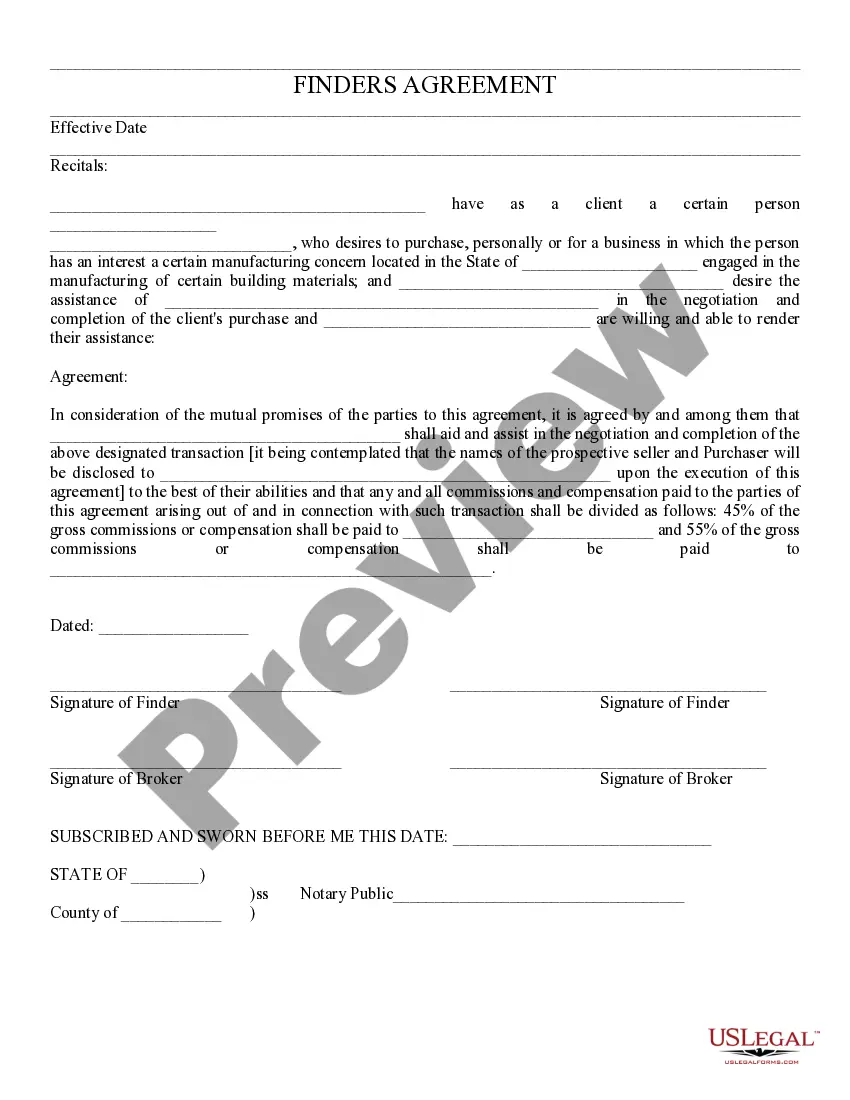

How to fill out Mecklenburg North Carolina Assignment Of Security Agreement And Note With Recourse?

If you need to find a reliable legal form supplier to obtain the Mecklenburg Assignment of Security Agreement and Note with Recourse, consider US Legal Forms. Whether you need to start your LLC business or take care of your belongings distribution, we got you covered. You don't need to be well-versed in in law to find and download the needed form.

- You can select from over 85,000 forms arranged by state/county and case.

- The self-explanatory interface, variety of supporting resources, and dedicated support make it easy to get and execute different documents.

- US Legal Forms is a reliable service offering legal forms to millions of users since 1997.

Simply type to search or browse Mecklenburg Assignment of Security Agreement and Note with Recourse, either by a keyword or by the state/county the document is intended for. After finding the necessary form, you can log in and download it or save it in the My Forms tab.

Don't have an account? It's simple to get started! Simply find the Mecklenburg Assignment of Security Agreement and Note with Recourse template and check the form's preview and description (if available). If you're confident about the template’s language, go ahead and hit Buy now. Create an account and select a subscription plan. The template will be instantly ready for download once the payment is completed. Now you can execute the form.

Taking care of your law-related matters doesn’t have to be pricey or time-consuming. US Legal Forms is here to demonstrate it. Our comprehensive variety of legal forms makes this experience less expensive and more affordable. Create your first company, organize your advance care planning, create a real estate contract, or complete the Mecklenburg Assignment of Security Agreement and Note with Recourse - all from the convenience of your sofa.

Join US Legal Forms now!