Description: Oakland Michigan Assignment of Security Agreement and Note with Recourse The Oakland Michigan Assignment of Security Agreement and Note with Recourse refers to a legal document that involves the transfer of rights and obligations related to a security agreement and promissory note between parties located in Oakland County, Michigan. This type of agreement is commonly used in financial transactions or business relationships where a lender assigns its rights in the security agreement and promissory note to another party, known as the assignee. The Assignment of Security Agreement and Note with Recourse is designed to protect the interests of the assignee by ensuring that the assignor remains liable for any default or non-payment in relation to the promissory note. In case the borrower fails to repay the loan, the assignee can seek recourse against the original lender to recover the outstanding debt or any losses incurred. Different types or variations of Oakland Michigan Assignment of Security Agreement and Note with Recourse may include: 1. Commercial Assignment of Security Agreement and Note with Recourse: This type of agreement is commonly used in commercial lending transactions, where a company assigns its rights as the original lender to a third party in exchange for a cash consideration or to mitigate risk exposure. 2. Real Estate Assignment of Security Agreement and Note with Recourse: This variation is specifically tailored for real estate financing where the security agreement primarily involves property assets. It allows the lender to assign its rights to another party, usually a mortgagee, who assumes the responsibility of collecting payments and enforcing any defaults. 3. Asset-based Assignment of Security Agreement and Note with Recourse: This type of agreement involves the transfer of rights to secured assets, such as inventory, equipment, or accounts receivable, in addition to the promissory note. It is commonly used in situations where the assignee requires collateral to secure their investment. Regardless of the specific type, an Assignment of Security Agreement and Note with Recourse in Oakland, Michigan, typically contains vital information such as the names and addresses of the parties involved, the effective date of the assignment, the terms and conditions of the assignment, including any recourse provisions, and the signatures of all parties to demonstrate their consent and agreement to the terms. In conclusion, the Oakland Michigan Assignment of Security Agreement and Note with Recourse is a legal document used to transfer rights and obligations related to a security agreement and promissory note. It serves to protect the assignee's interests and ensure the assignor remains liable for any default. Different variations of this agreement exist, depending on the nature of the transaction or assets involved.

Oakland Michigan Assignment of Security Agreement and Note with Recourse

Description

How to fill out Oakland Michigan Assignment Of Security Agreement And Note With Recourse?

Laws and regulations in every sphere vary around the country. If you're not an attorney, it's easy to get lost in a variety of norms when it comes to drafting legal documentation. To avoid expensive legal assistance when preparing the Oakland Assignment of Security Agreement and Note with Recourse, you need a verified template legitimate for your region. That's when using the US Legal Forms platform is so beneficial.

US Legal Forms is a trusted by millions web collection of more than 85,000 state-specific legal templates. It's a great solution for professionals and individuals searching for do-it-yourself templates for various life and business scenarios. All the documents can be used multiple times: once you pick a sample, it remains available in your profile for future use. Therefore, if you have an account with a valid subscription, you can simply log in and re-download the Oakland Assignment of Security Agreement and Note with Recourse from the My Forms tab.

For new users, it's necessary to make a few more steps to obtain the Oakland Assignment of Security Agreement and Note with Recourse:

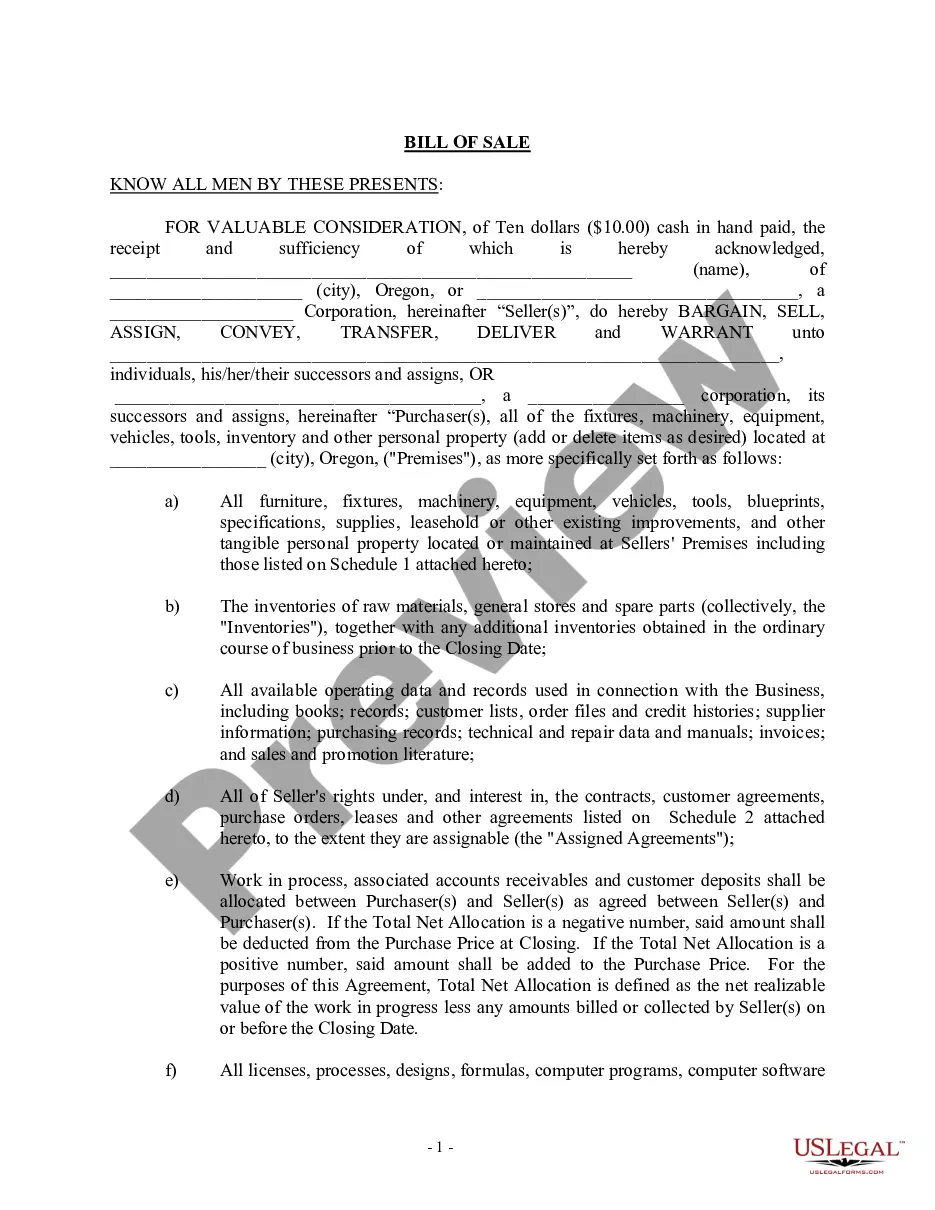

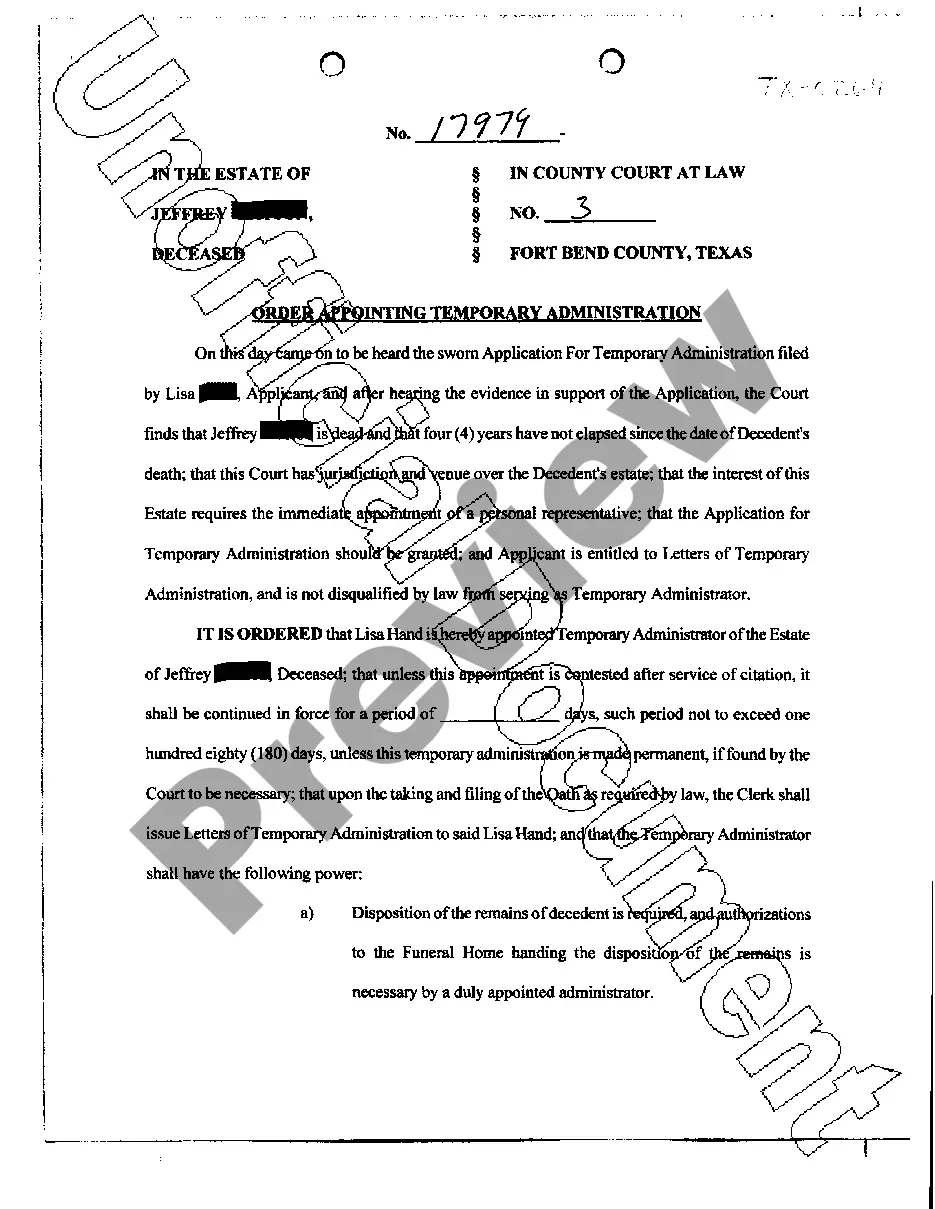

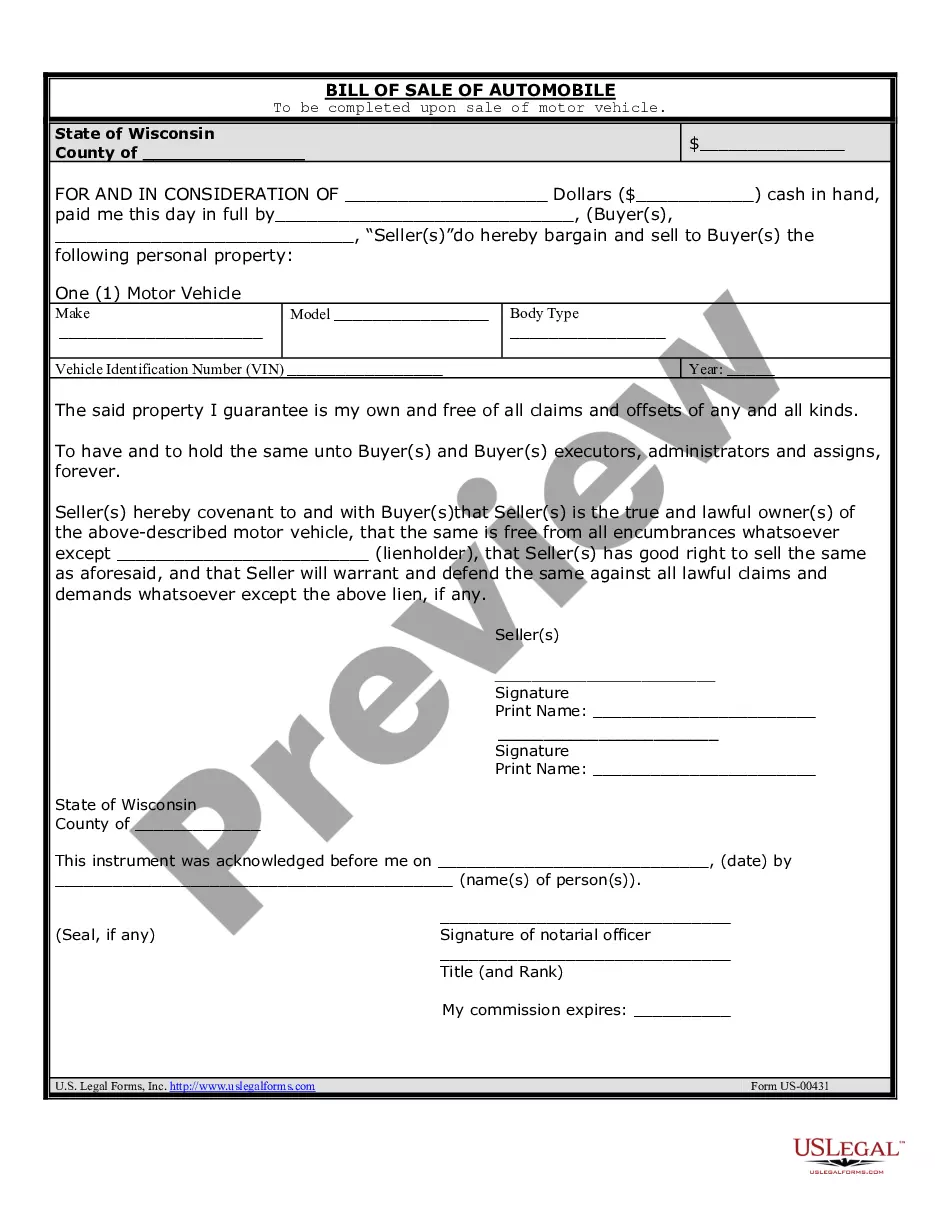

- Analyze the page content to ensure you found the correct sample.

- Take advantage of the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your criteria.

- Utilize the Buy Now button to obtain the document when you find the correct one.

- Opt for one of the subscription plans and log in or create an account.

- Decide how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the document in and click Download.

- Fill out and sign the document in writing after printing it or do it all electronically.

That's the simplest and most affordable way to get up-to-date templates for any legal purposes. Find them all in clicks and keep your documentation in order with the US Legal Forms!

Form popularity

FAQ

Promissory notes can be secured using a financing statement, deed of trust, or a mortgage. If a promissory note includes these terms, then it is a secured promissory note. So, the inclusion of collateral is the only real difference between secured promissory notes and unsecured promissory notes.

Secured Promissory Notes A secured promissory note is an obligation to pay that is secured by some type of property. This means that if the payor fails to pay, the payee can seize the designated property to obtain reimbursement of the loan.

Types of Unsecured Promissory Notes Promissory notes can be classified in two ways: by the length of the loan, and by the manner in which the loan is repaid. Loans may be considered long-term or short-term. Although there is no legal definition, a short-term loan is generally for a year or less.

Generally, a Secured Promissory Note will be secured using an additional document. If the property being used as collateral is personal property, the Note will be secured using a Security Agreement. If the property being used as collateral is real property, the Note will be secured using a Deed of Trust.

In order for a promissory note to be valid and legally binding, it needs to include specific information. "A promissory note should include details including the amount loaned, the repayment schedule and whether it is secured or unsecured," says Wheeler.

Homebuyers usually think of the mortgage as the contract they're signing with the lender to borrow money to buy a house. But the promissory note is the document that contains the promise to repay the amount borrowed. The purpose of the mortgage is to provide security for the loan that's evidenced by a promissory note.

In addition, the note resembles a security if the lender takes the note as an investment, in the same sense that the lender might buy stock as an investment. Depending on the facts and circumstances, a Note that has a term of less than 9 months may be security.

In general, the promissory note is your written promise to repay the loan and a security agreement is used when collateral is given for the loan.

So, what's the difference between secured and unsecured promissory notes? It's actually quite simple. A secured note is any debt collateralized with real property like a first deed of trust or car title. Conversely, an unsecured note is any debt not secured by collateral (or uncollateralized).

A secured promissory note, as the name partially implies, is secured by some form of property (i.e. collateral), while an unsecured promissory note does not involve collateral. If the borrower defaults on a Secured Promissory Note, the lender gets to keep the collateral (the property that was used to secure the loan).

More info

Banks that are not on-site at each of the designated locations will count as an indirect deposit or e-bank. For a listing of all online financial institutions, click here. MD Public School System Schools accept the same list. Schools do not accept e-bank from other banks. In-State, out-of-state, and other credit card inquiries (1) will result in a referral to the appropriate branch or office. (2) Any other inquiries may result in further processing. Please complete the online application for school to be put through a background check. The only approved credit cards are those issued through this credit card processing service. See for this list. You will only be approved for one account per application. If you need to cancel, that will cause a reversal of the approval on this application. Please ensure you have the most current address information.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.