Houston Texas Equipment Lease with Lessor to Purchase Equipment Specified by Lessee is a contractual agreement between a lessee and a lessor in which the lessee leases equipment for a specified period with the option to purchase the equipment at the end of the lease term. This type of lease is a popular choice for businesses in Houston, Texas, as it provides flexibility and allows them to acquire necessary equipment without a large upfront investment. There are several types of Houston Texas Equipment Lease with Lessor to Purchase Equipment Specified by Lessee, each tailored to meet specific needs and requirements. Let's explore some of these variations: 1. Operating Lease with Purchase Option: This type of equipment lease allows the lessee to use the equipment for a defined period, typically less than the equipment's useful life, with an option to purchase the equipment at the end of the lease term. The purchase amount may be predetermined or based on the fair market value at that time. 2. Capital Lease with Purchase Obligation: Unlike an operating lease, a capital lease is structured as a long-term financing agreement. The lessee assumes most of the risks and benefits of ownership, and at the end of the lease period, they are obligated to purchase the equipment at a pre-determined price or through a specified formula. 3. Equipment Rental Agreement with Purchase Option: This type of lease provides the lessee with the option to rent equipment for a short-term period, usually less than a year, and decide whether to purchase the equipment at the end of the rental period. It offers flexibility for businesses that require equipment on a temporary basis. 4. Lease-to-Own Agreement: This unique lease arrangement allows lessees to make regular lease payments for a set period, typically with a higher portion allocated towards the lease's principal. Once the lease concludes, the lessee gains ownership of the equipment, making it an appealing option for smaller businesses aiming to eventually own their equipment. Houston, Texas, being a thriving hub for various industries, such as oil and gas, manufacturing, and healthcare, can benefit greatly from Houston Texas Equipment Lease with Lessor to Purchase Equipment Specified by Lessee. By opting for this approach, businesses can effectively manage their cash flow while accessing the necessary equipment to fuel their operations. Overall, Houston Texas Equipment Lease with Lessor to Purchase Equipment Specified by Lessee offers businesses in Houston, Texas, the opportunity to acquire essential equipment without a substantial upfront investment. With different variations available, lessees can tailor their lease contract to best suit their specific needs and industry requirements.

Houston Texas Equipment Lease with Lessor to Purchase Equipment Specified by Lessee

Description

How to fill out Houston Texas Equipment Lease With Lessor To Purchase Equipment Specified By Lessee?

Laws and regulations in every area differ around the country. If you're not an attorney, it's easy to get lost in countless norms when it comes to drafting legal documentation. To avoid expensive legal assistance when preparing the Houston Equipment Lease with Lessor to Purchase Equipment Specified by Lessee, you need a verified template legitimate for your region. That's when using the US Legal Forms platform is so helpful.

US Legal Forms is a trusted by millions online collection of more than 85,000 state-specific legal templates. It's an excellent solution for specialists and individuals looking for do-it-yourself templates for various life and business scenarios. All the forms can be used multiple times: once you purchase a sample, it remains available in your profile for further use. Thus, when you have an account with a valid subscription, you can simply log in and re-download the Houston Equipment Lease with Lessor to Purchase Equipment Specified by Lessee from the My Forms tab.

For new users, it's necessary to make some more steps to get the Houston Equipment Lease with Lessor to Purchase Equipment Specified by Lessee:

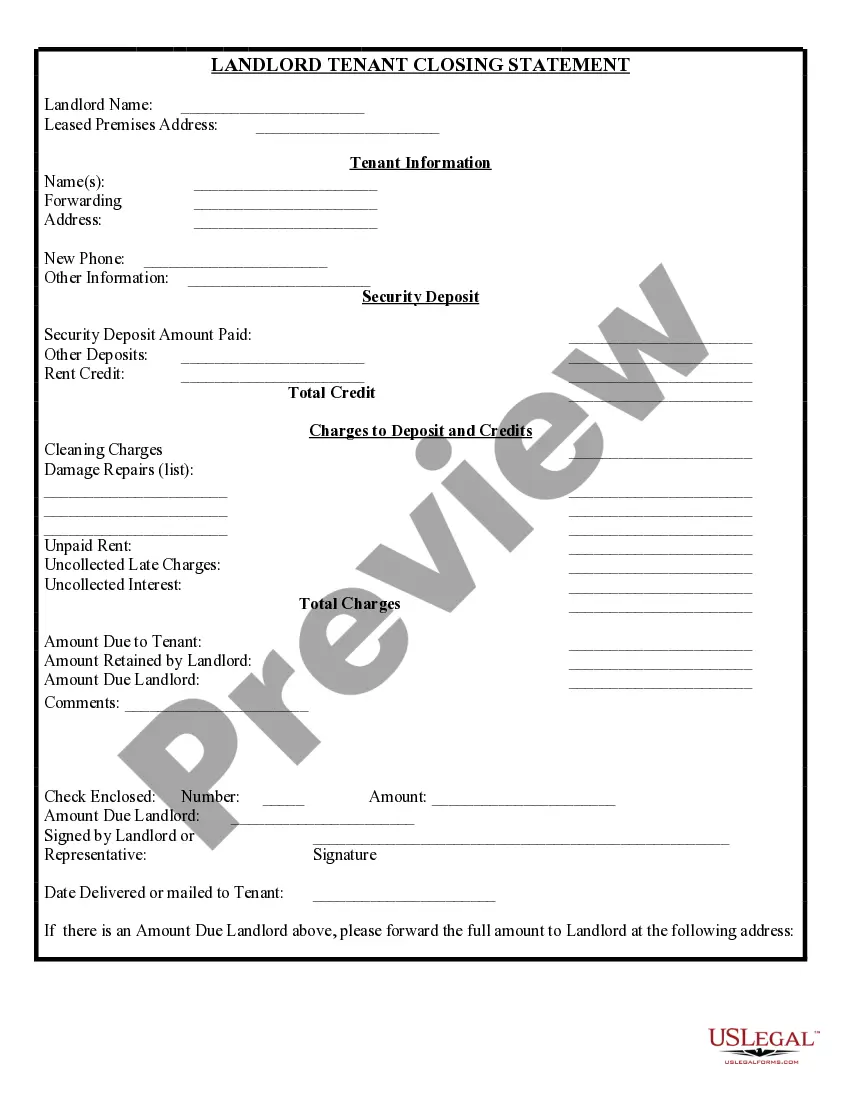

- Analyze the page content to ensure you found the right sample.

- Use the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your criteria.

- Use the Buy Now button to obtain the document when you find the proper one.

- Opt for one of the subscription plans and log in or create an account.

- Select how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the document in and click Download.

- Complete and sign the document on paper after printing it or do it all electronically.

That's the simplest and most cost-effective way to get up-to-date templates for any legal purposes. Locate them all in clicks and keep your documentation in order with the US Legal Forms!