Harris Texas Assignment of Profits of Business refers to the legal process through which a business owner transfers their ownership rights of a specific portion or all of their profits to another party. This transfer of profits can happen for various reasons and is a formal agreement that binds both parties involved. The Assignment of Profits of Business is an important document that clearly outlines the terms and conditions of the profit transfer. In Harris Texas, there are different types of Assignment of Profits of Business agreements that can be established: 1. General Assignment of Profits: This type of agreement transfers all the business owner's profits to another party. The assignee then becomes entitled to receive and manage all profits generated by the business. 2. Partial Assignment of Profits: In this scenario, only a certain portion or percentage of the business profits are assigned to another party. The assignee will receive a fixed share of the profits, while the business owner retains the remaining portion. 3. Limited Assignment of Profits: This type of assignment is usually temporary and limited to a specific period or project. It allows the business owner to transfer a defined portion of the business profits to another party for a particular purpose or duration. When drafting a Harris Texas Assignment of Profits of Business agreement, it is crucial to include several key elements to ensure clarity and protection for both parties involved. These elements may include: 1. Identification of Parties: Clearly state the names, addresses, and contact details of both the assigning party (business owner) and the assignee. 2. Profit Transfer: Clearly specify the percentage or amount of profits being assigned, whether it's total, partial, or limited. Additionally, outline the method of profit calculation and distribution. 3. Purpose and Duration: If the assignment is temporary or limited to a specific project, clearly define the purpose or project and mention the duration of the agreement. 4. Consideration: State any consideration, such as monetary compensation or other benefits, provided by the assignee to the business owner in exchange for the assignment of profits. 5. Rights and Obligations: Clearly outline the rights and obligations of both parties to avoid any confusion or disputes regarding profit management and any associated responsibilities. 6. Governing Law: Specify that the agreement is subject to the laws of Harris Texas, ensuring its validity and enforceability within the jurisdiction. It is important for both parties to consult legal professionals specializing in business law to understand their rights and obligations before entering into a Harris Texas Assignment of Profits of Business agreement. This will help ensure a clear understanding of all terms and conditions, protecting the interests of both the business owner and the assignee.

Harris Texas Assignment of Profits of Business

Description

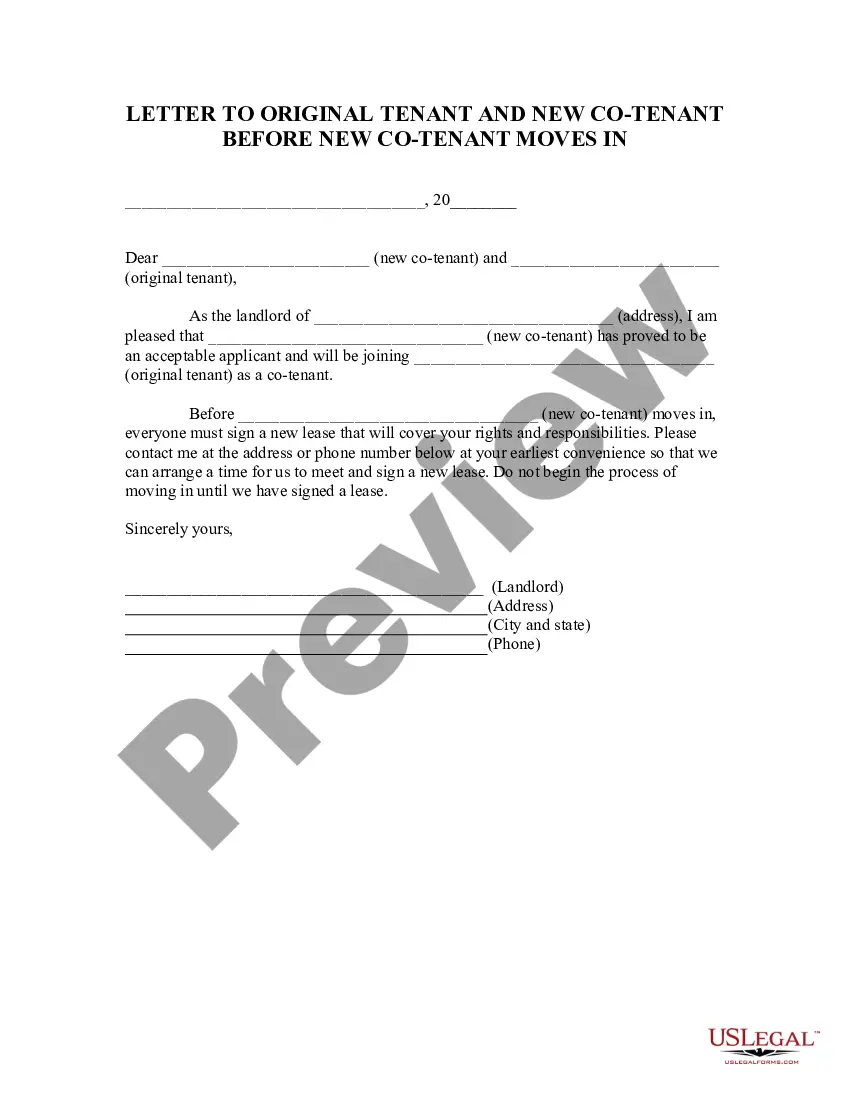

How to fill out Harris Texas Assignment Of Profits Of Business?

If you need to find a trustworthy legal document provider to find the Harris Assignment of Profits of Business, consider US Legal Forms. No matter if you need to start your LLC business or manage your asset distribution, we got you covered. You don't need to be knowledgeable about in law to find and download the needed form.

- You can select from over 85,000 forms categorized by state/county and case.

- The intuitive interface, number of supporting materials, and dedicated support team make it simple to locate and complete various documents.

- US Legal Forms is a trusted service offering legal forms to millions of customers since 1997.

Simply select to look for or browse Harris Assignment of Profits of Business, either by a keyword or by the state/county the form is intended for. After locating required form, you can log in and download it or save it in the My Forms tab.

Don't have an account? It's easy to start! Simply find the Harris Assignment of Profits of Business template and take a look at the form's preview and description (if available). If you're confident about the template’s terminology, go ahead and click Buy now. Create an account and select a subscription plan. The template will be instantly ready for download once the payment is processed. Now you can complete the form.

Taking care of your legal matters doesn’t have to be pricey or time-consuming. US Legal Forms is here to demonstrate it. Our extensive variety of legal forms makes this experience less costly and more affordable. Set up your first business, organize your advance care planning, create a real estate contract, or execute the Harris Assignment of Profits of Business - all from the convenience of your sofa.

Join US Legal Forms now!