Maricopa, Arizona is a city located in Pinal County, Arizona, United States. When exploring the topic of Assignment of Profits of Business in Maricopa, it refers to a legal process where the profits generated by a business are transferred or assigned to another party. This concept is essential in various business transactions, acquisitions, and partnerships. The Assignment of Profits of Business in Maricopa, Arizona involves a written agreement, outlining the terms and conditions under which the profits will be assigned. This agreement typically includes the names of the parties involved, the effective date, the duration of the assignment, and the specific percentage or amount of profits to be assigned. One type of Assignment of Profits of Business in Maricopa, Arizona, is the Assignment of Profits in a Partnership. In this scenario, partners may assign a portion of their profits to another partner or a third party. This helps manage the distribution of profits, allowing individuals or entities to benefit from the success of the partnership. Another type is the Assignment of Profits in Business Acquisitions. When a business is acquired, the new owner may require the assignment of profits from the existing business to ensure a smooth transition and maximize returns. This assignment is typically temporary until the new owner integrates the business into their operations. The Assignment of Profits of Business may also occur in the case of a Joint Venture. When two or more entities collaborate to undertake a specific project or venture, the assignment of profits determines how the revenue generated from the venture will be allocated among the participating parties. It is crucial to note that the Assignment of Profits of Business in Maricopa, Arizona, must comply with applicable state and federal laws. It is recommended to consult with legal professionals experienced in business law to ensure all legal requirements are met during the assignment process. In summary, the Assignment of Profits of Business in Maricopa, Arizona, is a legal process in which the profits generated by a business are transferred to another party. It may occur in different scenarios such as partnerships, business acquisitions, or joint ventures. Proper documentation and legal counsel are essential to execute this process accurately and in compliance with the law.

Maricopa Arizona Assignment of Profits of Business

Description

How to fill out Maricopa Arizona Assignment Of Profits Of Business?

Preparing paperwork for the business or personal needs is always a big responsibility. When creating an agreement, a public service request, or a power of attorney, it's crucial to consider all federal and state regulations of the particular region. Nevertheless, small counties and even cities also have legislative procedures that you need to consider. All these details make it tense and time-consuming to create Maricopa Assignment of Profits of Business without professional assistance.

It's possible to avoid spending money on attorneys drafting your paperwork and create a legally valid Maricopa Assignment of Profits of Business by yourself, using the US Legal Forms web library. It is the most extensive online catalog of state-specific legal templates that are professionally verified, so you can be sure of their validity when picking a sample for your county. Earlier subscribed users only need to log in to their accounts to download the needed form.

If you still don't have a subscription, follow the step-by-step guide below to obtain the Maricopa Assignment of Profits of Business:

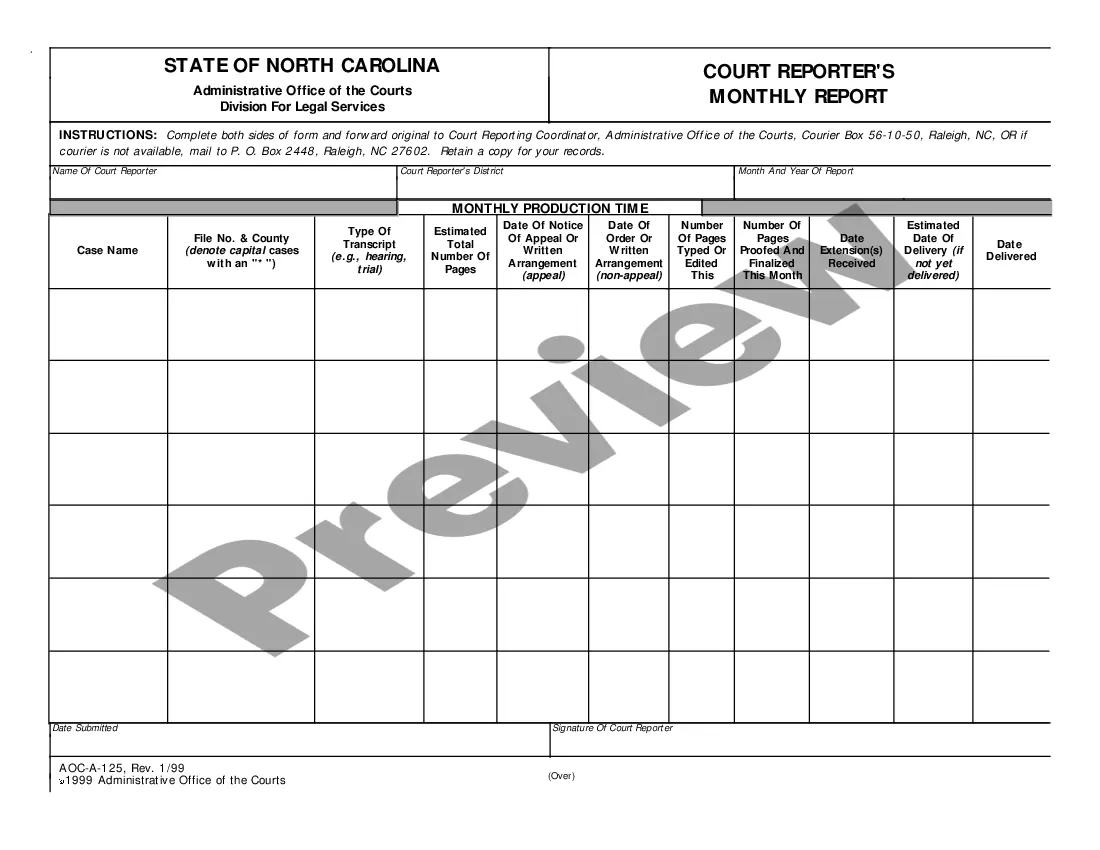

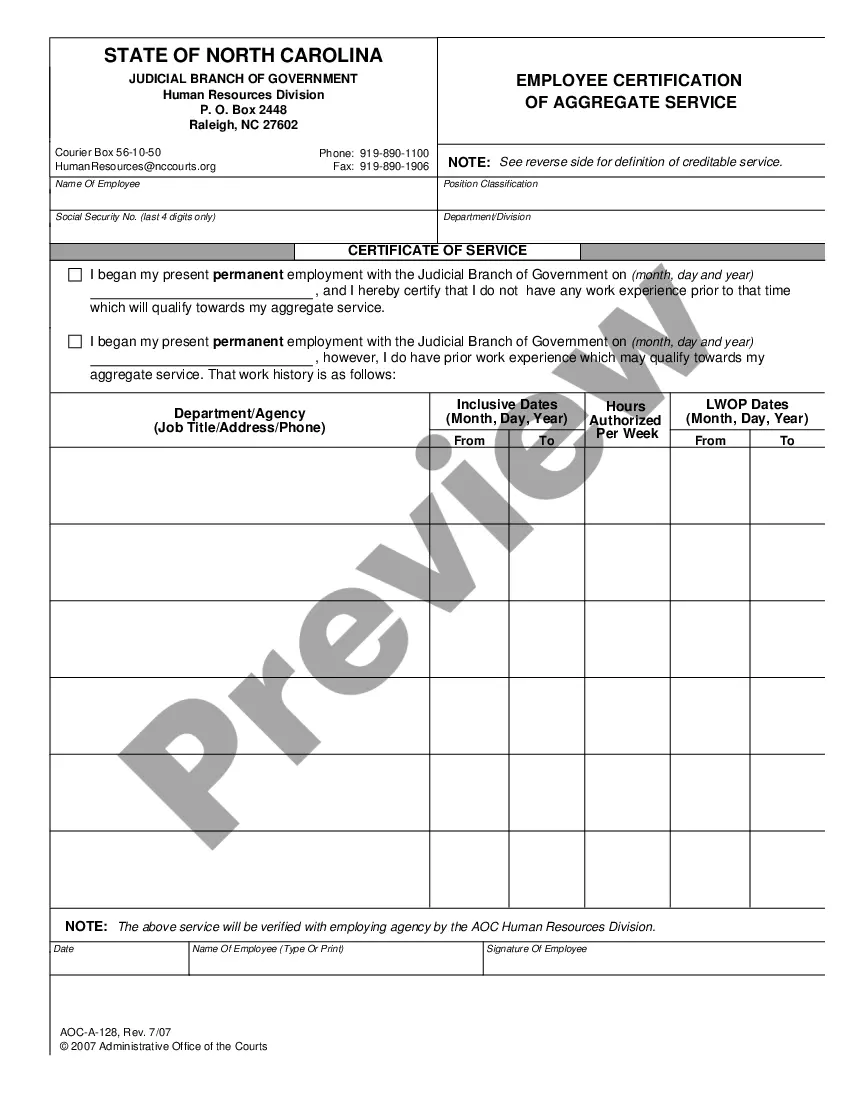

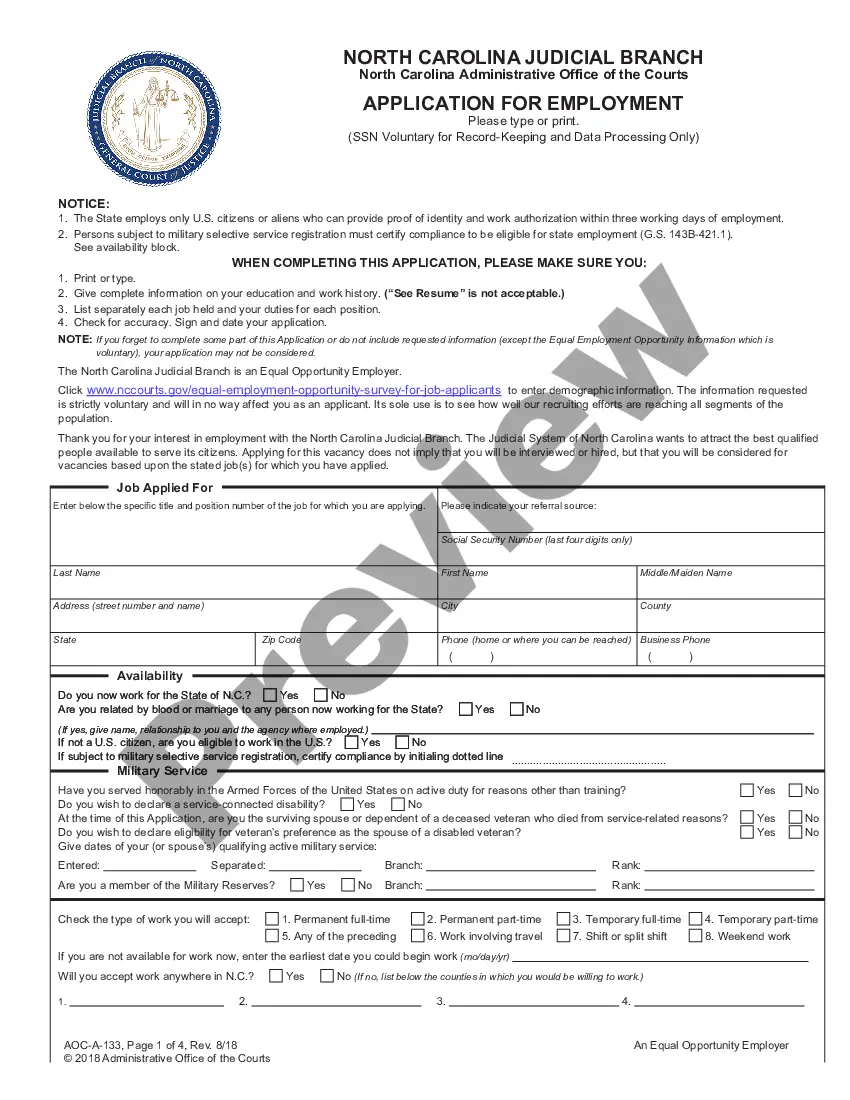

- Look through the page you've opened and check if it has the sample you require.

- To achieve this, use the form description and preview if these options are presented.

- To locate the one that suits your needs, utilize the search tab in the page header.

- Double-check that the template complies with juridical criteria and click Buy Now.

- Choose the subscription plan, then sign in or register for an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the chosen document in the preferred format, print it, or fill it out electronically.

The great thing about the US Legal Forms library is that all the paperwork you've ever purchased never gets lost - you can get it in your profile within the My Forms tab at any time. Join the platform and quickly obtain verified legal forms for any use case with just a few clicks!