Philadelphia, Pennsylvania is a bustling city known for its rich history, thriving business community, and diverse culture. When it comes to the Assignment of Profits of Business, Philadelphia provides several distinct types to cater to the varying needs of entrepreneurs and investors. One common type of Assignment of Profits of Business in Philadelphia is the Assignment of Profits and Rights Agreement. This agreement allows a business owner to transfer their right and interest in the profits generated by their business to another individual or entity. The designated party, known as the assignee, assumes ownership of these profits, typically in exchange for financial compensation. Additionally, Philadelphia offers the Assignee Partnership Interest Agreement, which pertains to businesses structured as partnerships. In this arrangement, a partner can assign their share of the partnership's profits to another party, granting them the right to receive their designated portion of profits. For those operating corporations in Philadelphia, the Assignment of Stock Agreement becomes crucial. This agreement facilitates the transfer of stock ownership, including the associated rights to dividends and profits, from one shareholder to another party. Another notable type is the Assignment of Business Assets Agreement, which involves the transfer of specific business assets that generate profits. This agreement allows an entrepreneur to assign their rights to these assets, ensuring that the assignee can benefit from the profits generated by those assets. Furthermore, Philadelphia acknowledges the Assignment of Royalty Rights Agreement, which is relevant for businesses operating in creative industries or those involved in licensing intellectual property. This agreement enables the transfer of royalty rights, giving another party the ability to earn income from the assigned royalties. In conclusion, Philadelphia, Pennsylvania, provides a comprehensive range of Assignment of Profits of Business types to accommodate various business structures and industries. Entrepreneurs and investors can choose a specific agreement that aligns with their needs, whether it is the Assignment of Profits and Rights Agreement, Assignee Partnership Interest Agreement, Assignment of Stock Agreement, Assignment of Business Assets Agreement, or Assignment of Royalty Rights Agreement.

Philadelphia Pennsylvania Assignment of Profits of Business

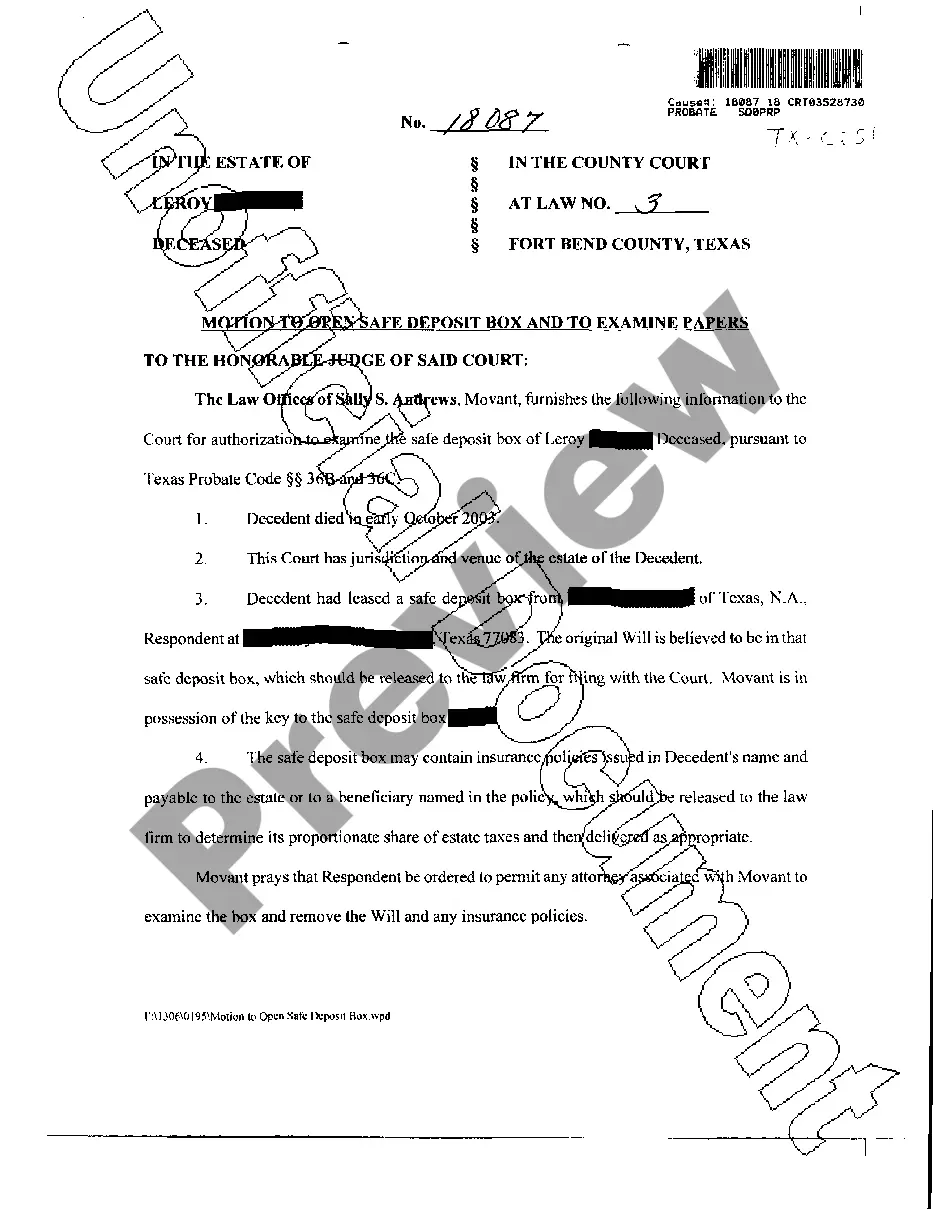

Description

How to fill out Philadelphia Pennsylvania Assignment Of Profits Of Business?

How much time does it normally take you to create a legal document? Since every state has its laws and regulations for every life sphere, finding a Philadelphia Assignment of Profits of Business meeting all local requirements can be tiring, and ordering it from a professional lawyer is often expensive. Numerous web services offer the most popular state-specific documents for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most comprehensive web catalog of templates, gathered by states and areas of use. Aside from the Philadelphia Assignment of Profits of Business, here you can find any specific form to run your business or individual deeds, complying with your county requirements. Specialists verify all samples for their actuality, so you can be certain to prepare your paperwork correctly.

Using the service is fairly easy. If you already have an account on the platform and your subscription is valid, you only need to log in, pick the required form, and download it. You can pick the document in your profile anytime in the future. Otherwise, if you are new to the website, there will be a few more actions to complete before you get your Philadelphia Assignment of Profits of Business:

- Check the content of the page you’re on.

- Read the description of the template or Preview it (if available).

- Search for another form using the corresponding option in the header.

- Click Buy Now once you’re certain in the selected document.

- Choose the subscription plan that suits you most.

- Register for an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Switch the file format if needed.

- Click Download to save the Philadelphia Assignment of Profits of Business.

- Print the sample or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the purchased template, you can find all the files you’ve ever saved in your profile by opening the My Forms tab. Give it a try!