Tarrant Texas Assignment of Money Due or to Become Due under Contract: A Comprehensive Overview Introduction: The Tarrant Texas Assignment of Money Due or to Become Due under Contract is a legal mechanism that allows parties involved in a contract to transfer their rights to receive payment to another entity before the payment is due. This assignment provides flexibility and can be utilized in various contractual agreements such as real estate transactions, loans, or even services rendered. Understanding the Assignment of Money Due or to Become Due under Contract: The Assignment of Money Due or to Become Due under Contract involves the transfer of a creditor's rights to a third party, known as the assignee. By assigning the rights to receive payment, the assignee steps into the shoes of the original creditor and gains the legal entitlement to collect the money owed. Types of Tarrant Texas Assignment of Money Due or to Become Due under Contract: 1. Real Estate Assignment: In real estate deals, parties can assign the rights to receive payment from rental agreements, lease agreements, or even pending transactions. For example, a property owner may assign their rights to receive future rent payments to another entity in return for an immediate lump-sum payment. This form of assignment is a common practice in the real estate industry. 2. Business Assignment: In the business context, the Assignment of Money Due or to Become Due under Contract can be used to assign outstanding invoices or accounts receivable. Small businesses often utilize this type of assignment to improve cash flow by transferring their rights to receive payment to financial institutions or factoring companies. 3. Financial Assignment: Financial transactions such as loans or mortgages can also involve an assignment of money due or to become due under contract. In such cases, borrowers might assign their rights to repay the loan or mortgage to other parties, potentially due to restructuring or refinancing needs. 4. Service Assignment: Contracts for services rendered can also be subject to assignment. For instance, a service provider who expects to receive a series of payments from a client can assign those rights to another entity to obtain immediate compensation. This type of assignment is valuable when companies need immediate funds or want to transfer the risk associated with collecting payments in the future. Conclusion: The Tarrant Texas Assignment of Money Due or to Become Due under Contract allows individuals and companies to transfer their rights to future payments to other entities. This legal mechanism facilitates financial flexibility, improves cash flow, and manages risk. Whether it is in the real estate, business, financial, or service sectors, the assignment of money due or to become due under contract plays a crucial role in facilitating smooth transactions and meeting immediate financial needs.

Tarrant Texas Assignment of Money Due or to Become Due under Contract

Description

How to fill out Tarrant Texas Assignment Of Money Due Or To Become Due Under Contract?

Whether you plan to start your company, enter into a contract, apply for your ID renewal, or resolve family-related legal issues, you must prepare specific paperwork corresponding to your local laws and regulations. Locating the right papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 expertly drafted and verified legal templates for any personal or business occurrence. All files are grouped by state and area of use, so picking a copy like Tarrant Assignment of Money Due or to Become Due under Contract is quick and straightforward.

The US Legal Forms website users only need to log in to their account and click the Download button next to the required form. If you are new to the service, it will take you several more steps to obtain the Tarrant Assignment of Money Due or to Become Due under Contract. Follow the instructions below:

- Make sure the sample meets your individual needs and state law regulations.

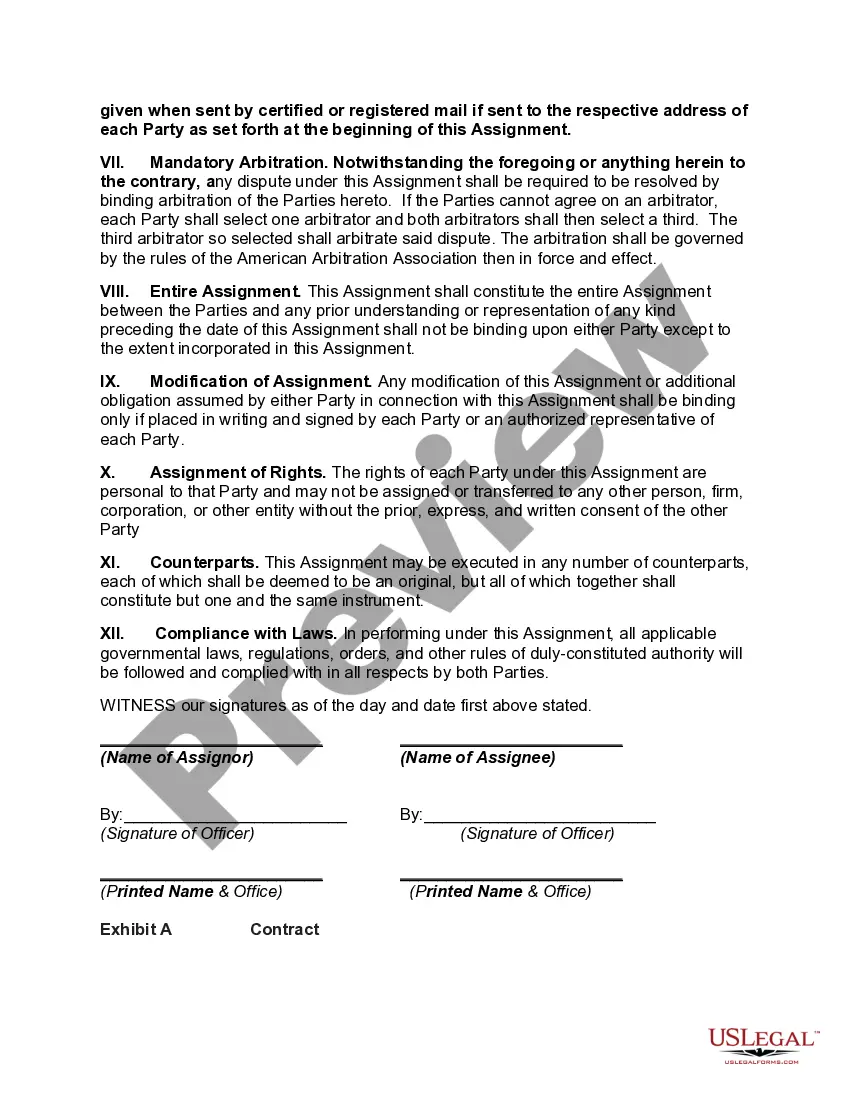

- Read the form description and check the Preview if available on the page.

- Utilize the search tab specifying your state above to locate another template.

- Click Buy Now to get the sample when you find the proper one.

- Opt for the subscription plan that suits you most to proceed.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the Tarrant Assignment of Money Due or to Become Due under Contract in the file format you prefer.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Forms provided by our website are multi-usable. Having an active subscription, you can access all of your previously acquired paperwork at any time in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date official documents. Sign up for the US Legal Forms platform and keep your paperwork in order with the most extensive online form library!