Chicago Illinois Marital-deduction Residuary Trust with a Single Trust or and Lifetime Income and Power of Appointment in Beneficiary Spouse is a specific type of trust arrangement designed to provide financial security and flexibility for married couples in Chicago, Illinois. This trust allows the trust or (the person creating the trust) to transfer their assets to a trust, with their spouse as the primary beneficiary. One of the key features of this trust is the marital deduction, which enables the trust or to transfer assets to their spouse without incurring any federal estate tax. This deduction is granted under the Internal Revenue Code, and it allows for unlimited transfers between spouses during life or after death. The trust is structured as a residuary trust, meaning that it includes all assets not specifically distributed or assigned to other beneficiaries or trusts. This ensures that all remaining assets, after specific bequests are made, are transferred to the trust and managed according to the provisions outlined in the trust's terms. The trust or can also provide their spouse with a lifetime income from the trust's assets. This income can be in the form of regular payments or distributions, which can be a fixed amount or based on a percentage of the trust's value. The lifetime income provision provides the spouse with financial security and helps maintain their standard of living. Additionally, the spouse is given the power of appointment in the trust. This means that they have the authority to designate or appoint the beneficiaries who will receive the trust's assets after their death. The spouse has the flexibility to choose their children, grandchildren, or other individuals as beneficiaries, allowing for tailored distribution of the trust's assets based on their own unique circumstances. Different types of Chicago Illinois Marital-deduction Residuary Trust with a Single Trust or and Lifetime Income and Power of Appointment in Beneficiary Spouse may include variations in the specific terms and conditions outlined by the trust or. These variations can include different provisions regarding the frequency and amount of lifetime income payments, the specific assets included in the trust, and the power of appointment provisions. Overall, this trust arrangement offers married couples in Chicago, Illinois, a comprehensive estate planning strategy that combines tax advantages, asset protection, and flexibility in providing for the surviving spouse and future beneficiaries. By utilizing the marital deduction, residuary trust structure, and lifetime income and power of appointment provisions, individuals can ensure their assets are efficiently managed and protected, while providing financial stability for their loved ones.

Chicago Illinois Marital-deduction Residuary Trust with a Single Trustor and Lifetime Income and Power of Appointment in Beneficiary Spouse

Description

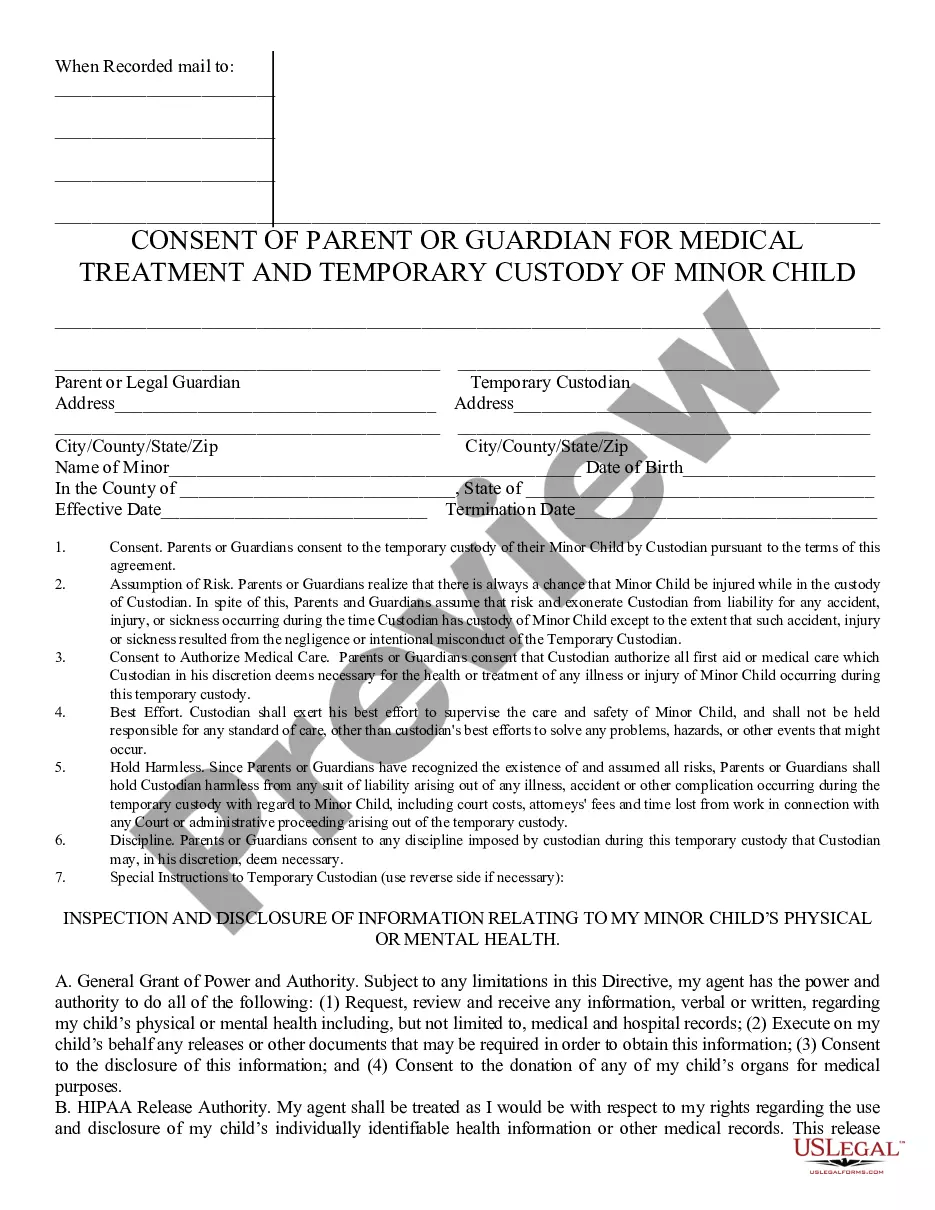

How to fill out Marital-deduction Residuary Trust With A Single Trustor And Lifetime Income And Power Of Appointment In Beneficiary Spouse?

Creating legal documents, such as the Chicago Marital-deduction Residuary Trust with a Single Trustor and Lifetime Income and Power of Appointment in Beneficiary Spouse, to handle your legal matters can be a challenging and time-intensive task.

Numerous scenarios necessitate an attorney’s assistance, which also renders this undertaking quite expensive.

However, you can take control of your legal issues and manage them independently.

The onboarding process for new users is just as simple! Here’s what you should do before obtaining the Chicago Marital-deduction Residuary Trust with a Single Trustor and Lifetime Income and Power of Appointment in Beneficiary Spouse: Ensure your form meets your state’s regulations as the criteria for drafting legal documents can differ from state to state. Explore additional information about the form by previewing it or reviewing a brief description. If the Chicago Marital-deduction Residuary Trust with a Single Trustor and Lifetime Income and Power of Appointment in Beneficiary Spouse isn’t what you need, utilize the header to find another option. Log In or create an account to begin using our website and download the form. Everything appear satisfactory on your side? Click on the Buy now button and choose the subscription plan. Select the payment method and input your payment information. Your form is ready. You can proceed to download it. It’s simple to find and purchase the required template with US Legal Forms. Countless businesses and individuals are already gaining from our extensive collection. Subscribe now if you want to discover more benefits available with US Legal Forms!

- US Legal Forms is here to assist.

- Our platform offers over 85,000 legal templates tailored for various situations and life events.

- We guarantee that every document adheres to the legal requirements of each state, so you won’t have to fret about possible compliance issues.

- If you are already acquainted with our services and possess a subscription with us, you're aware of how effortless it is to obtain the Chicago Marital-deduction Residuary Trust with a Single Trustor and Lifetime Income and Power of Appointment in Beneficiary Spouse form.

- Just Log In to your account, download the template, and customize it to fit your needs.

- Lost your document? No problem. You can retrieve it from the My documents tab in your account - accessible on both desktop and mobile.

Form popularity

FAQ

A trust qualifies for the marital deduction when it meets specific legal requirements set by the IRS. Primarily, a Chicago Illinois Marital-deduction Residuary Trust with a Single Trustor and Lifetime Income and Power of Appointment in Beneficiary Spouse must ensure that the surviving spouse has the right to access the income generated by the trust during their lifetime. Furthermore, the trust should allow the surviving spouse to exert control over trust assets, which can enhance their financial security. By understanding these criteria, you can effectively utilize this trust structure to maximize the benefits it offers.

In Illinois, beneficiaries usually have the right to request information about the trust, including its terms and distributions. However, the details can depend on the specific provisions set within a Chicago Illinois Marital-deduction Residuary Trust with a Single Trustor and Lifetime Income and Power of Appointment in Beneficiary Spouse. Transparency between the trustee and beneficiaries is encouraged to foster trust and understanding among all parties involved.

A spousal lifetime access trust is generally considered a revocable trust, allowing the trustor to retain control over the assets and receive income during their lifetime. For a Chicago Illinois Marital-deduction Residuary Trust with a Single Trustor and Lifetime Income and Power of Appointment in Beneficiary Spouse, income generated may be taxable to the trustor. Upon the trustor's passing, the assets may receive a step-up in basis, benefiting the surviving spouse.

structured trust typically holds up in court if it was created according to applicable laws and protocols. When challenged, the terms of a Chicago Illinois Maritaldeduction Residuary Trust with a Single Trustor and Lifetime Income and Power of Appointment in Beneficiary Spouse can be defended based on its clear provisions, intent of the trustor, and compliance with statutory requirements. Ensuring that the trust is created and managed correctly is crucial for its validity.

Generally, a trust does not need to be filed with the court in Illinois unless it is involved in a probate case. A Chicago Illinois Marital-deduction Residuary Trust with a Single Trustor and Lifetime Income and Power of Appointment in Beneficiary Spouse operates privately outside of court unless there is a dispute or issue that necessitates judicial oversight. This privacy can be beneficial for maintaining your financial matters confidential.

Yes, a properly structured trust can qualify for the marital deduction under federal tax law. A Chicago Illinois Marital-deduction Residuary Trust with a Single Trustor and Lifetime Income and Power of Appointment in Beneficiary Spouse allows the surviving spouse to receive benefits without incurring estate tax during the grantor's lifetime. This feature offers significant tax advantages, ensuring that the surviving spouse can access income while preserving the principal for future generations.

In Illinois, trusts are not required to be recorded in a public registry. However, the terms of a Chicago Illinois Marital-deduction Residuary Trust with a Single Trustor and Lifetime Income and Power of Appointment in Beneficiary Spouse may require certain documents to be filed with the court if the trust becomes a part of a probate case. It is advisable to maintain accurate records for private trust documents for your reference and that of your beneficiaries.

To make a trust enforceable, it must meet specific legal requirements set forth by Illinois law. A properly drafted Chicago Illinois Marital-deduction Residuary Trust with a Single Trustor and Lifetime Income and Power of Appointment in Beneficiary Spouse typically includes clear terms regarding the trustor's intent, named beneficiaries, and the distribution of assets. Additionally, the trust should be funded appropriately, and all necessary documentation must be executed in accordance with state regulations.

Assets that are not eligible for the marital deduction typically include lifetime interests that do not provide full ownership rights or assets bequeathed to third parties. Common examples include property left in trust for minor children. Understanding these nuances helps in structuring a Chicago Illinois Marital-deduction Residuary Trust with a Single Trustor effectively, ensuring that your estate plan maximizes potential benefits.

Property that does not qualify for the marital deduction includes property passing to someone other than a spouse or property with terms that create a terminable interest. Additionally, certain joint tenancies and life insurance policies may not qualify. It’s important to consult with an expert to ensure your Chicago Illinois Marital-deduction Residuary Trust with a Single Trustor excludes ineligible properties.