The Salt Lake Utah Marital-deduction Residuary Trust with a Single Trust or and Lifetime Income and Power of Appointment in Beneficiary Spouse is a type of trust that allows a single individual residing in Salt Lake City, Utah, to protect and manage their assets while benefiting their surviving spouse during their lifetime. This trust is commonly used for estate planning purposes, ensuring that the surviving spouse is provided for financially after the trust or's death. As the name suggests, the primary feature of this trust is the "marital deduction." This means that upon the trust or's death, the assets transferred into the trust are eligible for a marital deduction, which allows for the entire value of the trust to pass to the surviving spouse free of federal estate tax. This deduction helps protect the estate from unnecessary taxation, ensuring that the surviving spouse receives the maximum benefit from the trust. The trust also incorporates a "residuary" provision, which means that any remaining assets after the surviving spouse's lifetime will be distributed according to the trust or's stated wishes. This provision allows the trust or to dictate how the remaining assets will be distributed among beneficiaries, such as children or other family members. Another crucial feature of this trust is the provision for lifetime income to the surviving spouse. This ensures that the beneficiary spouse will receive regular income from the trust assets, providing financial stability and support throughout their lifetime. This is particularly helpful if the surviving spouse does not have sufficient income or financial resources of their own. Additionally, the beneficiary spouse is granted a "power of appointment" over the trust assets. This power allows the surviving spouse to designate who will receive the remaining trust assets upon their death. This provision provides flexibility and allows the beneficiary spouse to adjust the distribution of assets based on their changing circumstances and needs. Overall, the Salt Lake Utah Marital-deduction Residuary Trust with a Single Trust or and Lifetime Income and Power of Appointment in Beneficiary Spouse is a comprehensive estate planning tool that offers tax benefits, financial protection, and flexibility for individuals residing in Salt Lake City, Utah.

Salt Lake Utah Marital-deduction Residuary Trust with a Single Trustor and Lifetime Income and Power of Appointment in Beneficiary Spouse

Description

How to fill out Salt Lake Utah Marital-deduction Residuary Trust With A Single Trustor And Lifetime Income And Power Of Appointment In Beneficiary Spouse?

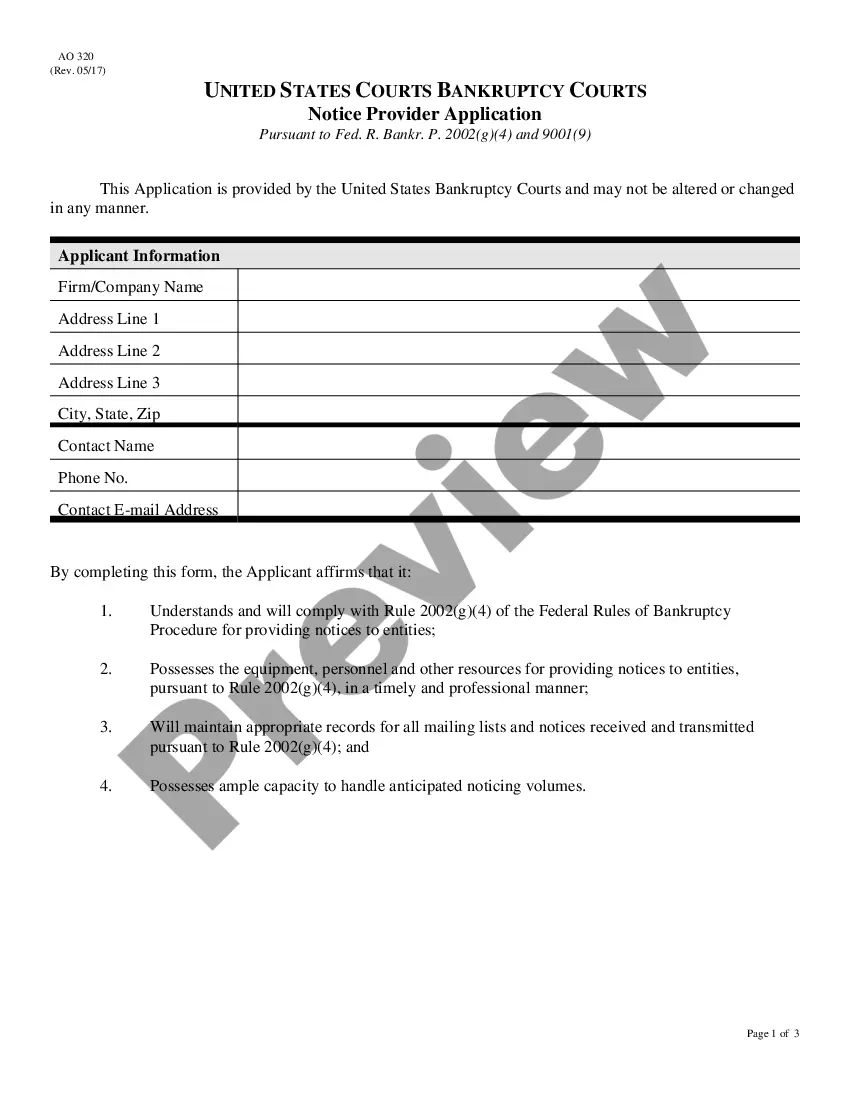

How much time does it typically take you to create a legal document? Since every state has its laws and regulations for every life scenario, finding a Salt Lake Marital-deduction Residuary Trust with a Single Trustor and Lifetime Income and Power of Appointment in Beneficiary Spouse suiting all regional requirements can be stressful, and ordering it from a professional lawyer is often expensive. Numerous web services offer the most popular state-specific documents for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most extensive web catalog of templates, collected by states and areas of use. In addition to the Salt Lake Marital-deduction Residuary Trust with a Single Trustor and Lifetime Income and Power of Appointment in Beneficiary Spouse, here you can get any specific form to run your business or individual affairs, complying with your regional requirements. Professionals check all samples for their actuality, so you can be sure to prepare your paperwork correctly.

Using the service is remarkably straightforward. If you already have an account on the platform and your subscription is valid, you only need to log in, select the required form, and download it. You can get the file in your profile anytime later on. Otherwise, if you are new to the platform, there will be a few more steps to complete before you obtain your Salt Lake Marital-deduction Residuary Trust with a Single Trustor and Lifetime Income and Power of Appointment in Beneficiary Spouse:

- Examine the content of the page you’re on.

- Read the description of the template or Preview it (if available).

- Look for another form utilizing the related option in the header.

- Click Buy Now when you’re certain in the selected file.

- Select the subscription plan that suits you most.

- Create an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Switch the file format if necessary.

- Click Download to save the Salt Lake Marital-deduction Residuary Trust with a Single Trustor and Lifetime Income and Power of Appointment in Beneficiary Spouse.

- Print the doc or use any preferred online editor to complete it electronically.

No matter how many times you need to use the purchased document, you can locate all the files you’ve ever downloaded in your profile by opening the My Forms tab. Try it out!

Form popularity

FAQ

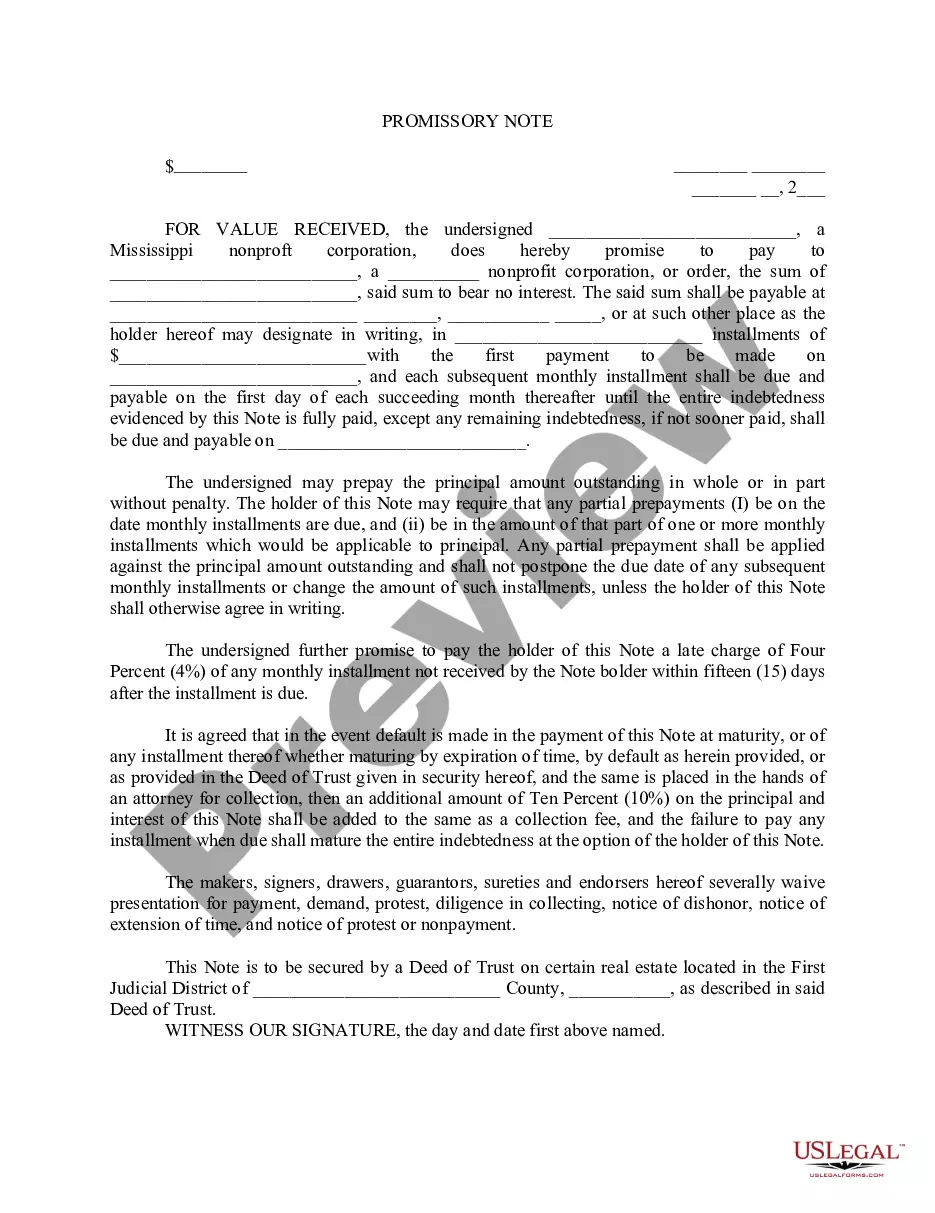

This technique is novel because normally, gifts between spouses qualify for the federal estate and gift tax marital deduction and must be included in the spouse's estate at death. Gifts made to an Irrevocable Spousal Trust are not taxed in the survivor's estate.

A marital deduction trust can take one of two forms, either a life estate coupled with a general power of appointment given to the spouse or a Qualified Terminable Interest Property (QTIP) trust.

Generally speaking, a marital trust is a specific allocation to the surviving spouse without too many strings attached. The family trust is more intended for the living children of the spouse who died first. Usually, the family trust is the money used as a last resort.

A SLAT allows the donor spouse to transfer up to the donor spouse's available exemption amount without a gift tax. When the donor spouse dies, the value of the assets in the SLAT is excluded from the donor spouse's gross estate and are not subjected to the federal estate tax.

Two common trusts qualify for the marital deduction: power of appointment trusts and qualified terminable interest property (QTIP) trusts. An important difference between the two types of trusts concerns the surviving spouse's ability to appoint the stock to someone else during life or at death.

For a transfer to qualify for the estate tax unlimited marital deduction, the property interest must meet three requirements. First, the property must be included in the decedent's gross estate. Second, the property must be transferred to the surviving spouse. Third, the interest must not be a terminable interest.

Property interests passing to a surviving spouse that are not included in the decedent's gross estate do not qualify for the marital deduction. Expenses, indebtedness, taxes, and losses chargeable against property passing to the surviving spouse will reduce the marital deduction.

A marital trust is a type of irrevocable trust that allows one spouse to transfer assets to a surviving spouse tax free, using the unlimited marital deduction, while providing benefits not available if transferred outright.

The marital deduction applies to property that is left outright to a spouse, in a Trust in which the spouse has the right to withdraw any or all of the property during his or her lifetime, or in a Trust for the spouse's life under a QTIP (Qualified Terminable Interest Property) Trust.