San Diego California Marital-deduction Residuary Trust with a Single Trust or and Lifetime Income and Power of Appointment in Beneficiary Spouse is a type of trust established in San Diego, California that allows a single trust or to create a trust, providing a secure financial future for their spouse. This type of trust is designed to ensure that the surviving spouse receives income and has control over the assets during their lifetime, with the ability to appoint these assets to other beneficiaries upon their death. The San Diego California Marital-deduction Residuary Trust with a Single Trust or and Lifetime Income and Power of Appointment in Beneficiary Spouse provides several benefits. First and foremost, it offers peace of mind to the trust or by ensuring their surviving spouse is provided for financially after their passing. Additionally, it allows the trust or to retain control over the assets during their lifetime while also providing a significant level of protection for their estate. There are two main types of San Diego California Marital-deduction Residuary Trust with a Single Trust or and Lifetime Income and Power of Appointment in Beneficiary Spouse: 1. Irrevocable Marital-deduction Residuary Trust: This type of trust is established with the understanding that it cannot be modified or revoked once it is created. The trust or transfers assets into the trust, providing income for the surviving spouse and allowing them to use the assets as necessary. However, the power of appointment gives the surviving spouse the ability to distribute the remaining assets to other beneficiaries upon their death. 2. Revocable Marital-deduction Residuary Trust: Unlike the irrevocable trust, this type of trust can be modified or even revoked by the trust or during their lifetime. It provides the same income and power of appointment benefits to the surviving spouse, but with the added flexibility for the trust or to make changes as circumstances evolve. It's important to note that the San Diego California Marital-deduction Residuary Trust with a Single Trust or and Lifetime Income and Power of Appointment in Beneficiary Spouse must comply with federal and state laws, including California probate and trust laws. This trust structure is widely used in San Diego and provides an effective solution for individuals seeking to preserve and protect their wealth for their spouse's lifetime while maintaining control and flexibility over their assets.

San Diego California Marital-deduction Residuary Trust with a Single Trustor and Lifetime Income and Power of Appointment in Beneficiary Spouse

Description

How to fill out San Diego California Marital-deduction Residuary Trust With A Single Trustor And Lifetime Income And Power Of Appointment In Beneficiary Spouse?

Laws and regulations in every area differ throughout the country. If you're not an attorney, it's easy to get lost in various norms when it comes to drafting legal paperwork. To avoid high priced legal assistance when preparing the San Diego Marital-deduction Residuary Trust with a Single Trustor and Lifetime Income and Power of Appointment in Beneficiary Spouse, you need a verified template valid for your county. That's when using the US Legal Forms platform is so beneficial.

US Legal Forms is a trusted by millions web library of more than 85,000 state-specific legal templates. It's a great solution for professionals and individuals searching for do-it-yourself templates for different life and business occasions. All the documents can be used multiple times: once you purchase a sample, it remains available in your profile for subsequent use. Thus, when you have an account with a valid subscription, you can simply log in and re-download the San Diego Marital-deduction Residuary Trust with a Single Trustor and Lifetime Income and Power of Appointment in Beneficiary Spouse from the My Forms tab.

For new users, it's necessary to make some more steps to obtain the San Diego Marital-deduction Residuary Trust with a Single Trustor and Lifetime Income and Power of Appointment in Beneficiary Spouse:

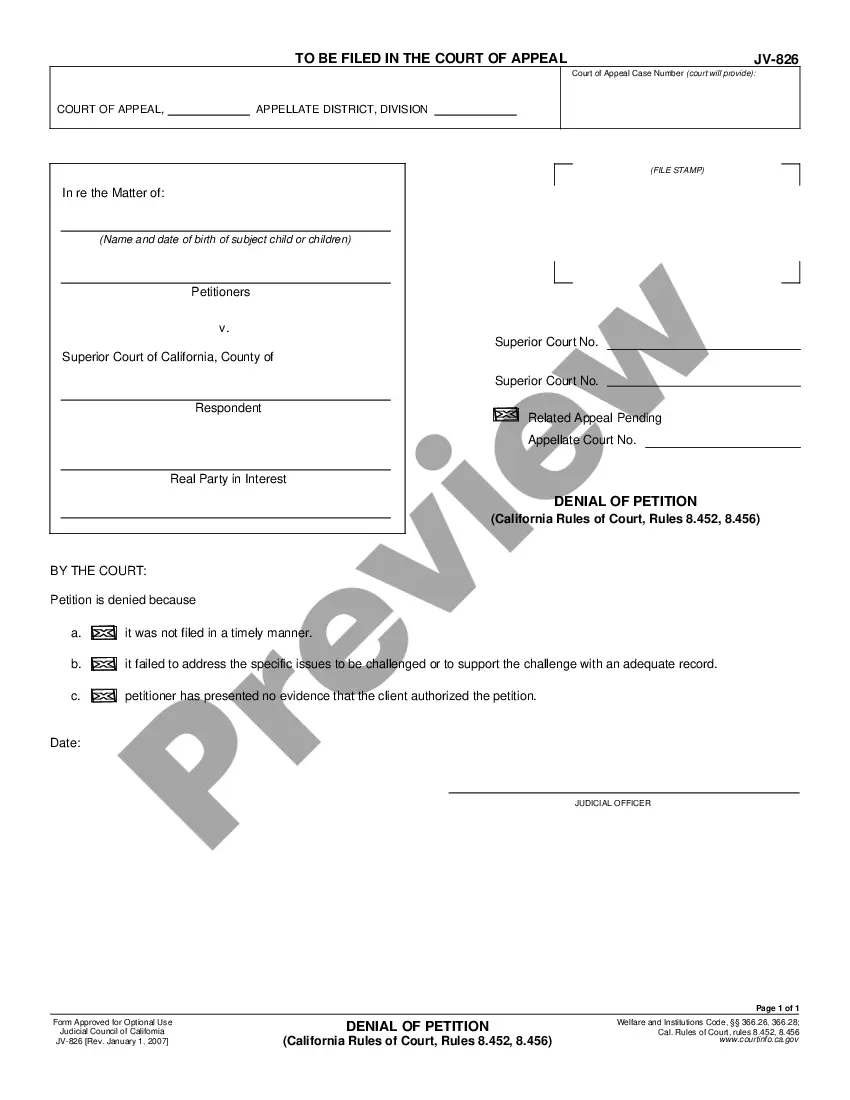

- Take a look at the page content to ensure you found the appropriate sample.

- Use the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your requirements.

- Click on the Buy Now button to get the document when you find the proper one.

- Opt for one of the subscription plans and log in or sign up for an account.

- Choose how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the file in and click Download.

- Fill out and sign the document on paper after printing it or do it all electronically.

That's the easiest and most affordable way to get up-to-date templates for any legal scenarios. Locate them all in clicks and keep your documentation in order with the US Legal Forms!