Title: Exploring Alameda California Resolution of Directors to Dissolve Corporation with Submission of Proposition to Stockholders Keywords: Alameda California, Resolution of Directors, Dissolve Corporation, Submission of Proposition, Stockholders Introduction: In Alameda, California, the process of dissolving a corporation may occur through a Resolution of Directors, followed by the submission of a proposition to stockholders. This article aims to provide a detailed understanding of Alameda California's Resolution of Directors to Dissolve Corporation with Submission of Proposition to Stockholders, highlighting the different types involved within this dissolution process. 1. Resolution of Directors Explained: A Resolution of Directors refers to an official decision made by a corporation's board members to dissolve the corporation. This resolution serves as a crucial initial step in the dissolution process, indicating the intent to dissolve a corporation. 2. Dissolve Corporation: Dissolving a corporation means winding down its operations and existence. Corporations are typically dissolved for various reasons, such as bankruptcy, merger or acquisition, change in business direction, or the completion of a specific project. Dissolution involves settling outstanding debts, distributing assets, and ceasing business operations. 3. Submission of Proposition to Stockholders: After the Resolution of Directors, a proposition or special resolution must be submitted to stockholders for their approval. This proposition outlines specific details regarding the dissolution process, distribution of assets, liabilities settlement, and any other pertinent matters. It requires stockholder consent to proceed with the dissolution. Different Types of Alameda California Resolution of Directors to Dissolve Corporation with Submission of Proposition to Stockholders: A. Voluntary Dissolution: Voluntary dissolution occurs when a corporation's board and stockholders voluntarily decide to dissolve the corporation. The decision may arise due to various reasons, such as declining profitability, changes in industry dynamics, or strategic realignment. In such cases, the board passes a resolution, followed by the submission of a proposition to stockholders for approval. B. Involuntary Dissolution: Involuntary dissolution occurs when external forces or legal actions compel the dissolution of a corporation. These circumstances may include serious breaches of corporate law, failure to fulfill reporting obligations, or court orders due to non-compliance. In such cases, the resolution and proposition are typically initiated by legal entities, such as courts or regulatory bodies. C. Dissolution for Mergers and Acquisitions: Corporations may also undergo dissolution as part of a merger or acquisition process. When two corporations merge or one acquires another, it may lead to the dissolution of the target company. In such cases, the resolution and proposition are essential for stockholder approval to proceed with the dissolution and subsequent integration. Conclusion: Alameda California Resolution of Directors to Dissolve Corporation with Submission of Proposition to Stockholders involves the critical steps required when dissolving a corporation. By passing the resolution and obtaining stockholder approval through a proposition, corporations in Alameda, California, can formally wind down their operations, distribute assets, and settle liabilities. Whether voluntary, involuntary, or for mergers and acquisitions, each type of dissolution underlines the importance of following the necessary legal procedures and ensuring transparency for all stakeholders involved.

Alameda California Resolution of Directors to Dissolve Corporation with Submission of Proposition to Stockholders

Description

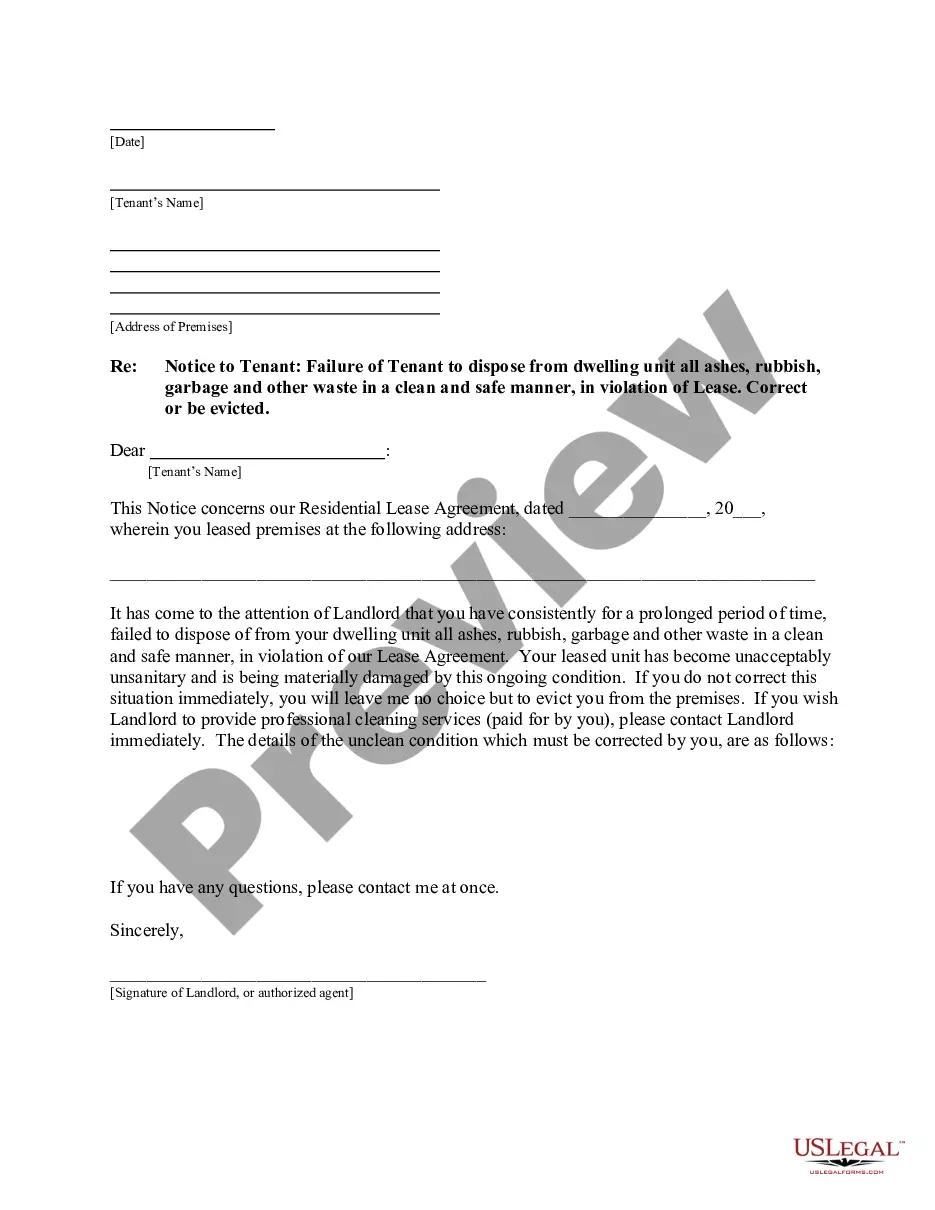

How to fill out Alameda California Resolution Of Directors To Dissolve Corporation With Submission Of Proposition To Stockholders?

Are you looking to quickly draft a legally-binding Alameda Resolution of Directors to Dissolve Corporation with Submission of Proposition to Stockholders or probably any other form to take control of your personal or business matters? You can go with two options: contact a professional to write a legal paper for you or draft it entirely on your own. Luckily, there's another solution - US Legal Forms. It will help you get neatly written legal documents without having to pay unreasonable prices for legal services.

US Legal Forms provides a huge collection of over 85,000 state-specific form templates, including Alameda Resolution of Directors to Dissolve Corporation with Submission of Proposition to Stockholders and form packages. We provide templates for an array of life circumstances: from divorce paperwork to real estate documents. We've been on the market for more than 25 years and got a rock-solid reputation among our customers. Here's how you can become one of them and obtain the necessary template without extra hassles.

- First and foremost, carefully verify if the Alameda Resolution of Directors to Dissolve Corporation with Submission of Proposition to Stockholders is tailored to your state's or county's laws.

- In case the document has a desciption, make sure to check what it's intended for.

- Start the searching process again if the template isn’t what you were seeking by using the search box in the header.

- Choose the plan that best fits your needs and move forward to the payment.

- Select the format you would like to get your document in and download it.

- Print it out, complete it, and sign on the dotted line.

If you've already set up an account, you can easily log in to it, find the Alameda Resolution of Directors to Dissolve Corporation with Submission of Proposition to Stockholders template, and download it. To re-download the form, simply head to the My Forms tab.

It's stressless to buy and download legal forms if you use our services. In addition, the documents we provide are reviewed by industry experts, which gives you greater confidence when dealing with legal affairs. Try US Legal Forms now and see for yourself!

Form popularity

FAQ

Any corporation may be dissolved with the unanimous written consent of the shareholders; this is a voluntary dissolutionDissolution of a corporation by unanimous written consent of its shareholders.. This provision is obviously applicable primarily to closely held corporations.

The first step in dissolving a corporation usually involves having your board of directors and shareholders vote to approve the dissolution. Under most state rules, you start by holding a meeting of the board of directors to vote on a resolution to approve the dissolution of the corporation.

How to end your business Step 1: Approval of the owners of the corporation or LLC.Step 2: Filing the Certificate of Dissolution with the state.Step 3: Filing federal, state, and local tax forms.Step 4: Wind up affairs.Step 5: Notifying creditors your business is ending.Step 6: Settling creditors' claims.

6 Steps to Dissolve a Corporation #1 Seek Approval from the Board of Directors and Shareholders. First, hold a meeting with the board of directors.#2 File Articles of Dissolution.#3 Finalize Taxes.#4 Notify Creditors.#5 Liquidate and Distribute Assets.#6 Wrap Up Operations.

When a corporation is dissolved, it no longer legally exists and, in most cases, its debts disappear as well. State laws usually give additional time beyond the dissolution for creditors to file suits for failure to pay any corporate debts or for the wrongful distribution of corporate assets.

The major steps in formation of a company are as follows: Promotion stage. Registration stage. Incorporation stage.

How to File Corporate Dissolution in California Board Meeting, Motion, and Vote.File a Certificate of Dissolution With the California Secretary of State.Advise Federal and State Tax Agencies of the Corporation Dissolution.Close Accounts, Credit Lines, and Licenses.

How to Form a Corporation in 11 Steps Choose a Business Name. Register a DBA. Appoint Directors. File Your Articles of Incorporation. Write Your Corporate Bylaws. Draft a Shareholder Agreement. Hold Initial Board of Directors Meeting. Issue Stock.

A shareholder resolution to dissolve corporation agreement is an authorization used when shareholders, during a formal meeting, agree to dissolve the corporation.

After a company is dissolved, it must liquidate its assets. Liquidation refers to the process of sale or auction of the company's non-cash assets. Note that only those assets your company owns can be liquidated. Thus, you can't liquidate assets that are used as collateral for loans.