Harris Texas Resolution of Directors to Dissolve Corporation with Submission of Proposition to Stockholders

Description

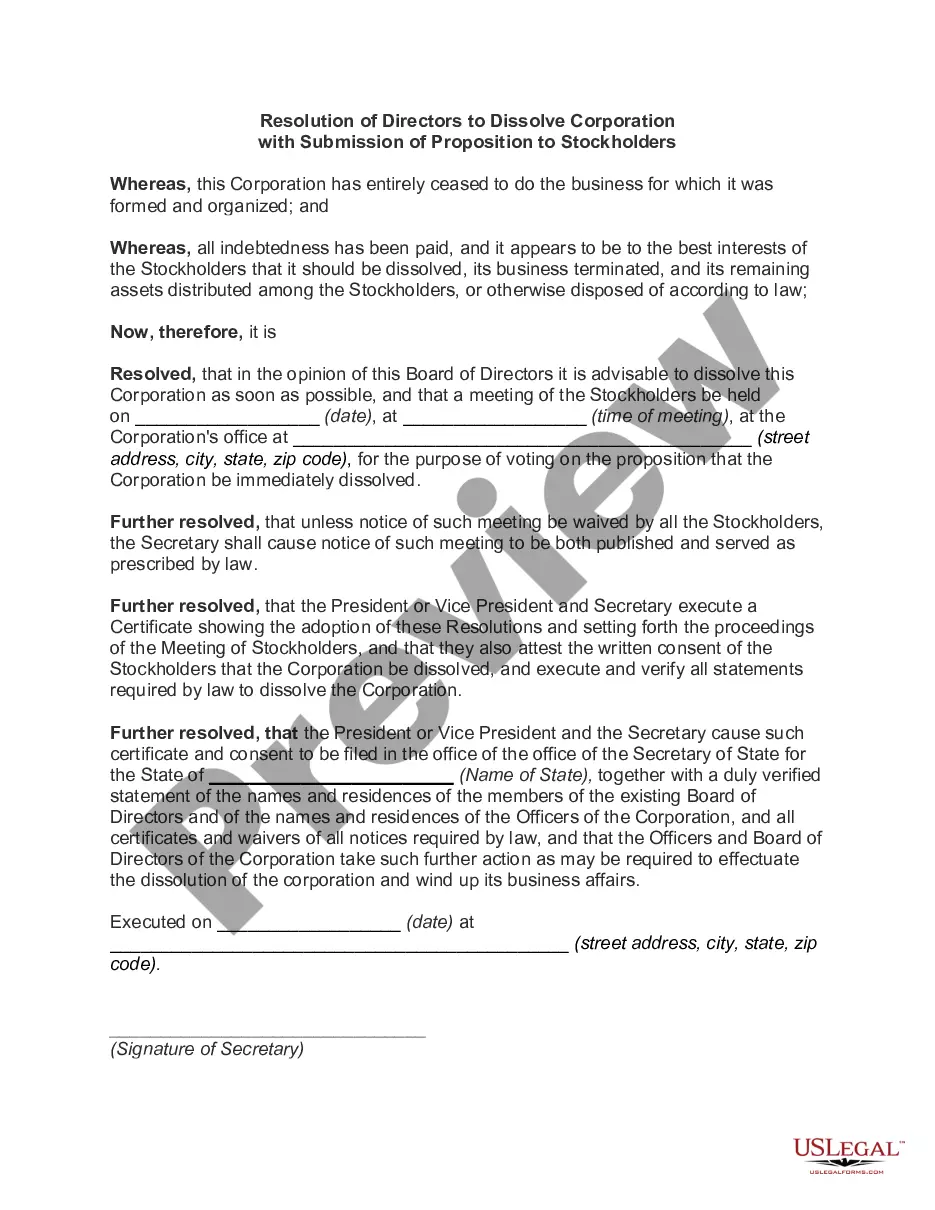

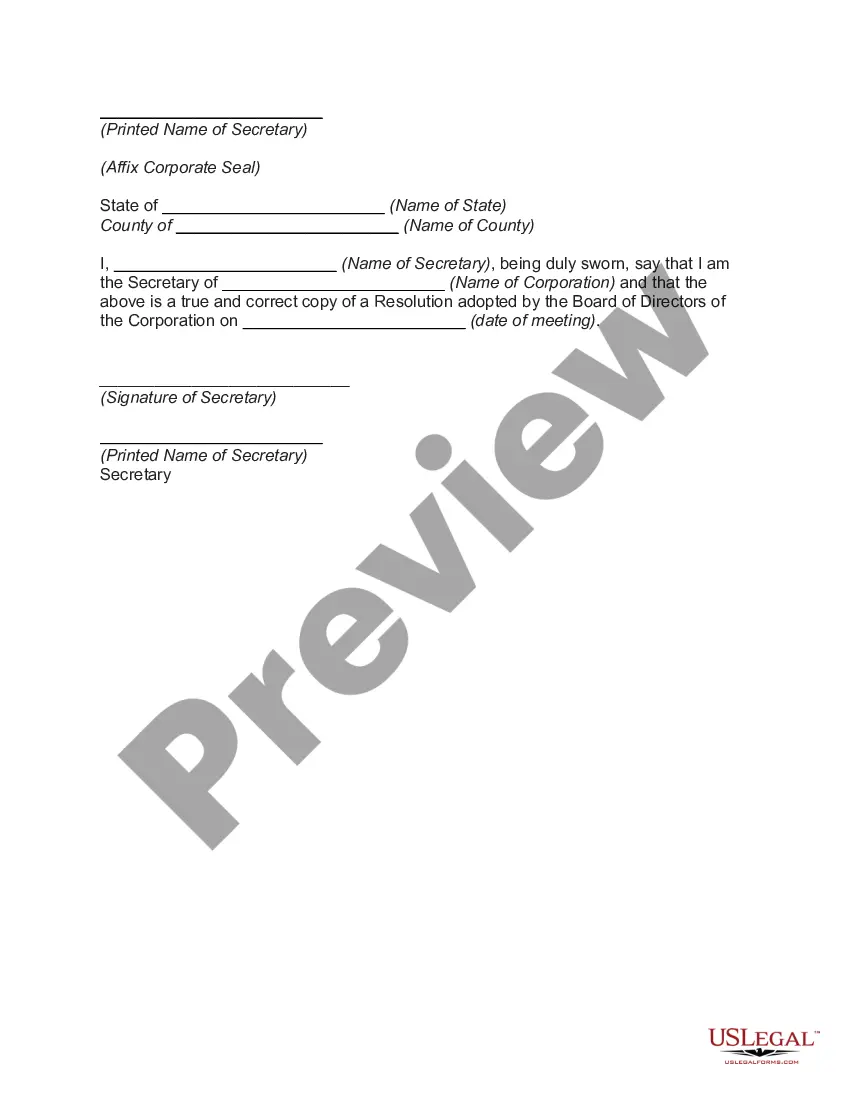

How to fill out Resolution Of Directors To Dissolve Corporation With Submission Of Proposition To Stockholders?

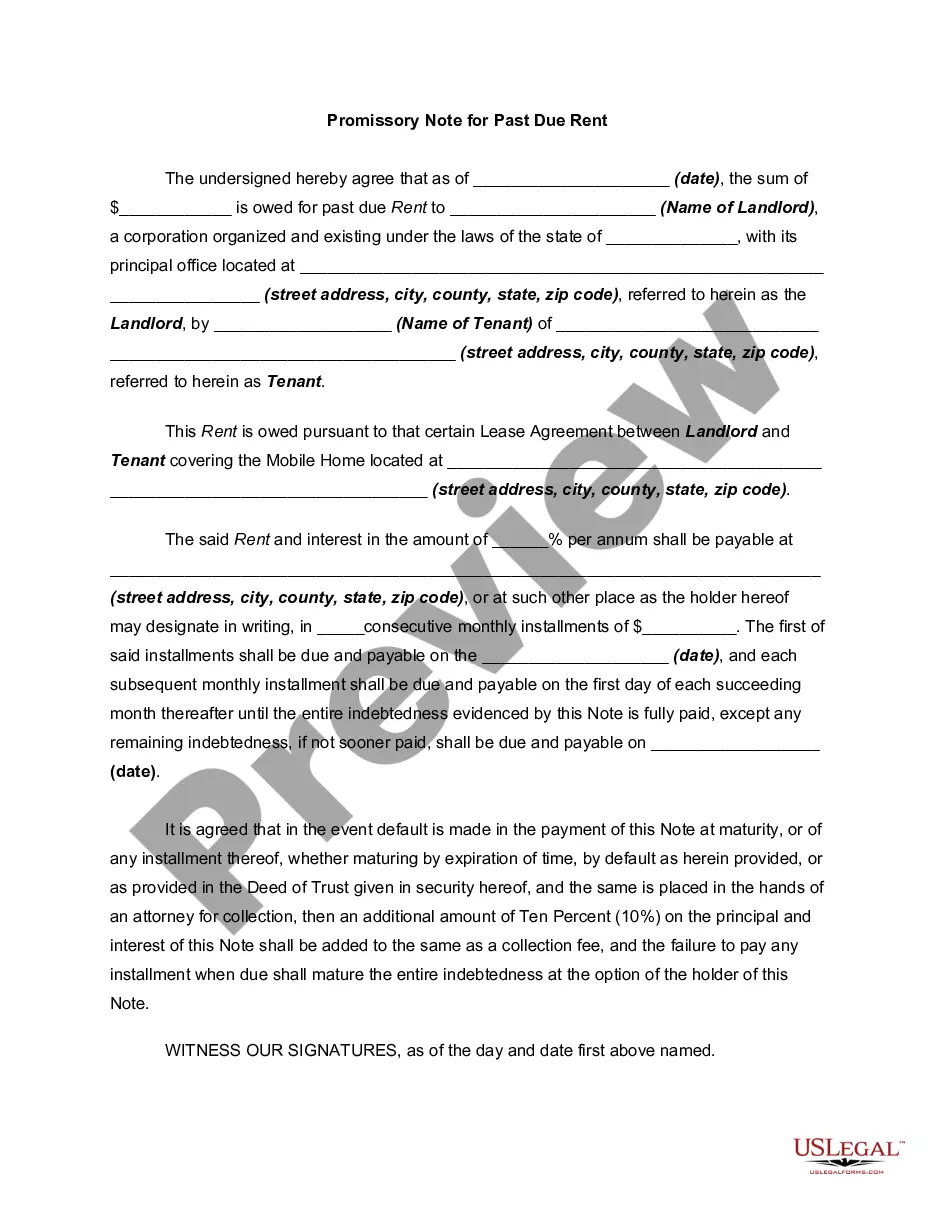

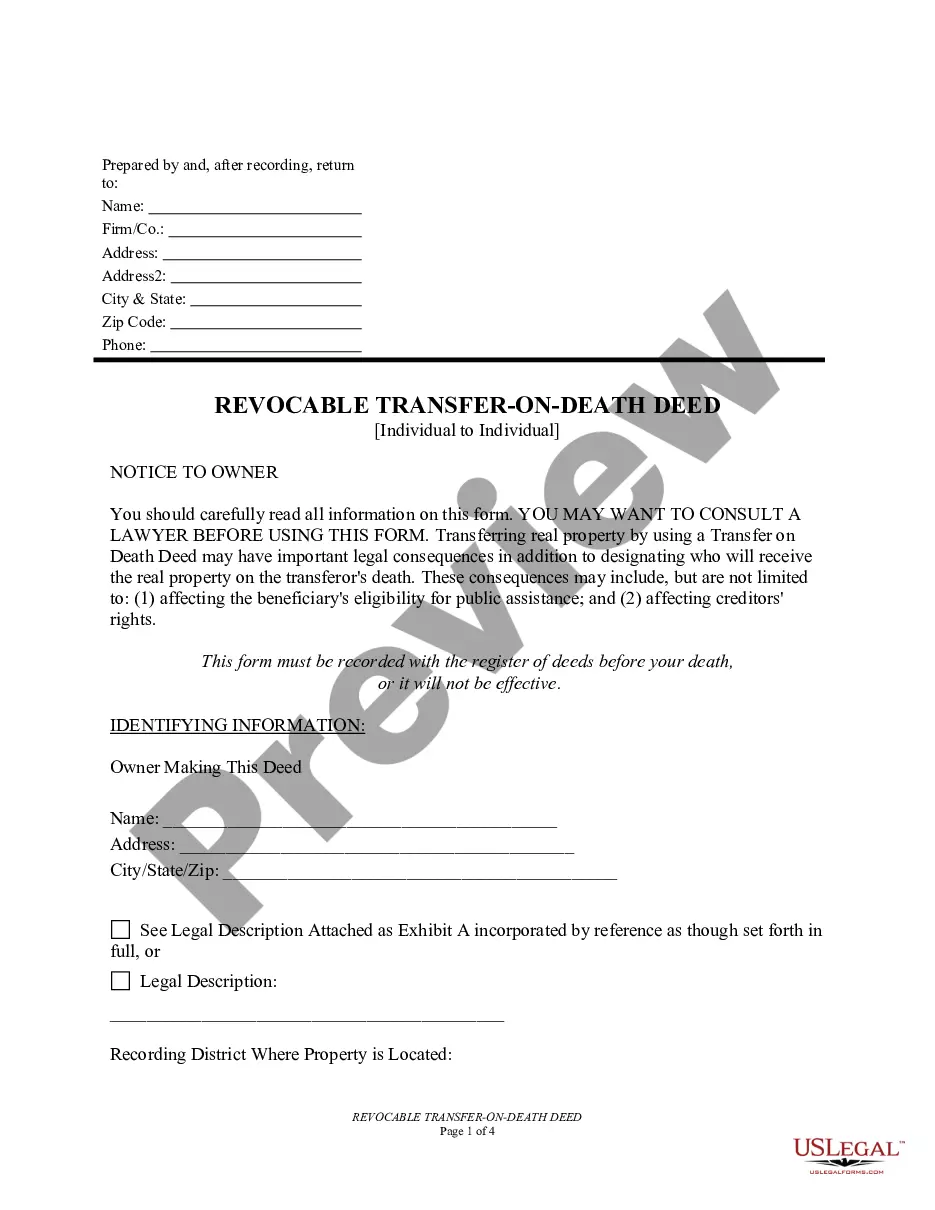

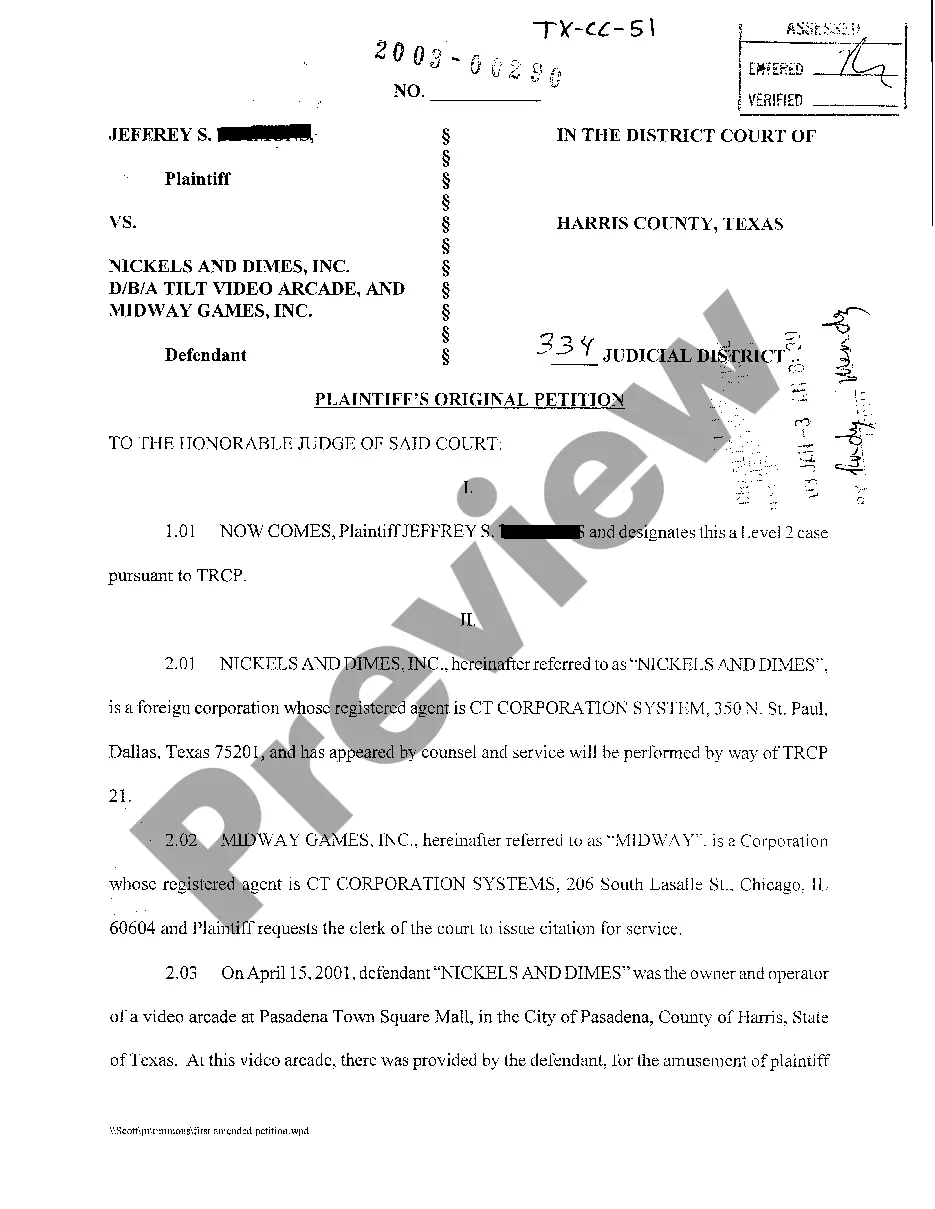

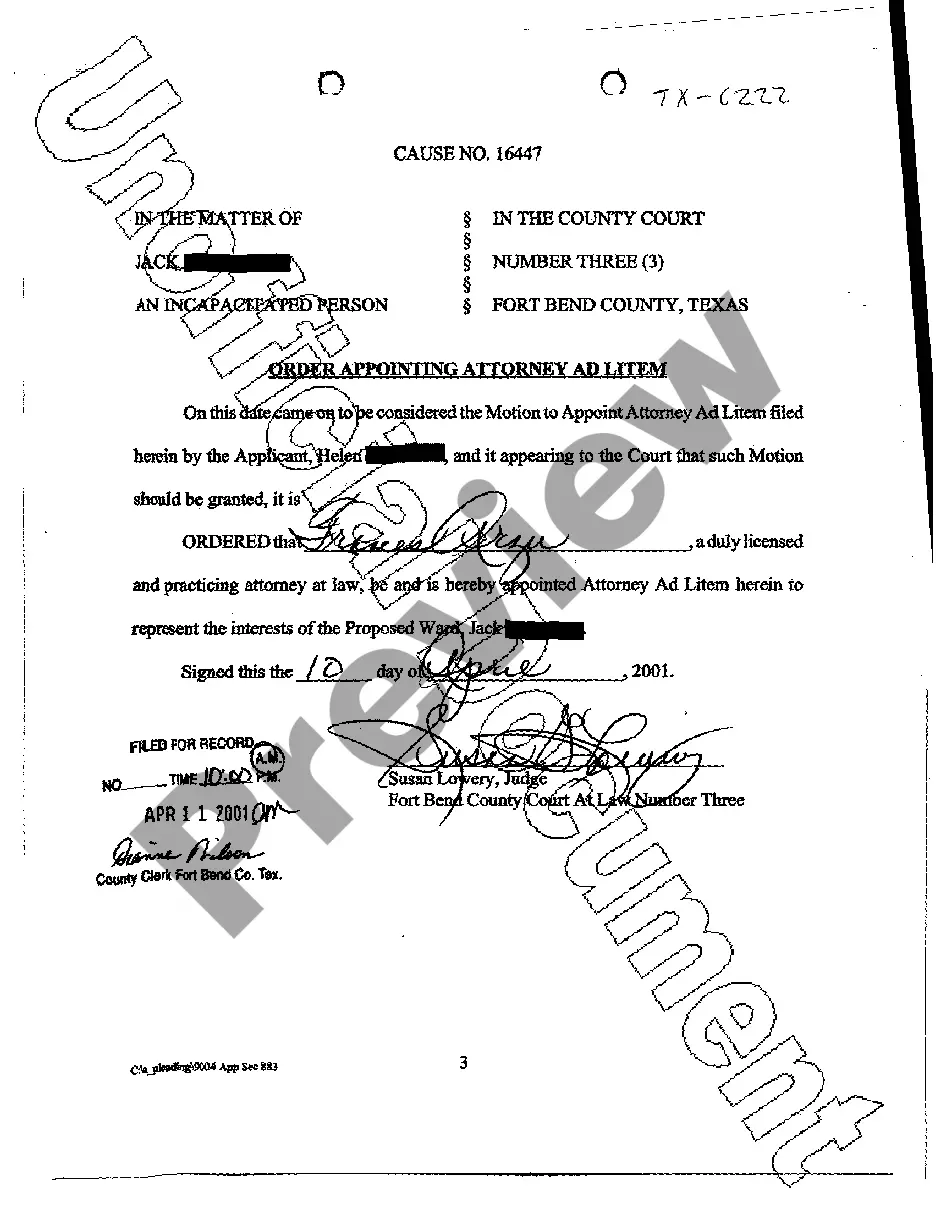

Handling legal documents is essential in the contemporary world. Nevertheless, you don't necessarily have to seek expert help to create some of them from scratch, including the Harris Resolution of Directors to Dissolve Corporation with Submission of Proposition to Stockholders, using a service like US Legal Forms.

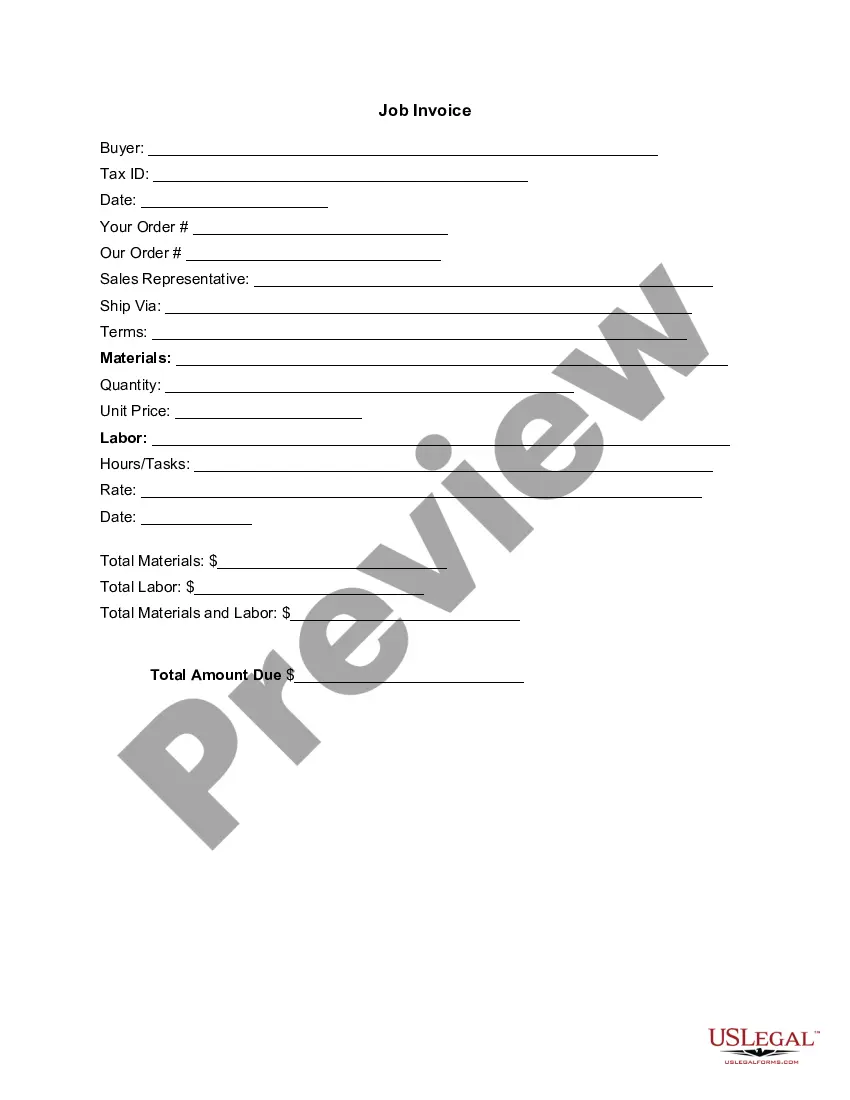

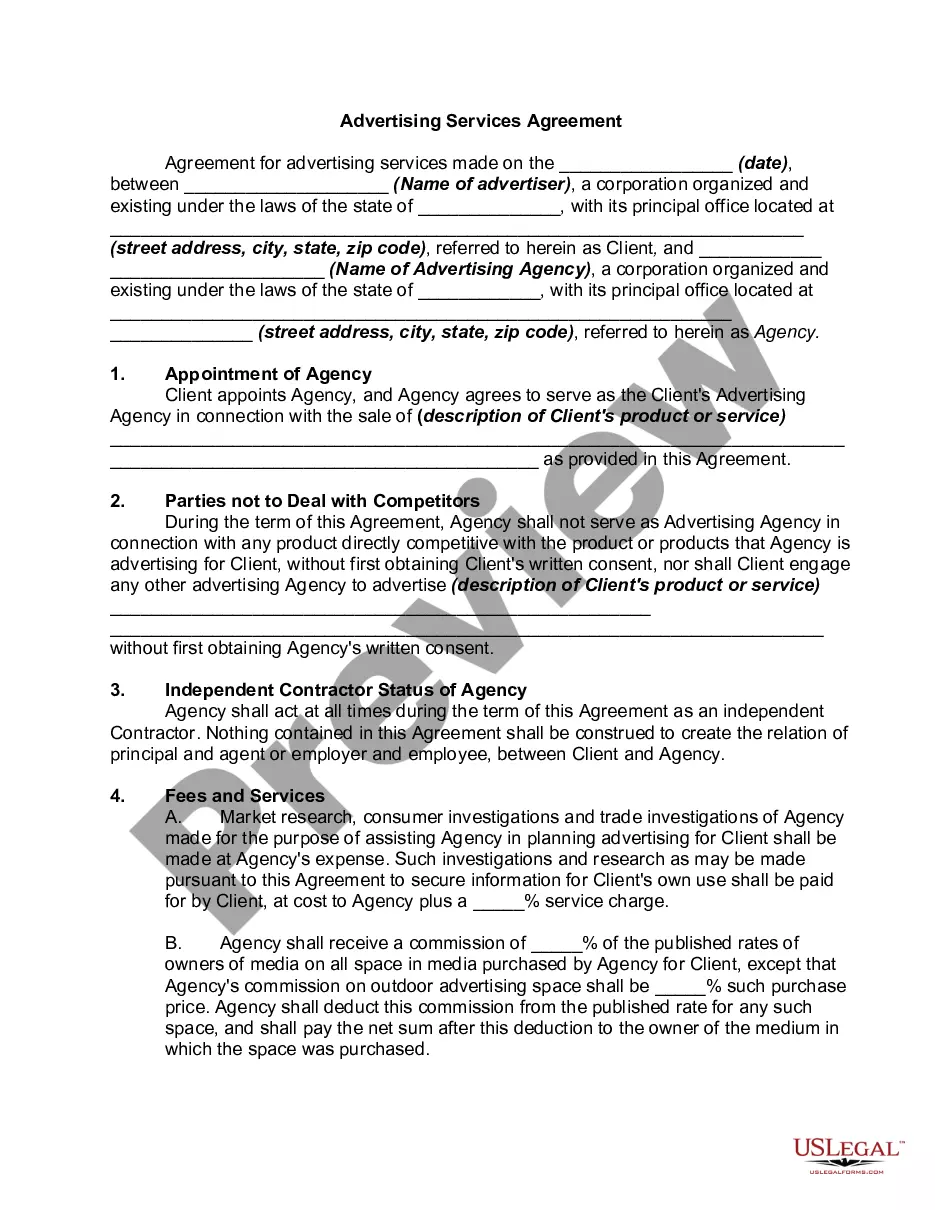

US Legal Forms offers over 85,000 templates that cover a variety of categories ranging from living wills to real estate contracts to divorce papers. All documents are organized by their respective state, simplifying the search process.

You can also find comprehensive resources and guides on the site to make any tasks associated with document preparation straightforward.

If you are already a subscriber to US Legal Forms, you can find the required Harris Resolution of Directors to Dissolve Corporation with Submission of Proposition to Stockholders, Log In to your account, and download it. Naturally, our website cannot fully substitute for a lawyer. If you encounter an exceptionally complex situation, we suggest utilizing the services of an attorney to review your document before signing and filing it.

With over 25 years in the industry, US Legal Forms has become a trusted resource for various legal forms for millions of clients. Join them today and obtain your state-compliant documentation with ease!

- Review the document's preview and description (if available) to understand what you will receive after acquiring the document.

- Ensure that the template you select is tailored to your state/county/region since local laws may affect the validity of certain documents.

- Examine the related forms or start your search anew to find the appropriate document.

- Click Buy now and set up your account. If you already have an account, proceed to Log In.

- Choose the pricing plan, then select a suitable payment method, and purchase the Harris Resolution of Directors to Dissolve Corporation with Submission of Proposition to Stockholders.

- Opt to save the form template in any available file format.

- Go to the My documents section to re-download the document.

Form popularity

FAQ

You must file Form 966, Corporate Dissolution or Liquidation, if you adopt a resolution or plan to dissolve the corporation or liquidate any of its stock. You must also file your corporation's final income tax return.

To dissolve a corporation in Texas, you need to file a Certificate of Termination with the Texas Secretary of State. The Certificate of Termination must be accompanied by a Certificate of Account Status for Dissolution/Termination, which is issued by the Texas Comptroller of Public Accounts (CPA).

There are several methods by which a corporation may be dissolved. The first is voluntary dissolution, which is an elective decision to dissolve the entity. A second is involuntary dissolution, which occurs upon the happening of statute-specific events such as a failure to pay taxes.

Within 30 days after the adoption of any resolution or plan for or in respect of the dissolution of a corporation or the liquidation of the whole or any part of its capital stock, the corporation shall file a return on Form 966, containing the information required by paragraph (b) of this section and by such form.

6 Steps to Dissolve a Corporation #1 Seek Approval from the Board of Directors and Shareholders. First, hold a meeting with the board of directors.#2 File Articles of Dissolution.#3 Finalize Taxes.#4 Notify Creditors.#5 Liquidate and Distribute Assets.#6 Wrap Up Operations.

The Secretary of State charges a $40 filing fee for dissolving an LLC. If submitting via the website, you can pay online when you submit the forms. Checks should be payable to the secretary of state, and if you're paying by credit card via fax, make sure you also attach Form 807.

When a corporation is dissolved, it no longer legally exists and, in most cases, its debts disappear as well. State laws usually give additional time beyond the dissolution for creditors to file suits for failure to pay any corporate debts or for the wrongful distribution of corporate assets.

A corporation (or a farmer's cooperative) must file Form 966 if it adopts a resolution or plan to dissolve the corporation or liquidate any of its stock. Exempt organizations and qualified subchapter S subsidiaries should not file Form 966.

Absent a penalty authorized in the law, there is literally no penalty for failing to file Form 966. Legal Information Institute: U.S. Code 6652 - Failure to File Certain Information Returns, Registration Statements, etc.

A corporation can choose to dissolve by two different methods: by filing a notarized affidavit of dissolution with the Louisiana Secretary of State, or by filing an application to dissolve, referred to as a long form dissolution.