A Dallas Texas Marital-deduction Residuary Trust with a Single Trust or and Lifetime Income and Power of Appointment in Beneficiary Spouse is a legal arrangement that allows a single individual from Dallas, Texas to provide for their spouse after their passing, while also maintaining control over the assets during their lifetime. This type of trust comes with several variations, including: 1. Traditional Marital-deduction Residuary Trust: In this setup, the single trust or establishes a trust that holds their remaining property and assets after all specific bequests and debts have been settled. The trust is designated for the benefit of their spouse, who receives income generated from the trust during their lifetime. 2. Qualified Terminable Interest Property (TIP) Trust: Similar to the traditional setup, this variation provides income to the surviving spouse but also allows the trust or to designate the ultimate beneficiaries of the trust's assets after the spouse's passing. This type of trust is often utilized when the trust or wants to ensure that their children or other loved ones inherit the remaining assets. 3. Power of Appointment Trust: A power of appointment allows the surviving spouse to direct how the trust assets will be distributed among a specified class of beneficiaries, including children, grandchildren, or even charitable organizations. This gives the spouse flexibility in determining the ultimate beneficiaries based on their needs or circumstances. 4. Spendthrift Trust: This type of trust provides protection for the beneficiary spouse and the trust assets from creditors, lawsuits, or irresponsible spending. It allows for control over the distribution of income and principal to ensure the long-term financial security of the surviving spouse. In summary, a Dallas Texas Marital-deduction Residuary Trust with a Single Trust or and Lifetime Income and Power of Appointment in Beneficiary Spouse offers a way for a single individual from Dallas, Texas to create a trust that provides financial support to their spouse during their lifetime, while also maintaining control over the trust's assets and determining the ultimate beneficiaries after the spouse's passing. This trust can take different forms, such as a traditional trust, TIP trust, power of appointment trust, or spendthrift trust, depending on the specific goals and circumstances of the trust or.

Dallas Texas Marital-deduction Residuary Trust with a Single Trustor and Lifetime Income and Power of Appointment in Beneficiary Spouse

Description

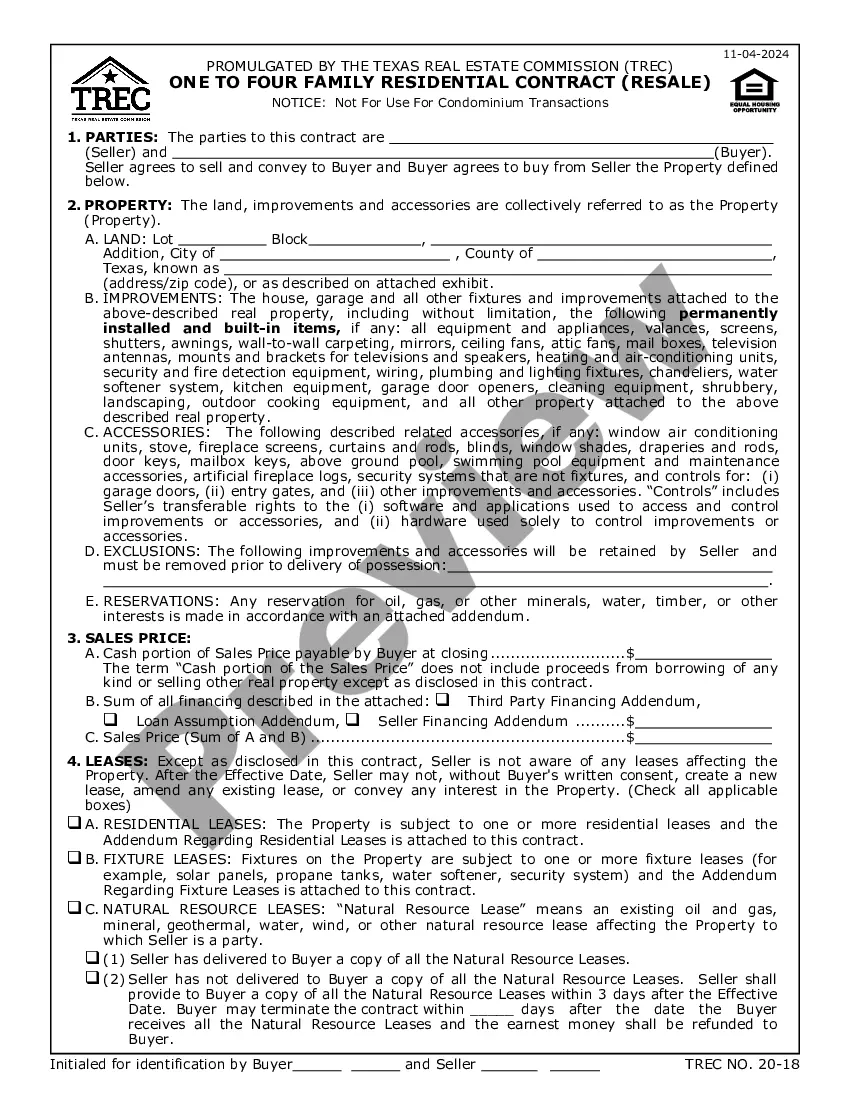

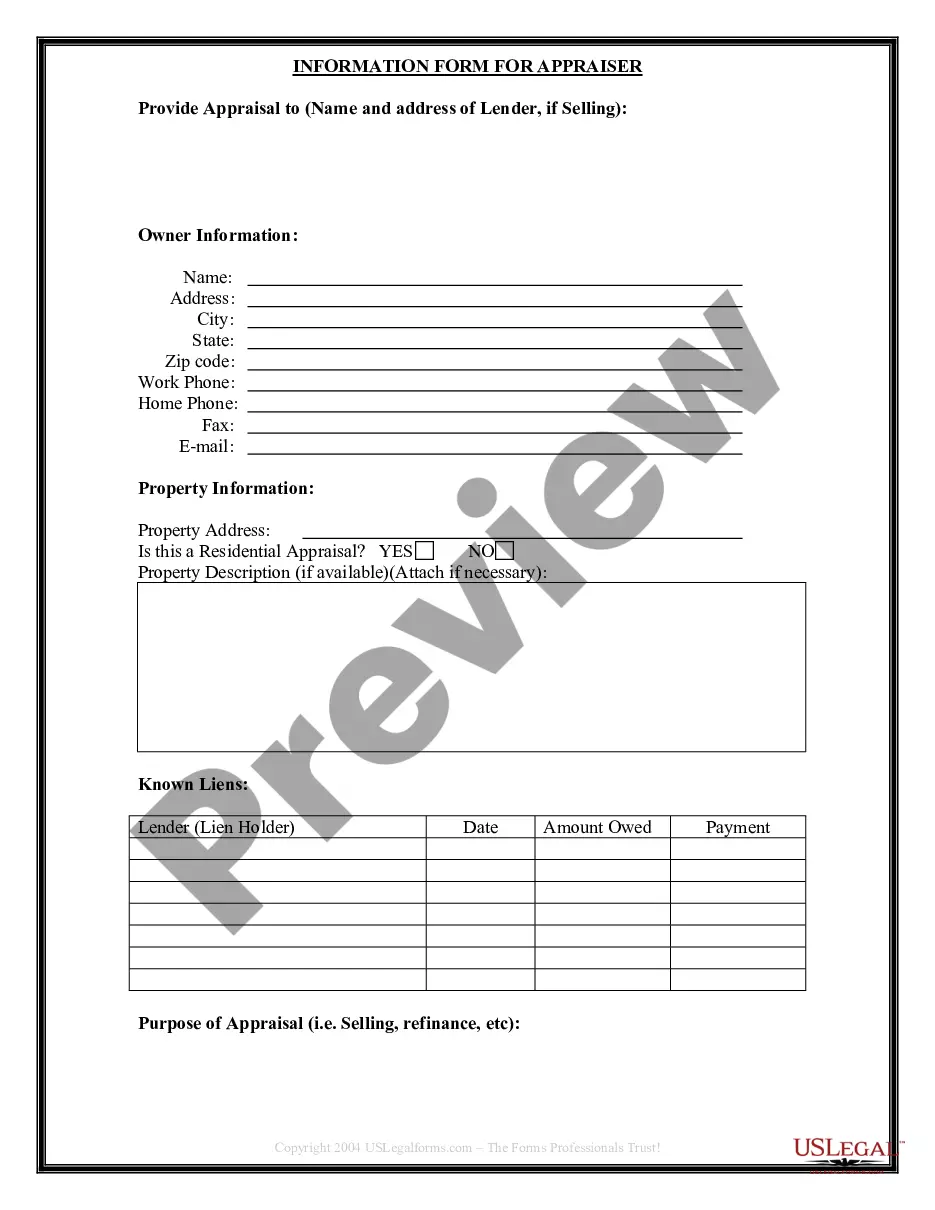

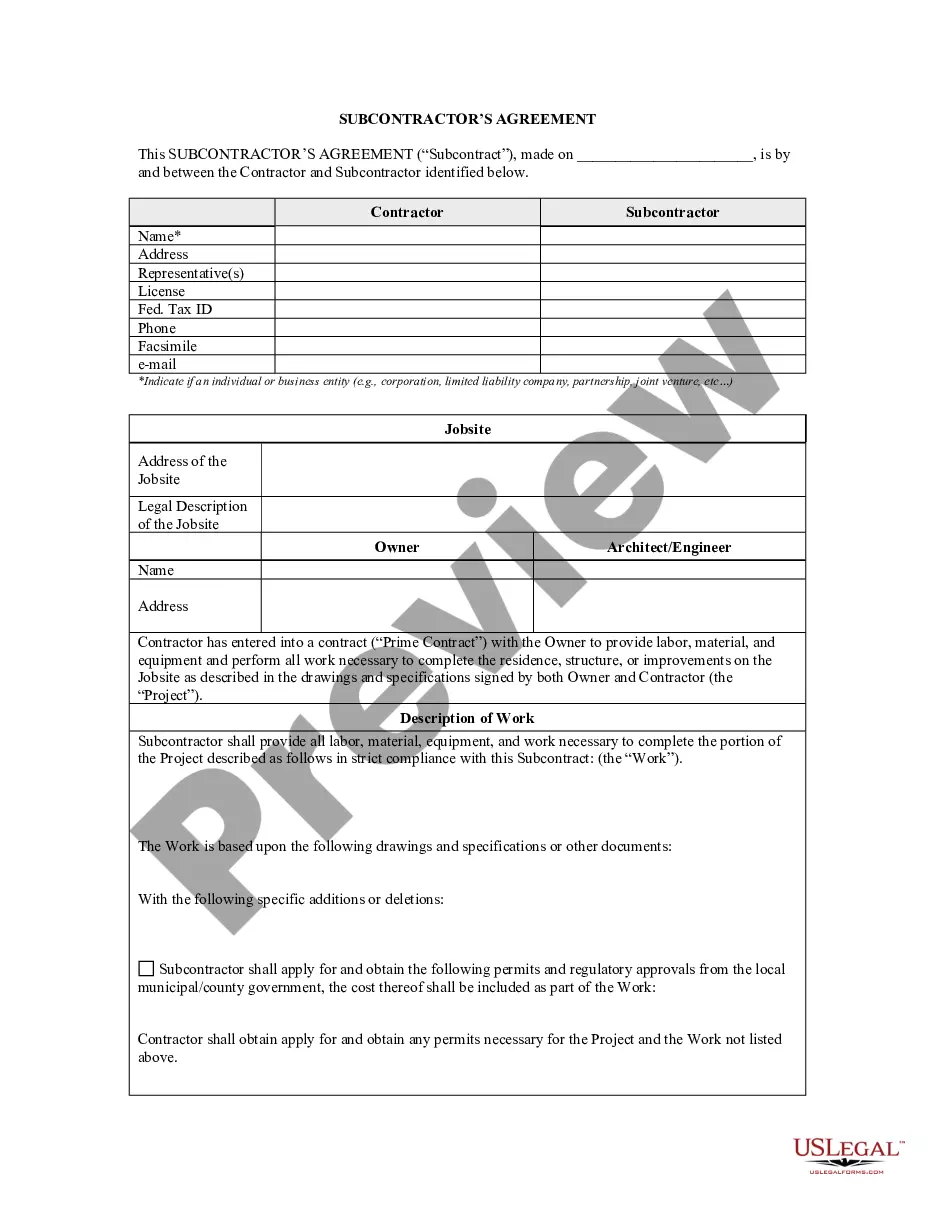

How to fill out Dallas Texas Marital-deduction Residuary Trust With A Single Trustor And Lifetime Income And Power Of Appointment In Beneficiary Spouse?

If you need to get a trustworthy legal paperwork supplier to obtain the Dallas Marital-deduction Residuary Trust with a Single Trustor and Lifetime Income and Power of Appointment in Beneficiary Spouse, consider US Legal Forms. Whether you need to start your LLC business or take care of your asset distribution, we got you covered. You don't need to be well-versed in in law to find and download the needed form.

- You can browse from more than 85,000 forms categorized by state/county and situation.

- The intuitive interface, variety of learning materials, and dedicated support make it simple to find and complete various papers.

- US Legal Forms is a reliable service providing legal forms to millions of customers since 1997.

Simply type to look for or browse Dallas Marital-deduction Residuary Trust with a Single Trustor and Lifetime Income and Power of Appointment in Beneficiary Spouse, either by a keyword or by the state/county the form is created for. After finding the required form, you can log in and download it or retain it in the My Forms tab.

Don't have an account? It's effortless to get started! Simply locate the Dallas Marital-deduction Residuary Trust with a Single Trustor and Lifetime Income and Power of Appointment in Beneficiary Spouse template and take a look at the form's preview and short introductory information (if available). If you're comfortable with the template’s terminology, go ahead and hit Buy now. Register an account and choose a subscription option. The template will be instantly ready for download as soon as the payment is completed. Now you can complete the form.

Handling your legal affairs doesn’t have to be expensive or time-consuming. US Legal Forms is here to demonstrate it. Our rich variety of legal forms makes this experience less costly and more affordable. Set up your first business, organize your advance care planning, create a real estate contract, or execute the Dallas Marital-deduction Residuary Trust with a Single Trustor and Lifetime Income and Power of Appointment in Beneficiary Spouse - all from the convenience of your home.

Sign up for US Legal Forms now!