Riverside California Marital-deduction Residuary Trust with a Single Trustor and Lifetime Income and Power of Appointment in Beneficiary Spouse

Description

How to fill out Riverside California Marital-deduction Residuary Trust With A Single Trustor And Lifetime Income And Power Of Appointment In Beneficiary Spouse?

Creating forms, like Riverside Marital-deduction Residuary Trust with a Single Trustor and Lifetime Income and Power of Appointment in Beneficiary Spouse, to take care of your legal matters is a tough and time-consumming task. Many situations require an attorney’s participation, which also makes this task not really affordable. Nevertheless, you can take your legal affairs into your own hands and take care of them yourself. US Legal Forms is here to save the day. Our website comes with more than 85,000 legal documents intended for different scenarios and life situations. We make sure each document is compliant with the laws of each state, so you don’t have to be concerned about potential legal pitfalls compliance-wise.

If you're already familiar with our website and have a subscription with US, you know how easy it is to get the Riverside Marital-deduction Residuary Trust with a Single Trustor and Lifetime Income and Power of Appointment in Beneficiary Spouse form. Go ahead and log in to your account, download the template, and personalize it to your requirements. Have you lost your document? Don’t worry. You can get it in the My Forms folder in your account - on desktop or mobile.

The onboarding process of new customers is just as simple! Here’s what you need to do before downloading Riverside Marital-deduction Residuary Trust with a Single Trustor and Lifetime Income and Power of Appointment in Beneficiary Spouse:

- Make sure that your form is specific to your state/county since the regulations for writing legal papers may vary from one state another.

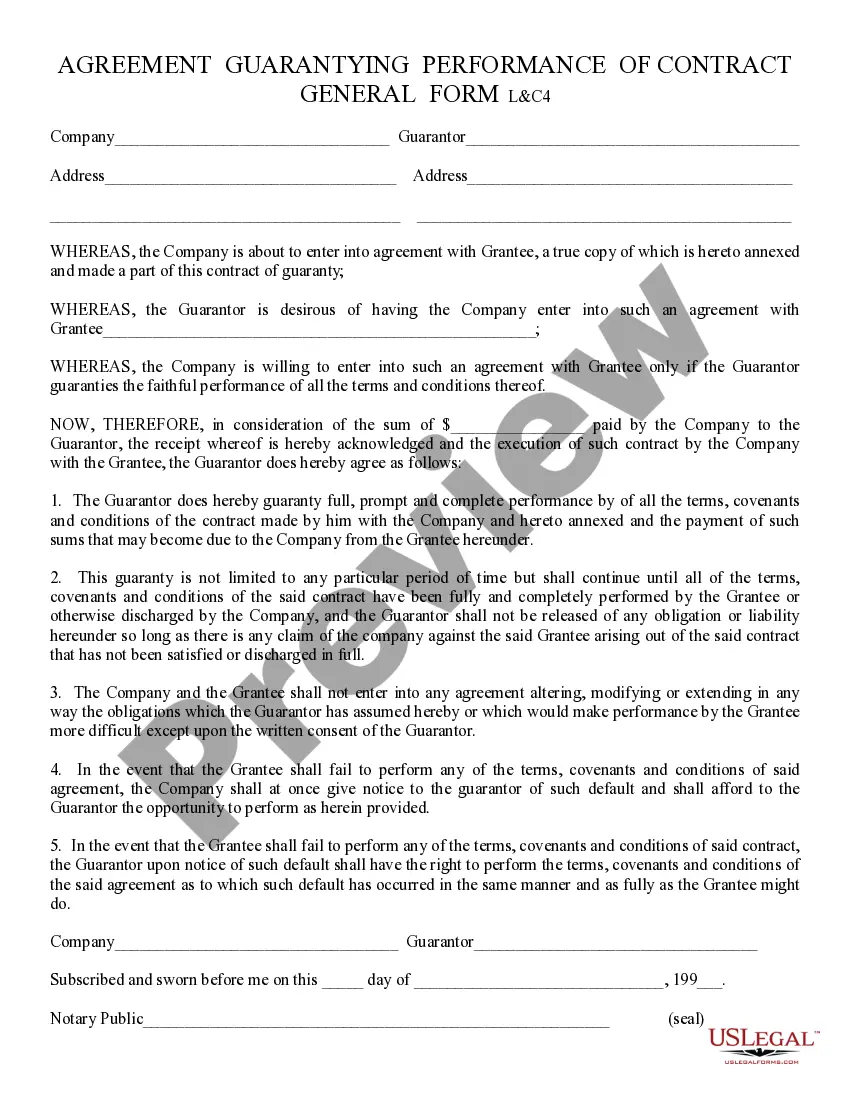

- Find out more about the form by previewing it or going through a brief description. If the Riverside Marital-deduction Residuary Trust with a Single Trustor and Lifetime Income and Power of Appointment in Beneficiary Spouse isn’t something you were hoping to find, then take advantage of the search bar in the header to find another one.

- Log in or register an account to start utilizing our website and get the document.

- Everything looks good on your end? Click the Buy now button and select the subscription plan.

- Pick the payment gateway and enter your payment details.

- Your form is all set. You can try and download it.

It’s easy to find and buy the appropriate document with US Legal Forms. Thousands of organizations and individuals are already benefiting from our rich collection. Subscribe to it now if you want to check what other advantages you can get with US Legal Forms!