A San Diego California Marital-deduction Residuary Trust with a Single Trust or and Lifetime Income and Power of Appointment in Beneficiary Spouse is a specific type of trust designed to provide financial security and flexibility for married couples in San Diego, California. This trust arrangement allows the trust or (the individual establishing the trust) to allocate their assets in a manner that benefits their spouse as the primary beneficiary. In this trust, the trust or transfers their assets into the trust during their lifetime or upon their death, thereby creating a separate legal entity to hold and manage these assets. The trust is structured in a way that ensures the surviving spouse receives a lifetime income from the trust's assets while maintaining control through the power of appointment. There may be different variations or types of San Diego California Marital-deduction Residuary Trust with a Single Trust or and Lifetime Income and Power of Appointment in Beneficiary Spouse based on specific factors such as the distribution of the trust's residuary assets (the remaining assets after all other trust obligations have been met). These variations include: 1. Conventional Trust: This type of trust provides the surviving spouse with a lifetime income and allows them to appoint the remaining trust assets to beneficiaries upon their death. The appointed beneficiaries may be children, grandchildren, or other individuals specified in the trust. 2. Qualified Terminable Interest Property Trust (TIP Trust): This type of trust is often utilized in situations where the trust or wants to provide for their surviving spouse while also controlling the ultimate disposition of the trust assets. With a TIP trust, the surviving spouse receives income from the trust during their lifetime, but they have limited power to appoint the trust assets to beneficiaries. The trust or can specify how the trust assets will be distributed to named beneficiaries upon the surviving spouse's death. 3. Charitable Remainder Trust (CRT): In certain cases, the trust or may choose to allocate a portion of the trust's assets for charitable purposes. A CRT allows the surviving spouse to receive income for their lifetime, while the remaining trust assets are directed towards charitable organizations or causes upon their death. These types of San Diego California Marital-deduction Residuary Trusts with a Single Trust or and Lifetime Income and Power of Appointment in Beneficiary Spouse offer various advantages, including tax benefits and asset protection for both the trust or and beneficiary spouse. It is crucial to consult with an experienced estate planning attorney to determine the most suitable trust structure based on individual circumstances and goals.

San Diego California Marital-deduction Residuary Trust with a Single Trustor and Lifetime Income and Power of Appointment in Beneficiary Spouse

Description

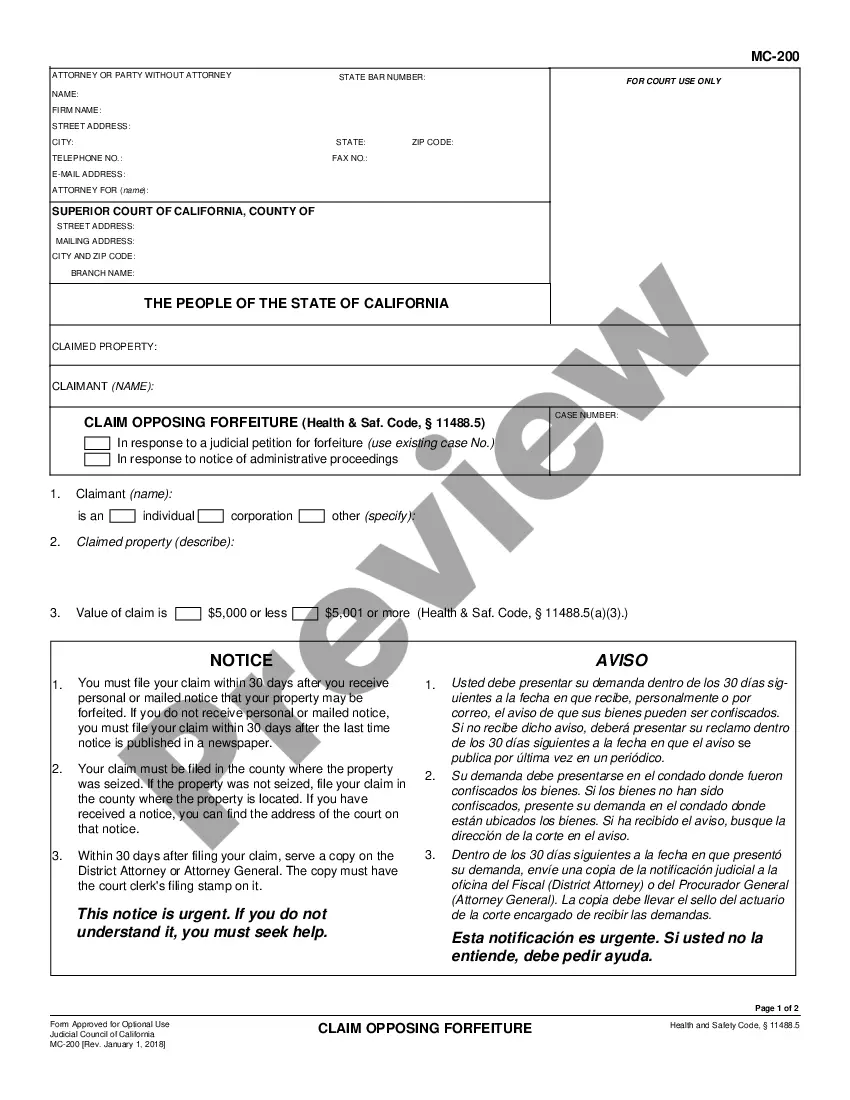

How to fill out San Diego California Marital-deduction Residuary Trust With A Single Trustor And Lifetime Income And Power Of Appointment In Beneficiary Spouse?

A document routine always accompanies any legal activity you make. Creating a company, applying or accepting a job offer, transferring property, and many other life scenarios demand you prepare official paperwork that differs from state to state. That's why having it all collected in one place is so valuable.

US Legal Forms is the biggest online collection of up-to-date federal and state-specific legal forms. Here, you can easily locate and get a document for any individual or business purpose utilized in your region, including the San Diego Marital-deduction Residuary Trust with a Single Trustor and Lifetime Income and Power of Appointment in Beneficiary Spouse.

Locating templates on the platform is remarkably straightforward. If you already have a subscription to our service, log in to your account, find the sample through the search field, and click Download to save it on your device. Following that, the San Diego Marital-deduction Residuary Trust with a Single Trustor and Lifetime Income and Power of Appointment in Beneficiary Spouse will be accessible for further use in the My Forms tab of your profile.

If you are using US Legal Forms for the first time, follow this quick guideline to obtain the San Diego Marital-deduction Residuary Trust with a Single Trustor and Lifetime Income and Power of Appointment in Beneficiary Spouse:

- Ensure you have opened the correct page with your regional form.

- Make use of the Preview mode (if available) and browse through the template.

- Read the description (if any) to ensure the template meets your requirements.

- Look for another document using the search option if the sample doesn't fit you.

- Click Buy Now once you find the required template.

- Select the appropriate subscription plan, then sign in or register for an account.

- Select the preferred payment method (with credit card or PayPal) to proceed.

- Choose file format and download the San Diego Marital-deduction Residuary Trust with a Single Trustor and Lifetime Income and Power of Appointment in Beneficiary Spouse on your device.

- Use it as needed: print it or fill it out electronically, sign it, and send where requested.

This is the simplest and most reliable way to obtain legal paperwork. All the templates provided by our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and manage your legal affairs efficiently with the US Legal Forms!