The Wayne Michigan Marital-deduction Residuary Trust with a Single Trust or and Lifetime Income and Power of Appointment in Beneficiary Spouse is a specific type of trust governed by the laws and regulations of Michigan, specifically in Wayne County. This trust is designed to provide financial protection and estate planning benefits for a married couple residing in Wayne, Michigan, while allowing the trust or (the person establishing the trust) to retain control over the trust assets during their lifetime. The Marital-deduction Residuary Trust involves a single trust or, meaning only one spouse sets up the trust. The trust's primary purpose is to take advantage of the marital deduction, which allows for the unlimited transfer of assets between spouses without incurring federal estate tax. By establishing this trust, the trust or can ensure that their spouse will have financial security and access to income from the trust's assets throughout their lifetime. In this particular type of trust, the trust or designates the spouse as the sole beneficiary, who is entitled to receive income generated by the trust assets for the duration of their life. This provides a reliable source of income for the spouse, ensuring their financial well-being even after the trust or's passing. Moreover, another crucial aspect of the Wayne Michigan Marital-deduction Residuary Trust with a Single Trust or and Lifetime Income and Power of Appointment in Beneficiary Spouse is the inclusion of a power of appointment. This power allows the beneficiary spouse to have control over the distribution of trust assets upon their death. They can appoint these assets to beneficiaries of their choice, such as their children, grandchildren, or charitable organizations, according to their wishes and priorities. Different types or variations of this trust may be customized to suit individual preferences and circumstances. For instance, the trust or may choose to add certain provisions like a spendthrift clause to protect the trust assets from creditors or an incentive clause to encourage certain behaviors in the beneficiaries. However, the primary framework of the Wayne Michigan Marital-deduction Residuary Trust with a Single Trust or and Lifetime Income and Power of Appointment in Beneficiary Spouse remains consistent throughout, focusing on providing financial stability to the spouse while maintaining control over trust assets during the trust or's lifetime and granting distribution flexibility to the beneficiary spouse.

Wayne Michigan Marital-deduction Residuary Trust with a Single Trustor and Lifetime Income and Power of Appointment in Beneficiary Spouse

Description

How to fill out Wayne Michigan Marital-deduction Residuary Trust With A Single Trustor And Lifetime Income And Power Of Appointment In Beneficiary Spouse?

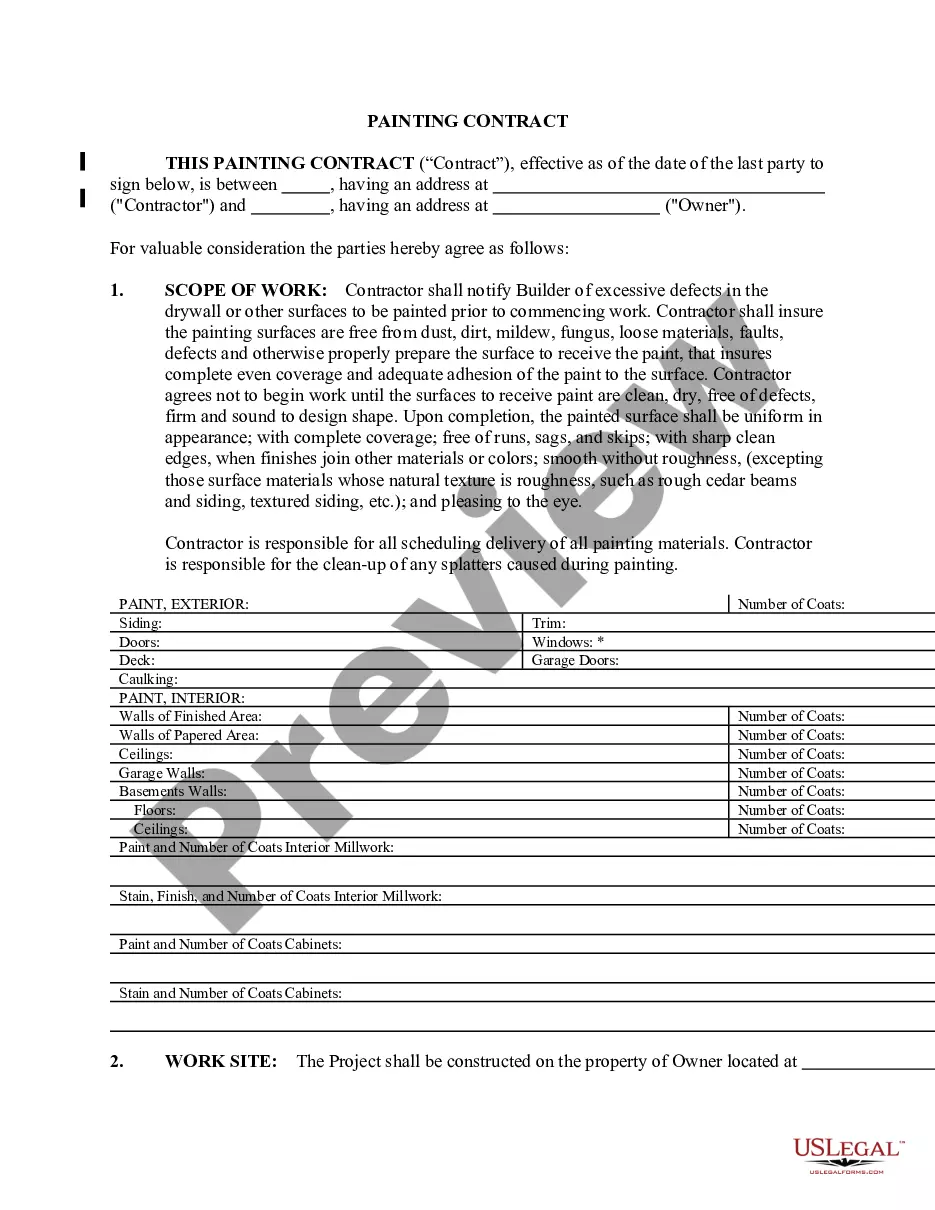

Preparing legal paperwork can be burdensome. In addition, if you decide to ask a lawyer to draft a commercial agreement, documents for proprietorship transfer, pre-marital agreement, divorce papers, or the Wayne Marital-deduction Residuary Trust with a Single Trustor and Lifetime Income and Power of Appointment in Beneficiary Spouse, it may cost you a lot of money. So what is the most reasonable way to save time and money and draw up legitimate documents in total compliance with your state and local laws? US Legal Forms is a great solution, whether you're looking for templates for your personal or business needs.

US Legal Forms is the most extensive online collection of state-specific legal documents, providing users with the up-to-date and professionally checked templates for any scenario accumulated all in one place. Consequently, if you need the current version of the Wayne Marital-deduction Residuary Trust with a Single Trustor and Lifetime Income and Power of Appointment in Beneficiary Spouse, you can easily locate it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample with the Download button. If you haven't subscribed yet, here's how you can get the Wayne Marital-deduction Residuary Trust with a Single Trustor and Lifetime Income and Power of Appointment in Beneficiary Spouse:

- Look through the page and verify there is a sample for your area.

- Examine the form description and use the Preview option, if available, to ensure it's the sample you need.

- Don't worry if the form doesn't suit your requirements - look for the correct one in the header.

- Click Buy Now when you find the needed sample and select the best suitable subscription.

- Log in or register for an account to purchase your subscription.

- Make a payment with a credit card or via PayPal.

- Choose the document format for your Wayne Marital-deduction Residuary Trust with a Single Trustor and Lifetime Income and Power of Appointment in Beneficiary Spouse and save it.

Once done, you can print it out and complete it on paper or import the samples to an online editor for a faster and more convenient fill-out. US Legal Forms allows you to use all the paperwork ever purchased multiple times - you can find your templates in the My Forms tab in your profile. Give it a try now!