Palm Beach Florida Agreement for Services between an Attorney and Accountant with Respect to an Internal Revenue Service Audit is a legally binding document that outlines the terms and conditions for collaboration between an attorney and an accountant in assisting individuals or businesses facing an Internal Revenue Service (IRS) audit in Palm Beach, Florida. This agreement ensures a smooth working relationship between the attorney and accountant while coordinating efforts to effectively handle the audit process. In this agreement, key aspects are covered, including responsibilities and duties of both parties, the scope of services provided, and the division of fees. The primary objective is to work towards a favorable outcome for the client being audited, while adhering to legal and ethical standards. Keywords: Palm Beach Florida, Agreement for Services, Attorney, Accountant, Internal Revenue Service Audit, legally binding, collaboration, responsibilities, duties, scope of services, division of fees, favorable outcome, legal standards, ethical standards. Different types of Palm Beach Florida Agreements for Services between an Attorney and Accountant with Respect to an Internal Revenue Service Audit may include: 1. Comprehensive Audit Defense Agreement: This type of agreement entails a comprehensive approach to handle various aspects of an IRS audit, such as document review, communication with the IRS, representation during administrative meetings, and negotiating settlements or appeals if necessary. 2. Limited Scope Agreement: In some cases, the attorney and accountant may agree to limit their services to specific areas of the audit process. This could be related to document review, drafting responses to IRS inquiries, or providing legal and financial advice on specific matters. 3. Audit Resolution Agreement: This agreement focuses specifically on resolving the issues identified during an IRS audit. The attorney and accountant collaborate closely to devise strategies, negotiate settlements, or prepare for potential litigation, aiming to achieve a favorable resolution for the client. 4. Extended Representation Agreement: In situations where the audit process extends beyond the initial phase, an extended representation agreement may be necessary. This type of agreement ensures that the attorney and accountant continue to provide services, including representation and guidance throughout the entire audit process, until a resolution is reached. 5. Consultation Agreement: Sometimes, a client may require advice and consultation from both an attorney and accountant without the need for formal representation. In such cases, a consultation agreement can be established, allowing the client to seek guidance on specific tax-related issues or strategies to minimize audit risks. Keywords: Comprehensive Audit Defense Agreement, Limited Scope Agreement, Audit Resolution Agreement, Extended Representation Agreement, Consultation Agreement, representation, document review, communication, settlements, appeals, administrative meetings, litigation, tax-related issues, minimize audit risks.

Palm Beach Florida Agreement for Services between an Attorney and Accountant with Respect to an Internal Revenue Service Audit

Description

How to fill out Palm Beach Florida Agreement For Services Between An Attorney And Accountant With Respect To An Internal Revenue Service Audit?

Creating legal forms is a must in today's world. Nevertheless, you don't always need to seek professional help to draft some of them from scratch, including Palm Beach Agreement for Services between an Attorney and Accountant with Respect to an Internal Revenue Service Audit, with a service like US Legal Forms.

US Legal Forms has more than 85,000 forms to pick from in various types ranging from living wills to real estate papers to divorce documents. All forms are arranged according to their valid state, making the searching experience less challenging. You can also find information materials and tutorials on the website to make any tasks related to paperwork completion simple.

Here's how you can locate and download Palm Beach Agreement for Services between an Attorney and Accountant with Respect to an Internal Revenue Service Audit.

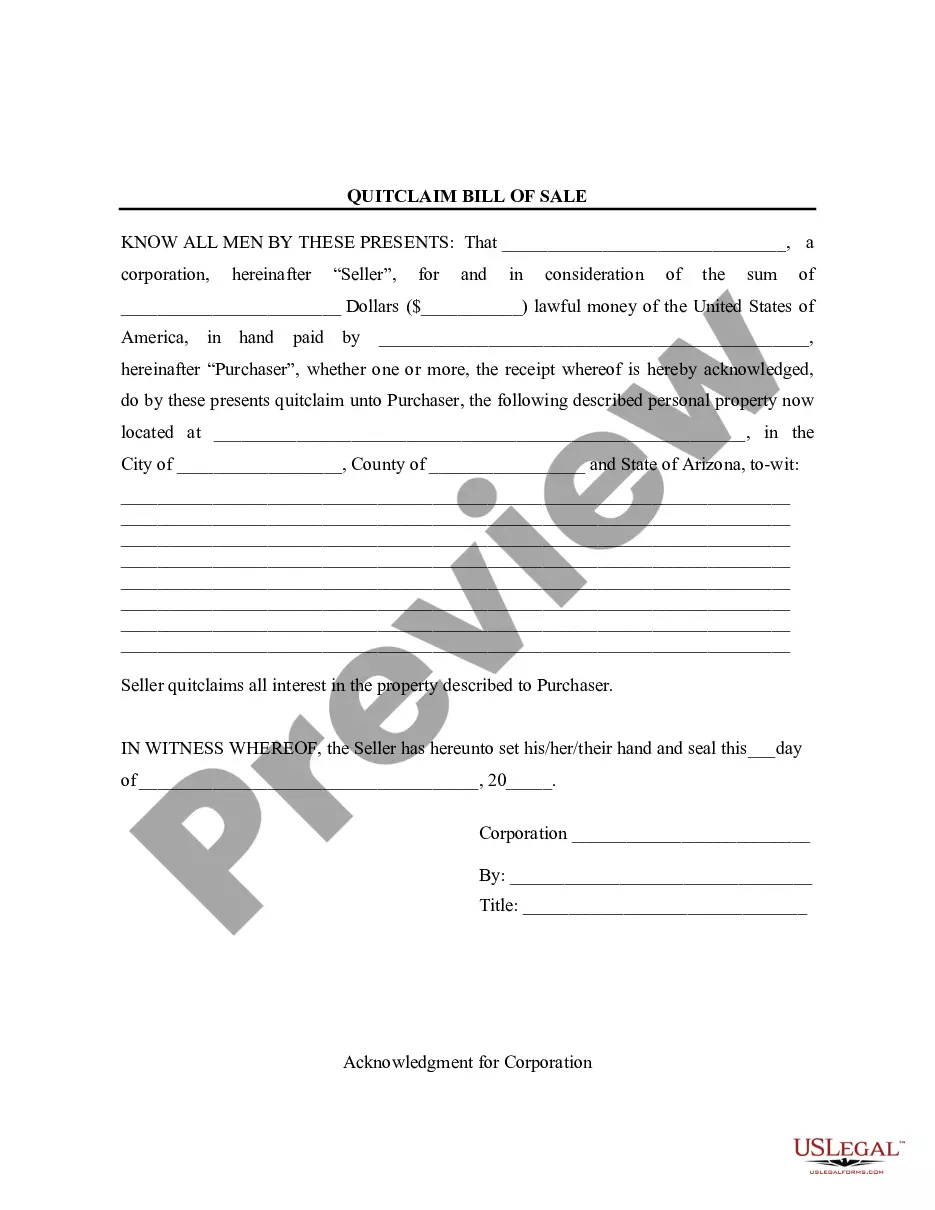

- Take a look at the document's preview and description (if provided) to get a general information on what you’ll get after downloading the form.

- Ensure that the document of your choice is specific to your state/county/area since state regulations can affect the legality of some documents.

- Examine the related document templates or start the search over to find the correct document.

- Hit Buy now and create your account. If you already have an existing one, select to log in.

- Pick the pricing {plan, then a suitable payment method, and buy Palm Beach Agreement for Services between an Attorney and Accountant with Respect to an Internal Revenue Service Audit.

- Select to save the form template in any available file format.

- Go to the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can find the appropriate Palm Beach Agreement for Services between an Attorney and Accountant with Respect to an Internal Revenue Service Audit, log in to your account, and download it. Of course, our website can’t take the place of a lawyer entirely. If you need to deal with an extremely complicated situation, we recommend getting a lawyer to check your form before signing and submitting it.

With more than 25 years on the market, US Legal Forms became a go-to platform for many different legal forms for millions of customers. Become one of them today and get your state-compliant paperwork effortlessly!