The Salt Lake Utah Agreement for Services between an Attorney and Accountant with Respect to an Internal Revenue Service Audit is a legally binding contract that outlines the terms and conditions under which an attorney and an accountant will work together to assist a client who is undergoing an Internal Revenue Service (IRS) audit. This agreement clearly defines the roles and responsibilities of both parties and ensures the smooth coordination of efforts to achieve the best possible outcome for the client. Keywords: Salt Lake Utah, Agreement for Services, Attorney, Accountant, Internal Revenue Service Audit Types of Salt Lake Utah Agreement for Services between an Attorney and Accountant with Respect to an Internal Revenue Service Audit: 1. Full Representation Agreement: This type of agreement involves the attorney and accountant providing comprehensive representation throughout the entire IRS audit process. They work closely with the client to gather all necessary documentation, communicate with the IRS on behalf of the client, develop a strategic defense strategy, and negotiate potential settlements or appeal options. 2. Limited Scope Agreement: In some cases, a client may require specific services from either an attorney or an accountant rather than full representation. In a limited scope agreement, the roles and responsibilities of each party are tailored to the specific needs of the client. For example, an attorney might assist with legal advice and representation during an audit appeal, while an accountant focuses on handling financial documentation and tax calculations. 3. Consultation Agreement: Under a consultation agreement, the attorney and accountant provide advisory services to the client while empowering them to handle their IRS audit independently. They offer guidance, answer questions, review documents, and provide recommendations to ensure the client is well-informed and prepared to navigate the audit process successfully. 4. Preaudit Planning Agreement: A preaudit planning agreement is designed to help clients proactively prepare for an upcoming IRS audit. The attorney and accountant collaborate to assess the client's tax situation, identify potential audit triggers, and develop strategies to minimize risk. This agreement primarily focuses on preventive measures and equips the client with the knowledge needed to avoid or mitigate potential audit disputes. 5. Audit Resolution Agreement: After completing an IRS audit, a client may require assistance from both an attorney and an accountant to resolve any issues identified during the examination. The audit resolution agreement outlines the joint efforts of the attorney and accountant to negotiate with the IRS, file appeals, or explore settlement options to reach a favorable resolution for the client. These different types of Salt Lake Utah Agreements for Services between an Attorney and Accountant with Respect to an Internal Revenue Service Audit allow clients to choose the level of involvement and services they require based on their unique circumstances and budget. It is essential for both parties to clearly define their scope of work, compensation terms, communication channels, and responsibilities outlined in the agreement to ensure a successful collaboration and provide the client with the best possible outcome.

Salt Lake Utah Agreement for Services between an Attorney and Accountant with Respect to an Internal Revenue Service Audit

Description

How to fill out Salt Lake Utah Agreement For Services Between An Attorney And Accountant With Respect To An Internal Revenue Service Audit?

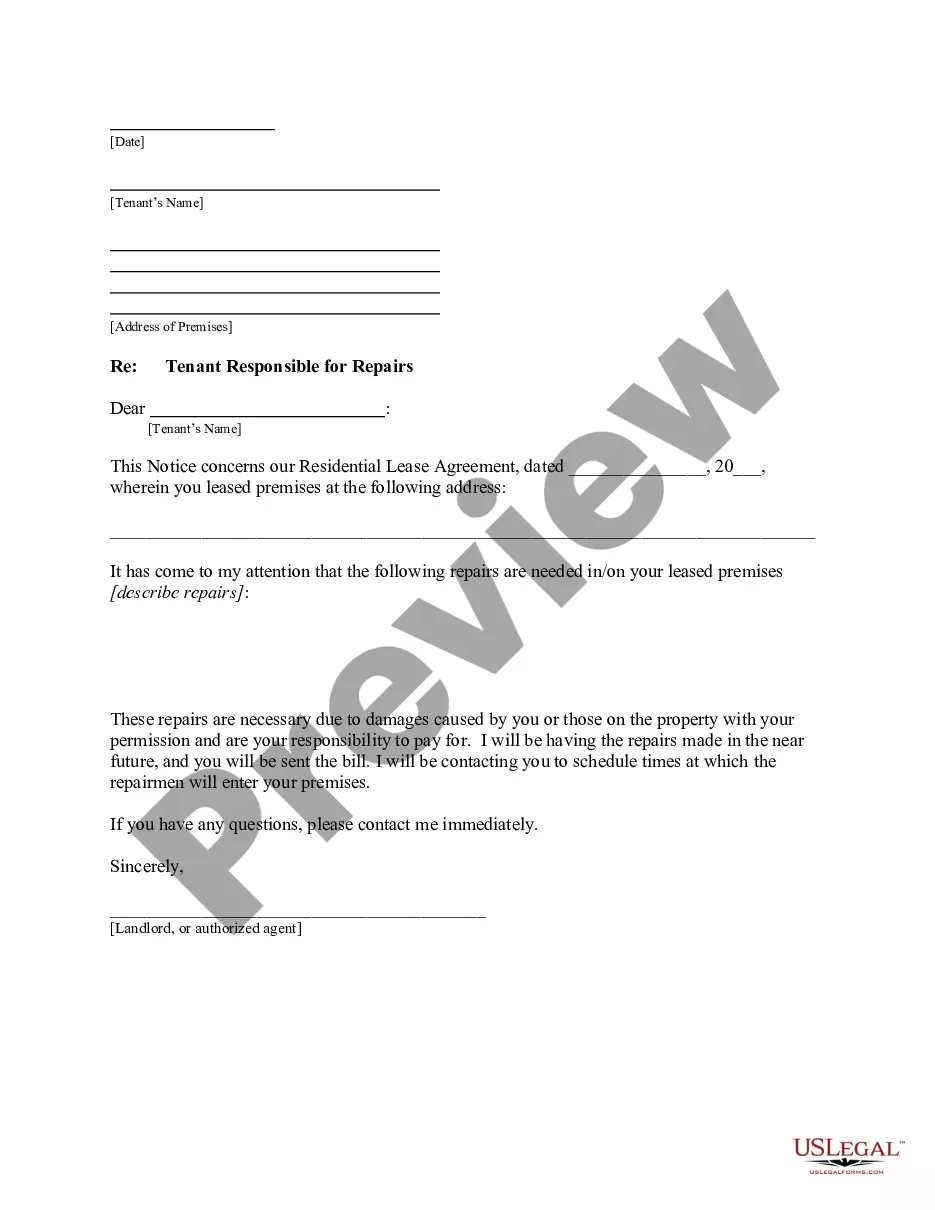

Creating legal forms is a must in today's world. Nevertheless, you don't always need to seek professional help to draft some of them from scratch, including Salt Lake Agreement for Services between an Attorney and Accountant with Respect to an Internal Revenue Service Audit, with a service like US Legal Forms.

US Legal Forms has over 85,000 forms to select from in various categories ranging from living wills to real estate papers to divorce papers. All forms are arranged according to their valid state, making the searching process less challenging. You can also find information materials and guides on the website to make any tasks related to document completion simple.

Here's how to find and download Salt Lake Agreement for Services between an Attorney and Accountant with Respect to an Internal Revenue Service Audit.

- Go over the document's preview and outline (if available) to get a general idea of what you’ll get after getting the form.

- Ensure that the document of your choosing is specific to your state/county/area since state laws can impact the legality of some records.

- Examine the similar forms or start the search over to locate the right document.

- Click Buy now and create your account. If you already have an existing one, select to log in.

- Choose the pricing {plan, then a needed payment method, and buy Salt Lake Agreement for Services between an Attorney and Accountant with Respect to an Internal Revenue Service Audit.

- Select to save the form template in any offered format.

- Visit the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can locate the needed Salt Lake Agreement for Services between an Attorney and Accountant with Respect to an Internal Revenue Service Audit, log in to your account, and download it. Of course, our platform can’t take the place of a legal professional entirely. If you have to deal with an extremely difficult case, we advise getting an attorney to check your document before signing and submitting it.

With over 25 years on the market, US Legal Forms became a go-to platform for various legal forms for millions of customers. Become one of them today and get your state-specific documents effortlessly!

Form popularity

FAQ

Where To File Chart THEN use this address...Fax numberInternal Revenue Service 1973 Rulon White Blvd., MS 6737 Ogden, UT 84201855-214-7522Internal Revenue Service International CAF Team 2970 Market Street MS 4-H14.123 Philadelphia, PA 19104855-772-3156 304-707-9785 (Outside the United States)2 more rows ?

A closing agreement is a binding agreement between the IRS and a taxpayer that, if properly executed, finally and conclusively settles a tax issue between the IRS and a taxpayer. While closing agreements exhibit some of the attributes of a contract, they are not strictly subject to the law of contracts.

You can safely upload and submit your client's third-party authorization forms: Form 2848, Power of Attorney and Declaration of RepresentativePDF. Form 8821, Tax Information AuthorizationPDF.

Power of Attorney - Form 2848 THEN use this address...Fax numberInternal Revenue Service PO Box 268, Stop 8423 Memphis, TN 38101-0268901-546-4115Internal Revenue Service 1973 N Rulon White Blvd MS 6737 Ogden, UT 84404801-620-42492 more rows ?

File Form 8821 to: Authorize any individual, corporation, firm, organization, or partnership you designate to inspect and/or receive your confidential information verbally or in writing for the type of tax and the years or periods listed on the form. Delete or revoke prior tax information authorizations.

File Form 8821 to: Authorize any individual, corporation, firm, organization, or partnership you designate to inspect and/or receive your confidential information verbally or in writing for the type of tax and the years or periods listed on the form.

Where to File Forms 2848 and 8821. Practitioners must mail or fax their authorization forms to the applicable CAF unit (Ogden, Utah; Memphis, Tenn.; or Philadelphia) unless they check the box on line 4 of Form 2848 or 8821 (specific use not recorded on the CAF).

File Form 8821 to: Authorize any individual, corporation, firm, organization, or partnership you designate to inspect and/or receive your confidential information verbally or in writing for the type of tax and the years or periods listed on the form. Delete or revoke prior tax information authorizations.

Signatures on mailed or faxed forms must be handwritten. Electronic signatures are not allowed. Most Forms 2848 and 8821 are recorded on the IRS's Centralized Authorization File (CAF).