San Antonio Texas Agreement for Services between an Attorney and Accountant with Respect to an Internal Revenue Service Audit is a legal document that outlines the terms and conditions of the collaboration between an attorney and an accountant in assisting their client during an audit conducted by the Internal Revenue Service (IRS). This agreement is crucial as it establishes clear guidelines, responsibilities, and expectations for all parties involved. The key components of a San Antonio Texas Agreement for Services between an Attorney and Accountant with Respect to an Internal Revenue Service Audit may include: 1. Purpose: Clearly state the objective of the agreement, which is to provide comprehensive services and representation to the client during an IRS audit. 2. Scope of Services: Detail the specific services to be provided by both the attorney and accountant. This may encompass preparing and reviewing financial documents, conducting legal research, attending meetings with the IRS, and representing the client throughout the audit process. 3. Responsibilities: Clearly outline the responsibilities of both the attorney and accountant. This may include providing timely updates to the client, cooperating with each other, and maintaining confidentiality. 4. Fees and Payment: Specify the fees for the services rendered by the attorney and accountant, including any applicable hourly rates or flat fees. Outline the payment terms, such as when invoices will be issued and due dates for payment. 5. Confidentiality: Emphasize the importance of maintaining client confidentiality and specify that any shared information during the audit process should only be used for the purpose of assisting the client. 6. Termination: Define the conditions under which either party can terminate the agreement, including the provision of sufficient notice. Address any potential fees or consequences associated with early termination. 7. Compliance with Regulations: State that both the attorney and accountant will comply with all relevant laws, regulations, and ethical guidelines during the engagement. Different types of San Antonio Texas Agreement for Services between an Attorney and Accountant with Respect to an Internal Revenue Service Audit may include variations specific to certain industries, such as: 1. Agreement for Services in the Healthcare Industry: This agreement may focus on audits conducted on healthcare providers or medical facilities and include provisions pertaining to compliance with healthcare regulations, such as the Health Insurance Portability and Accountability Act (HIPAA). 2. Agreement for Services in the Real Estate Industry: This type of agreement may be tailored for audits related to real estate transactions or properties, including provisions addressing tax implications specific to this industry. In summary, a San Antonio Texas Agreement for Services between an Attorney and Accountant with Respect to an Internal Revenue Service Audit is a legal document that establishes the terms and conditions of a collaboration between an attorney and an accountant in assisting a client during an IRS audit. This agreement ensures a comprehensive and well-coordinated approach to help the client navigate through the audit process while maintaining confidentiality and compliance with relevant regulations.

San Antonio Texas Agreement for Services between an Attorney and Accountant with Respect to an Internal Revenue Service Audit

Description

How to fill out San Antonio Texas Agreement For Services Between An Attorney And Accountant With Respect To An Internal Revenue Service Audit?

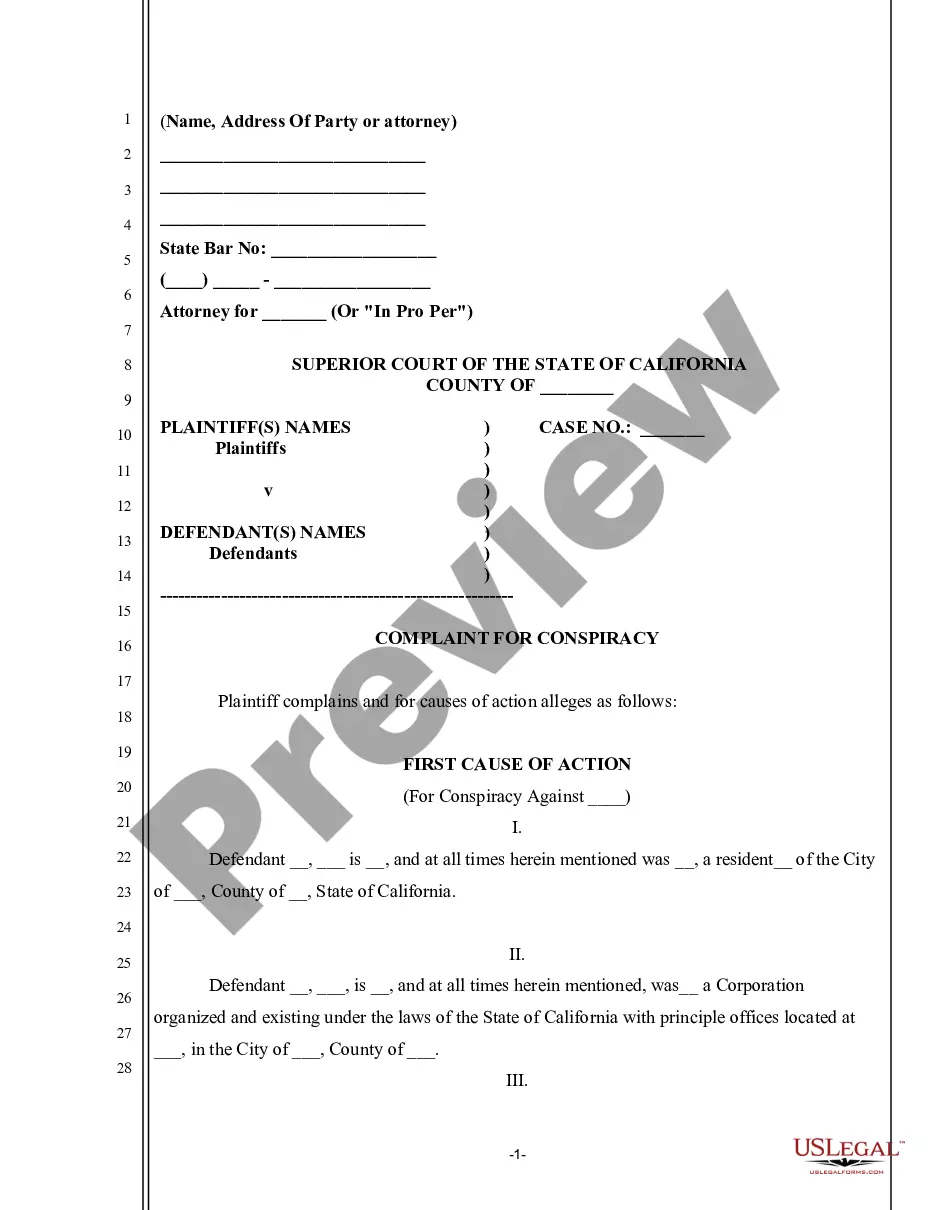

Draftwing paperwork, like San Antonio Agreement for Services between an Attorney and Accountant with Respect to an Internal Revenue Service Audit, to take care of your legal affairs is a challenging and time-consumming process. A lot of circumstances require an attorney’s participation, which also makes this task expensive. However, you can get your legal affairs into your own hands and manage them yourself. US Legal Forms is here to save the day. Our website features more than 85,000 legal forms intended for a variety of cases and life circumstances. We make sure each document is compliant with the regulations of each state, so you don’t have to be concerned about potential legal issues compliance-wise.

If you're already aware of our services and have a subscription with US, you know how easy it is to get the San Antonio Agreement for Services between an Attorney and Accountant with Respect to an Internal Revenue Service Audit form. Simply log in to your account, download the template, and customize it to your requirements. Have you lost your document? No worries. You can find it in the My Forms folder in your account - on desktop or mobile.

The onboarding flow of new users is fairly straightforward! Here’s what you need to do before getting San Antonio Agreement for Services between an Attorney and Accountant with Respect to an Internal Revenue Service Audit:

- Ensure that your template is compliant with your state/county since the rules for writing legal documents may vary from one state another.

- Discover more information about the form by previewing it or going through a brief intro. If the San Antonio Agreement for Services between an Attorney and Accountant with Respect to an Internal Revenue Service Audit isn’t something you were hoping to find, then take advantage of the search bar in the header to find another one.

- Sign in or register an account to begin utilizing our website and download the form.

- Everything looks good on your side? Hit the Buy now button and choose the subscription option.

- Select the payment gateway and type in your payment information.

- Your form is good to go. You can go ahead and download it.

It’s easy to find and purchase the needed template with US Legal Forms. Thousands of organizations and individuals are already benefiting from our extensive library. Sign up for it now if you want to check what other benefits you can get with US Legal Forms!