San Jose, California Agreement for Services between an Attorney and Accountant with Respect to an Internal Revenue Service Audit: Introduction: The San Jose, California Agreement for Services between an Attorney and Accountant with Respect to an Internal Revenue Service (IRS) Audit is a legally binding document that outlines the specific roles and responsibilities of both the attorney and the accountant in assisting a client through an IRS audit. This agreement ensures a collaborative approach to address potential legal and financial implications effectively. Key Terms: 1. San Jose, California: Specifies the geographical location where the agreement is applicable, referring to the city of San Jose in California, United States. 2. Agreement for Services: Defines the nature of the relationship between an attorney and an accountant to provide professional services concerning an IRS audit. 3. Attorney: Refers to the legal professional hired by the client to represent them in legal matters related to the IRS audit. The attorney's role can include legal advice, negotiating with the IRS, and representing the client in proceedings. 4. Accountant: Denotes the financial professional hired by the client to help navigate through the complex financial aspects of the IRS audit. The accountant assists with organizing and preparing financial documents, analyzing tax records, and providing expertise regarding tax laws. 5. Internal Revenue Service Audit: Describes the process of examination and verification of a taxpayer's financial information by the IRS to ensure compliance with tax laws. An audit may be triggered by discrepancies in tax returns, random selection, or suspicion of fraud. Key Clauses: 1. Scope of Work: Details the specific tasks and responsibilities assigned to both the attorney and the accountant throughout the audit process. This may include document review, analysis, representation at hearings, and communication with the IRS. 2. Communication: Emphasizes the importance of clear and timely communication between the attorney, accountant, and the client. It may outline the preferred method of communication, such as email or in-person meetings, and establish regular update schedules. 3. Confidentiality: Ensures that all information shared between the attorney, accountant, and client remains strictly confidential. It may specifically address attorney-client privilege and accountant-client privilege to maintain the confidentiality of sensitive information. 4. Compensation: Explains the method and schedule of payment for the professional services rendered by the attorney and the accountant. It may include details such as hourly rates, contingency fees, or a retainer agreement. Types of Agreements: Different variations of the San Jose, California Agreement for Services between an Attorney and Accountant with Respect to an Internal Revenue Service Audit may include specific areas of focus or variations in payment structures. For example: 1. Comprehensive Audit Agreement: Covers all aspects of the IRS audit, including representation, document review, and negotiations with the IRS. 2. Document Review Agreement: Focuses primarily on the attorney's and accountant's role in reviewing and organizing the client's financial documents to ensure proper compliance with IRS requests. 3. Contingency Fee Agreement: Establishes that the attorney's and accountant's fees will only be paid if they are successful in reducing the client's tax liability or achieving a favorable outcome in the IRS audit. Conclusion: The San Jose, California Agreement for Services between an Attorney and Accountant with Respect to an Internal Revenue Service Audit provides a legally binding framework for the collaboration between an attorney and accountant to effectively assist clients in navigating through the complexities of an IRS audit. This agreement ensures a well-defined scope of work, sets clear communication channels, and protects the confidentiality of sensitive client information.

San Jose California Agreement for Services between an Attorney and Accountant with Respect to an Internal Revenue Service Audit

Description

How to fill out San Jose California Agreement For Services Between An Attorney And Accountant With Respect To An Internal Revenue Service Audit?

Laws and regulations in every sphere vary from state to state. If you're not a lawyer, it's easy to get lost in a variety of norms when it comes to drafting legal paperwork. To avoid pricey legal assistance when preparing the San Jose Agreement for Services between an Attorney and Accountant with Respect to an Internal Revenue Service Audit, you need a verified template legitimate for your county. That's when using the US Legal Forms platform is so beneficial.

US Legal Forms is a trusted by millions online library of more than 85,000 state-specific legal templates. It's a perfect solution for professionals and individuals looking for do-it-yourself templates for various life and business scenarios. All the forms can be used many times: once you pick a sample, it remains available in your profile for future use. Therefore, if you have an account with a valid subscription, you can just log in and re-download the San Jose Agreement for Services between an Attorney and Accountant with Respect to an Internal Revenue Service Audit from the My Forms tab.

For new users, it's necessary to make several more steps to get the San Jose Agreement for Services between an Attorney and Accountant with Respect to an Internal Revenue Service Audit:

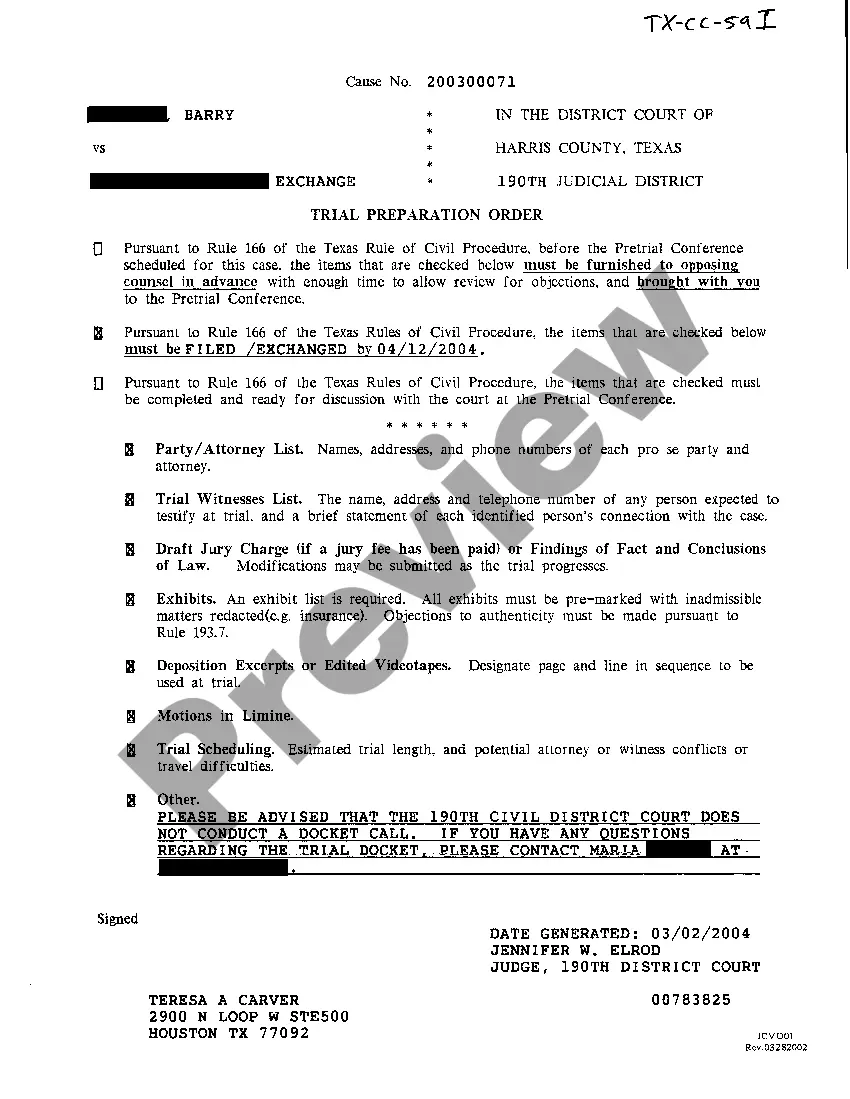

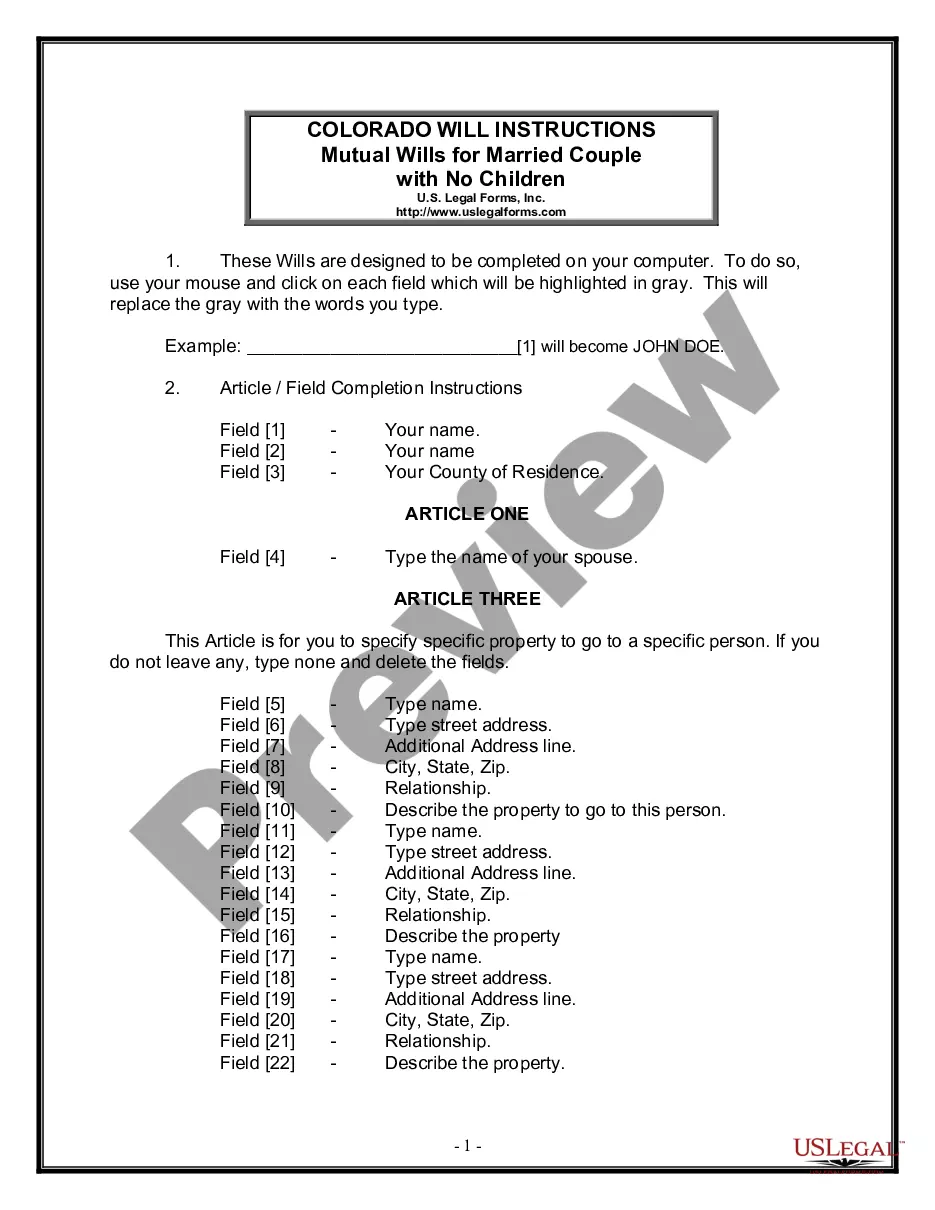

- Take a look at the page content to make sure you found the correct sample.

- Use the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your criteria.

- Click on the Buy Now button to get the document once you find the correct one.

- Choose one of the subscription plans and log in or create an account.

- Select how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the document in and click Download.

- Complete and sign the document on paper after printing it or do it all electronically.

That's the simplest and most economical way to get up-to-date templates for any legal reasons. Locate them all in clicks and keep your paperwork in order with the US Legal Forms!