The Tarrant Texas Agreement for Services between an Attorney and Accountant with Respect to an Internal Revenue Service (IRS) Audit is a legally binding document that outlines the terms and conditions of the professional relationship between an attorney and an accountant when representing a client during an IRS audit. This agreement ensures that both parties understand their roles, responsibilities, and the scope of their services throughout the audit process. The agreement typically includes key sections such as: 1. Introduction: This section provides a brief overview of the purpose of the agreement, the parties involved (attorney, accountant, and client), and the specific context of the IRS audit. 2. Scope of Services: This section details the specific services that the attorney and accountant will provide. It may include tasks such as reviewing tax returns, gathering supporting documentation, representing the client in meetings with the IRS, and negotiating settlements, among others. 3. Responsibilities: This section outlines the responsibilities of both the attorney and the accountant. It may include tasks such as maintaining accurate records, communicating regularly with the client, and ensuring compliance with applicable laws and regulations. 4. Confidentiality: This section highlights the importance of maintaining client confidentiality. It sets forth the obligations of both the attorney and the accountant to protect sensitive information and restrict its disclosure to unauthorized parties. 5. Compensation: This section defines the fees and payment terms for the attorney and accountant's services. It may specify hourly rates, flat fees, or a combination of both. Additionally, any potential expenses incurred during the audit process, such as travel or expert witnesses, may be addressed in this section. 6. Term and Termination: This section specifies the duration of the agreement, which is typically throughout the duration of the IRS audit. It may also outline the circumstances under which either party can terminate the agreement, such as a breach of contract or the completion of agreed-upon services. Types of Tarrant Texas Agreement for Services between an Attorney and Accountant with Respect to an Internal Revenue Service Audit may include: 1. General Agreement: This is the standard agreement used for most IRS audits, covering a wide range of services required to represent the client effectively. 2. Limited Scope Agreement: In some cases, the attorney and accountant may enter into a limited scope agreement, where they agree to provide specific services for a defined portion of the audit process, such as reviewing only a particular year's tax returns or attending select meetings with the IRS. 3. Co-Representation Agreement: In certain complex audit cases, the client may require both an attorney and an accountant to work together closely. In such instances, a co-representation agreement is drafted to clearly define the roles and responsibilities of both professionals, ensuring a coordinated approach to the audit. In conclusion, the Tarrant Texas Agreement for Services between an Attorney and Accountant with Respect to an Internal Revenue Service Audit is a vital document that establishes the framework for collaboration between these professionals during an IRS audit. By clearly defining roles, responsibilities, and expectations, this agreement helps ensure a smooth and effective representation of the client's interests throughout the audit process.

Tarrant Texas Agreement for Services between an Attorney and Accountant with Respect to an Internal Revenue Service Audit

Description

How to fill out Tarrant Texas Agreement For Services Between An Attorney And Accountant With Respect To An Internal Revenue Service Audit?

How much time does it usually take you to create a legal document? Considering that every state has its laws and regulations for every life sphere, locating a Tarrant Agreement for Services between an Attorney and Accountant with Respect to an Internal Revenue Service Audit suiting all regional requirements can be exhausting, and ordering it from a professional lawyer is often expensive. Many online services offer the most common state-specific documents for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most comprehensive online collection of templates, grouped by states and areas of use. Aside from the Tarrant Agreement for Services between an Attorney and Accountant with Respect to an Internal Revenue Service Audit, here you can get any specific form to run your business or personal affairs, complying with your regional requirements. Specialists check all samples for their actuality, so you can be certain to prepare your paperwork properly.

Using the service is remarkably straightforward. If you already have an account on the platform and your subscription is valid, you only need to log in, opt for the required form, and download it. You can get the file in your profile at any time later on. Otherwise, if you are new to the platform, there will be a few more steps to complete before you obtain your Tarrant Agreement for Services between an Attorney and Accountant with Respect to an Internal Revenue Service Audit:

- Examine the content of the page you’re on.

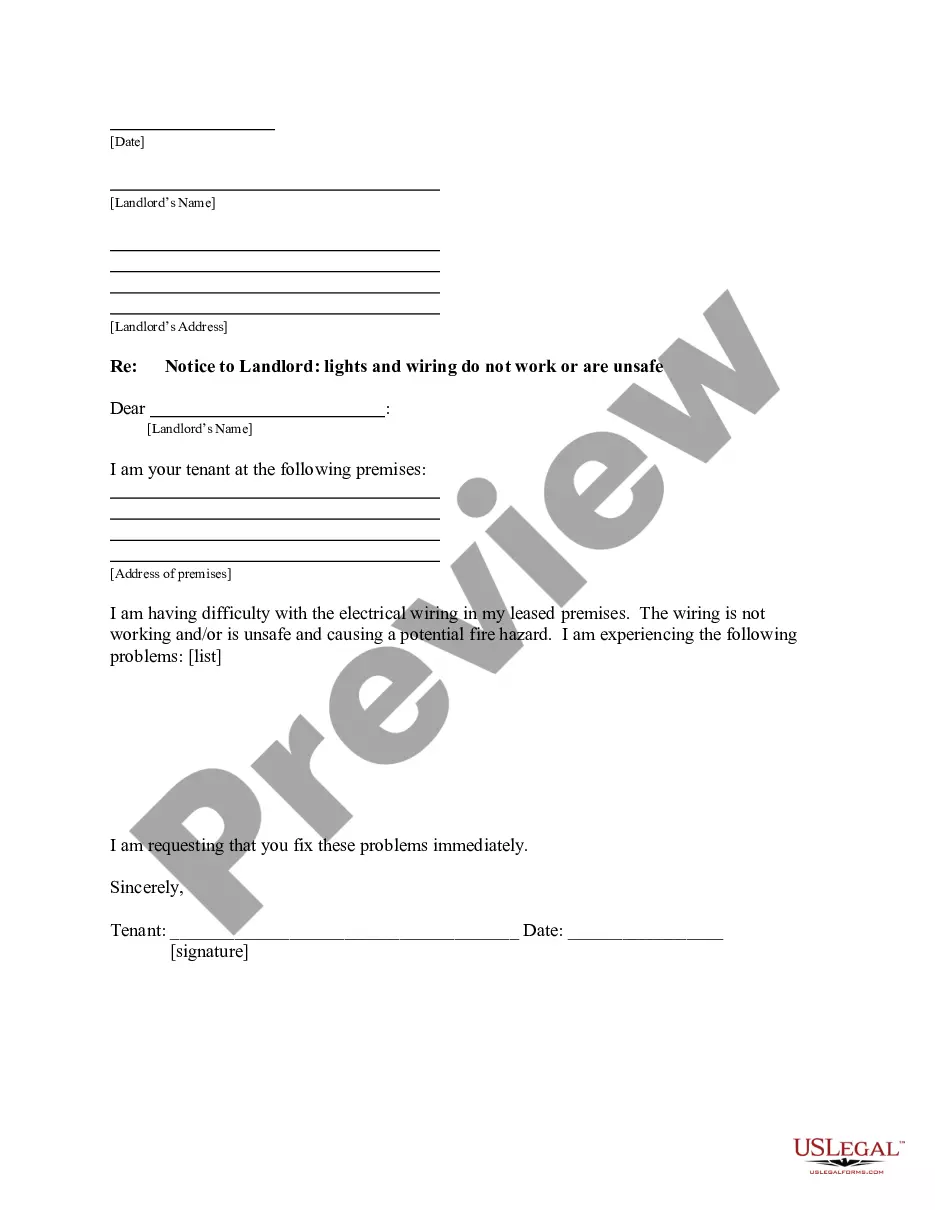

- Read the description of the template or Preview it (if available).

- Look for another form using the related option in the header.

- Click Buy Now when you’re certain in the chosen file.

- Choose the subscription plan that suits you most.

- Create an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Change the file format if necessary.

- Click Download to save the Tarrant Agreement for Services between an Attorney and Accountant with Respect to an Internal Revenue Service Audit.

- Print the doc or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the acquired template, you can find all the files you’ve ever saved in your profile by opening the My Forms tab. Try it out!

Form popularity

FAQ

The IRS performs three main functionstax return processing, taxpayer service, and enforcement. In addition, the IRS conducts criminal investigations and oversees tax-exempt organizations and qualified retirement plans.

Form 866 (Rev. July 1981) Page 1. Department of the Treasury - Internal Revenue Service. Agreement as to Final Determination of Tax Liability.

What does IRS stand for? to collect income taxes and to enforce tax laws.

Enclosed is Form 906, Closing Agreement, under Internal Revenue Code Sections 7121 and 6224 (c), reflecting the terms of the settlement, as well as certain attachments.

IRS Definition Practice includes, but is not limited to, preparing or filing documents, corresponding and communicating with the IRS, rendering written tax advice and representing a client at conferences, hearings and meetings. Tax return preparation is not practice as currently defined by case law.

- The Bureau of Internal Revenue shall be under the supervision and control of the Department of Finance and its powers and duties shall comprehend the assessment and collection of all national internal revenue taxes, fees, and charges, and the enforcement of all forfeitures, penalties, and fines connected therewith,

An audit agreement is an agreement between the CRA and a taxpayer 2 where the parties set out the terms under which one or more audit issues will be assessed based on a common understanding and interpretation of the facts, audit policy and law applicable at that time.

File returns and pay taxes on time. Provide accurate information on tax returns. Substantiate claims for refund. Pay all taxes on time after closing a business, and request cancellation of the tax account.

A closing agreement is a binding agreement between the IRS and a taxpayer that, if properly executed, finally and conclusively settles a tax issue between the IRS and a taxpayer. While closing agreements exhibit some of the attributes of a contract, they are not strictly subject to the law of contracts.

The IRS Mission The taxpayer's role is to understand and meet his or her tax obligations. The IRS role is to help the large majority of compliant taxpayers with the tax law, while ensuring that the minority who are unwilling to comply pay their fair share.