A Salt Lake Utah Revocable Letter of Credit is a financial instrument that guarantees payment to a beneficiary on behalf of an applicant, undertaken by a bank or financial institution located in Salt Lake City, Utah. It serves as a secure method for ensuring that commitments are met between parties involved in international or domestic trade. The Salt Lake Utah Revocable Letter of Credit operates by the applicant (buyer) requesting their bank to issue the letter of credit in favor of the beneficiary (seller). The specified amount is held by the bank and will be released upon the beneficiary's compliance with the terms and conditions outlined in the letter of credit. Unlike an irrevocable letter of credit, the revocable letter of credit can be altered or revoked by the applicant without the consent of the beneficiary. There are several types of Salt Lake Utah Revocable Letter of Credit: 1. Commercial Letter of Credit: This type is commonly used in trade transactions to ensure payment to the seller. It guarantees that the buyer's payment obligations will be fulfilled upon satisfying the terms and conditions mentioned in the letter. 2. Standby Letter of Credit: Primarily used as a secondary payment option, this type of letter of credit ensures that the beneficiary will receive payment if the buyer fails to fulfill their obligations or defaults. 3. Revolving Letter of Credit: Suitable for long-term business relationships, this type allows recurring transactions within a specific period. Once the amount is utilized, it is replenished for future transactions. 4. Confirmed Letter of Credit: In this case, an additional bank (usually a foreign correspondent bank) confirms the letter of credit, ensuring payment to the beneficiary in case the applicant's bank fails to fulfill its obligations. 5. Revocable Transferable Letter of Credit: This type allows the beneficiary to transfer a portion or the entire amount of the letter of credit to one or more secondary beneficiaries. The revocable aspect provides flexibility for the applicant to modify or cancel the credit. 6. Red Clause Letter of Credit: This type allows for an advance payment to the beneficiary, providing working capital to fulfill the transaction before shipping the goods. In summary, a Salt Lake Utah Revocable Letter of Credit is a flexible payment instrument issued by a bank in Salt Lake City, Utah, ensuring payment to a beneficiary upon fulfilling the terms and conditions outlined in the letter. The different types of revocable letters of credit include commercial, standby, revolving, confirmed, revocable transferable, and red clause letters of credit.

Po Box 17316 Salt Lake City Utah

Description po box 17316 salt lake city utah card enclosed 2024

How to fill out Who Owns P O Box 17316 Salt Lake City Utah Card Enclosed 2023?

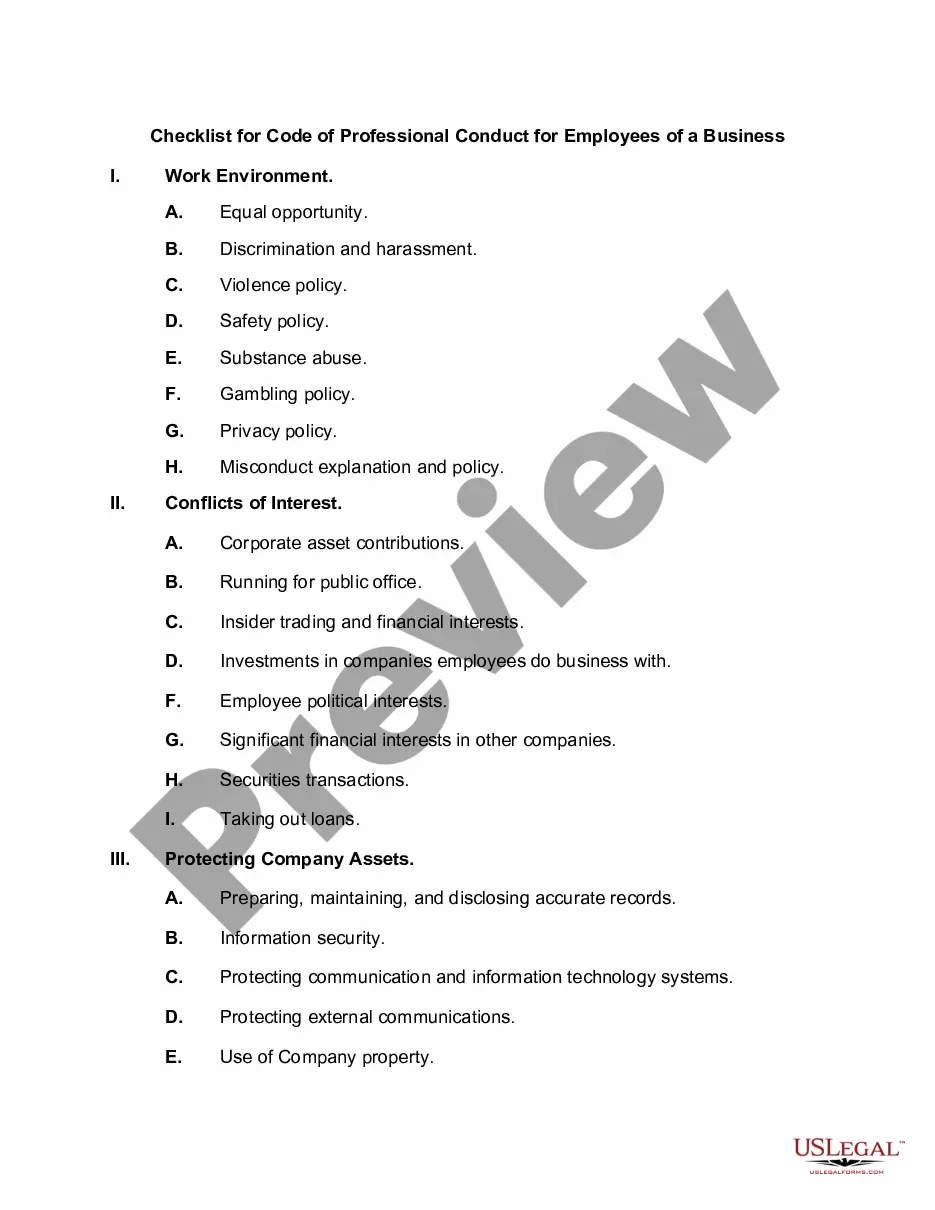

How much time does it typically take you to draft a legal document? Because every state has its laws and regulations for every life sphere, locating a Salt Lake Revocable Letter of Credit suiting all local requirements can be tiring, and ordering it from a professional attorney is often expensive. Many web services offer the most popular state-specific documents for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most comprehensive web collection of templates, grouped by states and areas of use. Aside from the Salt Lake Revocable Letter of Credit, here you can find any specific document to run your business or individual affairs, complying with your regional requirements. Professionals verify all samples for their validity, so you can be sure to prepare your documentation correctly.

Using the service is fairly straightforward. If you already have an account on the platform and your subscription is valid, you only need to log in, opt for the required form, and download it. You can get the document in your profile at any time later on. Otherwise, if you are new to the website, there will be a few more steps to complete before you get your Salt Lake Revocable Letter of Credit:

- Examine the content of the page you’re on.

- Read the description of the template or Preview it (if available).

- Look for another document using the related option in the header.

- Click Buy Now when you’re certain in the chosen document.

- Select the subscription plan that suits you most.

- Register for an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Change the file format if needed.

- Click Download to save the Salt Lake Revocable Letter of Credit.

- Print the sample or use any preferred online editor to complete it electronically.

No matter how many times you need to use the acquired document, you can find all the samples you’ve ever saved in your profile by opening the My Forms tab. Try it out!

po box 17316 salt lake city 2024 Form popularity

p o box 17316 salt lake city Other Form Names

who owns po box 17316 salt lake city utah card enclosed 2024 FAQ

A revocable LC is a credit, the terms and conditions of which can be amended/ cancelled by the Issuing Bank. This cancellation can be done without prior notice to the beneficiaries. An irrevocable credit is a credit, the terms and conditions of which can neither be amended nor cancelled.

(a) "Irrevocable letter of credit" (ILC), as used in this clause, means a written commitment by a federally insured financial institution to pay all or part of a stated amount of money, until the expiration date of the letter, upon presentation by the Government (the beneficiary) of a written demand therefor.

An irrevocable letter of credit is issued when a bank representing an importer agrees to pay the seller (the exporter) for an international transaction. The letter of credit reduces the risks taken by both buyers and sellers that foreign goods will be shipped, and payment made.

A revocable letter of credit is one which can be cancelled or amended by the issuing bank at any time and without prior notice to or consent of the beneficiary. From the exporter's point of view such LCs are not safe. Besides exporter cannot get such LCs confirmed as no bank will add confirmation to Revocable LCs.

Q.When a letter of credit does not indicate whether it is revocable or irrevocable, it is treated asB.Irrevocable.C.Revocable or irrevocable in the option of the beneficiary.D.Revocable or irrevocable in the option of the negotiating bank.Answer» b. Irrevocable.1 more row

A revocable letter of credit is uncommon because it can be changed or cancelled by the bank that issued it at any time and for any reason. An irrevocable letter of credit cannot be changed or cancelled unless everyone involved agrees. Irrevocable letters of credit provide more security than revocable ones.

A revocable letter of credit is uncommon because it can be changed or cancelled by the bank that issued it at any time and for any reason. An irrevocable letter of credit cannot be changed or cancelled unless everyone involved agrees. Irrevocable letters of credit provide more security than revocable ones.

A revocable letter of credit is uncommon because it can be changed or cancelled by the bank that issued it at any time and for any reason. An irrevocable letter of credit cannot be changed or cancelled unless everyone involved agrees. Irrevocable letters of credit provide more security than revocable ones.

A Standby Letter of Credit is different from a Letter of Credit. An SBLC is paid when called on after conditions have not been fulfilled. However, a Letter of Credit is the guarantee of payment when certain specifications are met and documents received from the selling party.