The Allegheny Pennsylvania Agreement for Auditing Services between an Accounting Firm and a Municipality is a comprehensive document that outlines the scope, terms, and conditions of the auditing services provided by the accounting firm to the municipality. This agreement ensures transparency, accountability, and regulatory compliance in financial matters related to the municipality. The agreement encompasses a wide range of auditing services that cater to the distinct needs and requirements of the municipality. These services may include financial statement auditing, internal control evaluation, compliance auditing, performance auditing, forensic auditing, and specialized audits such as IT and environmental audits. Financial statement auditing forms a core component of the agreement, as it involves examining the municipality's financial records, transactions, and reports assessing their accuracy, completeness, and adherence to accounting principles and standards. This process aims to provide an independent and objective assessment of the municipality's financial position, enabling stakeholders to make informed decisions. Internal control evaluation is another significant aspect covered by this agreement. It involves assessing the efficiency and effectiveness of the municipality's internal control mechanisms, identifying weaknesses and recommending improvements to mitigate potential risks and ensure proper governance and safeguarding of assets. Compliance auditing ensures that the municipality complies with relevant laws, regulations, and policies governing financial activities. It involves reviewing financial processes and transactions to detect instances of fraud, noncompliance, or misappropriation of funds, ensuring adherence to ethical standards and legal requirements. Performance auditing focuses on assessing the economy, efficiency, and effectiveness of the municipality's operations and programs. It helps identify areas where cost savings, process improvements, or performance enhancements can be achieved. Forensic auditing is crucial in investigating suspected fraudulent activities, misuse of funds, or financial irregularities within the municipality. This type of audit requires specialized skills and techniques to gather evidence, analyze financial data, and produce reports suitable for legal proceedings if necessary. Additionally, the Allegheny Pennsylvania Agreement for Auditing Services may encompass specialized audits tailored to the municipality's specific needs. These could include Information Technology (IT) audits to evaluate the municipality's IT systems and data security, environmental audits to assess compliance with environmental regulations, or program audits to evaluate the effectiveness and impact of specific government initiatives. Overall, the Allegheny Pennsylvania Agreement for Auditing Services between an Accounting Firm and a Municipality ensures that all aspects of financial management within the municipality are subject to rigorous examination, ensuring transparency, accountability, and sound financial governance.

Allegheny Pennsylvania Agreement for Auditing Services between Accounting Firm and Municipality

Description

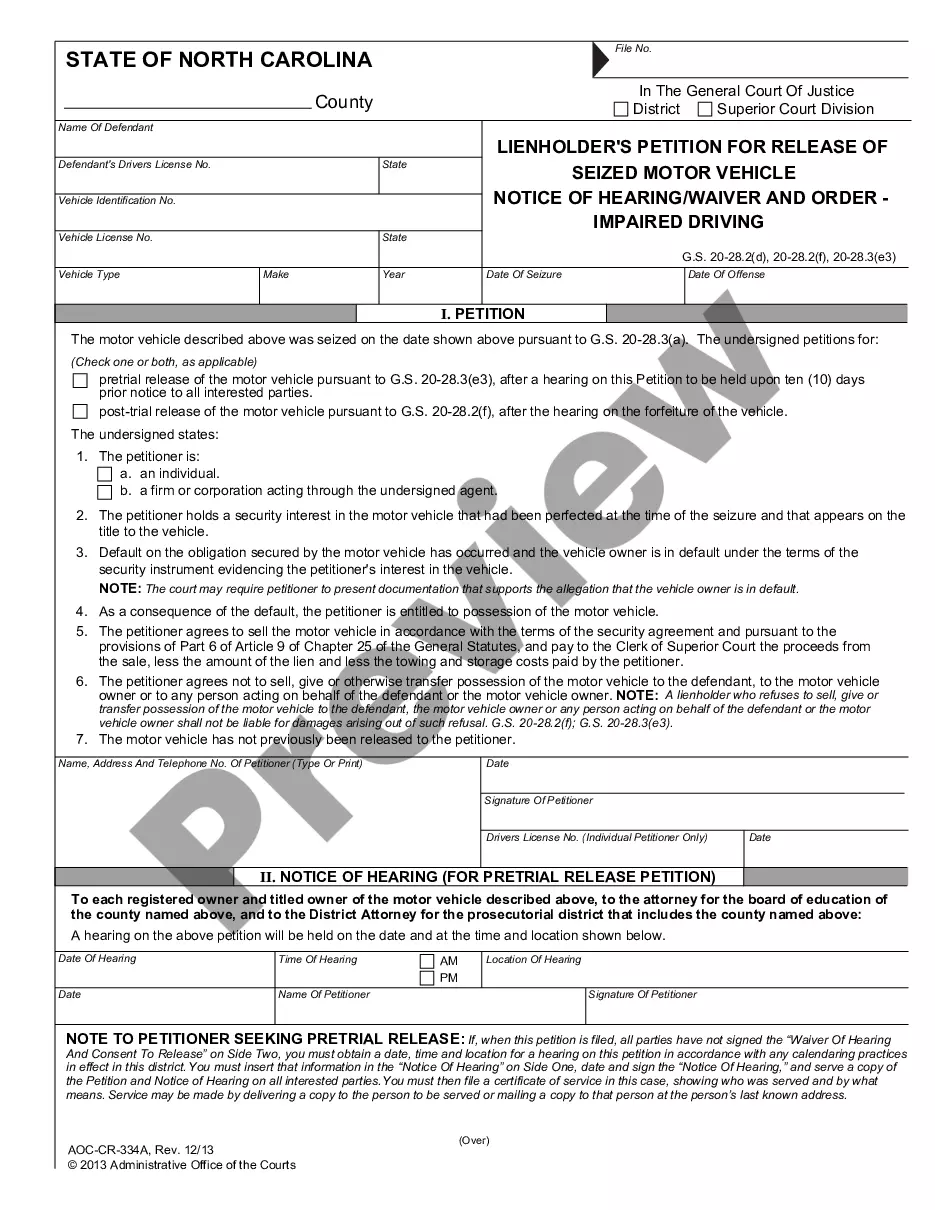

How to fill out Allegheny Pennsylvania Agreement For Auditing Services Between Accounting Firm And Municipality?

Laws and regulations in every area vary throughout the country. If you're not an attorney, it's easy to get lost in countless norms when it comes to drafting legal documentation. To avoid high priced legal assistance when preparing the Allegheny Agreement for Auditing Services between Accounting Firm and Municipality, you need a verified template valid for your county. That's when using the US Legal Forms platform is so advantageous.

US Legal Forms is a trusted by millions online collection of more than 85,000 state-specific legal templates. It's a great solution for professionals and individuals looking for do-it-yourself templates for various life and business situations. All the forms can be used many times: once you obtain a sample, it remains accessible in your profile for future use. Therefore, if you have an account with a valid subscription, you can simply log in and re-download the Allegheny Agreement for Auditing Services between Accounting Firm and Municipality from the My Forms tab.

For new users, it's necessary to make several more steps to get the Allegheny Agreement for Auditing Services between Accounting Firm and Municipality:

- Analyze the page content to ensure you found the right sample.

- Utilize the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your requirements.

- Use the Buy Now button to get the document once you find the proper one.

- Opt for one of the subscription plans and log in or create an account.

- Choose how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the file in and click Download.

- Fill out and sign the document in writing after printing it or do it all electronically.

That's the simplest and most cost-effective way to get up-to-date templates for any legal purposes. Locate them all in clicks and keep your documentation in order with the US Legal Forms!

Form popularity

FAQ

Public accounting firm means a sole proprietorship, partnership, corporation or other legal entity engaged in the business of providing services as public accountants.

Yes. By law, the annual financial statements of public companies must be audited each year by independent auditors, accountants who examine the data for conformity with U.S. Generally Accepted Accounting Principles (GAAP).

4) Statutory Audit: However, statutory audit refers to only auditing of the entity's financial statements that are required by local law. External audit firms normally perform the statutory audit, and the audit report will be issued by the auditor and submit to the government body by the entity.

Definition: Audit is the examination or inspection of various books of accounts by an auditor followed by physical checking of inventory to make sure that all departments are following documented system of recording transactions. It is done to ascertain the accuracy of financial statements provided by the organisation.

A statutory audit is a legally required review of the accuracy of a company's or government's financial statements and records. An audit is an examination of records held by an organization, business, government entity, or individual, which involves the analysis of financial records or other areas.

Auditing is a part of the accounting world. It is an examination of accounting and financial records that is undertaken independently. This is done to determine if the company or the business undertaking has conformed its operations to the laws and the generally accepted accounting principles.

If a public accounting firm wants to engage in auditing activities for publicly held companies in the United States, the firm must first register with the Public Company Accounting Oversight Board (PCAOB), which imposes certain requirements and annual fees on these businesses.

Management functions. Human resources. Broker-dealer, investment advisor, or investment banking services. Legal services.

The main services provided by public accounting firms are the preparation, review, and auditing of financial statements, tax work, and consulting and advice on accounting systems, M&A, and capital raising.

Statutory Audit is a type of audit which is mandated by a Statute or Law to ensure true and fair view of the book of accounts of a Business is presented to the Regulators and the Public. Unlike internal audit, Statutory Audits are not optional and must be performed if a business satisfies certain criterias.